Contents

- The Eleven Market Sectors

- Which Sector Is This In?

- Chart Of Sectors

- Sector Rotation

- Industries

- Conclusion

Many investors use the S&P 500 index (SPX) as a gauge of the stock market.

This index consists of 500 large companies listed on stock exchanges in the United States.

Each of those companies belongs to a “category,” or what we call the “market sector.”

For example, Bank of America (BAC) belongs in the “Financials” sector.

And Microsoft (MSFT) belongs to the “Technology” sector.

Investors that want a more granular view of the market might want to look at the individual sectors of the market.

The Eleven Market Sectors

There are eleven market sectors that make up the market.

Some sectors make up a larger percentage of the market than other sectors.

We’ve listed them here in order from the largest sector to the smallest sector.

- The technology sector (XLK)

- Financials (XLF)

- Consumer Discretionary (XLY)

- Healthcare (XLV)

- Industrial (XLI)

- Communication (XLC)

- Consumer Staples (XLP)

- Materials (XLB)

- Energy (XLE)

- Real Estate (XLRE)

- Utilities (XLU)

As of 2022, the technology sector is the largest sector comprising about 21% of the market.

In contrast, the utilities sector makes up only 3% of the S&P 500.

Keep in mind that the percentage weight of each sector will change over time.

Ten years ago, in 2012, the Financials made up the largest percentage of the market.

You can keep up to date on the sector percentages with the infographics at msci.com.

On barchart.com, under “Popular ETFs,” you can see the eleven ETFs that track the sectors…

source: barchart.com

For example, XLC is the ticker that tracks the communication sector.

I’ve placed the ETF symbol in parenthesis in the above list for your convenience.

Technology Sector

The technology sector consists of companies researching, developing, or manufacturing tech-based goods and services.

For example, companies such as Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Intel (INTC), and Cisco (CSCO) are in the technology sector.

Financials

Companies involved in banking and finance, such as JP Morgan Chase (JPM), Bank of America (BAC), Morgan Stanley (MS), and Wells Fargo (WFC), are in the financial sector.

Consumer Discretionary

Consumer discretionary (also known as Consumer Cyclicals) are goods and services considered non-essential, such as entertainment, high-end apparel, leisure travel, etc.

Consumers are more likely to spend money on these things when economic times are good and less likely when economic times are bad.

These are known as “discretionary spending.”

Since economic times cycle from good to bad and vice versa.

This sector is sometimes also known as “consumer cyclical.”

Examples of companies in this sector are Marriot Hotels (MAR), Royal Caribbean Cruises (RCL), CarMax (KMX), Las Vegas Sands (LVS), and Ralph Lauren (RL).

Healthcare Sector

Companies involved in medical-related goods and services such as UnitedHealth (UNH), Johnson & Johnson (JNJ), Abbvie (ABBV), Pfizer (PFE), Abbott Labs (ABT), Merck (MRK), and Bristol-Myers (BMY) are in the healthcare sector.

Industrial Sector

This sector consists of companies that manufacture equipment and machines used to produce other goods. For example, Caterpillar (CAT) makes heavy construction machinery. Deere (DE) produces forestry machinery and lawnmowers. Honeywell (HON) and Lockheed ( LMT) produce aerospace products.

