Today, you will learn why paper trading and backtesting may not simulate real trading accurately.

There are two main reasons for this.

- The fills are not realistic.

- And the psychological factors

ThinkOrSwim, Tradier, and other platforms have a paper trading feature where you can use simulated money, or what is known as “paper money.”

Their purpose for providing such features is for you to learn how to use their platform without risking real money.

However, many traders find themselves using it to test out new strategies.

This is a good idea.

However, realize that the result from these simulated trading would likely be better than what would be achieved in live trading.

Contents

Fills

Unfortunately, it is very difficult for such software to predict accurate fills because real-life fills will depend on the participants in the marketplace and other market forces.

Experienced traders who have traded live markets will find that simulated software sometimes gives them favorable fills that they normally would not see in live markets.

There have been many anecdotal reports of this.

This software would take the lowest bid and high ask prices and then compute the average, called the mid-price.

It simply assumes that you get filled at this mid-price.

This bid/ask spread is small and less of an issue for stock trading or futures trading.

For options trading, this bid/ask spread can be quite wide.

When the market is making a large down move, the bid-ask spread increases, and transaction orders are more difficult to get filled.

Because of this, traders trading live on those days will have to “give some on the bid/ask spread.”

This means that they must keep modifying their order at a less favorable price to get the order executed.

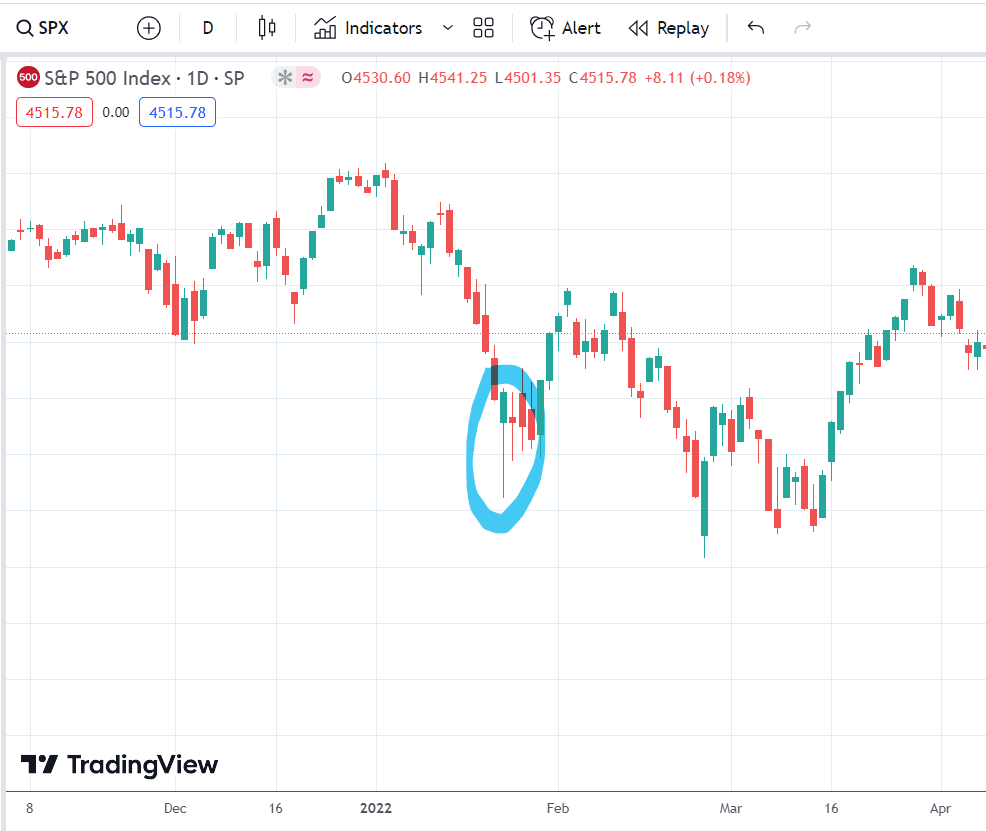

As a case in point, let’s look at the bid-ask spread reported by OptionNet Explorer when we tried to exit a simulated butterfly trade on January 24, 2022.

Looking back at the chart, January 24 is that green candlepin bar where the market made a big drop in the morning just to come back up by the end of the session:

Exiting a butterfly is a three-legged order involving buying an option and selling two other options.

Because each leg has its own bid/ask spread, the more legs in an order, the more the bid/ask spread adds up, giving an even wider overall bid/ask spread for the order.

Here, we see that to exit this butterfly on SPX (the liquid Standard & Poor’s 500 index), the trader can get a credit of $27.90 or might have to pay a debit of $17.40.

This wide bid-ask spread can certainly be the difference between a winning and a losing trade.

What the software will do by default is to give the simulated trade a credit of $5.25, which is the average of two ends of the spectrum.

In live trading, one would likely get a credit less than that.

Some savvy traders may already realize this and would manually adjust the fills to be more realistic.

In OptionNet Explorer manual testing, one can type in a specific fill price.

The “Price” field in the above screenshot is an input box.

The trader can type in “3.75” if they want.

But what would be the more accurate and realistic fill?

This is hard to determine and can only be determined if you are currently in the live market.

For those doing automated testing, they can try to see if they can find a setting in their software that can automatically downgrade the credit or increase the debit from mid-price to make it more realistic.

But it is not guaranteed that all such software would have this feature.

Psychological Factors

On top of that, psychological factors make trading more difficult when trading live.

The trader, desperate to get out of the butterfly, may become impatient and give up even more credit than necessary, making the order fill even worse than mid-price.

This goes with stock traders afflicted by greed and “FOMO” (fear of missing out) and chasing a stock as the stock price gets away from them.

So they had to pay a higher price.

Other sets of traders are afflicted by fear – the fear that the market may take away their profits.

So they exit the position too soon and do not follow the rules of the strategy, which tell them to stay in the trade because the profit target has not been hit yet.

It is much easier to follow the trading plan when trading with paper money than when there is real money on the line and other factors.

Conclusion

This is not to say that backtesting and paper trading have no value.

They do.

Just understand that they have limitations.

Their results tend to be better than what would occur in real-life trading due to their favorable fills that one might not be able to get in the live market.

Also, they do not consider the psychological factors that may affect traders in live trading.

There may be other nuance differences between live trading and simulated trading.

One example is the early assignment of a stock with an in-the-money option close to expiration.

Such things do not occur in simulated trading. However, it can occur in live trading.

A good way to go about it is to use simulated trading to test a new strategy and see if it is viable.

If the strategy can not perform well in backtest or paper trading, it will likely not do well when traded live.

If the strategy has a positive outcome in paper trading and backtesting, one can start trading live in small sizes.

Trading live with a small position is a good way to learn and start.

We hope you enjoyed this article on the difference between paper trading and backtesting.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Great article, Gavin. I’ve experienced both of these caveats in transferring my backtesting to the live market. Nice to read an article about them.