We initiated a bear call spread on Deere & Company (DE) because we feel that its price will decline.

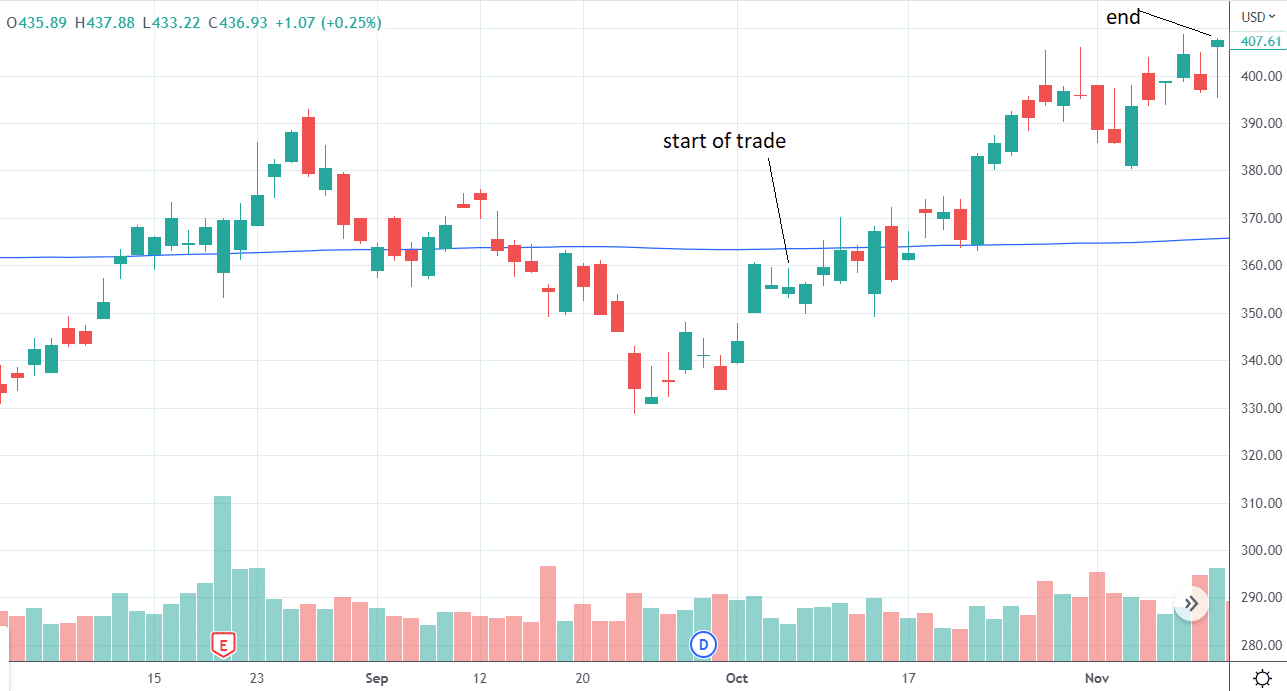

It was already under the 200-day moving average, and we thought it would continue its downtrend after a short pull-back rally.

As we shall see, it did not. Instead, the price went up against the bear call spread.

Don’t you hate it when that happens?

Let’s see how we Condorize the bear call spread and manage the trade.

