Many people are turning to shorter terms options trades using weekly options.

I can understand the rationale for it.

A shorter-term trade means a higher turnover of capital.

Instead of waiting a few weeks for a trade to complete, a trade can be completed in a few days, and then you can re-use that capital to put on another trade.

But the market does not give us anything for free.

There is always an exchange of something in return.

Yes, you do get a better turnover of capital.

But in return, you have additional risk — primarily in terms of price risk.

What is meant by “price risk” is that your P&L is at risk if the price of the underlying moves in the wrong direction.

What was a profitable trade can be at a loss in a very short time.

This is the nature of shorter-term trades.

We can see these characteristics in the Greeks.

Contents

Greeks Comparison

Several primary Greeks drive the P&L of an options trade:

- Delta: the price movement

- Vega: the volatility change

- Theta: the passage of time

- Gamma: the rate of change of delta

When we move from a longer days to expiration trade to a shorter DTE trade, we improve theta characteristics.

However, we increase the delta risk and gamma risk.

What does that mean?

It’s all Greek to me.

Think of a credit spread, such as a bull put spread.

Closer to expiration means higher theta values.

This means it picks up a greater amount of dollars as time passes.

This is good.

The problem is that gamma is higher in shorter-term trades.

This is bad because it means the P&L changes a lot if the price moves.

Gamma causes delta to change rapidly.

The delta of the trade may be fine one day.

If the price goes against us the next day, the delta changes rapidly.

The worst thing is that delta changes in a way that makes it less beneficial to us.

This will become clearer when we look at an example.

Example Of A Weekly Credit Spread

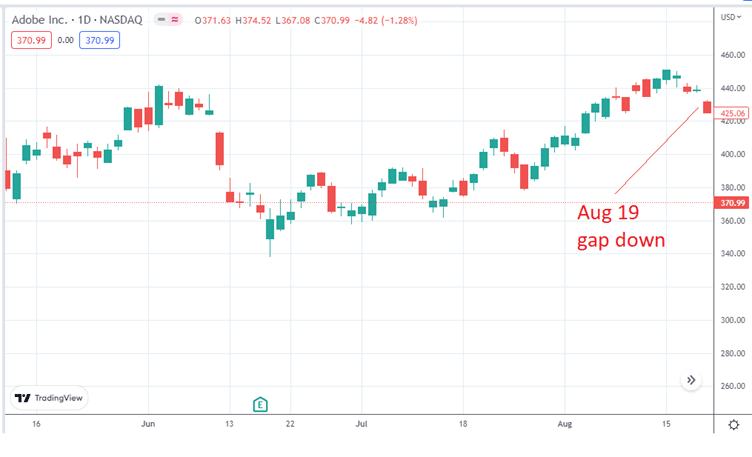

Suppose we saw Adobe (ADBE) on an uptrend on August 15, 2022…

source: TradingView.com

We decide to go long with a bull put spread with the short strike at the 15-delta.

This is a short-term trade using the weekly expiration cycle of August 26, which is 11 days away.

Date: August 15, 2022

Price: ADBE @ $448.56

Buy one August 26 ADBE $410 put @ $1.48

Sell one August 26 ADBE $420 put @ $2.44

Credit: $96

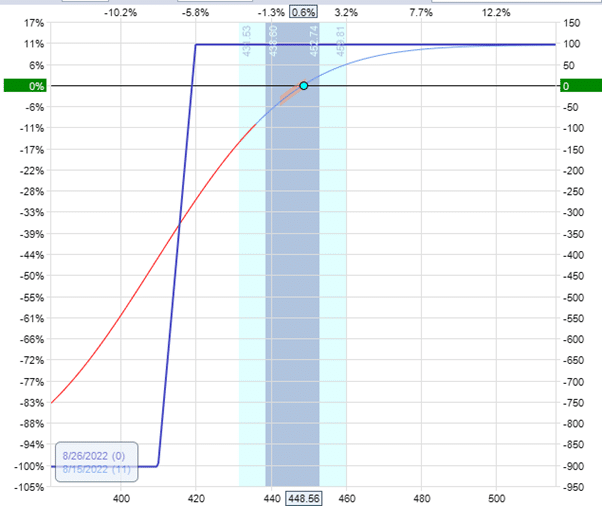

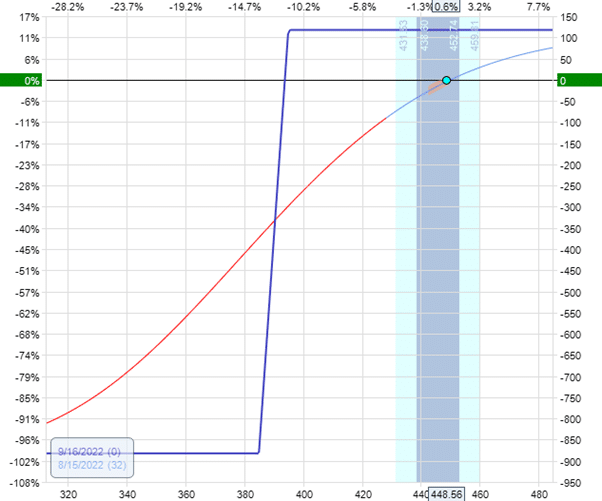

Here is the payoff graph, or risk graph.

