Today, we are looking at an asymmetric iron condor.

We are using the adjective “asymmetric” in the generic sense of the word, meaning non-symmetrical.

These condors that may not look quite the same as your traditional symmetrical condor.

There is a strategy by Amy Meissner with the name “Asymmetrical Iron Condor” spelled with a capital “A.”

We’ll touch briefly on her “AIC” strategy at the end of the article as well.

Contents

- Traditional Iron Condor

- Asymmetric Condors

- Different Widths

- All Put And All Call Asymmetric Condor

- TrapDoor Iron Condor

- Asymmetric Iron Condor with the Capital A

- FAQs

- Conclusion

Traditional Iron Condor

When you first learned the condor option strategy, it was probably the traditional iron condor that consists of an equal number of put spreads and call spreads, where the width of each spread is the same.

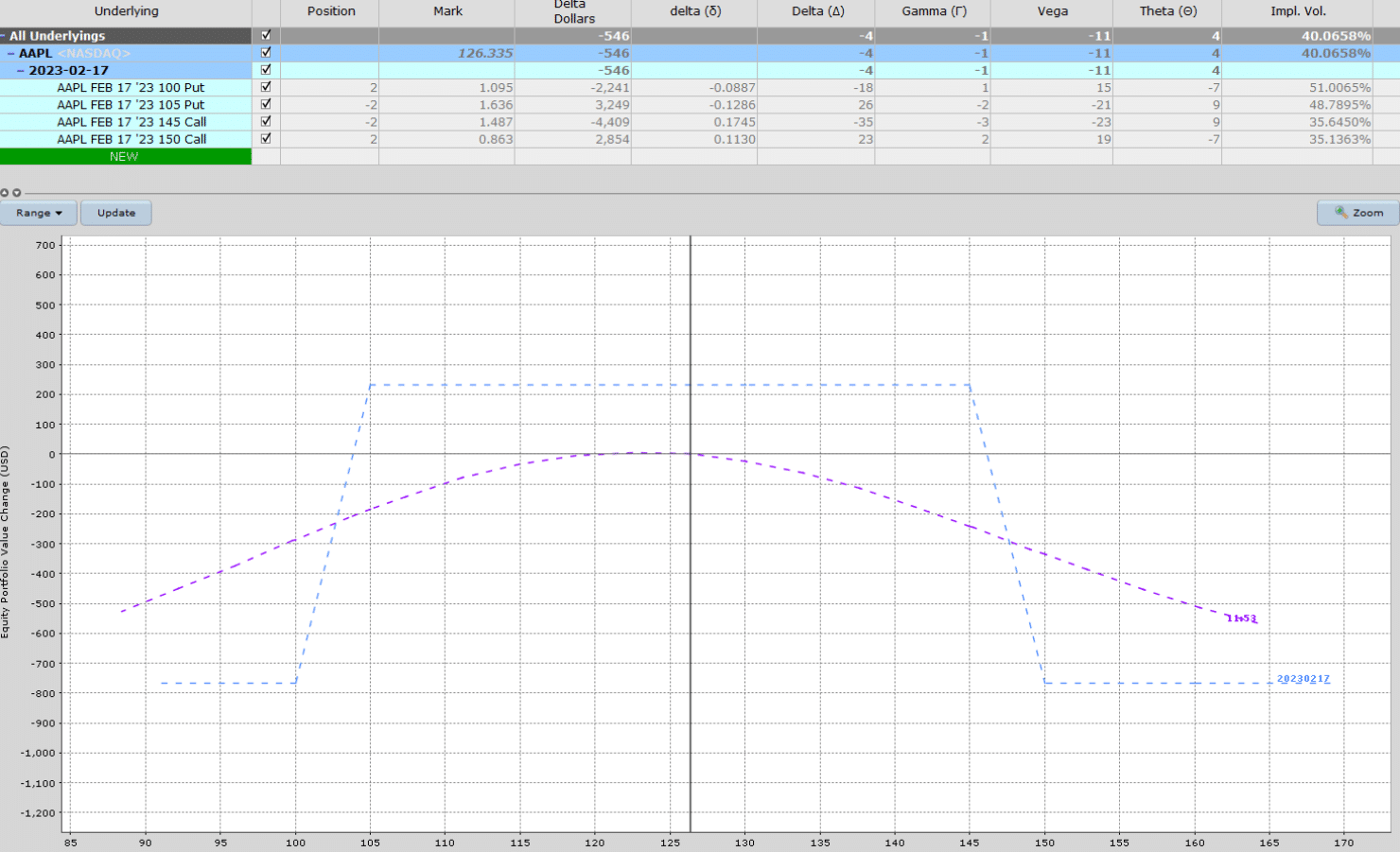

Here is an example with its payoff graph (or risk graph).

