This article will look at one of the many stock trading programs available to retail investors, Black Box Stocks. We will explore some of the platform’s features and discuss whether it is worth the membership. Here is our black box stocks review.

Contents

- Black Box Stocks Overview

- Initial Impressions

- The Platform

- Options Trader

- Education

- Pricing

- Concluding Remarks

Black Box Stocks Overview

Black Box Stocks is marketed as a user-friendly platform that claims to help investors discover large stock moves before they happen.

They try to do this by using high-frequency technology and proprietary algorithms to scan for the best opportunities in the market.

In addition to a stock platform, they also have an options scanner, education and community, which allow members to communicate with others using the platform.

Initial Impressions

The initial impressions of the website are quite disappointing.

On their page, the main video seems quite scammy.

Instead of being explanatory of the platform, it shows some examples of explosive gains which their system purportedly achieved.

It then goes into some vague language and fancy visuals on all the data they have access to.

It almost feels like a quick sales pitch, designed to have you signed up before you have time to think about the services offered.

If you go to their landing page through their ad on google, you get even more hype likely designed to lure in the uninformed retail investor: quick, easy gains, little description of what they do, as shown in the image below.

Source: Black Box Stocks

The Platform

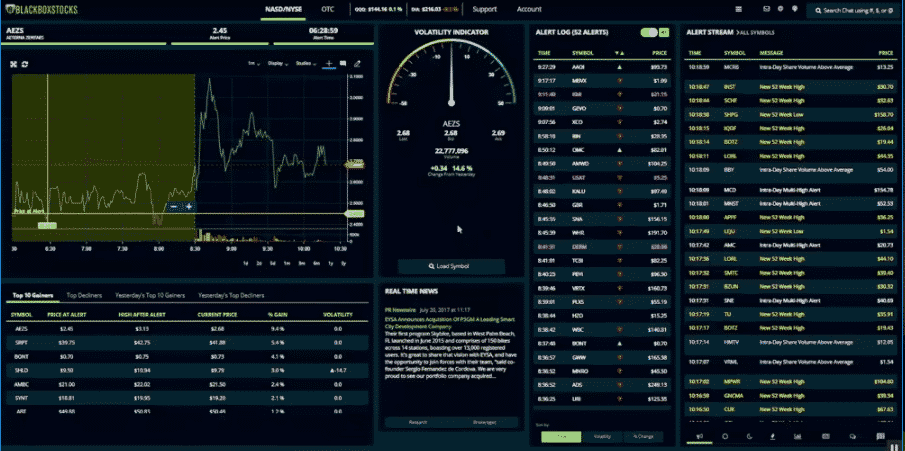

To give Black Box some credit.

The platform itself is both straightforward and visually appealing.

Despite this, many of the features offered in the stock platform will be provided in other places online.

Information such as real-time quotes, 52 week high, high volume, biggest movers is easy to find elsewhere.

Source: Black Box Stocks

What is not easy to find elsewhere is a profitable “alert” system designed to help traders access great opportunities with the click of a button.

This is their proprietary sauce.

While I cannot definitively say whether or not this algorithm provides any value, here are a few thoughts on why it probably does not.

- Why would the owners not simply sell it to a high-frequency firm if the algorithm made a lot of money?

- If the alerts were hugely successful, investors would keep growing in size and putting more and more money into it. At a certain point, these alerts would then fail to work.

- There is no unbiased research (not provided by the firm) or intuitive reasons why it should work.

While the alert system may be profitable, it is impossible to tell.

Even after spending months using the platform due to trading variance, one would have no idea whether or not the system works.

For now, let’s put it as highly doubtful.

Options Trader

As principally an options trader, I was curious to check out Black Boxes Option Scanner.

Here we can see both the most active calls and puts and the put to call ratios for certain tickers.

The scanner then allows you to search for unusual volume and dark pool transactions.

They also sort these orders into two types: blocks and sweeps.

Blocks are characterized as large institutional trades commonly executed on dark pools, while sweeps are more aggressive, often multi-exchange orders, usually placed at the ask.

