An option ladder expresses a unique view on the direction of an underlying.

This article is designed as a supplement to previous articles on the short call and short put ladder.

If you are not sure yet on the structure of a short call or short put ladder, please refer to these links first.

This article will be expanding on the tips section to see if we can find and discuss some real-life trading ideas.

It is always nice to get pointers, but it is even better to see actionable ideas and trades that come from them.

While some of these ideas may be outdated, the most important thing is the process.

We will outline some different types of trades in this article.

Contents

- Exploring Short Call Option Ladder Trades

- Placing Short Call Ladders As A Strategy

- Exploring A Trade with the Short Put Option Ladder

- Concluding Remarks

Exploring Short Call Option Ladder Trades

Let’s go back to some of the things we are looking for in a short call ladder trade.

These are low implied volatility, high put skew and significant upside jump risk.

We also want to focus on options with good liquidity and trade options with some time to expiry (which gives us some leeway to be right).

Again looking from the below graph, this makes sense.

We either want an explosive move to the upside or, if not, a more probable trickle down.

Keeping that in mind, I had a scan of different meme stocks.

These stocks have the potential for large squeezes but will likely trickle down due to poor fundamentals.

Putting short call ladders on these types of stocks should be a no-brainer.

Though unfortunately for us, meme stocks usually have a high call skew.

This means that the out-of-the-money options we buy for the short call ladder have higher implied volatility than the at-the-money options we sell.

The result is a less enticing risk to reward ratio.

Therefore, I will scan which meme stocks have the least relative call skew to what they usually have for this trade.

SPCE Example

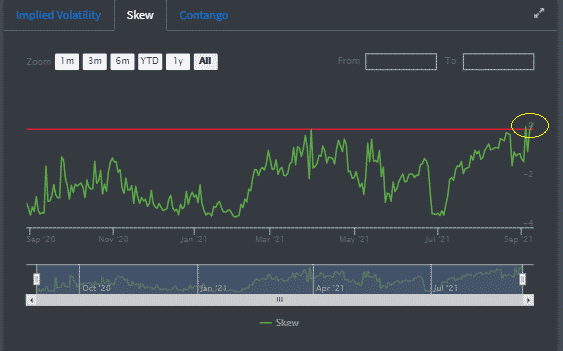

Let’s look at a candidate, SPCE.

Source: Predicting Alpha

This graph shows that SPCE usually has a lot of call skew (reflected by the green line) being below the red line.

Despite that, we see a very low call skew compared to what has historically been the case.

The implied volatility level or IV rank is also near historic lows.

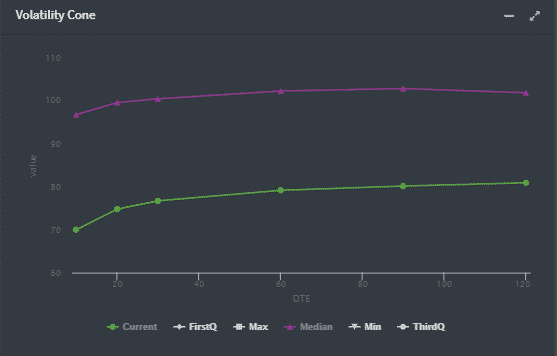

Here is a chart comparing the current implied volatility to the median level.

Source: Predicting Alpha

If we feel as though the market is discounting the squeeze potential in SPCE, we now have a pretty good situation to place a short call ladder trade.

Let’s check it out.