Contents

- Start Of Bear Call Spread Example

- Price Alert Hit

- Defensive Action On The Calls Again

- Still Fighting This One

- Back In The Black

- Conclusion

Start Of Bear Call Spread Example

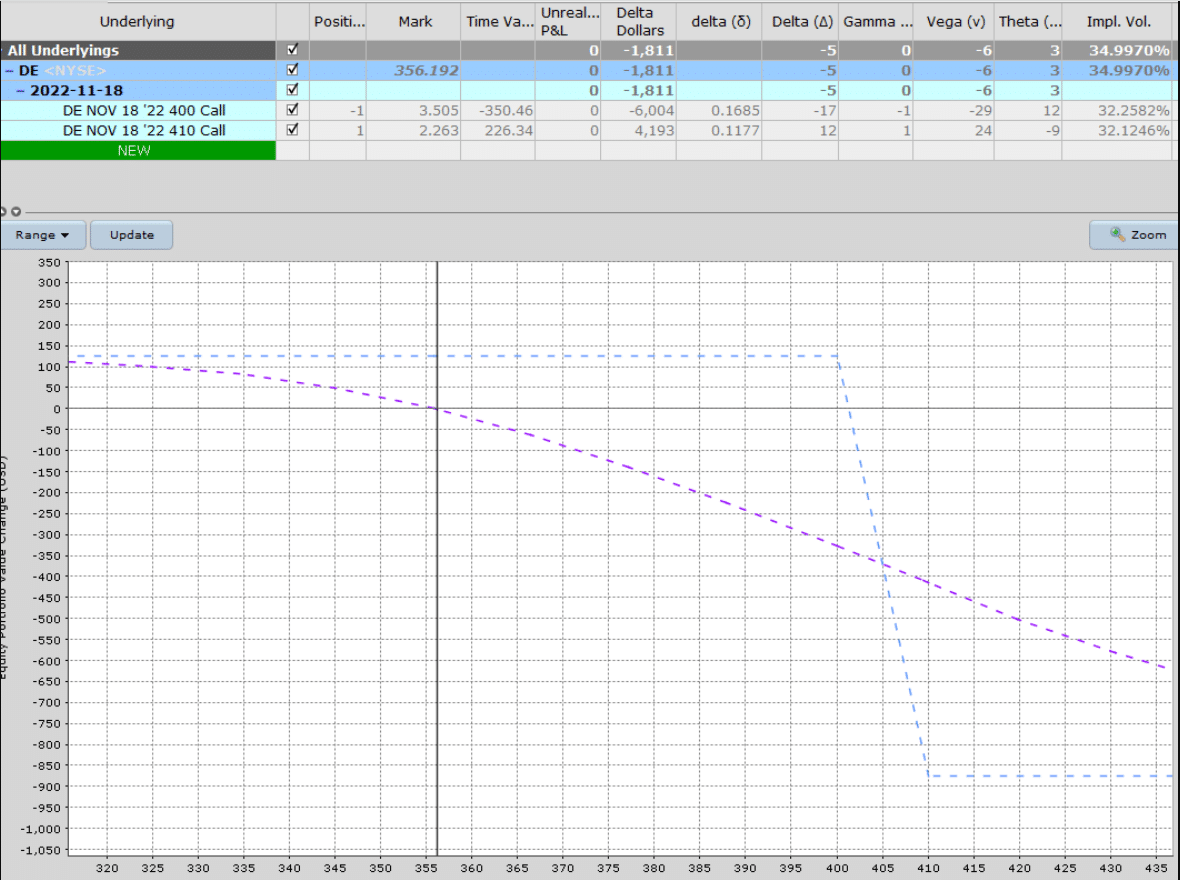

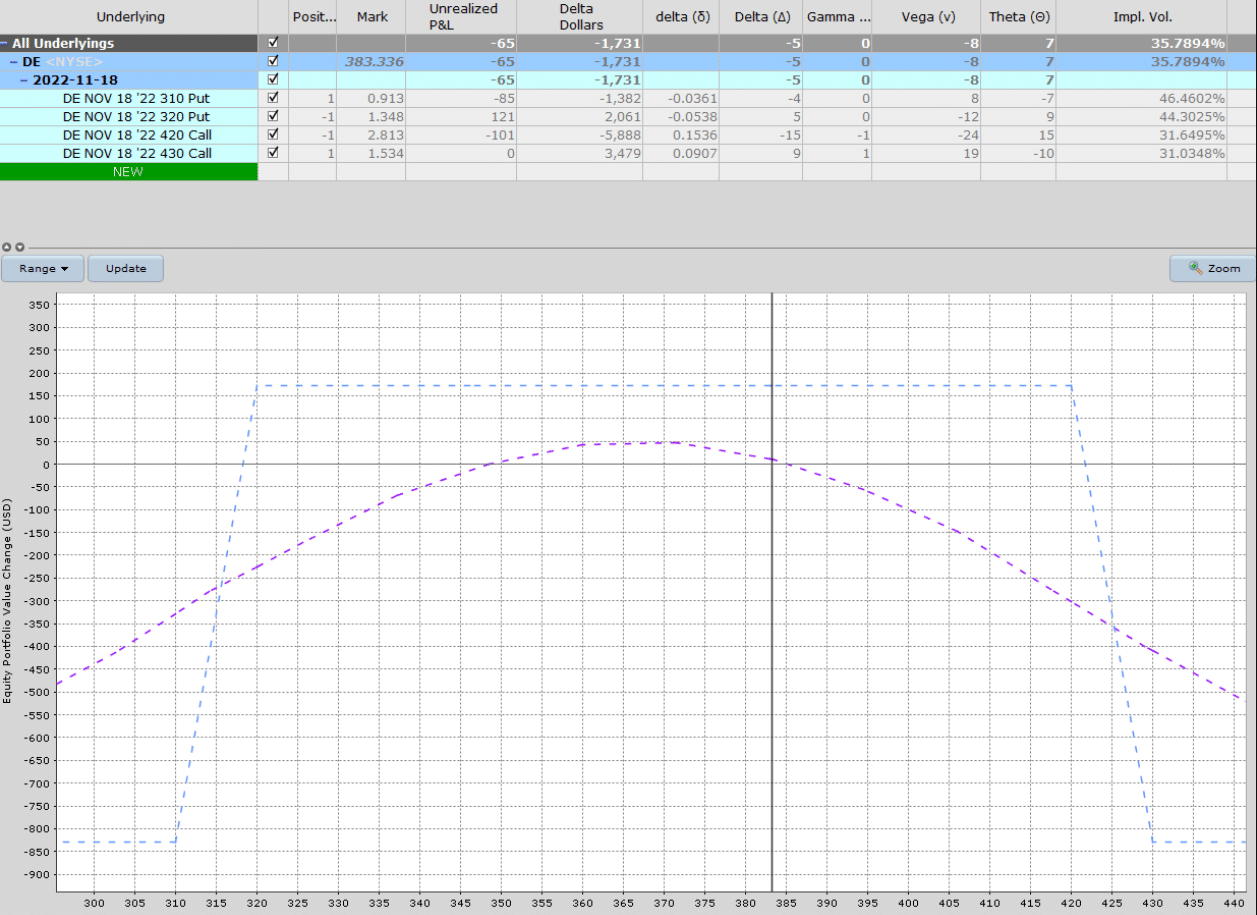

We start with a 10-point wide bear call spread with 43 days to expiration.

The short call is positioned at the 17-delta.

Date: October 6, 2022

Price: DE @ $356.19

Sell one November 18 DE $400 call @ $3.51

Buy one November 18 DE $410 call @ $2.26

Credit: $124.20

The position delta on the trade is -5, which means we want the price to go down.

Because the position vega is negative (-6), it is a short vega trade which means that we benefit if implied volatility drops.

As is our preference, we like option strategies that have a positive theta so that time is on our side.

This trade has a positive theta of 3.

A positive theta means that the trade benefits the longer we are in the trade, with all other things being equal.

The theta should increase as we get closer and closer to expiration as well.

This trade has a maximum potential profit of $124.20.

This is achieved if the price is below the short strike of $400 at expiration.

The maximum risk on the trade based on the visual reading of the risk graph is $875.

We will experience the max loss if we hold the trade to expiration and the price ends up above $410.

We say the price has completely blown through our call spread if that happens.

By looking at the curved T+0 line (also known as the “today” line), we can roughly gauge that we will lose about $100 if the price gets up to $370 today.

We set an alert at $370 so that we get notified if the price gets up there.

At that point, we will need to check and see if an adjustment is needed.