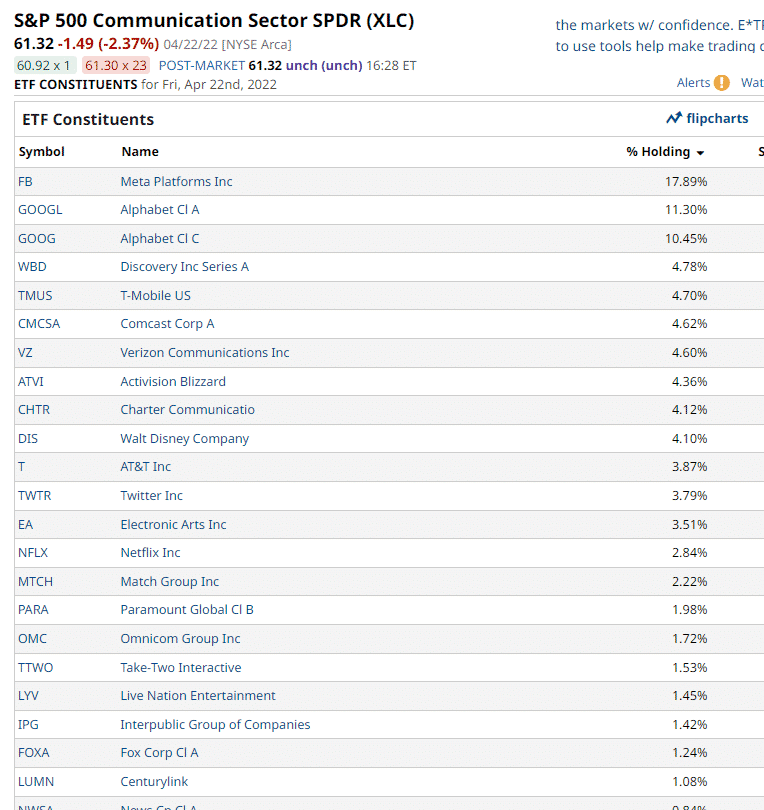

Communication Sector

Facebook (FB) and Google (GOOGL) — officially known as Meta Platforms and Alphabet, respectively — are the two largest holdings inside the Communications ETF (ticker symbol XLC).

Together, these two companies make up more than a third of the communications sector.

We can see this when we look at the “constituents” of XLC on barchart.com.

source: barchart.com

Other companies that are in the communication sector include Walt Disney (DIS), Verizon (VZ), Comcast (CMCSA), T-Mobile (TMUS), AT&T (T), Netflix (NFLX), Twitter (TWTR), and others.

Consumer Staples

Consumer staples are goods and products that are essential for everyday living by consumers.

For example, meat, grains, vegetables, toilet paper, and common household goods are considered consumer staples.

Whether economic times are good or bad, consumers will continue to buy toilet paper and toothpaste.

Examples of companies in this sector are Kimberly Clark (KMB) which produces toilet paper; Walgreens (WBA), which is a chain of drugstores; and Clorox (CLX), which makes cleaning supplies.

This sector is also known as “Consumer Defensive.” Stocks in this sector are known as defensive stocks.

The thinking is that these businesses will continue to have customers even in bad economic times.

Materials Sector

These are companies involved in discovering, acquiring, and extracting raw materials from the earth.

These raw materials can include oil, gold, timber, and other natural resources.

Examples of such companies are Freeport-Mcmoran (FCX), Newmont Mining (NEM), and Martin Marietta Materials (MLM).

Energy

Companies involved in energy production and distribution include Exxon Mobil (XOM), Chevron (CVX), Schlumberger (SLB), and Halliburton (HAL).

Real Estate

Companies such as Prologis (PLD) are involved acquisition and operation of real estate properties.

Companies in this sector also include REITs (Real Estate Investment Trusts) such as American Tower Corp (AMT) and Crown Castle International (CCI).

Many of these companies own income-producing real estate.

Utilities

The Utilities sector consists of companies that provide basic electric, gas, water, and sewage services.

These include American Electric Power (AEP), Nextera (NEE), Southern Company (SO), and American Water Works (AWK).

Which Sector Is This In?

For certain companies, it is not so obvious which sector they belong in.

Or you might disagree with the sector that a company is placed in.

In any case, someone (I don’t know who) has decided which sector a company falls into, and there is no argument about it.

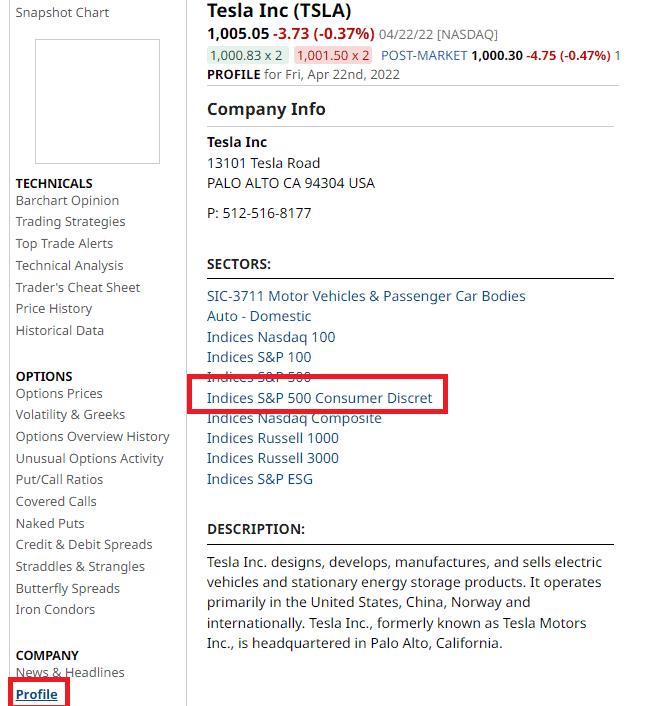

Take, for example, Telsa (TSLA), the maker of electric cars and battery technology. Is it considered a technology company or consumer discretionary?

