This post involves a more advanced delta neutral trading strategy, so it is not recommended for beginners but I’m making this post at the request of one of my readers.

First, we should begin with a definition of delta. Delta is the amount by which the price of an option changes for every dollar move in the underlying instrument. For example, an at-the-money call option has a delta of 0.50, the option price will increase by $0.50 for every $1 move in the underlying security. If you were to purchase 2 at-the-money call options, your delta would be 1, and your position would move inline with the underlying. The further in-the-money the call option is, the closer to 1 the delta will be, and the further out-of-the-money the option, the closer the delta will be to 0. Refer to the table below for further details:

Stock Price = $104

| Option | Delta | Option | Delta |

| 70 Call | 0.99 | 70 Put | -0.01 |

| 75 Call | 0.97 | 75 Put | -0.03 |

| 80 Call | 0.91 | 80 Put | -0.09 |

| 85 Call | 0.85 | 85 Put | -0.15 |

| 90 Call | 0.78 | 90 Put | -0.21 |

| 95 Call | 0.68 | 95 Put | -0.32 |

| 100 Call | 0.59 | 100 Put | -0.40 |

| 105 Call | 0.48 | 105 Put | -0.52 |

| 110 Call | 0.37 | 110 Put | -0.63 |

| 115 Call | 0.27 | 115 Put | -0.73 |

| 120 Call | 0.18 | 120 Put | -0.82 |

| 125 Call | 0.10 | 125 Put | -0.90 |

| 130 Call | 0.06 | 130 Put | -0.93 |

| 135 Call | 0.02 | 135 Put | -0.99 |

Two Main Types of Delta Neutral Trades

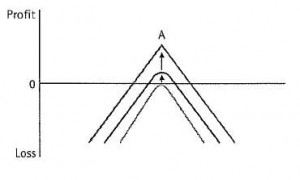

The two most common delta neutral trades are short straddle and long straddle. A short straddle involves selling a call and a put at the same strike price and has a payoff diagram as shown below:

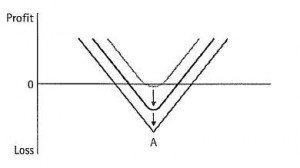

A long straddle involves buying a call and a put at the same strike price and has a payoff diagram as shown below:

These are two common types of delta neutral trades, but I want to talk more about a delta neutral trading strategy that has worked well for me in the past.

My Favorite Delta Neutral Strategy

Basically this strategy involves selling multiple out-of-the-money puts (positive delta) and selling the underlying stock (negative delta) in order to get to a delta neutral position. This trade does have it’s risks, so you need to ensure you understand the trade before attempting it. These are some of the criteria I look for when determining whether to use this trading strategy:

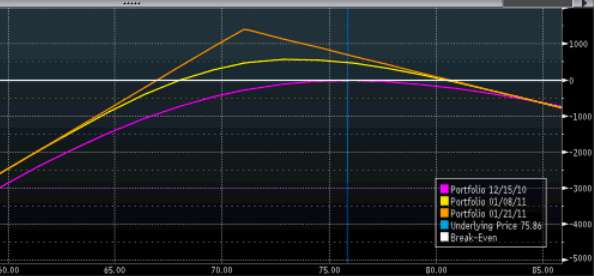

- Generally I pick a stock I’m a neutral to slightly bullish on. The payoff diagram below shows that you have much more to lose on the downside with this strategy.

- This is also a short volatility play, so I pick a stock that has high volatility that I think will reduce in volatility over the course of the trade. The other advantage of high volatility stocks is that you receive more premium for your out-of-the-money puts. Although, as with everything be aware that the higher the reward, the greater the risk!

- I pick a stock that I have followed for a while and I know a lot about. Picking a stock that you know little about just because it fits with your option strategy is a recipe for disaster.

- I plan in advance whether I will dynamically hedge the delta. As the underlying stock moves, so will my delta so that I am no longer delta neutral. Before I make the opening trade I will know what I plan to do in this situation. If I am bullish on the stock and my delta becomes positive (i.e. I now have a long exposure), I may leave it as is because I am happy with a slightly long bias. Otherwise I would short more stock to get my delta back to zero. I would also plan how often I was willing to do this, as commissions will eat into my profits.

- This is one of my riskier strategies, so I generally do not use too much of my capital.

A Real Life Example In Action

I used this trading strategy on EWZ earlier in 2010. These are the trades I made and how the strategy played out, the amounts shown below are AFTER commissions.

| DATE | TRADE | VALUE | NET AMOUNT |

| Feb 5th, 2010 | Sold 3 EWZ Jun 19 2010 55.0 Puts | 2.95 | +$872.74 |

| Feb 5th, 2010 | Sold Short 60 EWZ | 63.20 | +$3,781.96 |

| Feb 9th, 2010 | Bought to Cover 35 EWZ @ 65.6 | 65.60 | -$2,305.99 |

| June 1st, 2010 | Bought to Cover 25 EWZ | 64.23 | -$1,615.73 |

| June 19th, 2010 | 3 EWZ Jun 19 2010 55.0 Puts expired worthless | 0 | 0 |

| TOTAL | +$732.98 |

So, this strategy made $732.98 in around 4 and a half months. My total capital at risk was $16,500 which is the amount I would have needed to come up with had EWZ fallen below $55 and I had been exercised, even though I would have closed out my position if this looked likely. So, my return on the trade was 4.76%, or 12.77% annualized. With this trade my maximum profit on this trade would have occurred if EWZ finished around $55 as the puts would have expired worthless and I would have also made a profit on my short stock position.

I was somewhat bullish on EWZ when I made this trade which is why I bought to cover the 35 shares on Feb 9th. This gave me a slight bullish exposure on the trade.

Another point to note is that as the trade came closer to expiry, the delta began to rapidly reduce due to the fact that the options were so far out of the money and that there was little time left. For this reason I completely closed out the short stock position on June 1st. Below you can see the graph of EWZ before, during and after the trade period.

If you have any questions on this strategy or any other delta neutral trades, please post a comment below.