Price Alert Hit

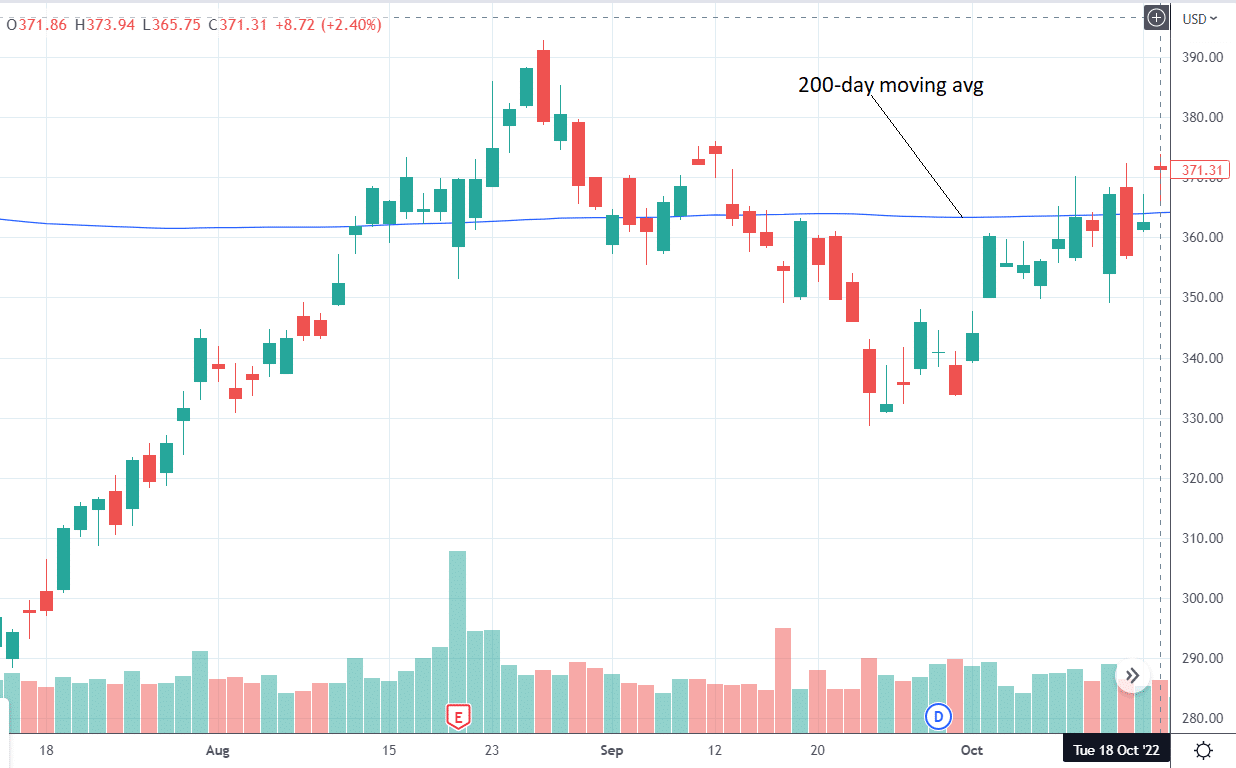

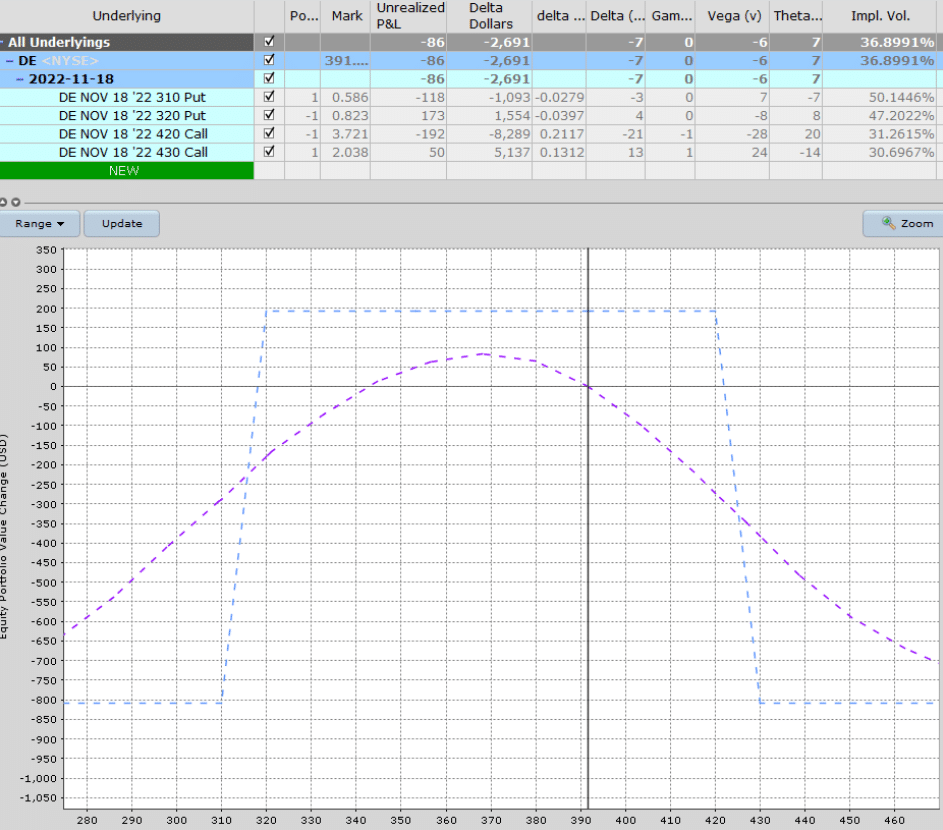

On October 18, the price alert was hit.

