Contents

The “GS Condor” – sounds like a good name for an airplane.

In this example, we analyze an iron condor on Goldman Sachs (GS) that started on December 21, 2022, with a one-month expiration.

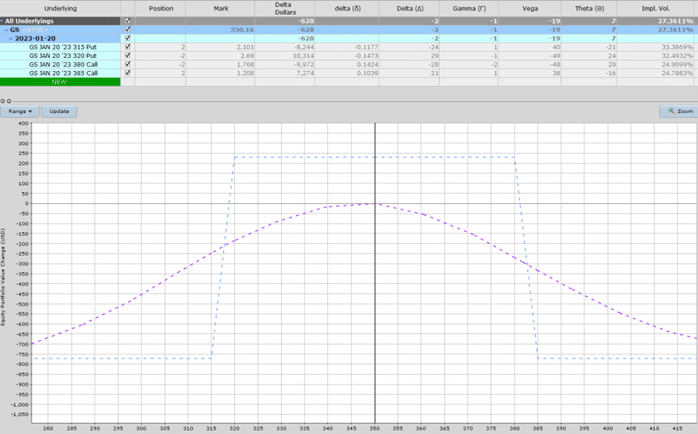

Date: December 21, 2022

Price: GS @ $350.16

Buy two January 20, 2023, GS $315 put @ $2.10

Sell two January 20, 2023, GS $320 put @ $2.69

Sell two January 20, 2023, GS $380 call @ $1.77

Buy two January 20, 2023, GS $385 call @ $1.21

You can see that we are selling more premium than we are buying.

We are options sellers in this trade.

The net credit we get from the sale is $230, calculated as follows:

2 x -$210 = -$420

2 x $269 = $538

2 x $177 = $354

2 x -$121 = -242

Net credit: $230

Below is the payoff diagram, where you can see the highest potential profit is at $230.

In an iron condor, the maximum potential profit is the initial credit received.

We will get this full credit only if we hold the trade to expiration, which we generally would not do.

Therefore, we want to see how much of that credit we can keep.

A typical target that many traders strive for is to keep 50% of that potential profit.

Also, from the graph, you can see the largest possible loss is $770.

The width of the spreads partly determines the risk.

We have two call spreads with a 5-point width. We have two put spreads with a width of 5 points.

Each spread has a maximum risk of $500, and we have four spreads.

The two spreads have a total risk of $1000.

But we collected a credit of $230, which reduces our risk.

Therefore, our maximum net risk is $1000 – $230 = $770.

Let’s see if this trade worked out or not.

Adjustment

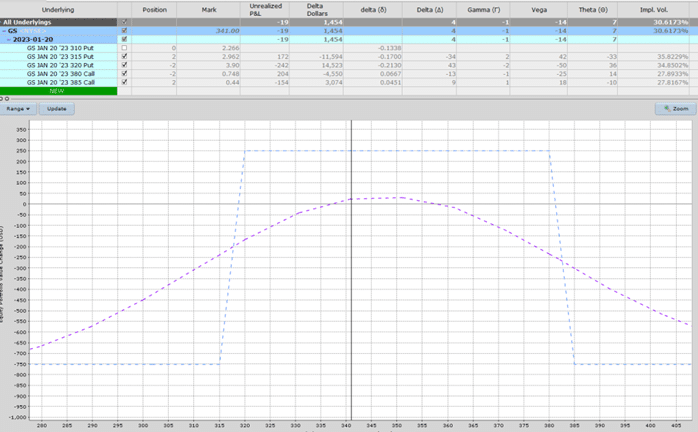

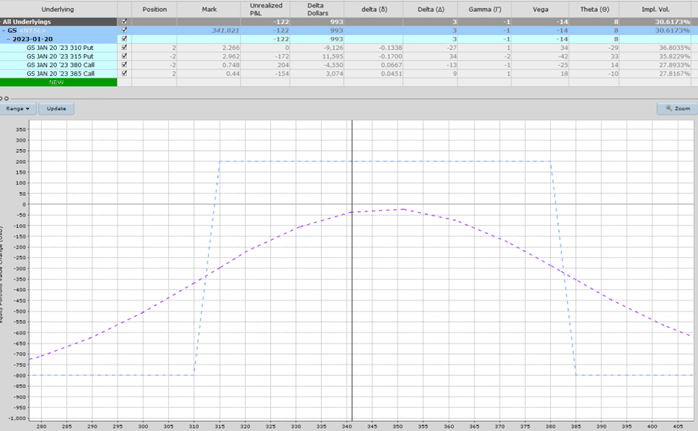

On December 29, even though the short put is only delta 21, it could be worth taking some pre-emptive defensive action here by rolling the put spreads down from 320-315 to 315-310.