Overall I found the Options trader section more valuable than the stock trader one.

There is some value in finding heavily traded contracts, and these can sometimes end up being mispriced.

Despite this, simply thinking you can follow the “smart” money when we have no idea who is placing the trade and why it is elementary.

This is as we have no idea what that individual’s portfolio or view is on the underlying.

Dark Pool Trading

Let’s take a massive order of 1,000 800 strike calls on Tesla expiring next December.

The order is executed in a dark pool.

One might think here the smart money is bullish on Tesla.

Despite this, it could be someone like Michael Burry who is bearish on Tesla, simply hedging a bit of his risk by purchasing these calls.

Of course, if we had access to more detail on the order flow, as some firms do.

There is significant money to be made.

That being said, we do not have this level of detail.

Having a few puzzle pieces on its own doesn’t make a picture.

I also found it ironic that they claim we can take this trade information and react before the market.

The market makers are already doing this with far more sophisticated data than Black Box offers, so competing against them in a speed game is usually ill-advised.

Education

Black Box Stocks also offers an education that comes free with a subscription to their platform.

The topics start relatively basic and move to more advanced as a trader progresses. Some of the beginner topics include:

- Basic market terminology

- What is “short selling,” and what are the risks?

- The dangers of trading penny stocks and low float stocks

- How to use technical analysis, charts, candles and more

- How to identify support and resistance levels

This education is pretty informative, though it can be found through youtube videos or articles online for free.

It is a nice add on though.

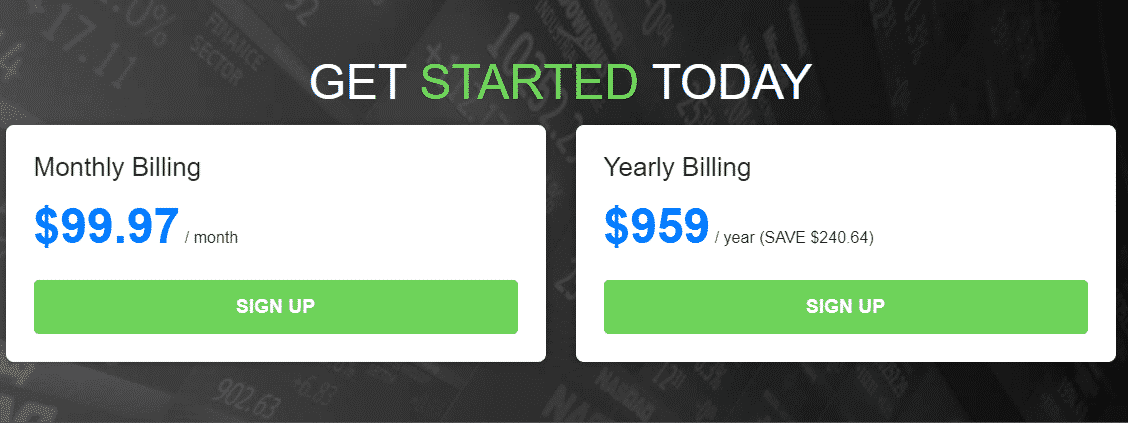

Pricing

Black Box Stocks offer two pricing levels, a monthly and annual membership, as shown below.

Source: Black Box Stocks

Whether or not it is pricey would ultimately depend on the value of the platform’s alerts and proprietary information.

There is no free trial of the software, which is unfortunate.

Concluding Remarks

Black Box Stocks offers an interesting platform with a fair number of overall features, including their education and community.

That being said, the site comes across initially as a typical money grab, showing large gains of their “system” instead of taking a non-biased approach.

A lot of the information they provide, and real-time quotes are available in multiple places online for free, so the value comes down to whether their proprietary alerts have any value.

This seems unlikely.

Furthermore, with no free trial, simply giving it a flyer will set you back a few hundred dollars.

Therefore, Black Box Stocks is best left avoided.

Have you used Black Box Stocks and have a similar or differing opinion?

I would love to hear from you in the comments below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.