The put spread and call spread does not need to be exactly the same distance away from the current price.

This is still called a balanced or symmetrical iron condor because the length of the legs is the same.

The traditional iron condor is non-directional.

That means the trader does not predict which direction the market will move.

Ideally, the trader would like the price to stay exactly in the same spot and just let theta decay bringing in the profits as time passes.

Asymmetric Condors

The asymmetric iron condor could be used if a trader had a directional opinion.

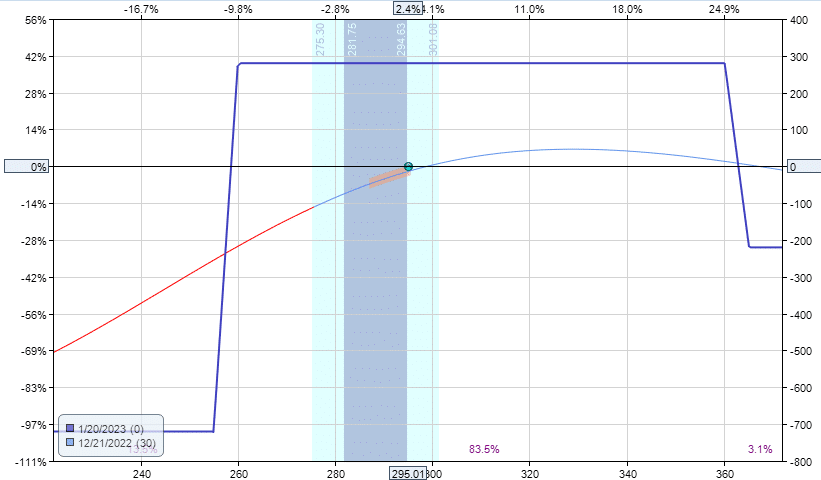

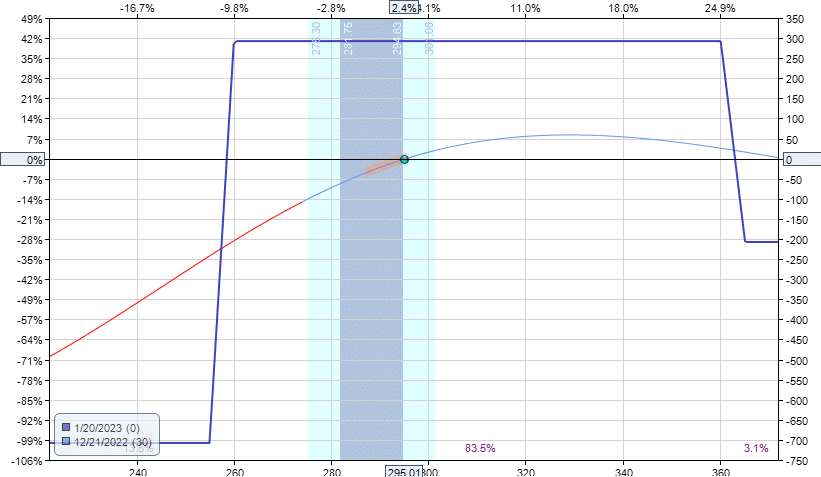

Here in NetFlix (NFLX), we have more put spreads than call spreads.

Date: Dec 21, 2022

Price: NFLX at $295

Buy two Jan 20 NFLX $255 put @ $6.63

Sell two Jan 20 NFLX $260 put @ $7.78

Sell one Jan 20 NFLX $360 call @ $3.73

Buy one Jan 20 NFLX $365 call @ $3.23

Total Credit: $280

The width of the spreads is all 5 points wide.

Because put spreads are bullish, this gives the condor a bullish directional bias.

In this case, there is a position delta of +3.8.

In a normal market, price tends to go up more often than down.

Hence you typically will see more traders applying more put spreads than call spreads to a condor.

However, there is nothing to say that you can’t have more call spreads than put spreads.

Here is one which gives a directional bias on the downside.

In both cases, you see that the sides are asymmetrical.

One leg is always longer than the other.

