Contents

This example case study of an iron condor in Apple (AAPL) has quite a bit of action and adjustments. So, it’s worth writing up a case study on.

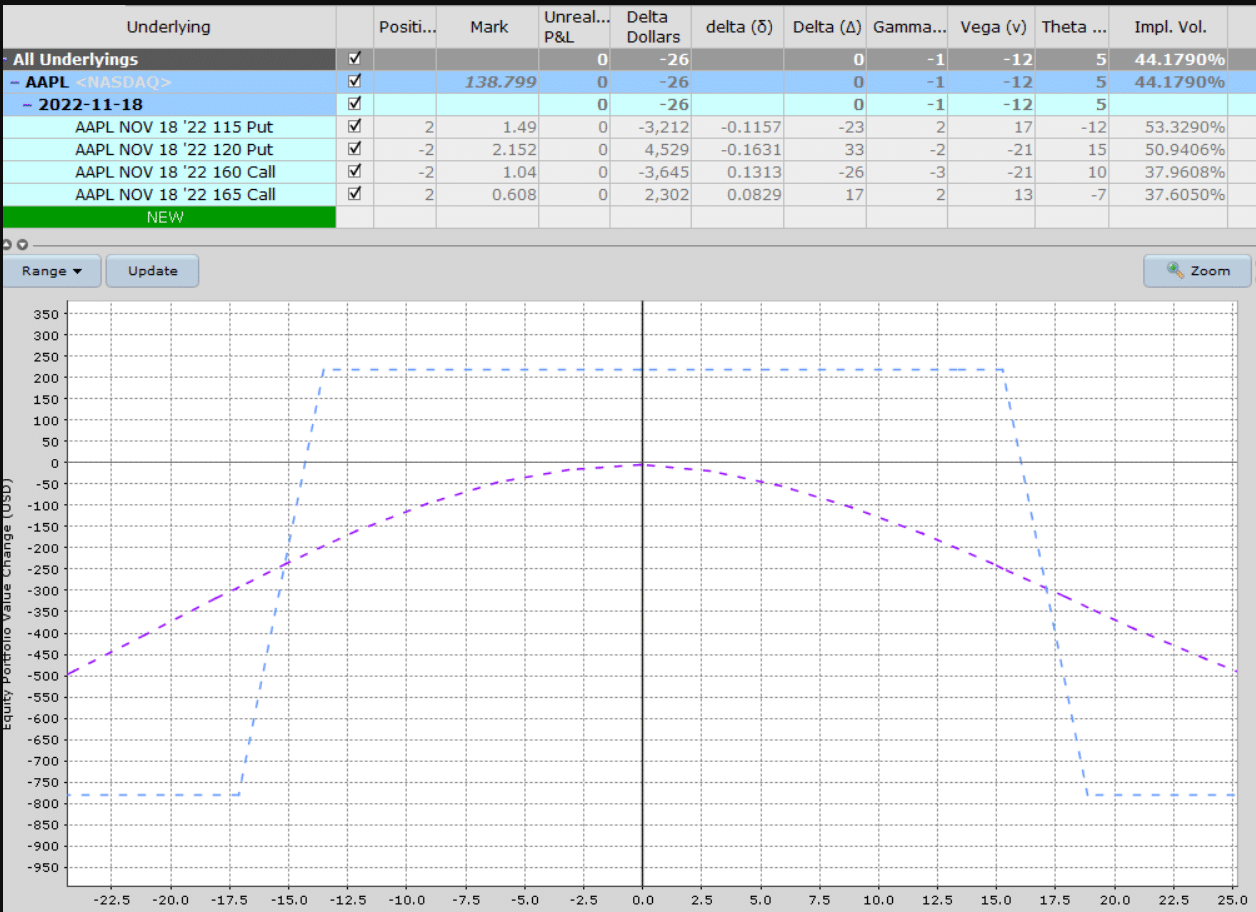

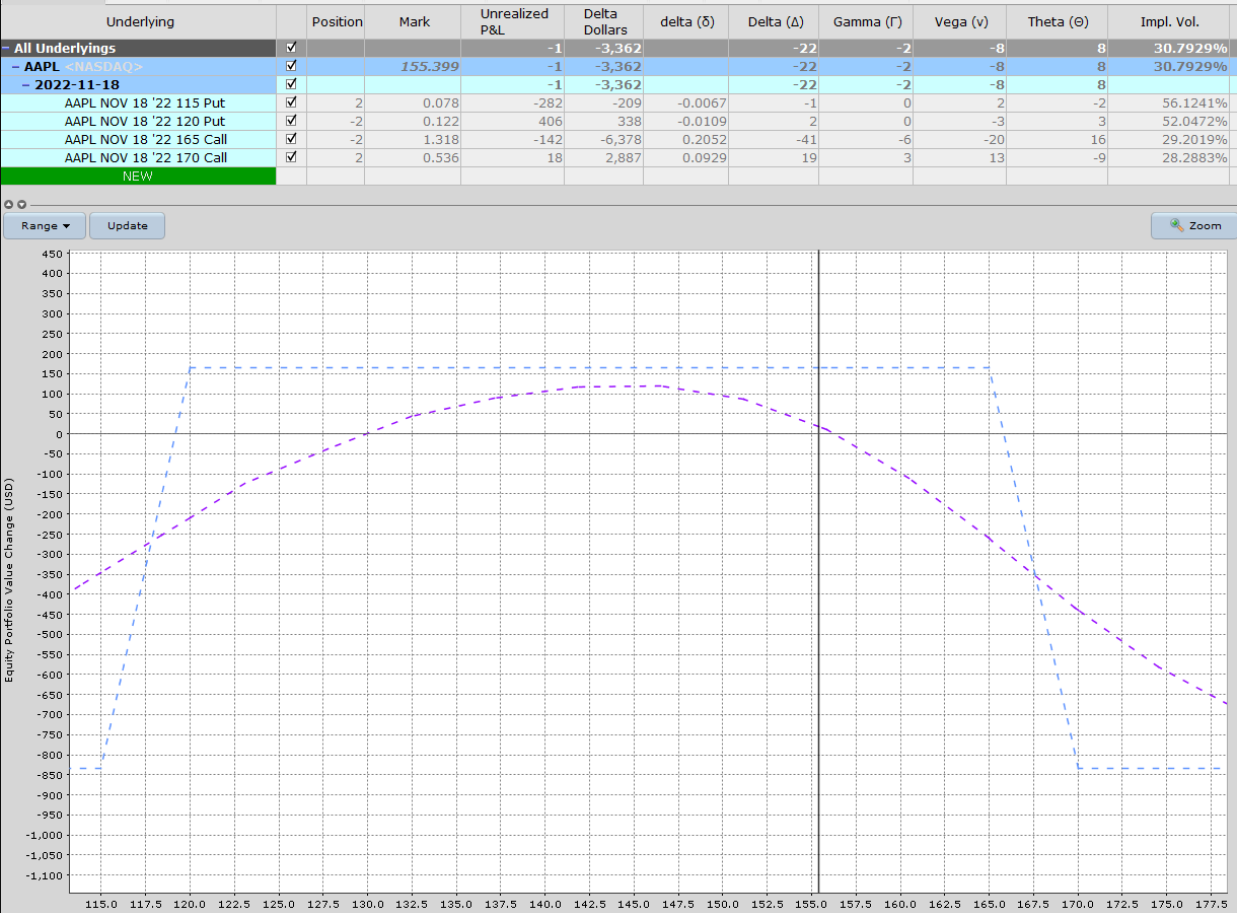

On October 12, 2022, we start with a standard 2-contract iron condor with just over a month till expiration.

Date: October 12, 2022

Price: AAPL @ $138.80

Buy two November 18 AAPL $115 puts @ $1.49

Sell two November 18 AAPL $120 puts @ $2.15

Sell two November 18 AAPL $160 calls @ $1.04

Buy two November 18 AAPL $165 calls @ $0.61

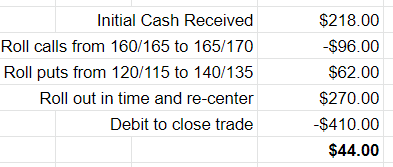

Net Credit Received: $218

Keep in mind that AAPL has earnings coming out Thursday, October 27, after the market closes.

