Entering the property market is getting harder and harder with prices rising strongly over recent years.

REIT’s provide a great way to gain exposure to real estate in your investment portfolio for a fraction of the cost of buying a physical property.

There are over 200 REIT’s trading on US exchanges, but some of them are illiquid and may not have options available.

So, which are the best REIT’s for option traders?

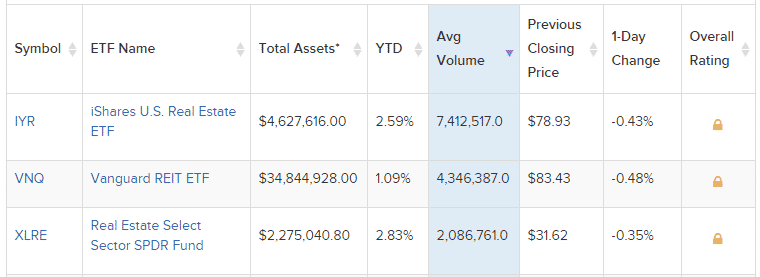

Liquidity is very important, so let’s first look at the most active REIT’s.

There are 3 standouts here as you can see below. Anything with daily volume less than 1 million shares has been excluded.

IYR – iShares US Real Estate ETF

VNQ – Vangaurd REIT ETF

XLRE – Real Estate Select Sector SPDR Fund

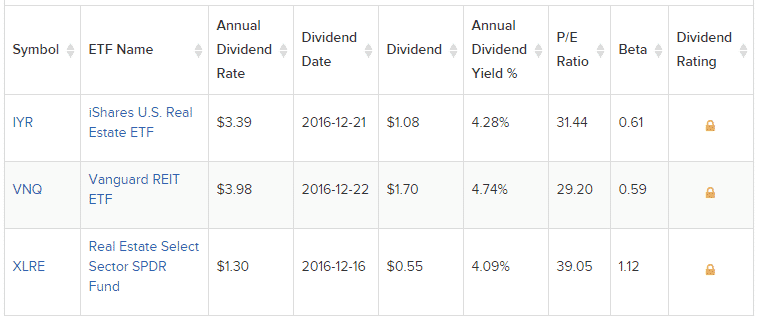

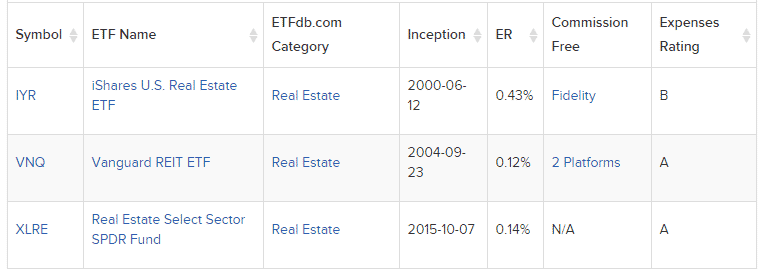

Next we’ll look at the dividend yield of the 3 ETF’s. All pretty similar with VNQ slightly ahead.

In terms of expense ratio, VNQ is again the winner, although only just. IYR is much higher than the other 2.

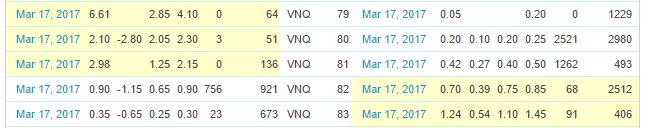

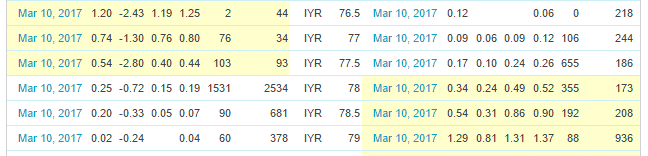

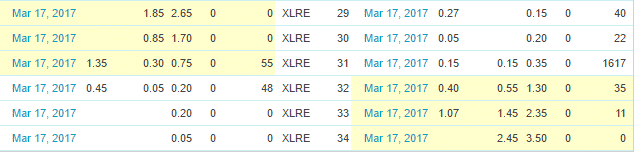

Finally lets look at the option trading volume and the bid – ask spread for each REIT. Low volume and high spreads can result in significant slippage so we want lots of liquidity and a tight spread if possible.

One of the three can be excluded for option traders based on the images below. Can you guess which one?

If you guessed XLRE, well done. For March 8th, there was zero volume in the near the money strikes. For me, that signals a no go zone. It can be hard to get filled near the mid-point if there is no one else trading these options.

IYR has a tighter bid-ask spread than VNQ while having similar volume and open interest.

For me that makes IYR the winner and the most attractive REIT for trading options.

Let me know if you’e ever traded options on any of these REITs?

>

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Test