Today we will review a recent iron condor on Tesla (TSLA) and show you an example of adjusting an iron condor that comes under pressure.

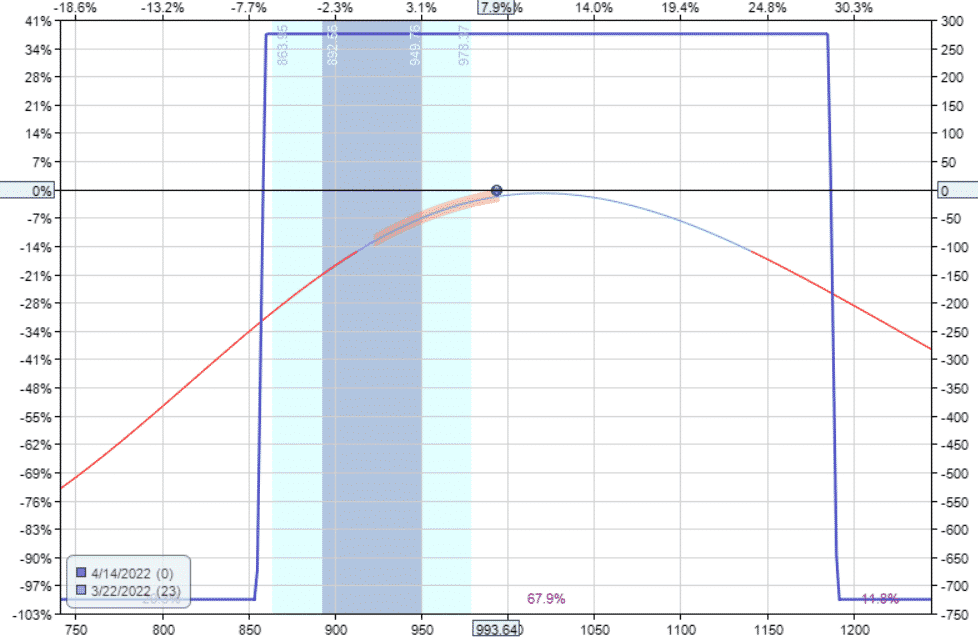

Date: March 22, 2022

Price: TSLA @ $993.64

Buy two Apr 14 TSLA $855 put @ $15.08

Sell two Apr 14 TSLA $860 put @ $15.98

Sell two Apr 14 TSLA $1185 call @ $12.55

Buy two Apr 14 TSLA $1190 call @ $12.07

Credit: $275

Risk: $725

source: OptionNet Explorer

While we like doing iron condors on indices such as SPX and RUT, we also like doing iron condors on high-priced stocks.

At the time, Telsa was trading around $1000 per share.

The short put is at 17 delta, and the short call is at 16 delta for this condor.

Because we are using narrow wings (with the distance between the short and long strike being only 5 points), we can get the risk to reward ratio down to 2.6, calculated by taking $725 divided by $275.

The initial Greeks show our condor’s position delta to be 0.5.

This exposure is equivalent to owning half a share of Telsa stock.

Hence, our Delta Dollars is around $500.

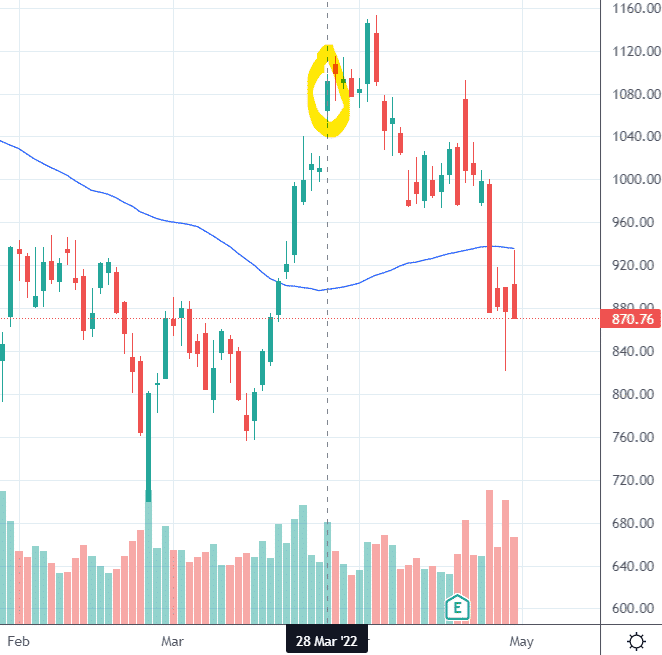

On March 28, TSLA gapped up and continued higher in the trading session.