Sometimes we will work the condor to avoid spanning earnings.

But it’s not a hard and fast rule because there are just too many earnings in the way.

In this case, we decided to take the chance and have the condor cross the earnings event.

Just have to be aware, is all.

From the Greeks, we see that it starts out delta neutral.

The payoff graph shows that the max risk is just short of $800.

Watch Earnings Dates

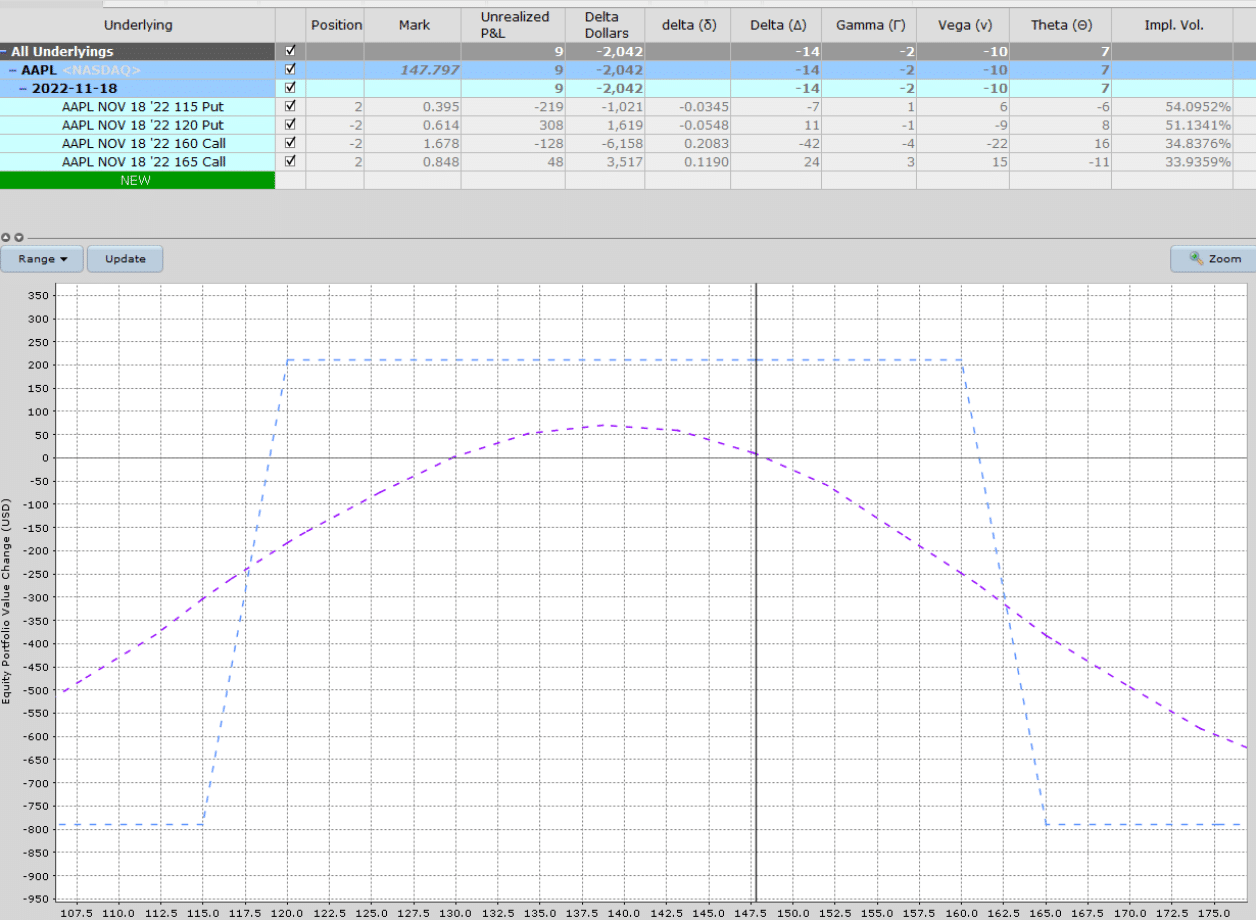

On October 23, we take a look to see how our condor is doing.