The definitive answer can be determined by looking at the “Profile” of the TSLA on barchart.com (or equivalent resource). Here we see that it is part of the consumer discretionary sector.

source: barchart.com as of April 24, 2022

This makes sense when you consider that if consumers do not have extra discretionary income, they will drive a Kia instead of a Tesla car.

Chart Of Sectors

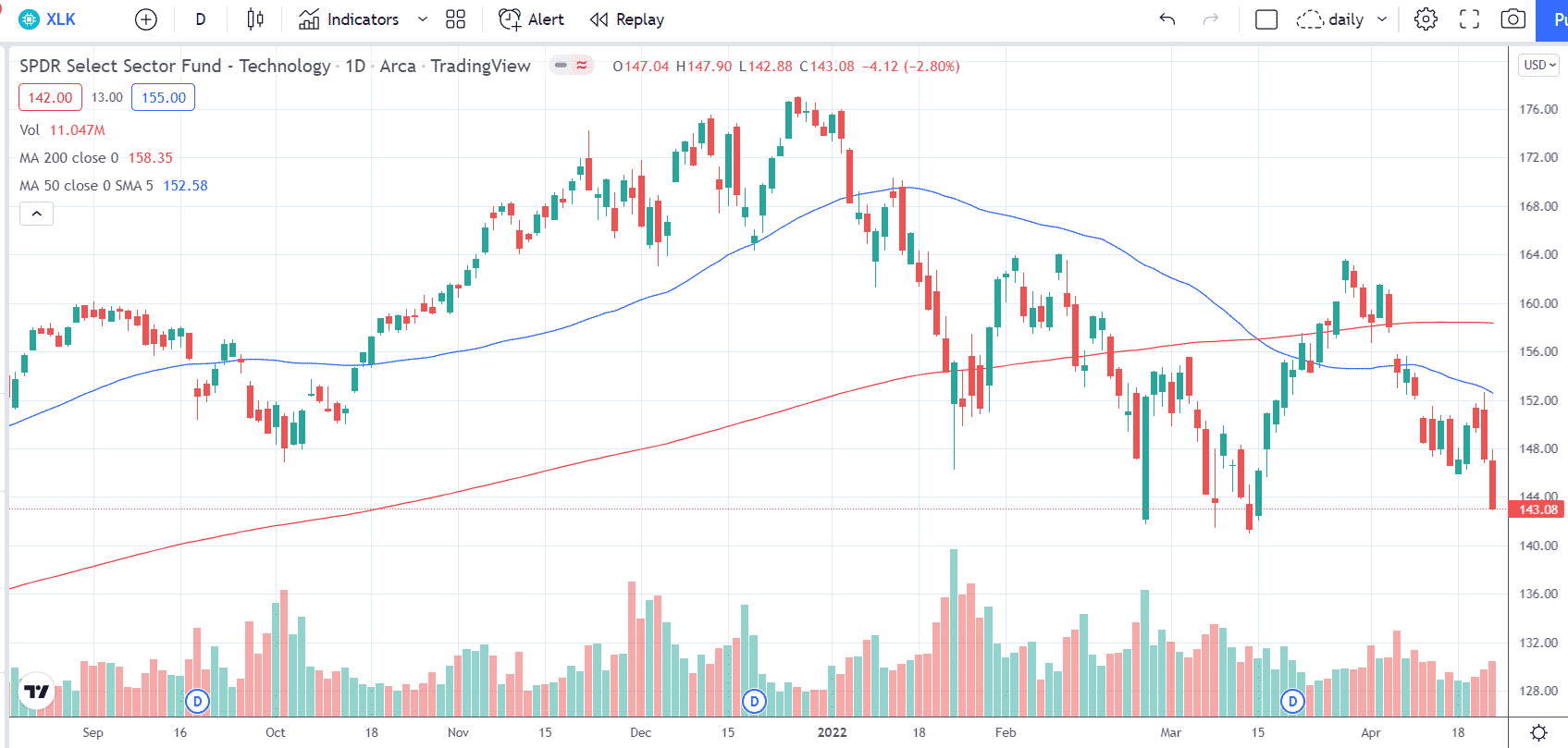

Let’s see how the technology sector (XLK) is doing at this point in time.

source: tradingview.com

Hmmm.

