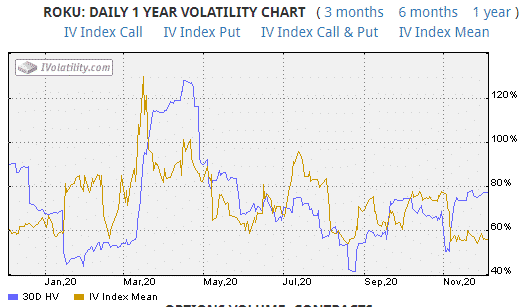

In today’s video, I’m looking at a ROKU Calendar Spread given that the stock is trading with an IV Percentile of 10%.

Basically we’re seeing some of the the lowest levels of implied volatility on ROKU in the last 12 months.

Calendar Spreads are long Vega trades.

In terms of trade management, would look at a 20% profit target, 20% stop loss and would consider turning it into a double calendar if it crosses through the expiration breakeven prices but has not hit a stop loss.

ROKU was trading at 296 at the time of the video, now that the stock is at 300, I would move the calendar up to 300.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.