This is the week in which AAPL is going to report earnings on Thursday after the market closes.

Looks okay so far.

The short call’s delta is at 21.

The P&L is $9 positive. Delta dollars is acceptable.

We hold for now.

Watch The Short Call Delta

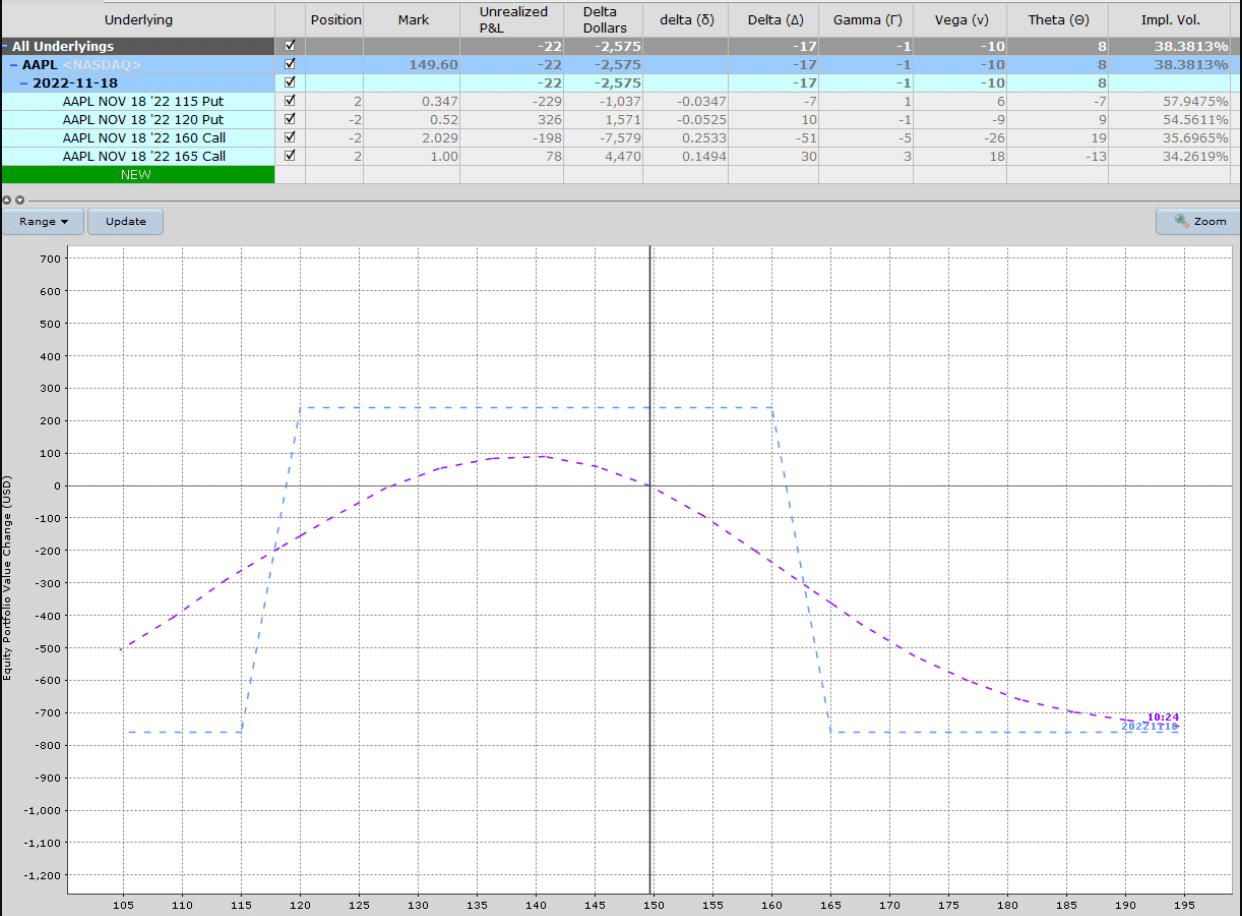

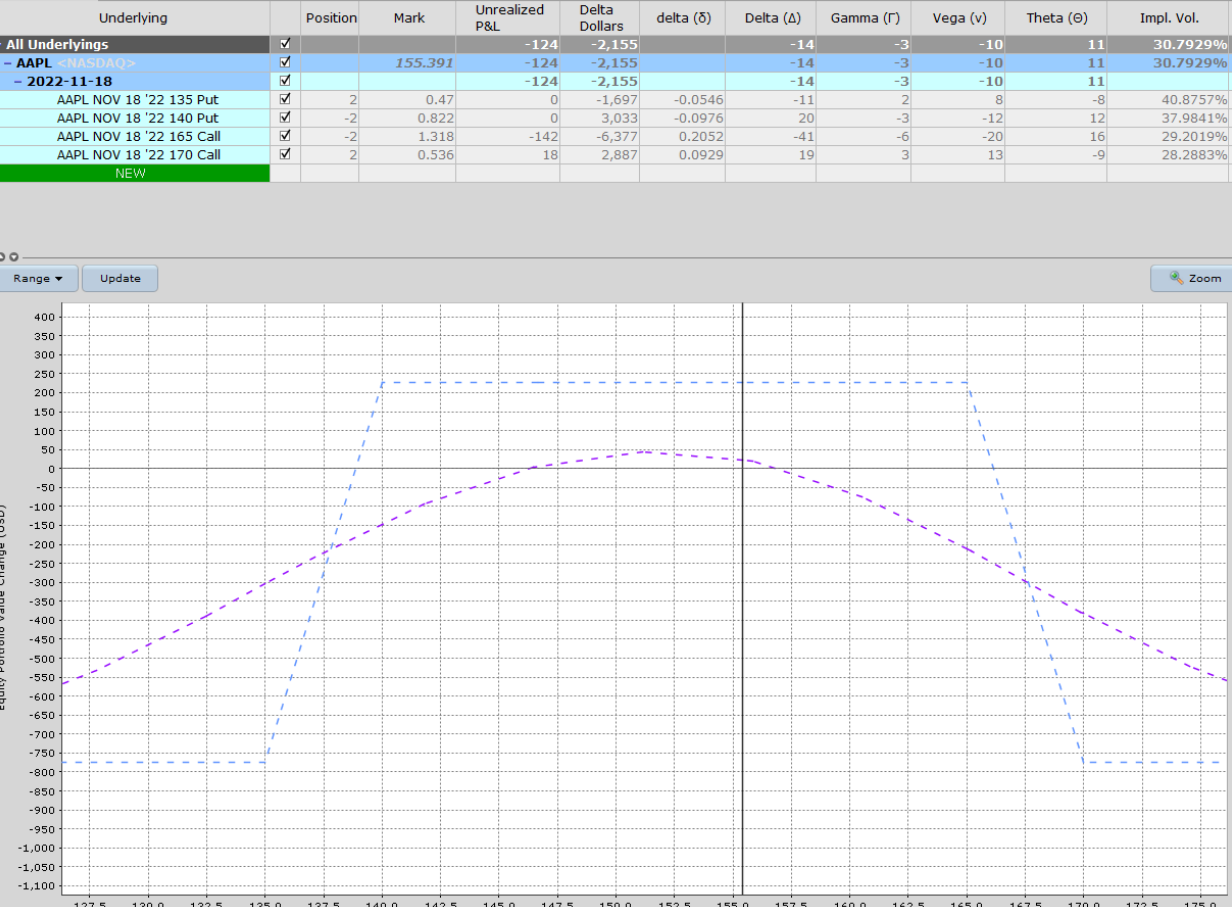

The following day, on October 24, defence is now needed because the short call delta is at 25.

With the price of AAPL at $149.60, we roll up the 160/165 call spread up 5 points to 165/170.

The result brings the delta of the short call down to 15.

The total debit for this adjustment is $96.

We’ll keep tabs on these in a spreadsheet for later reference.

Big Rally

October 28, the day after the earnings announcement, AAPL made a big rally of 7% to $155.40.

The short call is at 20 delta.

This is okay.

While a big price move is bad for the condor, the volatility crush due to post-earnings has helped us a little. So, no major harm was done.

The short puts are now so far out-of-the-money that they are useless as a hedge.

