Today, I’ll walk through an example where a bear call spread went against us and we needed to manage it with an adjustment.

While it may be more capital intensive, the use of stock to hedge may be a more efficient due to its liquidity and low slippage and zero impact on the option greeks.

Just be careful not to over-hedge.

We’ll show you how to calculate the right amount of stock to buy as a hedge.

If you’re new to options you’ll want to check out this post and maybe this one too.

Contents

The Initial Bear Call Spread

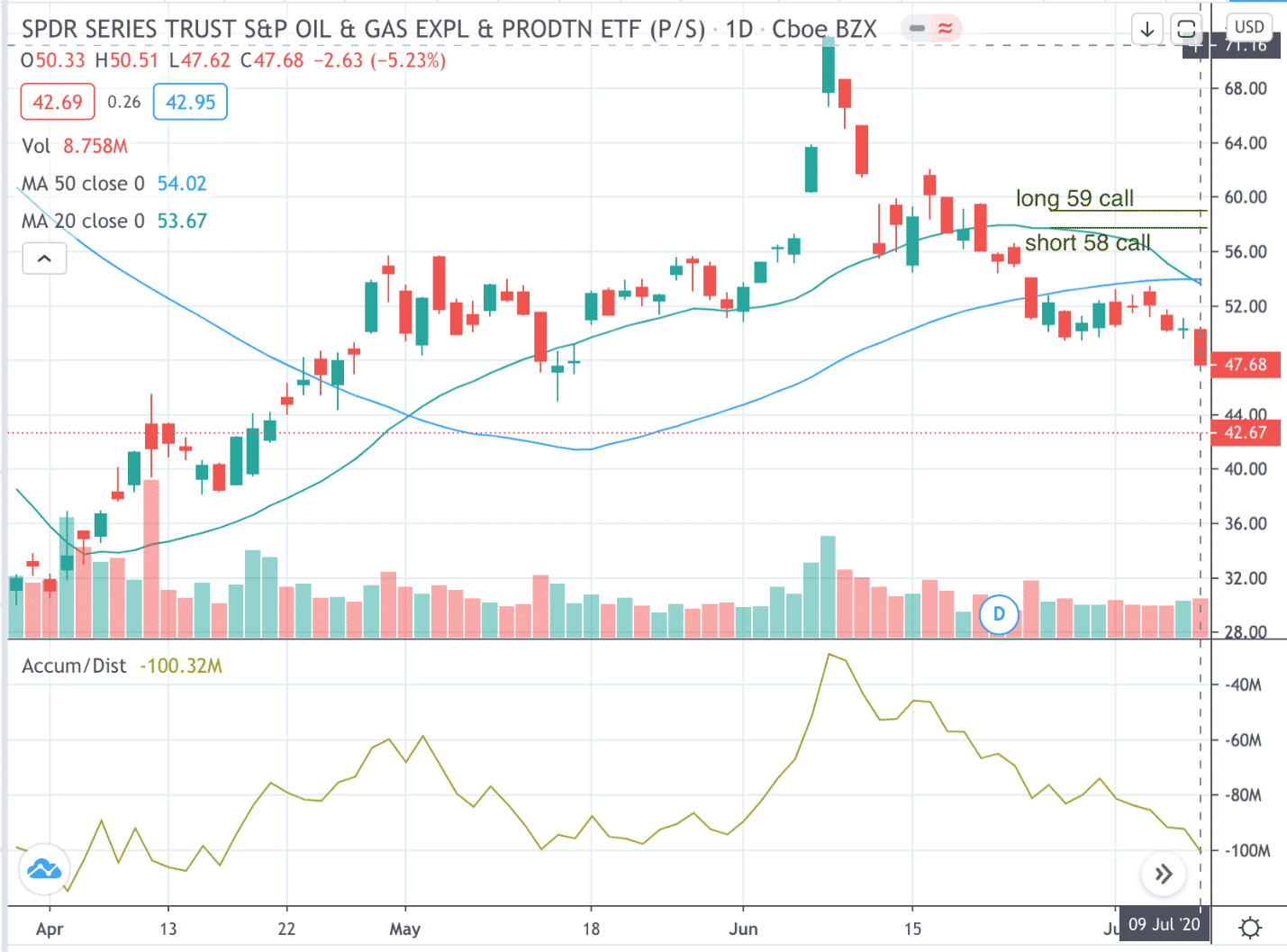

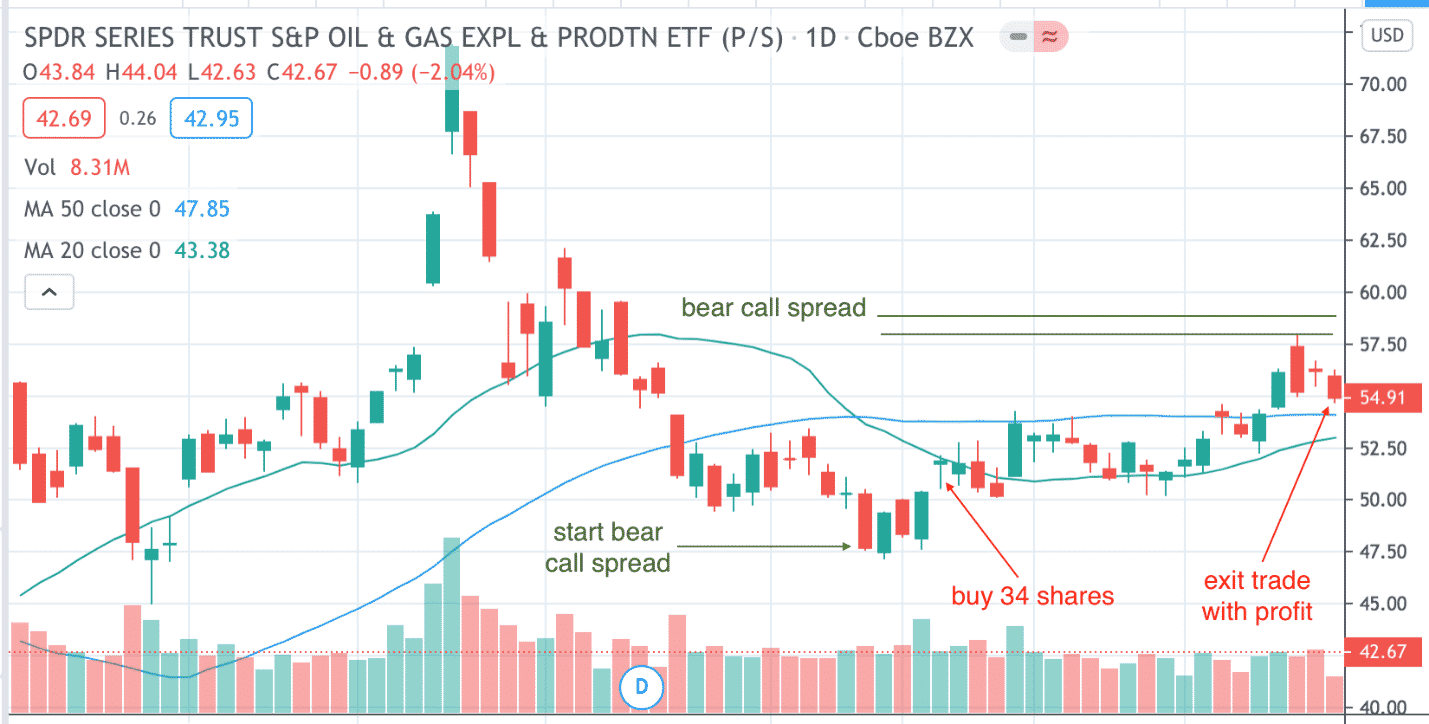

On July 9, 2020, XOP is showing bearish technicals.

The 20-day moving average is about to cross below the 50-day moving average with price below both.

The day ends with a strong bearish candle closing at the bottom of its range.

Both price trend and accumulation/distribution line is declining.

We initiate a bear call spread with short strike near 15-delta and expiration 43 days away.