You can see that we are risking $900 to collect $100.

Our plan is to take profit if we get $50, which is half our maximum potential profit.

We decided to exit for a loss if the price to buy back the spread increases to $200, which is twice the credit that we had received.

The Greeks, at the start of the trade, are:

Delta: 5.59

Vega: -5.05

Theta: 7.09

Gamma: -0.27

Let’s see what happens as the trade progress.

We are at a slight loss for the next couple of days but not yet at our loss limit.

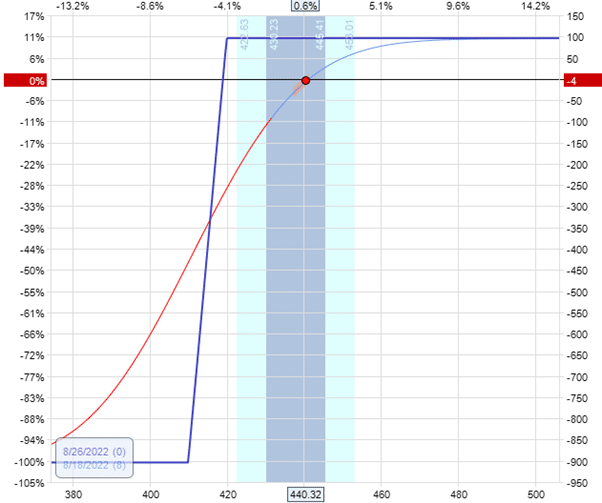

Here is where we are on August 18, one hour before the market close, with a P&L of –$3.50 (just about break-even).

The next morning, the stock price gapped down.

And one hour after the market opened, the spread is at our loss trigger:

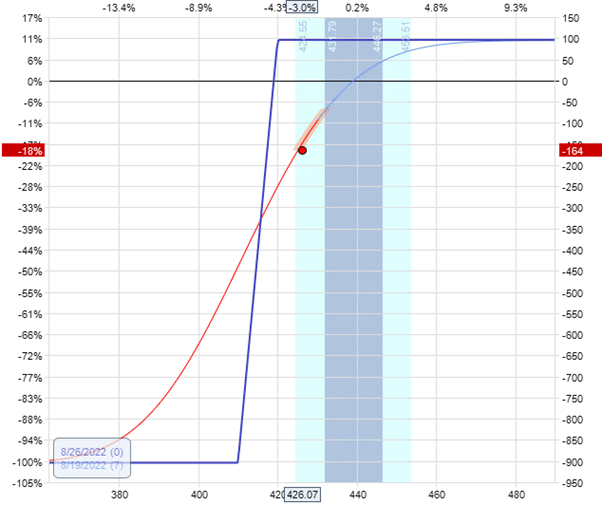

The market didn’t even give us a chance to adjust the trade.

Well, maybe if you got to your charts five minutes after the open, you might have made an adjustment before hitting our loss trigger.

Because 10 minutes after the open, the credit spread already cost over $2.00 to buy back.

Such is the nature of short-term trades.

It is almost like day trading, where you have to be glued to the screen to ensure you don’t oversleep in the mornings of a market day.

What happened on that day of August 19, 2023?

Was it a bad earnings report?

Nope, no earnings.

Nothing.

Just another normal day in the market.

Stock does things like this; they gap down and gap up for no reason.

When it gaps against us, there’s nothing we can do when these trades are just a week till expiration.

The only thing we can do now is to follow our planned rules and exit the trade by buying the spread back at $260.

That is a net loss of –164 dollars.

Comparison To A Longer-Term Trade

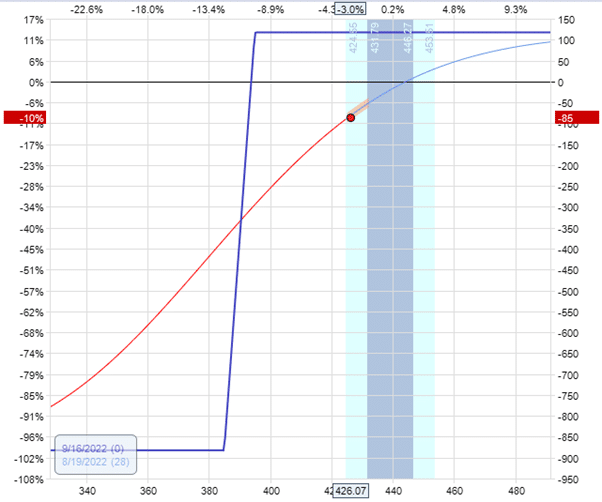

Let’s make the same trade but with 32 days to expiration on the monthly expiration cycle of September 16, 2022.