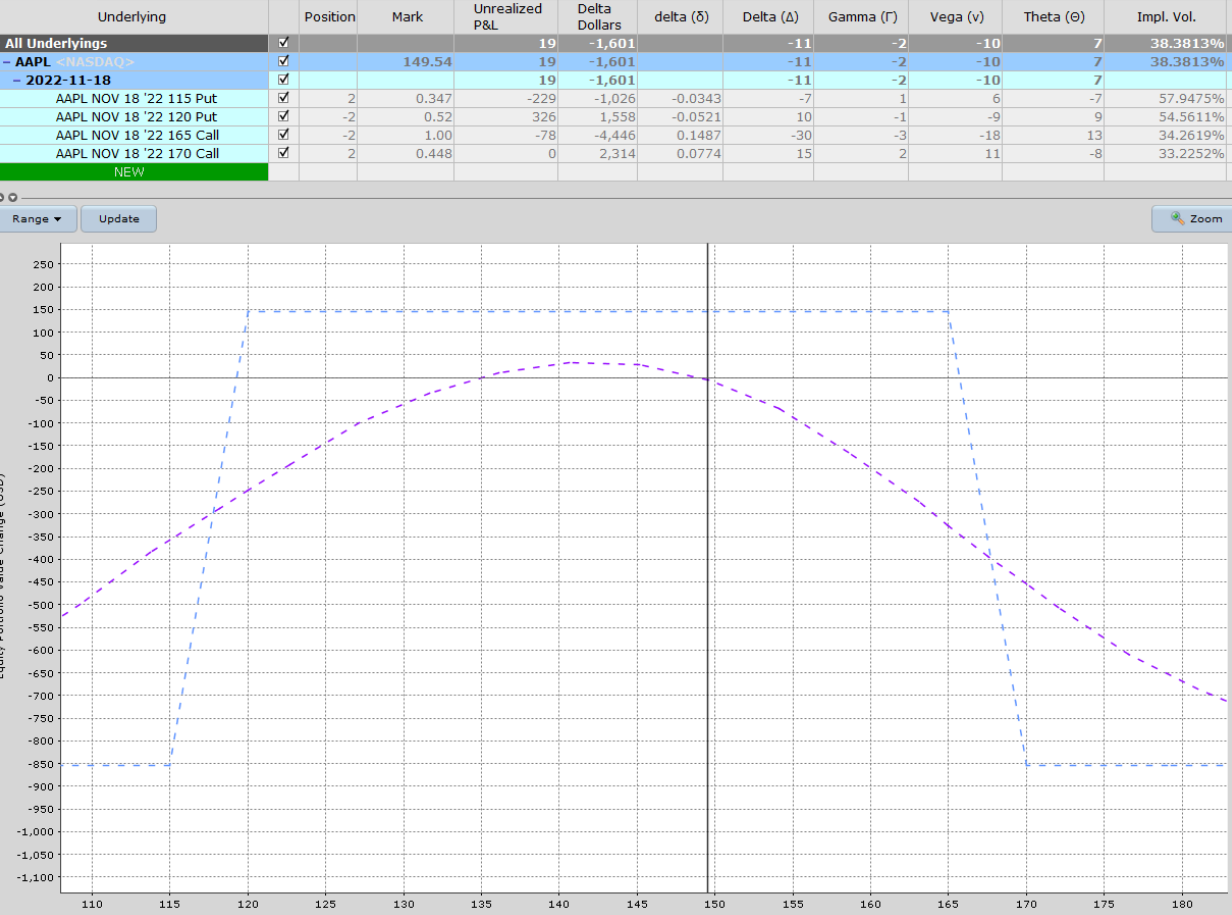

This is one of the few times that I’m willing to roll the untested side closer to the money.

We roll the 120/115 put spread 20 points up to 140/135.

As a result, we have the following graph with the short put at 10 delta.

Rolling the puts up gave us a $62 credit.

