It’s funny. Stock traders will look at options traders and say, “You trade options? Whoa. That’s risky.”

Options traders will look at stock traders and say, “You trade stocks? Without any hedge? And without limiting your losses with spreads? Wow. That’s risky.”

Today, we will help stock owners learn a bit about using options to help protect some of their stock.

And we will help options traders to not be afraid of owning stock.

A well balance long-term portfolio probably should contain both stocks and options (the percentage of which is your personal preference, but I like 50-50).

The strategy is to use a zero-cost collar to help protect a stock position. The key word here is “zero cost”, not “free”. In the market, nothing is free.

No free lunch here.

We’ll talk about the trade-offs shortly.

Another key word is “help protect”.

We did not say “100% protect” your stock position.

It will only partially protect.

If you are reading this blog, there is some chance that you might be an options trader who somehow ended up with some stock.

Perhaps by intention (such as picking up stocks at slight discount using cash-secured puts).

Or perhaps by accident (such as unexpected early assignment at or near option expiration).

The Setup

Long 100 shares of MSFT at $225

Long 1 MSFT Sept 18, $215 put @ $3.20

Short 1 MSFT Sept 18, $235 call @ $3.50

The Explanation

Suppose we own 100 shares of Microsoft (MSFT) on September 1, 2020 with the price of $225 being a bit extended on the upside.

We are worried that MSFT might pullback, or perhaps there will be a general market sell-off.

We’ve tried using stop loss before.

But the stock has an annoying habit of dropping down to trigger the stop loss and then proceeds to make higher highs without us.

Another way to protect your stock is to buy put options.

Let’s buy one contract of the $215 put with expiration 17 days away on September 18.

One contract will protect 100 shares of stock.

Put options acts as insurance in that it gives us the right to sell our MSFT stock at a $215 anytime before or on expiration day.

It turned out that on September 18 expiration day, MSFT closed at $200.

If stock is below $215 at expiration, most brokerages will automatically sell the stock at $215.

Selling our stock at $215 when it was previously at $225 is still a loss of $10 per share, or $1000.

Without the put, we would have suffered a loss of $25 per share ($225 – $200), or $2500.

But wait, we didn’t take into account the cost of purchasing this put. It cost us $320. Buying puts is expensive.

By selling an an out-of-the-money call option above the stock price we can finance the cost of the put.

The $235 call with same expiration of September 18 will provide us a premium of $350.

We sell this call, get $350 in our account, and use that money to buy the put.

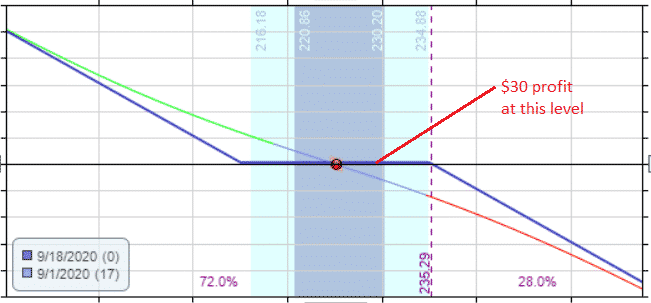

In fact, we gain $30 by doing this.

When employing this strategy, we recommend that you do this for exactly zero cost or for a slight net credit.

The expiration line of the profit-loss diagram for the long put and short call looks like this…

In the event that price did not move above $235 nor below $215, we still want to receive at least a slight credit, not a loss.

This setup with long stock, long put, and short call is known as a “collar” because we are putting a collar on our stock.

We limited the loss on our stock at $215. We limit the gain of the stock at $235.

Result on expiration day with collar

Gained $30 for putting on the collar. Lost $1000 on stock position.

Total Loss $970.

Result on expiration day without collar

Lost $2500 on stock position.

Using the collar saved us $1530

The reason why we don’t have the collar on our stock all the time is that it limits the upside move of the stock, capping our gains.

This is the trade-off.

Many people like to use this strategy while holding stock through earnings if they don’t want to take the risk of price dropping on them.

The collar is a family of strategies known as risk reversals.

Risk reversals and stock synthetics are cousins of each other.

In fact, the profit-loss graph of the collar is similar to the synthetic short stock graph shown in our previous article Synthetic Short Stock.

They both consist of a long put and short call.

The difference between synthetics and risk reversals is that synthetics have the same strike price for the put and call.

Risk reversals have different stock strike prices which gives the flat plateau in the profit-loss.

Have you ever used a zero cost collar to protect a stock position? Let me know in the comments.

Images for this article are from Option Net Explorer.

MSFT Zero Cost Collar Example

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.