BEFORE

AFTER

This reduced the overall delta in the position.

Closing Trade

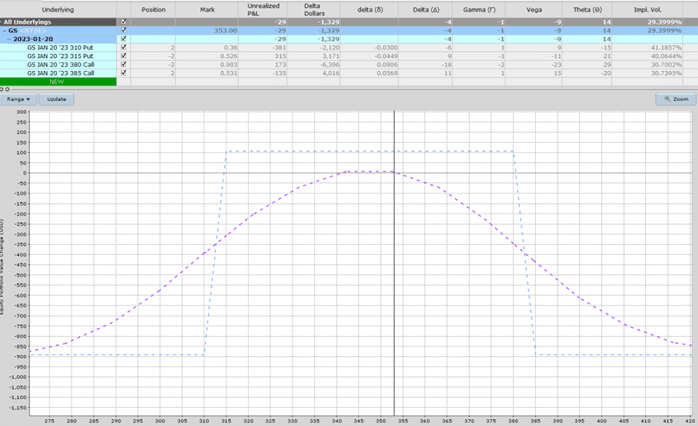

On January 1, we are getting close to January expiry, so this was a good time to start closing out January trades.

Closing this trade would give about +$70 net profit.

Conclusion

The $70 profit is about 30% of this trade’s maximum potential profit of $230.

Somewhere between 25% to 50% of the maximum profit is a good percentage.

But we also have to consider how much time is left till expiration.

The trade was taken off with 19 days left to the expiration date.

If possible, we must try to take off trades as it approaches two weeks till expiration.

FAQ

What is an iron condor?

An iron condor is an options trading strategy that involves selling both a call spread and a put spread on the same underlying asset with the same expiration date, creating a neutral position that profits from a range-bound market.

How does an iron condor work?

An iron condor involves selling an out-of-the-money call option and an out-of-the-money put option, while simultaneously buying a further out-of-the-money call option and a further out-of-the-money put option.

This creates a net credit, which is the maximum profit for the position, and establishes a range of prices within which the underlying asset must stay for the position to be profitable.

What are the benefits of an iron condor?

The main benefit of an iron condor is that it allows traders to profit from a range-bound market while limiting their risk.

This strategy is particularly effective in markets that are experiencing low volatility, as it takes advantage of the lack of price movement to generate income.

What are the risks of an iron condor?

The main risk of an iron condor is that if the price of the underlying asset moves outside of the established range, the trader can experience significant losses.

Additionally, as the position involves selling options, there is a risk of early assignment, which means that the trader may be forced to buy or sell the underlying asset at the option’s strike price.

How do you manage an iron condor?

To manage an iron condor, traders should closely monitor the price of the underlying asset and adjust the position as needed to maintain the established range.

Additionally, traders should have a clear exit strategy in place and be prepared to close the position if the price of the underlying asset moves outside of the established range.

What are some best practices for trading an iron condor?

Some best practices for trading an iron condor include carefully selecting the strike prices and expiration date of the options, using a risk management strategy such as stop-loss orders or position sizing, and regularly monitoring the position to ensure that it remains within the established range.

Additionally, traders should be comfortable with the risks involved in the position before opening the trade and should have a clear understanding of the potential outcomes of the strategy.

We hope you enjoyed this GS condor example.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thank you for the IC example- can you speak about how you do the rolling- usually that is assumed but rarely shown how to do it – for people like me who are novice to the business.

If you can tel me how you rolled this GS or another example- I would really appreciate it.

Thank you for the I Condor example- can you speak about how you do the rolling- usually that is assumed but rarely shown how to do it – for people like me who are novice to the business.

If you can tel me how you rolled this GS or another example- I would really appreciate it.