When talking about an iron condor setup, we need to decide the width of the wings.

What is better, narrow or wide?

Let’s find out.

Contents

- Narrow Wing Condor With Two Contracts

- Wide Wing Condor With One Contract

- No Difference

- Adjusting Multi Contract Condors

- Adjusting Wide Wing Condors

- Bonus Resources

- Real Examples and Case Studies

- Related Articles

- Conclusion

An investor can make the width of the wings of the iron condor narrow and trade two condors.

Or the investor can make the wings wider and trade one condor.

Both trades will have the same max risk.

Is there a difference between these two trades?

Is one better than the other?

Let’s look at the Greeks and find out.

Narrow Wing Condor With Two Contracts

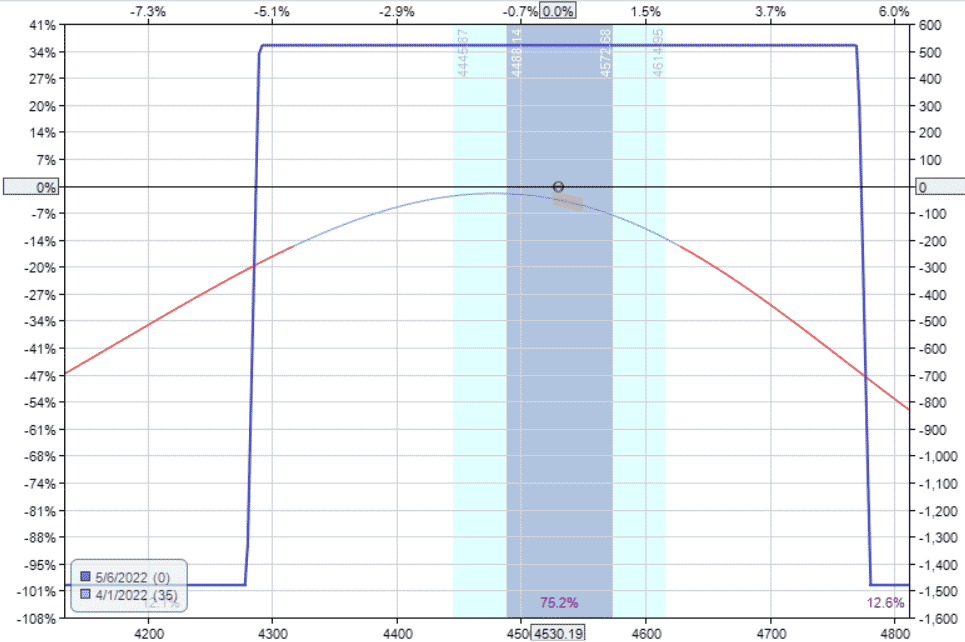

Here is an example of a condor with only 10-point wide wings on the SPX (S&P500 index):

Date: April 1, 2022

Price: SPX @ 4530

Buy two May 6 SPX 4280 put

Sell two May 6 SPX 4290 put

Sell two May 6 SPX 4770 call

Buy two May 6 SPX 4780 call

Total Credit: $520

Total Risk: $1480

Risk/Reward ratio: 2.85

We trade two of them, with the total capital allocated being $1480.

The Greeks are:

Delta: -0.78

Theta: 12.47

Vega: -58.02

Gamma: 0.01

Delta/Theta: 0.06

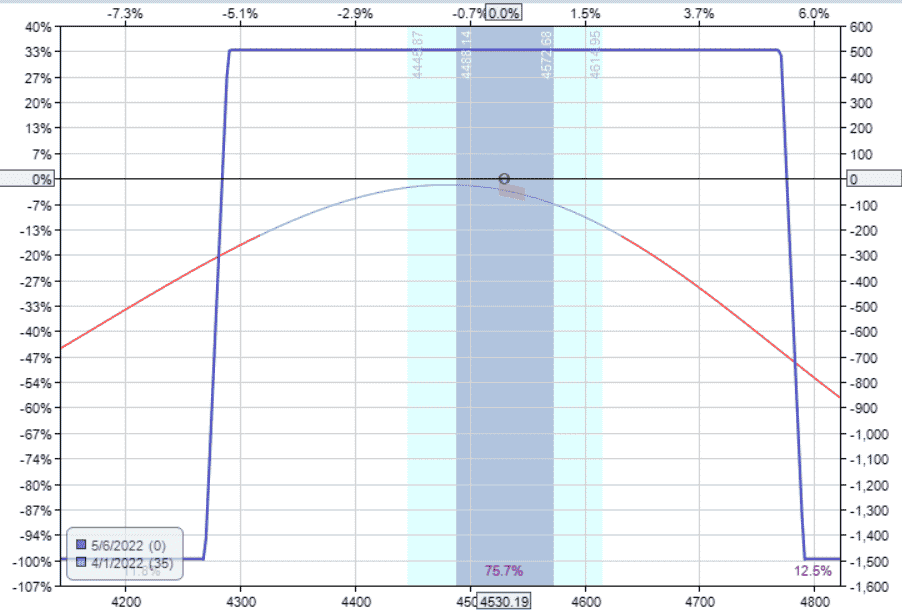

Wide Wing Condor With One Contract

Here is one condor using wings that are 20-points wide over the same timeframe.

Buy one May 6 SPX 4270 put

Sell one May 6 SPX 4290 put

Sell one May 6 SPX 4770 call

Buy one May 6 SPX 4790 call

Credit: $505

Risk: $1495

Risk/Reward ratio: 2.96

The capital allocated is about the same at $1495, and the payoff graph looks the same.

The Greeks are:

Delta: -0.85

Theta: 12.37

Vega: -57.77

Gamma: 0.01

Delta/Theta: 0.07

No Difference

As you can see, in terms of the Greeks at the initial starting position, they are essentially the same for both scenarios.

What about if the price starts moving?

Let’s examine the P&L of each eleven days later, on April 11.

The narrow wing condor with two contracts is showing a P&L of $60 with the Greeks as follows:

Delta: 1.10

Theta: 10.67

Vega: -37.28

Gamma: 0.02

Delta/Theta: 0.10

The wide wing condor with one contract is showing a P&L of $52.50 with the following Greeks:

Delta: 1.14

Theta: 10.44

Vega: -36.45

Gamma: 0.03

Delta/Theta: 0.11

Again, still pretty much the same.

Adjusting Multi-contract Condors

On April 11, we are ready to adjust the put side since the price is starting to get close to it with the short put option at 27-delta.

We can close one of the put spread as an adjustment technique for the narrow-wing condor with two contracts.

Sell one May 6 SPX 4280 put

Buy one May 6 SPX 4290 put

Debit: –$210

This adjustment reduces the delta from 1.10 down to 0.03.

Adjusting Wide Wing Condors

This adjustment technique is not available for the wide-wing condor with one contract.

Close one put spread would eliminate the entire put side, which results in a position delta of -0.96.

You would just be left with a bear call spread.

You no longer have a condor.

And you would not be in a delta-neutral position as in the first example.

So instead, we adjust the single contract of the wide-wing condor by narrowing the put spread instead.

We can do this by rolling the short put option from 4290 down to 4285.

That would reduce our position delta from 1.14 down to 0.60.

Or we can roll the short put from 4290 down to 4280, reducing our position delta to 0.01 for the investor who wants to make the position as delta-neutral as possible.

Or we can roll the short put from 4290 down to 4275, flipping our position delta from positive 1.14 to negative -0.43.

Bonus Resources

Free eBooks:

Mastering Credit Spreads

How to Fix Losing Option Trades

Ultimate Guide to Option Greeks

Earnings Season Mastery

Excel Templates:

Wheel Tracker Template

Cash Secured Put Calculator

Profit Tracking Spreadsheet

Real Examples and Case Studies

Below you will find some example trades to look through:

QQQ Iron Condor Example

No Stress Iron Condor Trade Example

TSLA Earnings Trade Example

GS Condor Example with Adjustments

DE Bear Call Spread Example

OIH Condor Example

To view more example trades go to the below link and search “example”

Option Education – The Best of Options Trading IQ

Related Articles

Iron Condors: The Complete Guide with Examples

Adjusting Iron Condors: 2025 Ultimate Guide

Best Stocks for Iron Condors

Iron Condor Success Rate

Trading Weekly Iron Condors for Income

Iron Condor Calculator

Weekly vs Monthly Iron Condors

Conclusion

Whether you trade two narrow-wing iron condors or one wide-wing iron condor, it is the same as long as the short strikes are at the same place and they have the same expirations.

For those who worry about commissions (and you should not), you may prefer to trade the one with fewer contracts.

The bigger difference between the two occurs during adjustment.

There are many methods to adjust iron condors, which will work fine in either scenario.

However, wider wings give better flexibility to narrow the wing to adjust the position delta.

Also, wider wings may be easier (meaning get better pricing) when rolling the entire spread further out in price or further out in time.

Having more contracts gives better flexibility in closing some spreads to adjust the position delta.

All in all, the differences between the two are quite minor.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.