They are not looking so good. It has seen better times.

Price of the XLK ETF is below the 200-day simple moving average (red line) and the 50-day moving average (blue line).

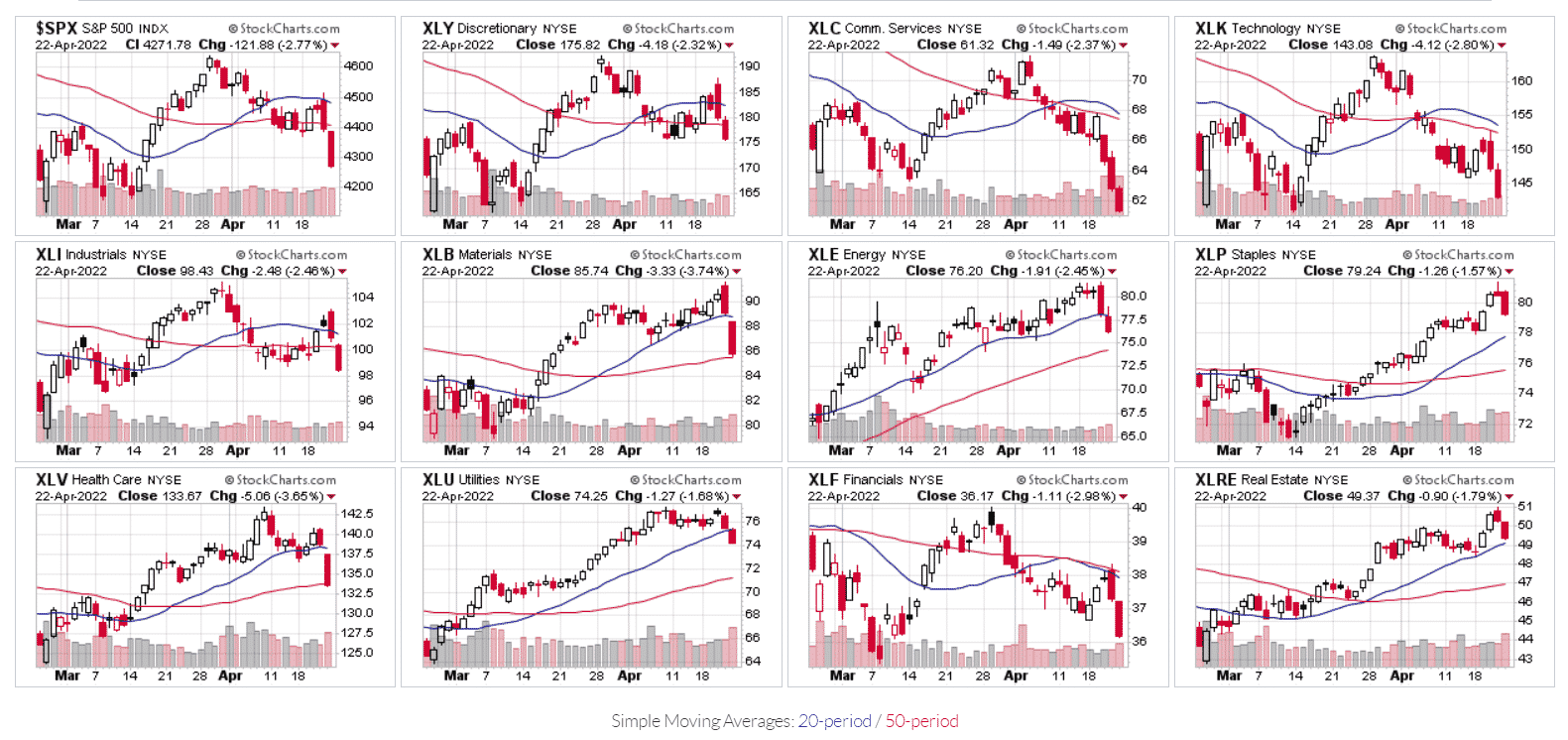

Or you can see the graphs of all eleven sectors at once using StockCharts CandleGlance.

