Here is another longer-term QQQ iron condor example.

Suppose an investor sells an iron condor on August 30, 2023, that expires on October 20 (almost two months till expiry).

Trade Details

Date: August 30, 2023

Price: QQQ @ $377

Buy two contracts October 20 QQQ $345 put @ $2.02

Sell two contracts October 20 QQQ $350 put @ $2.56

Sell two contracts October 20 QQQ $405 call @ $1.39

Buy two contracts October 20 QQQ $410 call @ $0.83

The price of this iron condor is $1.10 (on a per-share basis).

So we collect a credit of $110 for selling one condor.

We are selling two. So, $220 (minus commissions and fees) went into the investor’s account as soon as the order was filled.

The short options were near the 15 deltas on the option chain.

Note that the short call at $405 is 28 points away from the current price.

The short put at $350 is about the same at 27 points away.

The wings are 5 points wide each.

This way, there is equal risk on the upside and the downside.

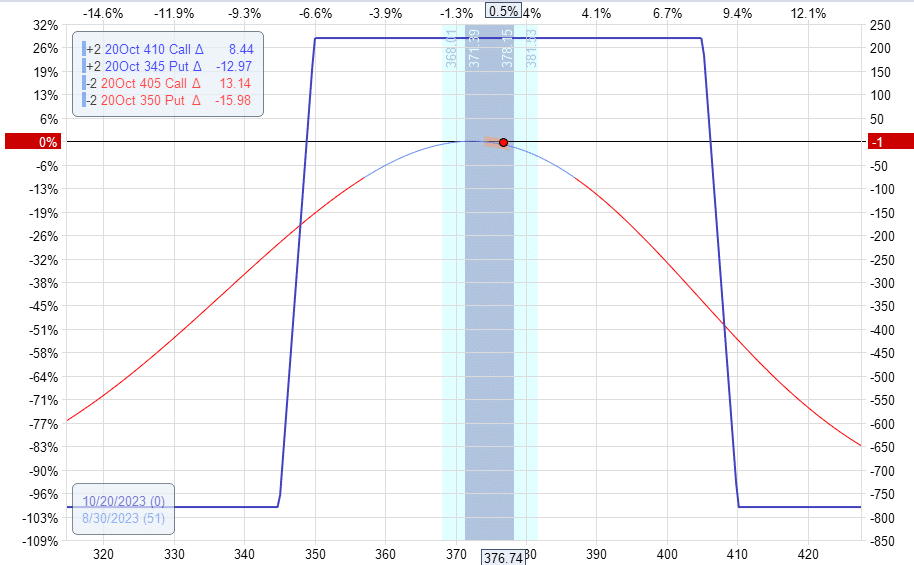

The payoff diagram, also known as the expiration graph, looks like this:

The Greeks:

Delta: -3.3

Theta: 4.3

Vega: -26

With a net credit of $220 and $780 of risk, the trade has a risk-to-reward ratio of 3.5, which is good for this kind of iron condor.

How do we know this condor has $780 of max risk? We can see this from the payoff graph above.

Or we can calculate it as follows.

Imagine the worst-case scenario where the market crashes and the price of QQQ is below $345 at expiration.

We would need to buy shares of QQQ at $350 because of the short put that we sold at the $350 strike.

Since we have a long call at $345, we can sell the shares at $345.

That is a $5 loss per share.

We have two contracts, each of which represents 100 shares.

So that is a payout of 200 x $5 = $1000.

It is not a $1000 total loss because we collected $220 at the start of the trade.

It is only a loss of $780. That is the maximum risk.

Order To Close

This condor has about two months to expiration.

But many investors will not hold it that long.

Some will decide to take profit if they can keep half the credit received.

In this example, we collected a total of $220.

We are willing to pay back $110 to close the trade to keep the other $110 as profit.

Therefore, it is a good idea to set a Good-Till-Cancel (GTC) order to buy back the condors and close the entire trade for a debit of $110.

The order to close would be like this:

Sell to close two contracts October 20 QQQ $345 put

Buy to close two contracts October 20 QQQ $350 put

Buy to close two contracts October 20 QQQ $405 put

Sell to close two contracts October 20 QQQ $410 put

We set a limit price of a debit of $0.55 for this order.

That is for one contract on a per-share basis.

Since we are buying back two contracts, this order would be a debit of $55 x 2 = $110 to close the entire trade.

The limit order will only get filled if the price of the condor drops to $0.55 or below.

That means we will not pay more than $55 to buy back one condor.

Conclusion

Even so, we need to monitor the condor daily to see that price stays relatively centered in the condor and that no adjustment is needed.