These big moves are not great for an iron condor.

The delta of the short call has increased to 30, and our P&L is at breakeven.

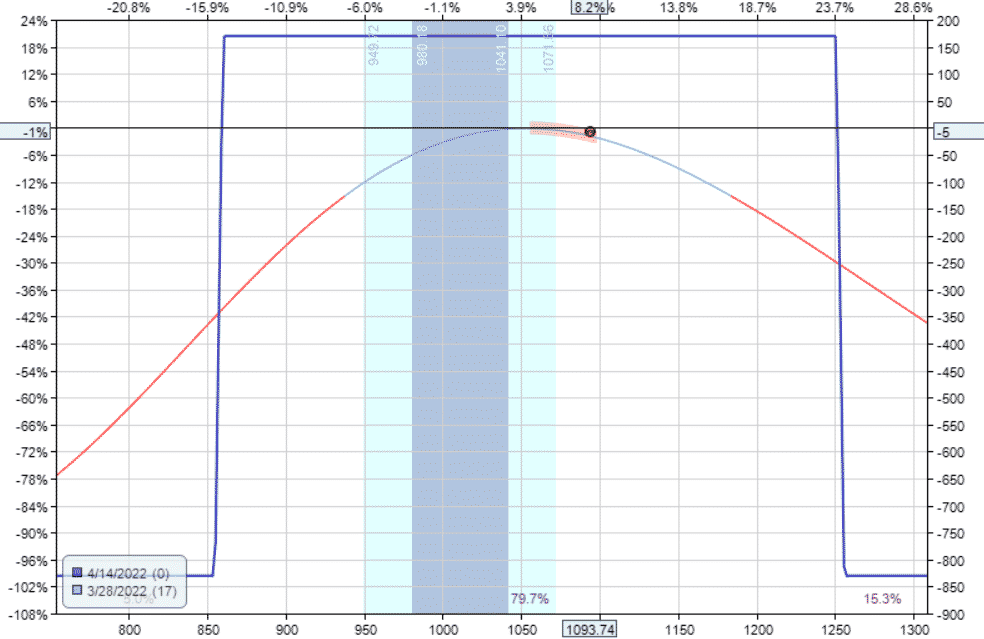

We are at a decision point with the payoff graph looking like this:

The Greeks at this time are:

Delta: -1.28

Theta: 8.46

Vega: -4.91

We can either close the condor and call it a scratch, or we can roll the call spread further up in price.