The max risk on one side is larger than the max risk on the other side.

These types of condors are also known as “unbalanced,” as they are tilted to one side or the other.

Different Widths

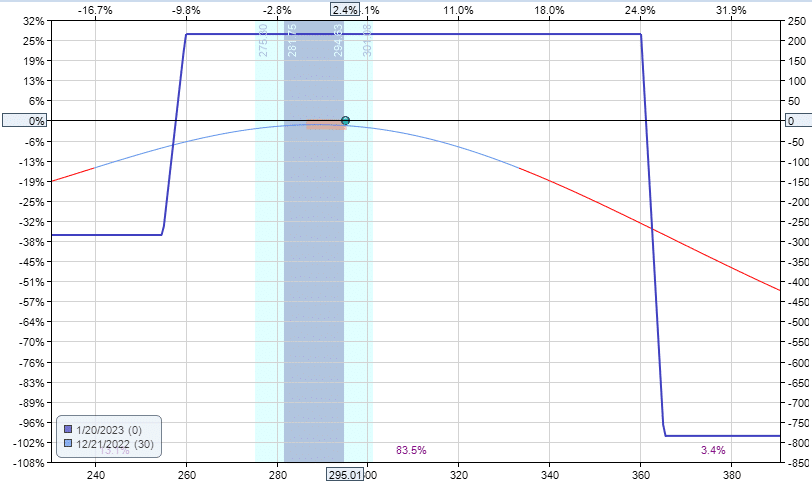

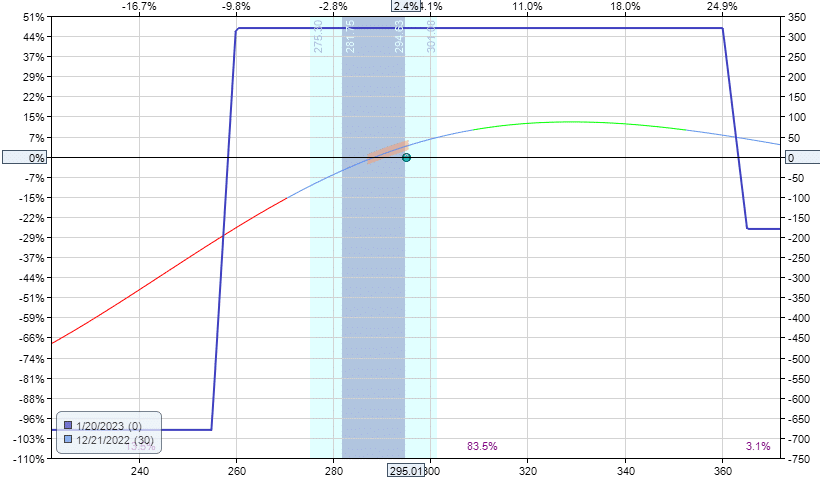

Another way to make the condor asymmetrical is to use the same number of contracts on both sides but to make the wing widths wider on one side.

Here we have only one put spread and one call spread.

The put spread is 10 points wide, while the call spread is 5 points wide.

Date: Dec 21, 2022

Price: NFLX at $295

Buy one Jan 20 NFLX $250 put @ $5.63

Sell one Jan 20 NFLX $260 put @ $7.78

Sell one Jan 20 NFLX $360 call @ $3.73

Buy one Jan 20 NFLX $365 call @ $3.23

Total Credit: $265

The resulting payoff graph is nearly the same as if we had two put spreads and one call spread.

Maybe the trader wants to save on commissions since this involves two contracts instead of three.

The wider put spread makes the bullish put spread stronger than the narrower call spread.

Hence, the overall delta on the trade is a bullish +3.8.

The bullish put spread is stronger than the narrower call spread because of the wider put spread.

All Put And All Call Asymmetric Condor

The asymmetric condors shown so far were asymmetric iron condors.

The word “iron” implies that the options structure contains both calls and puts.

However, you can have asymmetric condors that are not “iron.”

Here is an all puts asymmetric condor:

Date: Dec 21, 2022

Price: NFLX at $295

Buy two Jan 20 NFLX $255 put @ $6.63

Sell two Jan 20 NFLX $260 put @ $7.78

Sell one Jan 20 NFLX $360 put @ $67.85

Buy one Jan 20 NFLX $365 put @ $72.23

Total debit: –$207.50

And here is one that is all-calls:

Date: Dec 21, 2022

Price: NFLX at $295

Buy two Jan 20 NFLX $255 calls @ $47.55

Sell two Jan 20 NFLX $260 calls @ $43.90

Sell one Jan 20 NFLX $360 call @ $3.73

Buy one Jan 20 NFLX $365 call @ $3.23

Total debit: –$680

Whether it is iron, all-puts, or all-calls, the risk graph looks the same (as long as the strikes and expirations are the same).