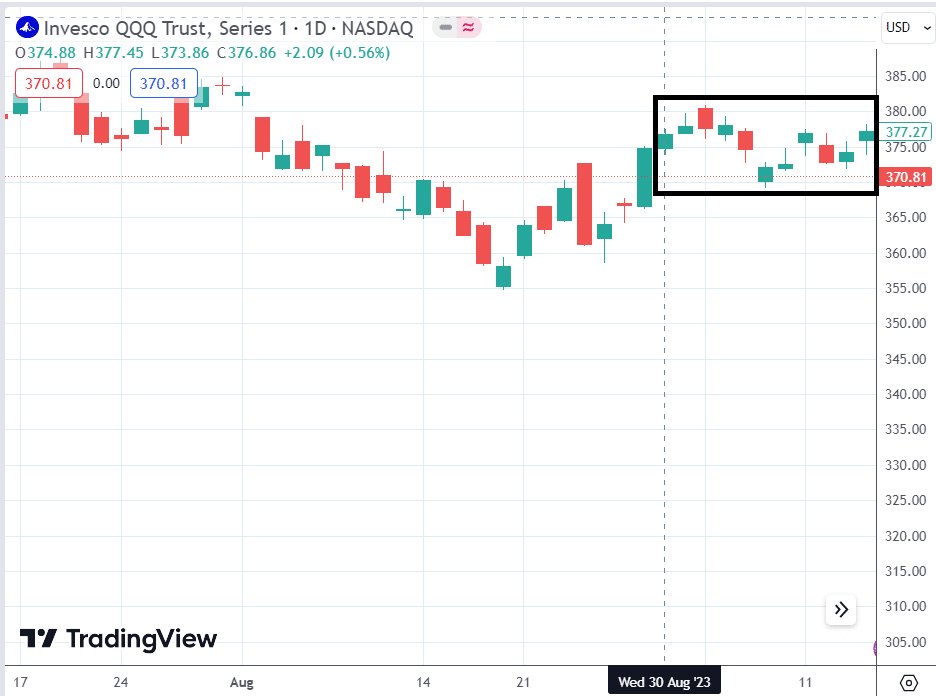

QQQ was friendly to us, and no adjustment was needed.

It stayed in a tight range for about two weeks.

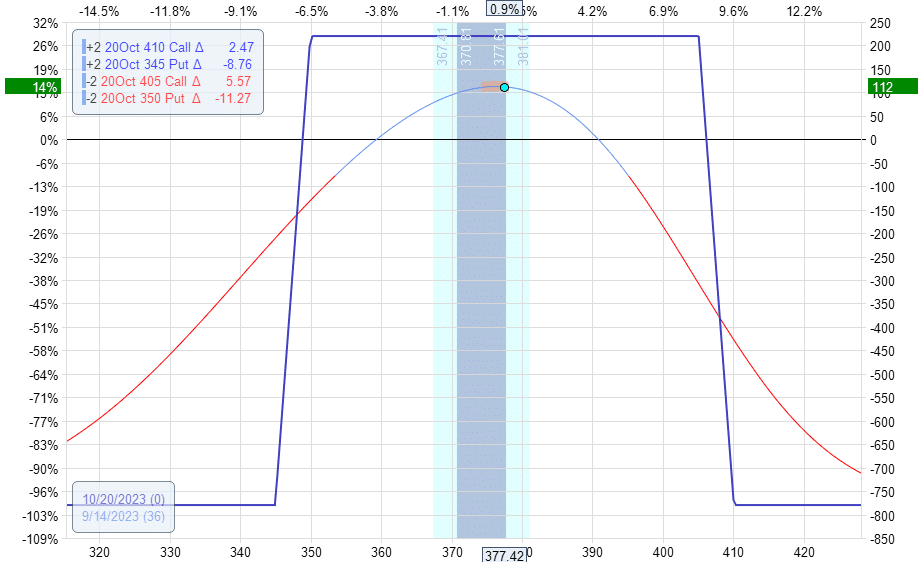

On September 14, the order was triggered, and the trade was closed.

That is a profit of $110 from the trade.

That’s a 14% return on capital at risk of $780.

Here is the price on September 14 – right around $377, just where the trade is:

This trade is one of those that collected 50% of its maximum potential profit in less than 50% of the duration of the trade.

We take it whenever we can get half the profit in less than half the time.

These longer-term trades are nice.

Had this been a shorter-term 14 days-to-expiration trade, some adjustment probably would have been needed.

While some traders like to be more active, for others, the less work, the better.

We hope you enjoyed this QQQ iron condor example.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks Gavin. There is only a small transcription error, you put all Put.

Always great ideas