The price is $374.

The price chart looks more bullish than it did, having broken above the 200-day moving average.

The delta on the short call is already at -27.

Before Adjustment:

Playing some defense on the call spread makes sense.

We will Condorized the trade by adding a put spread, which brings in additional credit of $79.20

Date: October 18

Price: DE @ $373.90

Sell one Nov 18 DE $320 put @ $2.56

Buy one November 18 DE $310 put @ $1.76

Credit: $79.20

After Adjustment:

The maximum potential reward on this trade has increased to $203 because of the additional credit.

The maximum reward will occur if the price stays between $320 and $400 at expiration.

With the short put positioned at around a -10 delta, the adjusted risk graph still has a little bit of a bearish delta of -4.

We could have sold the 330-320 put spread closer to the money to get it more delta neutral and collect a larger credit.

However, we will leave it for now because this negative delta will benefit us if the price decides to reverse downward.

Because the condor is short vega, a downward move in price will be accompanied by an increase in implied volatility which would hurt the trade.

As a hedge, the negative delta benefits us as the price goes down.

If the price continues up, we will have a new decision point when the price reaches $390.

Defensive Action On The Calls Again

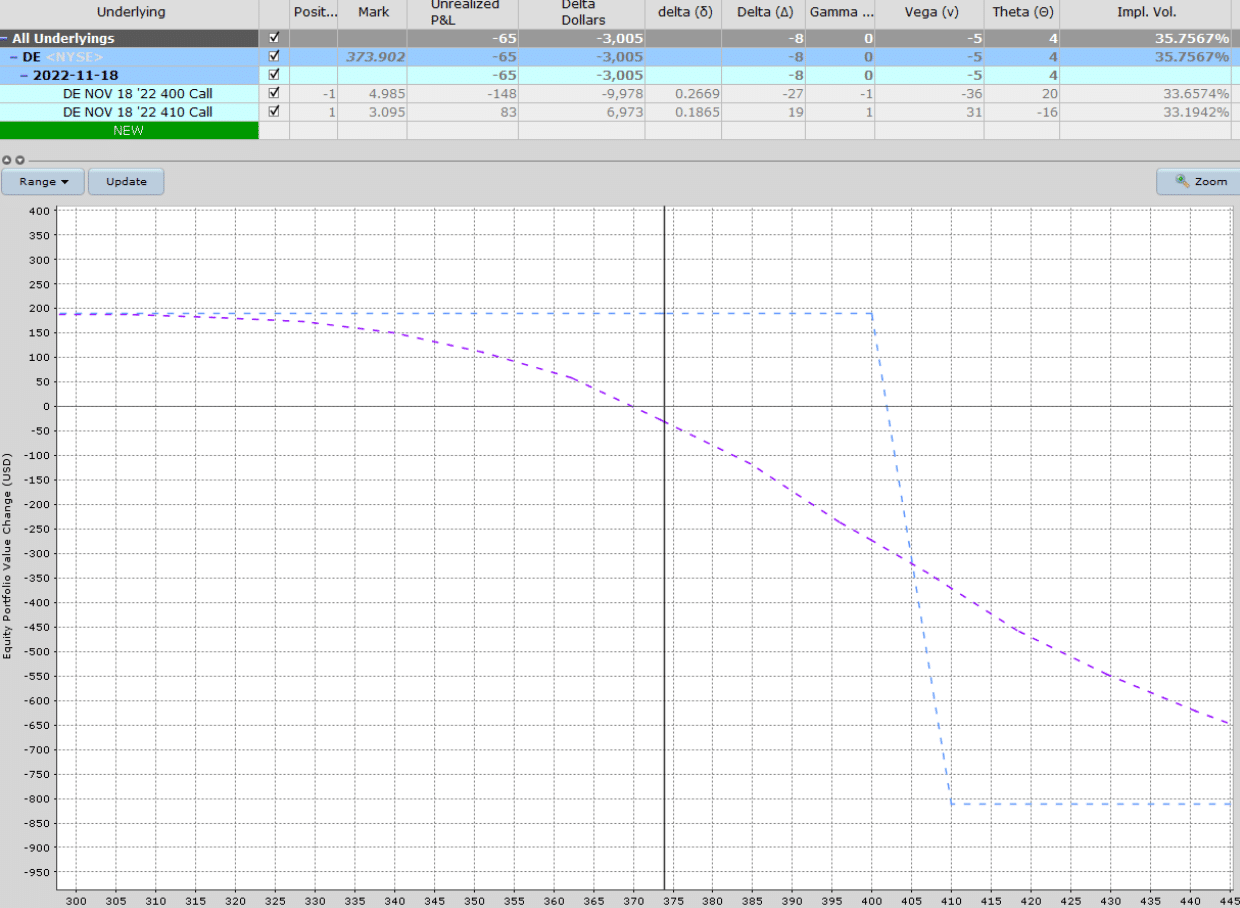

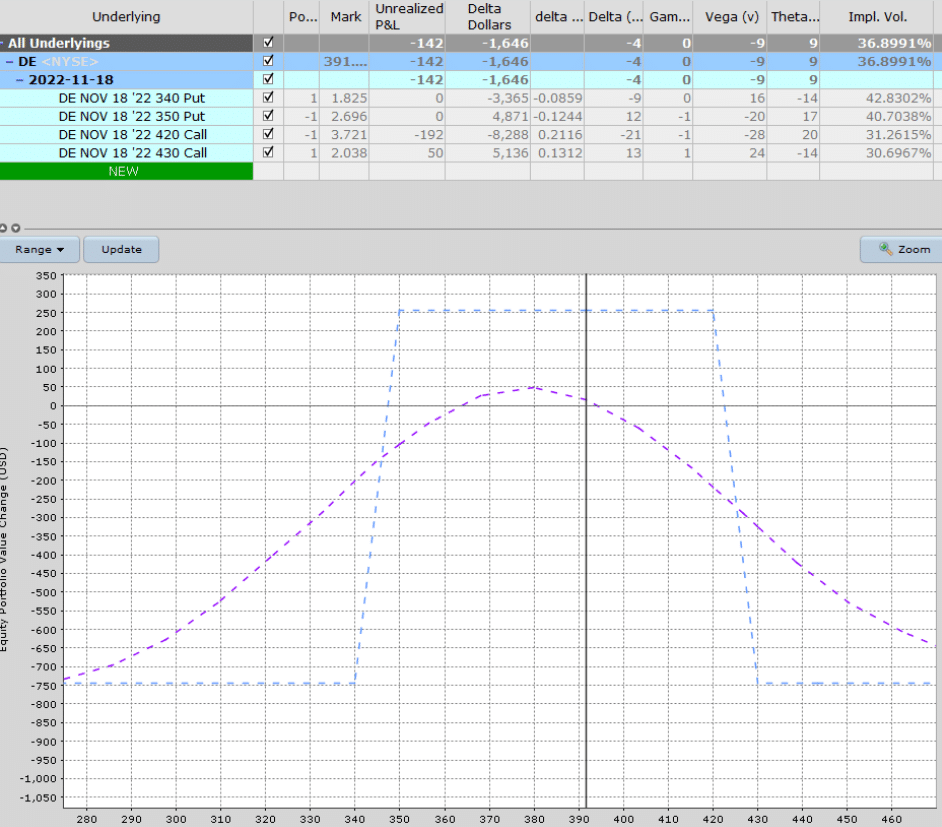

On October 23, we need to make another adjustment.

The price has gone up to $383 but has not triggered our alert.

We see that the delta of the short call is at -24.

This alone is enough to justify an adjustment to prevent the short call’s delta from getting any larger.

We roll the calls up by 10 points.

Date: October 23, 2022

Price: $383.46

Buy to close November 18 DE $410 call @ $4.77

Sell to close November 18 DE $420 call @ $2.81

Buy to open November 18 DE $430 call @ $1.53

Sell to open November 18 DE $420 call @ $2.81

Debit: –$67.70

This is also known as a butterfly adjustment because selling two $420 and buying one $410 and one $430 is a butterfly.

The debit paid for this adjustment or the cost of the butterfly is $67.70

The resulting risk-graph looks as follows:

The position delta was reduced from -6 to -5.