source: stockcharts.com as of April 24, 2022

Sector Rotation

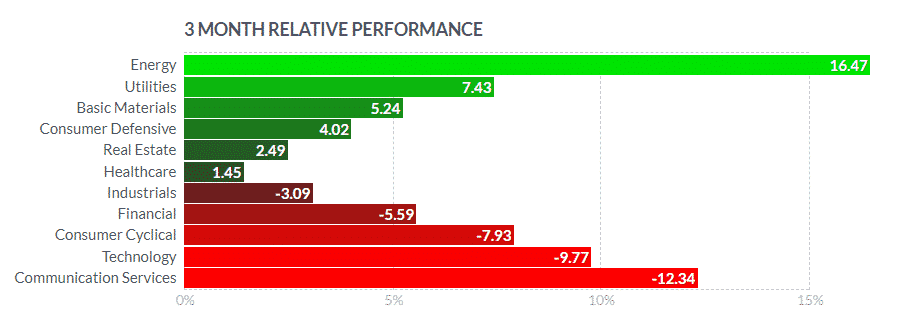

To see how each of the eleven sectors performed relative to each other, we can view the graph on StockCharts.com.

source: stockcharts.com as of April 24, 2022

This graph was configured to show 90 days using the S&P 500 as the baseline.

We can see that the energy sector did much better than the overall S&P 500 index.

It is followed by consumer staples and utilities.

We also see that communications, technology, and consumer discretionary underperformed the overall market.

By looking at the performance of the sectors on a regular basis using Finviz, a chart, or by other means, investors can get a sentiment of the market by “sector rotation analysis.”

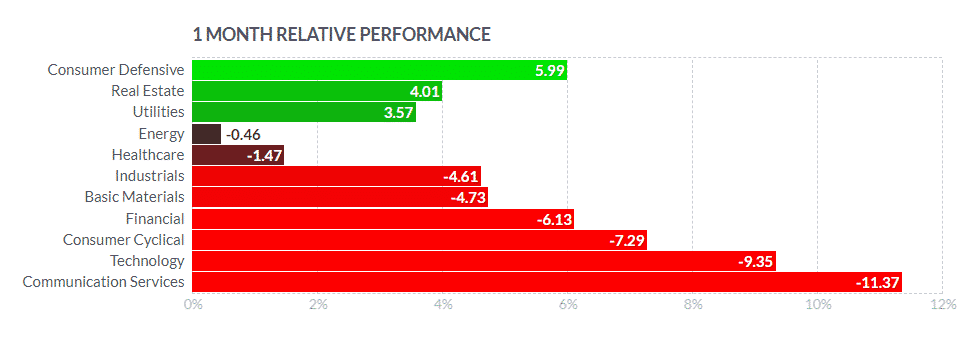

Take a look at the one-month performance of the eleven sectors of the Finviz screenshot shown below.

source: Finviz.com

While Finviz calls the sector “Consumer Defensive,” it is the same sector that is better known as “Consumer Staples.” Finviz uses the term “Consumer Cyclical,” which is the same as the “Consumer Discretionary” sector.

Over the last month, as of April 2022, consumer staples, real estate, and utilities have been doing well.

These are defensive sectors.

Consumers with less discretionary spending will still need to buy staples, pay rent, and pay their electric bills.

At the same time, communications, technology, consumer discretionary, and financials are doing poorly.

That means that investors are rotating money from growth stocks to defensive stocks (or, some say, value stocks).

They are starting to take a risk-off posture. And that can imply a bearish market sentiment.