Current price: $50.33

Sell 10 Aug 21st, XOP 58 call @ $0.665

Buy 10 Aug 21st, XOP 59 call @ $0.555

Credit per share: $0.11

Max Profit: $110

Max Loss: $1000 – $110 = $890

Profit Potential: $110 / $890 = 12.4%

Delta Dollars: -0.0219 x 1000 x $50.33 = –$1103

Profit target at $55. Stop Loss at $220

Adjusting A Bear Call Spread

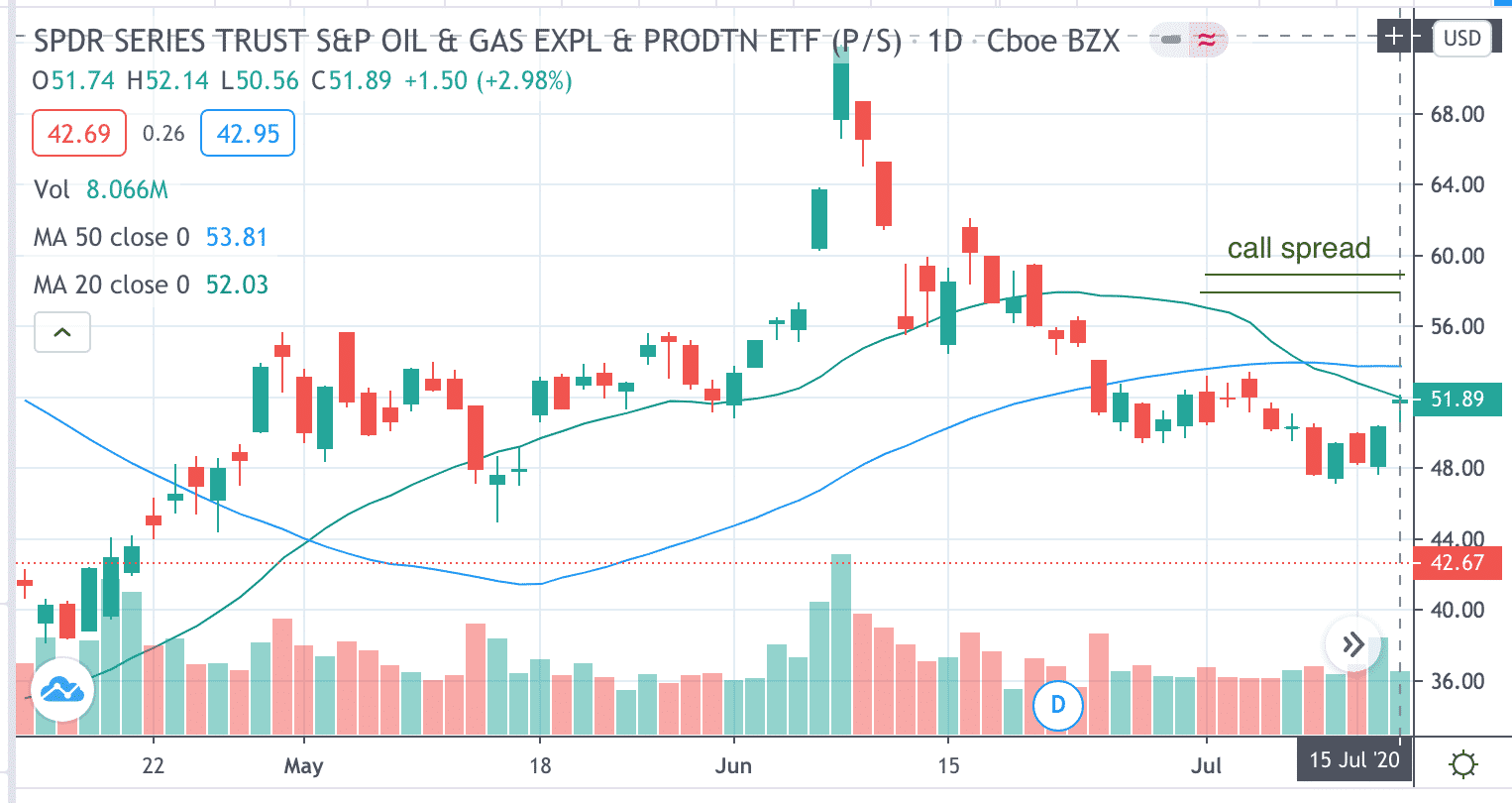

On July 15, XOP gapped up to $51.89

Current Price: $51.89

Long ten XOP 59 call (delta = 0.2594/share)

Short ten XOP 58 call (delta = -0.2936/share)