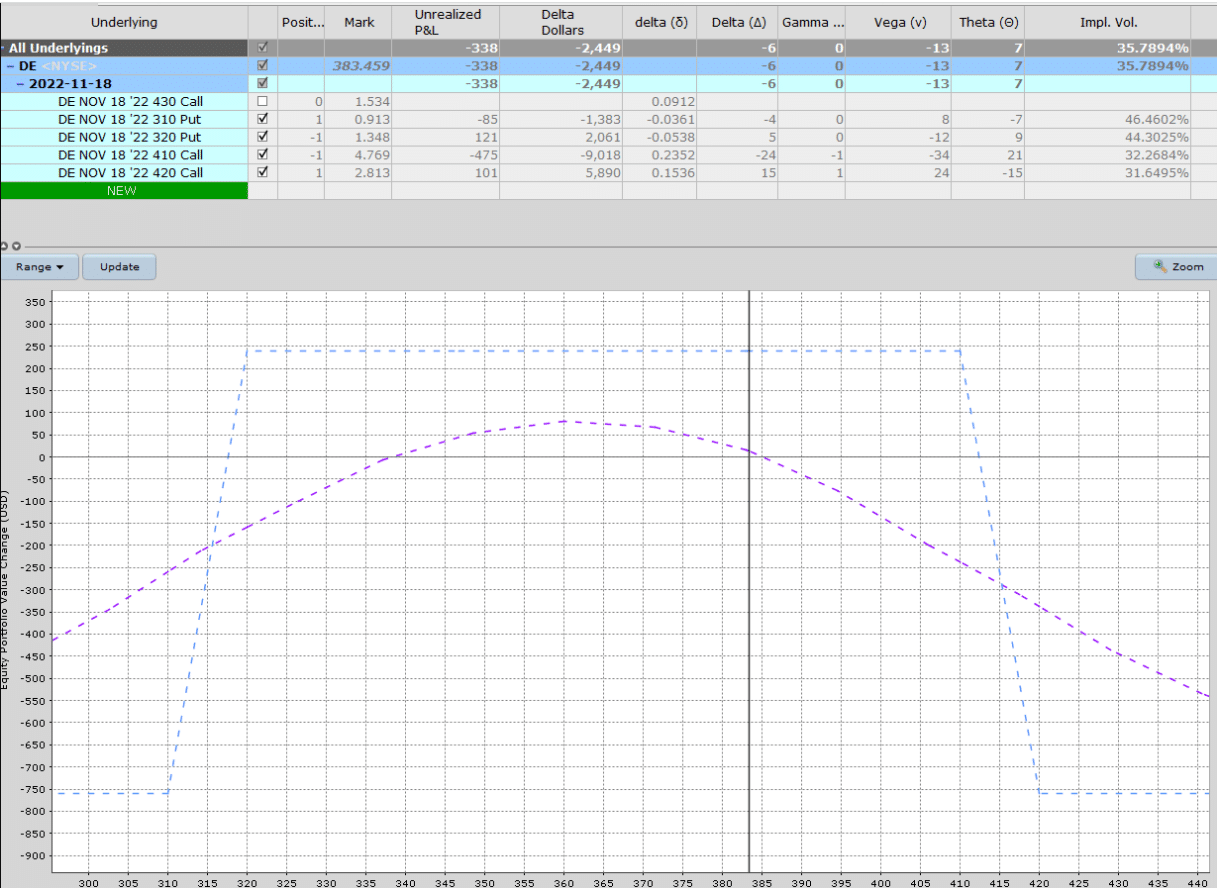

Still Fighting This One

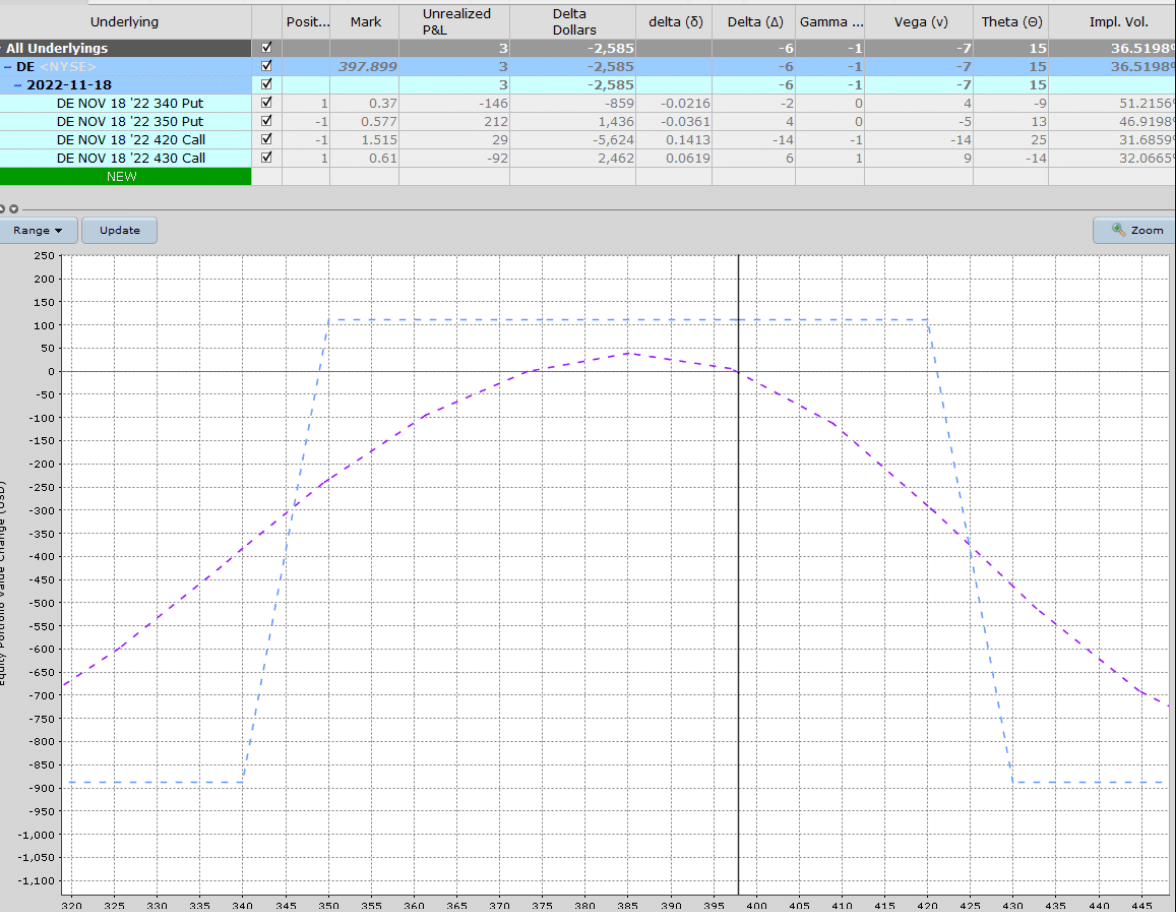

On October 25, the price of DE went to $391.

The call spread is under pressure again.

We’ve been fighting this one since day one.

Don’t like doing more than a couple of adjustments, but let’s see if we can salvage this one.

See that the position delta has gone up to -7.

This is too much negative delta.

We will roll the put spread up to add more bullishness to the trade.

Date: October 25, 2022

Price: DE @ $391

Sell to open November 18 DE $350 put @ $2.70

Buy to open November 18 DE $340 put @ $1.83

Buy to close November 18 DE $320 put @ $0.82

Sell to close November 18 DE $310 put @ $0.59

Credit: $63.40

After adjustment:

Because we collected a credit, we increased our max potential reward.

However, the price range of achieving this reward has narrowed from $320 to $420.

Back In The Black

Here is the risk graph for November 9.

We got this one completely wrong initially, but three adjustments later, we are back in the black.

It could be closed now with nine days left to expiration by doing the following:

Date: November 9, 2022

Price: $397.90

Sell to close November 18 DE $340 put @ $0.37

Buy to close November 18 DE $350 put @ $0.58

Buy to close November 18 DE $420 call @ $1.52

Sell to close November 18 DE $430 call @ $0.61

Debit: –$111.20

That would result in a profit of $87.90 as follows:

Credit for the bear call spread: $124.20

Credit for put call spread: $79.20

Debit for rolling the call spread up: –$67.70

Debit to close trade: –$111.20

P&L: $87.90

Conclusion

While we initially thought that the price would go down, it went completely the opposite direction, as we can see from the candlestick chart:

It is okay to be wrong. But it’s not okay to stay wrong.

When we realized the price was moving against us, we quickly adjusted the trade to react to the movement.

In the end, we were able to eke out a small profit after a month in the trade.

We hope you enjoyed this bear call spread example. If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.