It is almost as if the calls and puts are interchangeable.

While the initial debit (or Credit, as in the case of the iron condor) is different, that is immaterial.

The margin risked on the trade is all about the same.

The Greeks are the same.

And the trade will behave the same.

Receiving a credit instead of paying for a debit does not make the trade perform any differently.

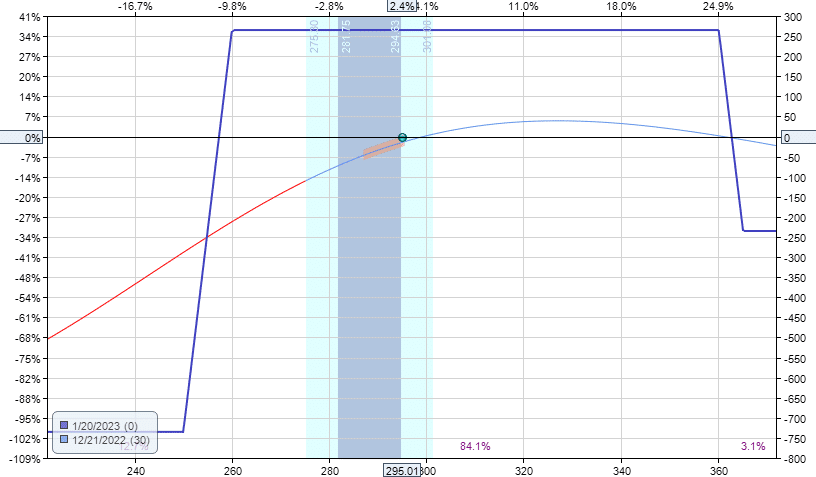

TrapDoor Iron Condor

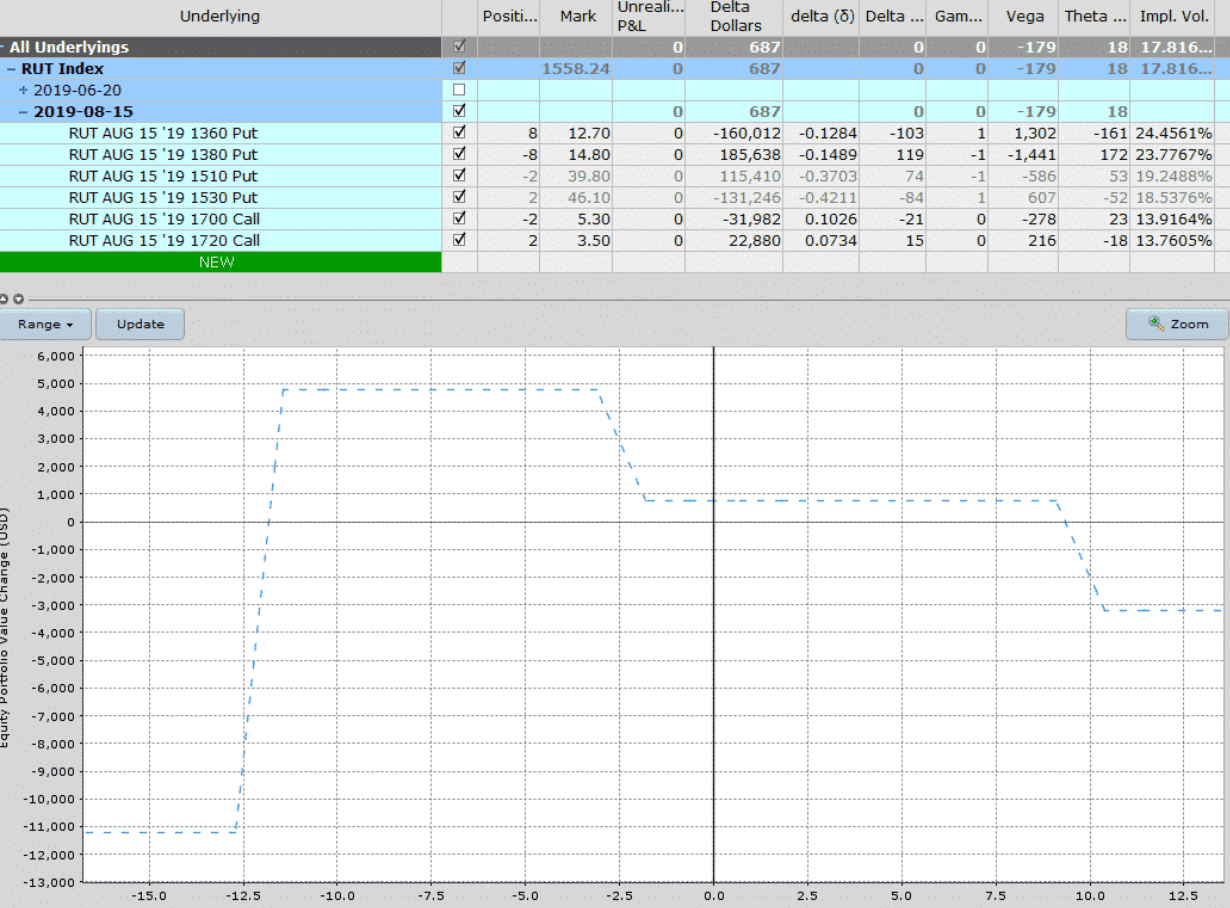

Okay, it’s time to get even more advanced mixing call spreads, put spreads, and debit spreads.

One of my favorite trades is the Iron Trapdoor.

It consists of two call spreads around delta 10.

Then buy two put spreads 20 points below the RUT market.

And finally, sell put spreads around delta 15.

The number of put spreads is, however, many to get the initial risk graph to be delta neutral.

In the below example, it was eight put spreads

There is still a profit zone if the price goes up.

The trap is the extra large profit zone on the downside.

This has the effect of picking up the T+0 line on the downside to provide some downside protection as the trade progress.

The only thing you don’t want is for the trade to make a large down move right at the start of the trade.

By giving the trade enough days to expiration, it will not be so sensitive to the price moves at the beginning of the trade.

Asymmetric Condor with the Capital A

Amy Meissner’s Asymmetric Iron Condor (AIC) has two versions: one with 14 days to expiration (DTE) and another with monthly expiration.

The strategy is essentially the same.

The 14-DTE version is more aggressive, with quicker capital turnovers.

When traded well, short-term trades can churn out profits much quicker.

On the flip side, shorter-term trades tend to be more volatile.

The P&L is more sensitive to price movement due to higher gamma in the trade.

The AIC is a high-probability market-neutral strategy.

It does not assume a direction, and adjustments are made in reaction to market moves so that we continue to remain direction-neutral.