Whipsaw

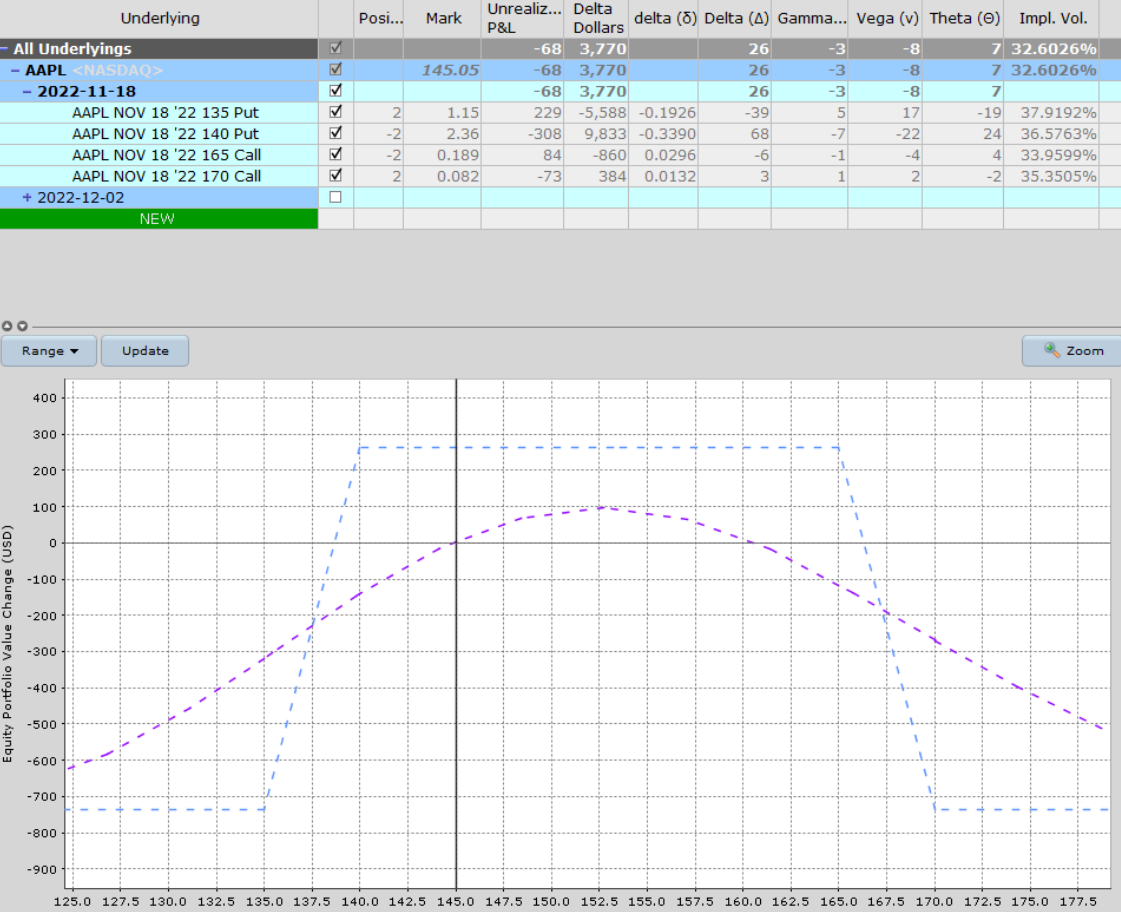

On November 2, the price of AAPL came back down to $145.

Whipsaw prices are the reason why I don’t like rolling the untested side closer to the money.

Now the short put is at 34 delta (not an acceptable position to be in).

P&L is down –$68.

We decide to roll the condor out in time to the December 2 expiration.

This gives us a chance to re-centre the condor and sell an extra contract to help pay for the adjustment.

The new position is now:

We got a credit of $270 for this adjustment.

Because this is a three-contract condor, our max risk is just slightly under $1000.