Net delta: -0.0342

Delta Dollars: -0.0342 x 100 x $51.89 = –$1775

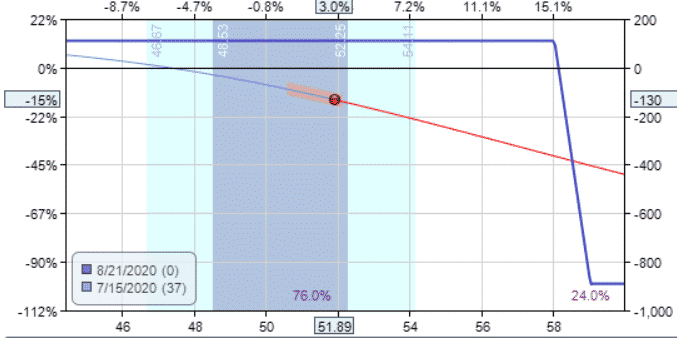

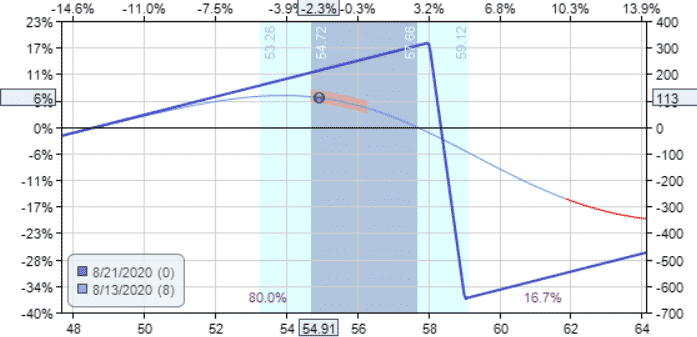

Our P&L graph shows that we are on a downward slope of the T-0 line…

XOP is up 3% from the start of the trade and our bear call spread is down $130.

While our stop loss level of $220 was not exceeded, the delta of our short 58 call went up to 29 (we consider adjustments when delta exceeds 25).

Our delta dollars went from a negative exposure of –$1103 to –$1775. This is equivalent to shorting $1775 worth of XOP, while XOP is going up.

Let’s buy some XOP to neutralize this bearish position. How much?

We need to buy $1775 worth just to keep delta neutral.

That would be 34 shares ($1775 / $51.89 = 34.2).

Another way to look at it is to think of a share of stock as having a delta of 1.

The net delta of our spread is -0.0342/share and our spread with 10 contracts consists of 1000 shares.

Our position Delta is -34.2. We need about 34 shares.

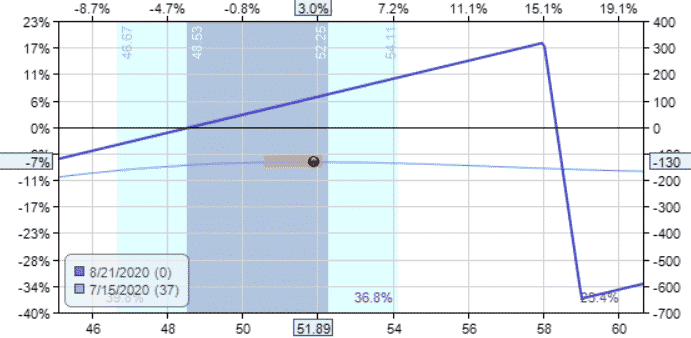

After buying 34 shares of XOP at $51.89, our combined (stock and bear call spread) payoff graph now looks like this…

Note how much flatter the T-0 line is. We are no longer on a downward slide.

Time to Take Profit

Checking the P&L at the end of each day, we are able to maintain our trade without it hitting our stop loss or profit target.

On August 13 (eight days away from expiration), XOP crossed our profit threshold of $55, at which point we could take the profit.

At the end of the day, the P&L reached $113 with payoff graph looking like this…

The chart looks like this…

Exit the trade:

Sell 34 shares of XOP at $54.91

Sell 10 Aug 21st, XOP 59 call @ $0.295

Buy 10 Aug 21st, XOP 58 call @ $0.395

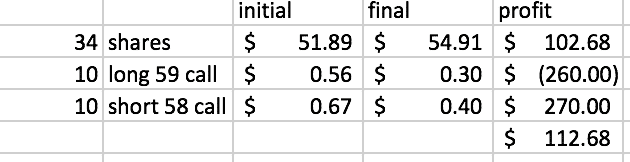

Breaking down the P&L of each component we get:.

Notice that the stock portion of the trade gained $103, which is the majority of the profit.

So, purchasing the shares did help in this case.

Sometimes the stock will start to drop again, in which case the delta hedge will hurt the trade.

Note This example was constructed based on historic data from Option Net Explorer. We used market close as the time of day at which data was taken.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Interesting! I mainly use bearish call spreads as my method of shorting, and never thought about using shares of stock to hedge it. I like how the delta correlates to shares of stock. Makes it easy to calculate how many shares you need!

Hey Shelley, nice to hear from you! Hope you’re doing well.