Like all non-directional condors, it is in the classification of “income-generating” strategies capitalizing on the sale of options and putting time decay in our favor.

Found on the web are some P&L numbers of the amount of monthly income this strategy can generate with an average monthly return on margin of 3.46% for the year 2020.

These were results as traded by Amy, who has many years of trading experience.

Your results may vary as the performance is highly dependent on the adjustments made and the timing of the adjustments — as many trading strategies are.

She likes to run the strategy on the RUT, but it can certainly be done in SPX or perhaps even on stocks.

FAQs

What is the Weirdor Strategy?

This is another name for Amy’s Asymmetric Iron Condor.

I really don’t know why they call it this name or how it came about.

Perhaps the name “Asymmetric Iron Condor” is too generic to be a memorable strategy name.

Is Amy still doing the trade alert service on the Asymmetric Iron Condor?

There had been an alert service on Aeromir.com in the past.

But there hasn’t been for a while, and there is none as of this writing in 2022.

Are iron condors better than all-puts condors?

No.

Whether you use all-puts, all-calls, or iron condors, they are the same because they have the same payoff diagram and the same Greeks.

Is the Trapdoor iron condor better than the traditional iron condor?

Based on experience, I do believe the Trapdoor performs slightly better.

However, due to the multiple legs, it is more complex.

When it comes time to make an adjustment, it is more suited for experienced traders.

Conclusion

Condors can come in all different shapes and sizes.

They need not be symmetrical.

They need not be balanced. And they need not be “iron.”

Even if you don’t plan on using these asymmetrical condors in favor of sticking to your traditional condor, at least now you can say that you’ve seen them.

We hope you enjoyed this article on the asymmetric condor.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Your trap door looks alot like the “Weirdor”