Close For A Small Win

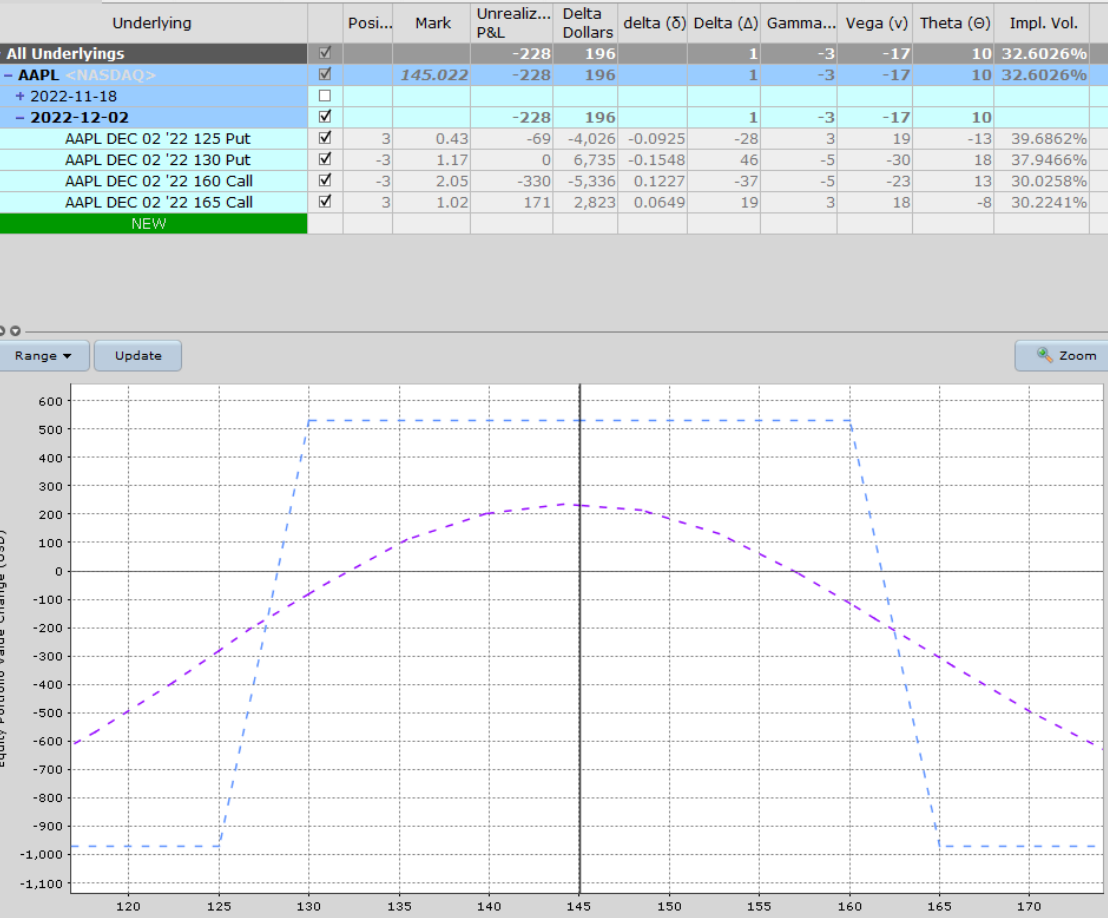

On November 9, the condor is in trouble again.

The short put is at delta 32, and the Delta Dollars is four times capital at risk.

If we were to close the position now:

Date: November 9, 2022

Price: AAPL @ $135.46

Sell to close Dec 2nd AAPL $125 puts @ $1.77

Buy to close Dec 2nd AAPL $130 puts @ $3.08

Buy to close Dec 2nd AAPL $160 calls @ $0.16

Sell to close Dec 2nd AAPL $165 calls @ $0.10

It would cost a debit of $410.

Because of all the adjustments, we have to reference our spreadsheet to see what’s our overall P&L in the trade.

We could continue fighting it and play defence on the puts, but with CPI and Mid-term elections coming up, we decide to close it for a small gain of $44 and be happy with turning a losing trade into a small winner.

We hope you enjoyed this iron condor case study.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Very interesting example, Gav

I only want to say that, if you dont realized adjustments, the trade in november 2 would have been a total win/win

The same situation in december, with only roll the spreadas in time (not strikes).

By this is a very interesting example. To the end, the initial probabilities was ok. But, in day to day, no one knows the future price. Due this, the adjustments are necessary

Thks Gav!!!

Very true.

Thanks for sharing. Interesting read.

Thanks.

Excellent. We learn Adjustment . Keep it up

You’re welcome. Glad it helped you.

Thank you very much! I always read your articles. Best regards from Argentina

Thanks Sergio. I appreciate you taking the time to comment.