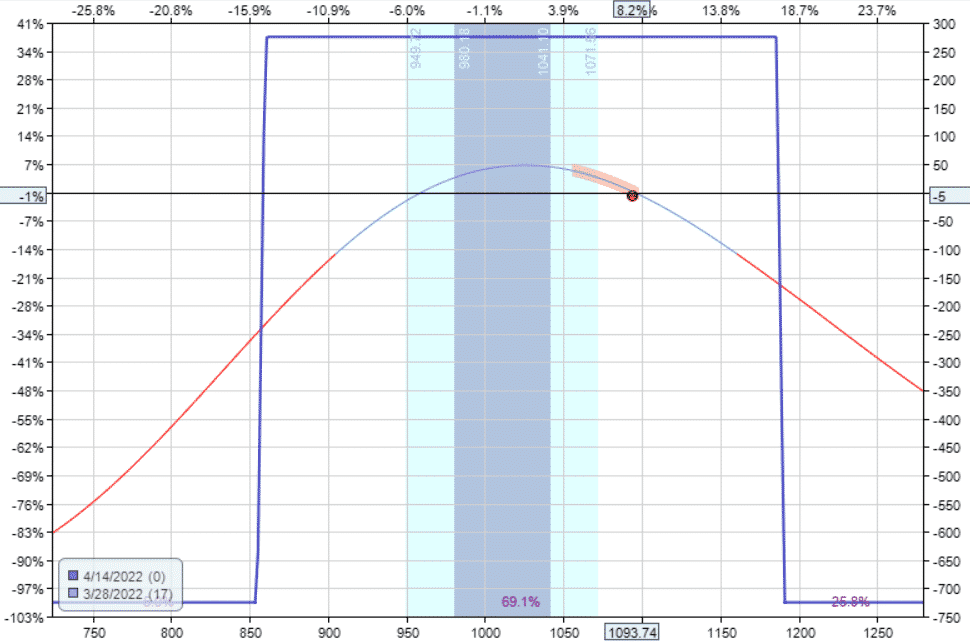

Let’s roll the call spread up to $1250/$1255 by doing the following:

Buy to close two April 14 TSLA $1185 call @ $28.70

Sell to close two April 14 TSLA $1190 call @ $27.53

Sell to open two April 14 TSLA $1250 call @ $16.90

Buy to open two Apr 14 TSLA $1255 call @ $16.25

This roll adjustment moves our short call back to the 20-delta.

The adjustment costs a debit of $105, which decreases the profit potential by that same amount.

Since we had collected $275 initially, we used some of that money to pay for the adjustment.

We don’t want to make any adjustment that costs more than the initial credit received.

Otherwise, we would be locking in a loss.

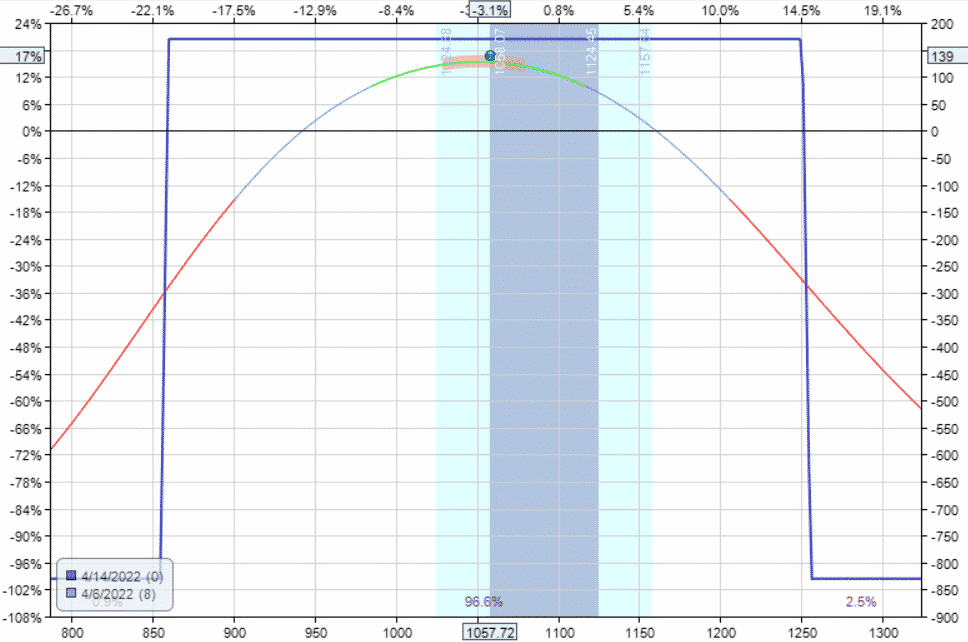

Here is the graph and the Greeks after the adjustment:

Delta: -0.69

Theta: 9.59

Vega: -5.26

This adjustment reduces our delta by approximately half and increases our theta slightly.

On April 6, we are sitting at the top of the curve with about a week till expiration.

There is not much profit potential left in the trade, and it is time to take our $139 profit.

This is 17% return on the capital used in the trade: $139/($725+$105) = 17%

We hope this example of adjusting an iron condor and it helps you with your trading.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Sorry can be a mistake in the credit of fist calls?

fixed, thanks.

Gavin, If you were going to make that adjustment, the put spread was down to nil. Why not roll the put spread up as well to 17 delta?

Hi Jim, yes rolling the untested side closer is also a valid strategy. It’s just not my preferred strategy. Too many times I’ve adjusted the untested side, only for the stock to reverse and then put that side under pressure.

Could you send me: “Information on trading COLLAR SPREADS & Trading LEAPS? ” Thanks