Today we’ll discuss the difference between two types of order: Stop order vs Stop limit order.

There are numerous different types of orders investors can place which will execute trades in different ways.

This article will discuss the difference between these two orders.

We will then explore strategies for when best to implement a Stop order vs a Stop-Limit order.

Contents

- Similarities and Differences

- Advantages of the Stop Order

- Advantages of the Stop Limit Order

- Which Order is Better?

- Concluding Remarks

Similarities and Differences

The Stop and Stop-Limit orders are both orders that become active once the price reaches a certain price threshold.

If that price is not breached, then the order will remain dormant until the good-till date.

If the price breaches the threshold before that good-till cancel date (for as little as a second), both the stop and the Stop-Limit order will become active.

This makes the stop and the Stop-Limit order identical before becoming active.

The difference between the two comes into effect once the order is activated.

Once a stop price is breached, a Stop order will submit a market order, and it will be executed into the market at the best bid or ask price.

Conversely, a Stop-Limit order will be submitted as a limit order once the stop price has been breached.

Advantages of the Stop Order

A Stop order has a distinct advantage over the Stop-Limit order by guaranteeing a fill for the trader.

Generally speaking, a stop price is either set as a maximum risk or an identification of being wrong on a trade.

At this point, there is no use hanging around “hoping” a position will come back.

If an order is placed as a Stop-Limit order and is not filled, an investor could face more losses than a simple stop order.

In extreme cases, this can lead to margin calls or substantial drawdowns.

Advantages of the Stop Limit Order

Due to the urgency associated with Stop orders, orders may be filled at a very unfavorable price.

This situation is especially the case for stocks with low liquidity.

When a significant move happens, spreads will often widen.

A simple Stop order will execute at the best bid.

This could mean horrible fills on occasion as an investor is at the whims of a market maker.

A Stop-Limit order helps prevent this by providing a floor price and will become active as a passive order when the stop price is breached.

This allows for liquidity to come back to the underlying and potentially a better fill for the investor.

Which Order is Better?

Neither the Stop nor Stop-Limit is in any way better.

In certain situations, one will work better than another, and it is often only visible after the fact.

Despite this, one factor helps determine whether to use a Stop or a Stop-Limit Order.

Liquidity.

Fill quality is directly related to the liquidity in the underlying security.

There will be very tight bid-ask spreads for securities that trade very frequently as there is a lot of turnover and competitiveness in the market.

This will usually ensure that a Stop Order will execute at a price near the stop, or in the case of a non-trading jump, move a reasonably fair price after the jump.

Using a Stop-Limit order in these cases that is too optimistic could involve you bag holding a position all because you wanted to get a few extra pennies out of a losing trade.

We broadly define Liquid security as a security that trades > 1,000,000 shares a day.

In contrast, for illiquid stocks, spreads will be wider and often vary greatly.

Using a Stop-Limit order here can help you get a fair fill.

I generally would suggest a Stop-Limit order of around .5% lower than the stop price.

This should ensure a fill in most situations of regular trading.

For companies with earnings or trading near the stop, monitoring the position for any overnight moves that may pass the limit price is beneficial.

If this occurs, exit the position the following day by adjusting the orders limit to the new spread.

We define Illiquid security as a security that trades < 1,000,000 shares a day.

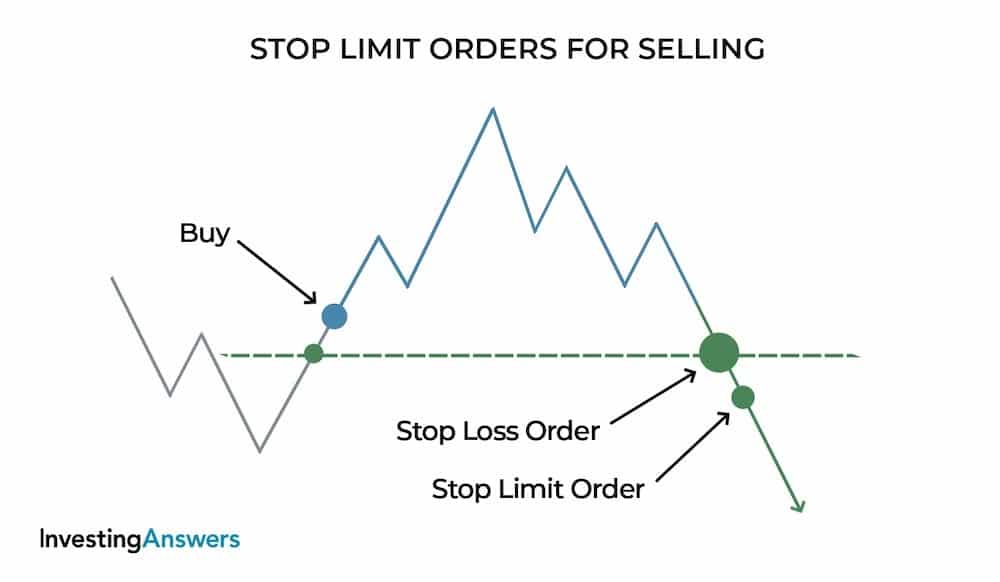

Source: Investing Answers

Using these liquidity metrics will not guarantee a better fill.

In fact, in some cases, one order will be better than another despite the liquidity metric.

That being said, by using liquidity as a filter, we can help avoid some of the horrible fills associated with stops on illiquid securities while still prioritizing fill urgency and getting out of the position when we are wrong.

Concluding Remarks

A Stop order is an order executed as a market order if a pre-determined stop price is breached.

A Stop-Limit order becomes active once the stop price is breached but is set as a limit order and not a market one.

Both orders are very similar in that they ensure a swift exit of a position when an investor is wrong or has reached the maximum loss they are willing to take.

A Stop order guarantees a fill and has the benefit of urgency, while the Stop-Limit order has the benefit of price.

Using them interchangeably depending on the liquidity of a security may help ensure better fill prices while also quickly exiting positions when a trader is wrong.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

One problem with Stop limit order, that many ignore

is that these type of orders do not execute outside of

normal market hours.

Yes, that’s true.