We sell the bull put spread at the 15-delta for the short strike.

Date: August 15, 2022

Price: ADBE @ $448.56

Buy one September 16 ADBE $385 put @ $3.75

Sell one September 16 ADBE $395 put @ $4.93

Credit: $117.50

The risk-to-reward is about the same as the previous example — risk $900 to make $100.

We will take profit if we get a profit of $59 (half of the max potential profit).

We will exit with a loss if the cost of the spread exceeds $235 (twice our credit).

The Greeks, at the start of the trade, are:

Delta: 3.36

Vega: -4.95

Theta: 2.77

Gamma: -0.11

Comparing those with the previous, we see that the delta is smaller.

This longer-term trade is less directional.

The vega is about the same in this case. But for trades that are much further out in time than this, you will tend to see a larger magnitude of vega.

This means that very long DTE trades become more sensitive to volatility.

The theta in this trade is significantly less.

Because theta power is low, we typically will need to hold the trade longer in order to reach the profit target.

The important Greek here is that gamma is smaller than that of the shorter-term trade.

We are only looking at the magnitude of gamma, ignoring its negative sign.

Let’s see how this one goes on the morning of August 19 when the price gapped down.

Our P&L is at –$85

. The credit spread has not hit our loss trigger yet.

The moral of the story is that longer-term trades are more resilient to price movements.

FAQs

Have you heard of the strategy of selling out-of-the-money put credit spreads on a weekly basis?

Yes, I have heard of such strategies.

But have not tried it myself.

Because the market goes up more than it goes down, the concept is to sell premium without any upside risk plus to capture some theta.

This is great when the market continues to go up, as in the year 2021.

But in a bear market of 2022, I would imagine that the strategy can take on some drawdowns that some traders may not be able to stomach.

Are there any liquidity issues with weekly options

As long as the underlying is liquid, there should not be any liquidity issues with weekly options.

While the example stock of Adobe used in this case is not the best in terms of liquidity, it is liquid enough that I don’t have problems trading options on it.

Is using short-term weekly options better than using monthly options?

Suppose liquidity is not an issue (see the answer to the previous question).

In that case, it does not matter too much if you choose weekly options or monthly options, provided that we are talking about a similar number of days to expiration.

If you are talking about using weekly options to construct a shorter-term with, say, seven to 14 days to expiration versus a longer-term trade that is 30 to 45 days to expiration, then that is a different question.

I believe that new traders learning a new strategy should start with longer-term trades since they are more forgiving when the price moves against them.

Experienced traders who are able to monitor the trades more frequently can go shorter-term as per their comfort zone.

But remember that one normal gap up or down in the market can wipe out any existing gains in the trade.

Or it can result in a loss large enough to force an exit of the trade.

For traders able to manage these risks and still keep their strategy profitable, there are advantages to shorter-term trades — mainly greater theta power and the ability to turn over capital more quickly.

When done successfully, this can yield a greater percentage of returns.

Conclusion

Like anything in the market, there are trade-offs between longer-term and shorter-term trades.

The main purpose of this article is to point out to newer traders that there are additional risks involved in using shorter-term weekly options — mainly what we call “gamma risk.”

Otherwise, all they hear are the benefits of higher theta and higher turnover of capital.

I can not really say whether the shorter-term or longer-term is better than the other.

It depends on the trading style and experience level of the trader.

Those traders willing to take on the risks of shorter-term trades and can manage them properly may also be able to reap the rewards of greater returns.

We hope you enjoyed this article on the risks of weekly credit spreads.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

great article – thanks Gav. Q: do you have an article to expain the common risk management techniques used on short-term credit spreads? Thanks for your support

Here are a couple that might be of interest:

https://optionstradingiq.com/credit-spread-adjustments/

https://optionstradingiq.com/credit-spread-mistakes/

https://optionstradingiq.com/how-to-adjust-a-losing-credit-spread/

https://optionstradingiq.com/option-credit-spreads-destroyed-my-life/

Good article! My experiences with money press style put calendar spreads has been that by the time I have bought downside protection 4-6 months out, the premiums on the weekly puts I sold are not enough to cover the cost of the puts I bought. My best trades have been buying the stock and selling 1-2 yr out covered calls that produce 10-30% premiums.

Nice. I really like that strategy as well David. Set and forget. I prefer longer-term trades that don’t require as much active management.