Industries

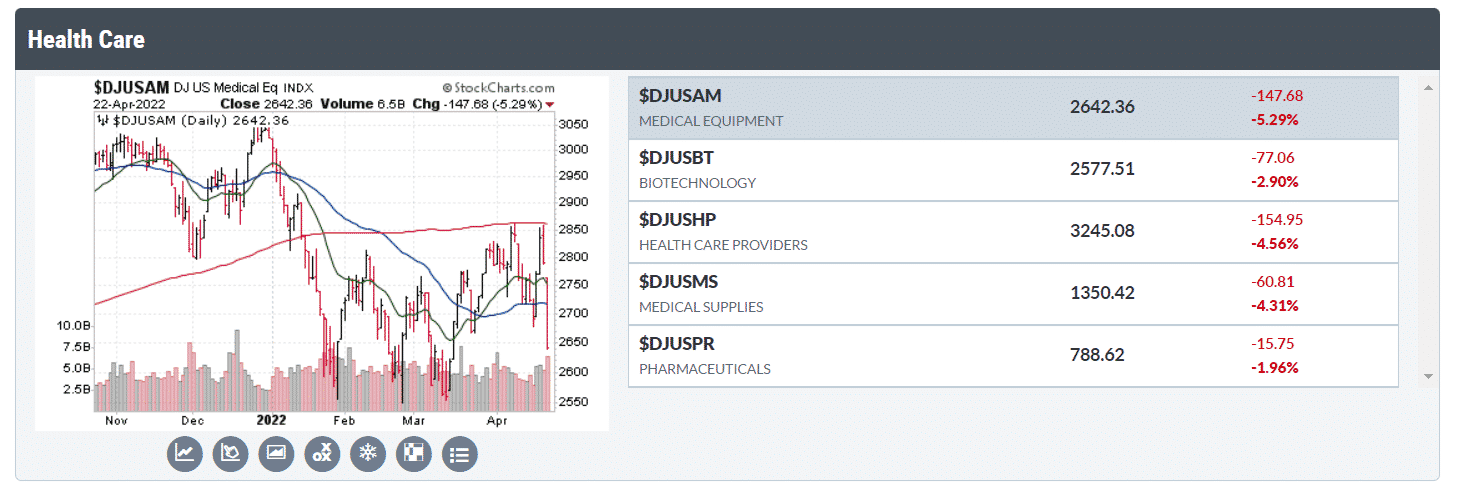

Market sectors are further broken down into industries.

For example, in the health care sector, we have five major sectors:

Medical Equipment BioTech Healthcare Providers Medical Supplies Pharmaceuticals

You can find these on StockCharts.com.

Conclusion

By becoming aware of the eleven sectors and how each is performing, investors can gauge the market’s sentiment and see which sectors money is flowing into.

One can then find the best performing sector at the current time, find the best performing industry in that sector, and then find the best performing stock within that sector and industry.

“Best performing” will depend on what time horizon you are looking at.

Over a three-month time horizon, we see half of the sectors being bullish, with energy far outperforming the rest:

source: Finviz as of April 24, 2022

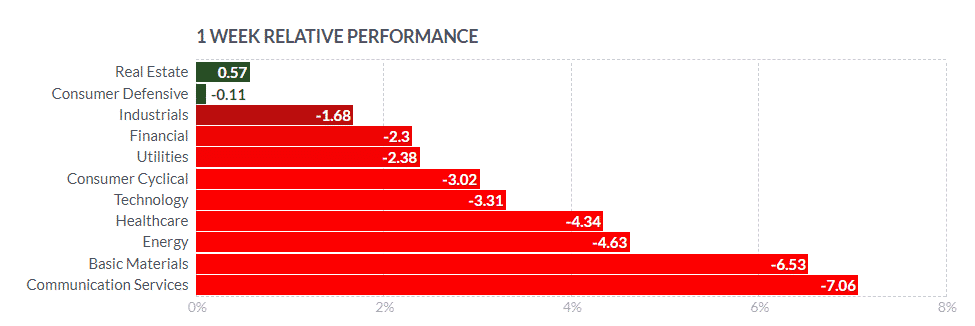

Over the past week, most sectors turned bearish, with a very small green in real estate.

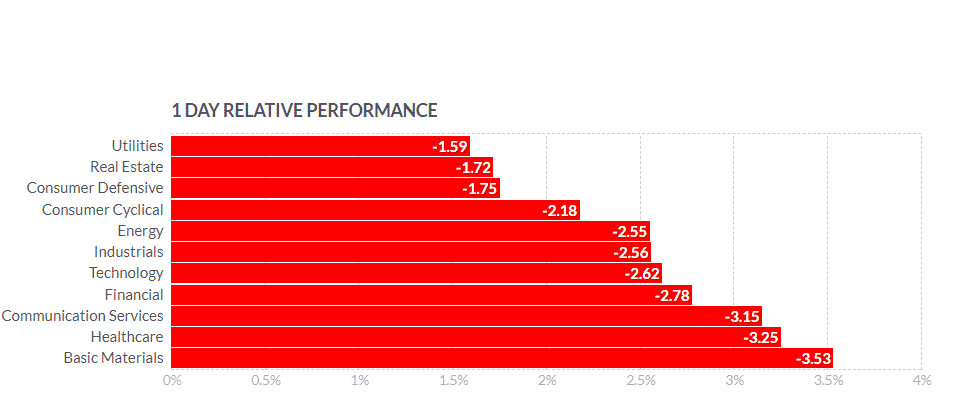

And in the last trading session on April 22, 2022, all sectors turned red…

Do you see a trend happening?

What is going to happen next?

Which sector will be the first to turn green again?

Keep watching the eleven market sectors to find out.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Great summary of the S&P sectors and breakdowns…. AND SOURCES! Thank you!

You’re welcome.