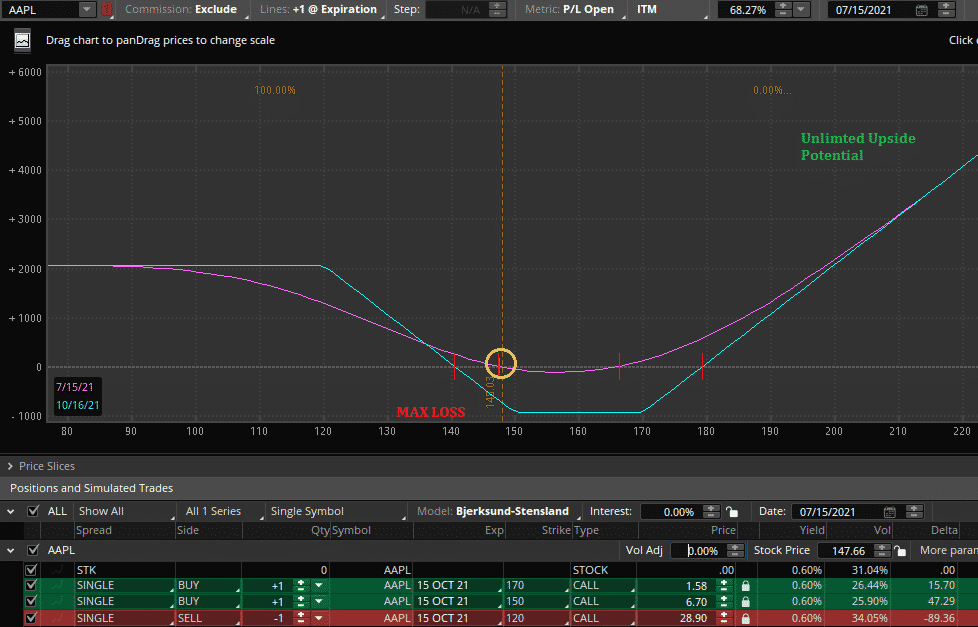

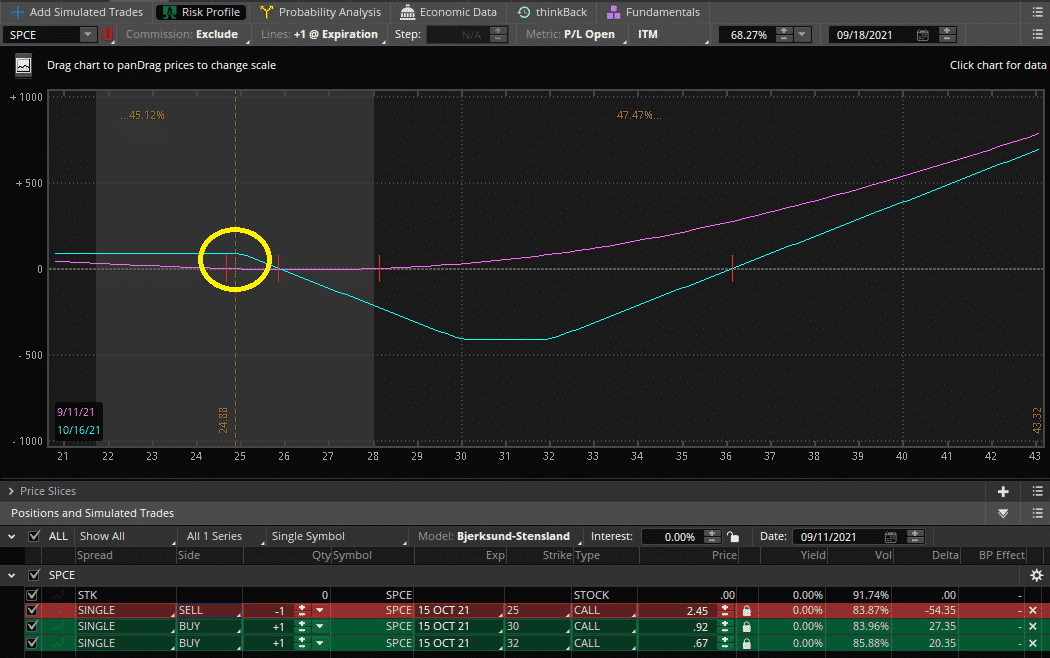

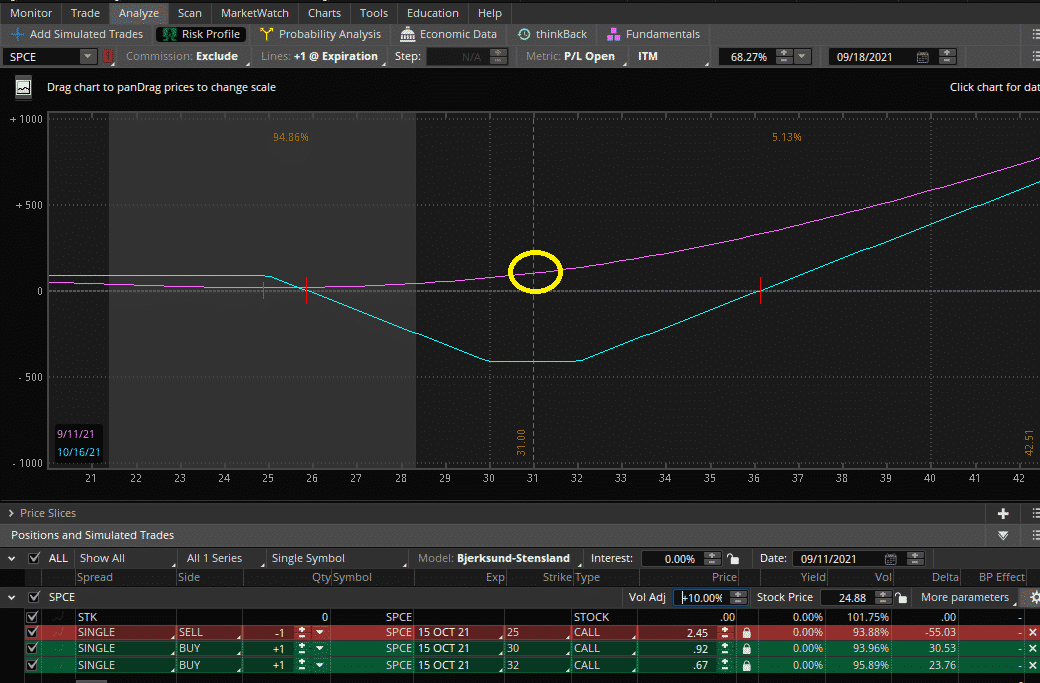

A 25/30/32 short call ladder for October 15th’s expiry has the above payoff with our current trading price.

In this case, we receive a credit of $86 for the trade.

If SPCE stock is unchanged or lower on expiration, we receive the full credit.

Per our thesis, odds are this will happen the majority of the time.

Our maximum loss is if SPCE moves up slowly and lands between $30-32 on expiration. Here we would lose $414.

In our best-case scenario SPCE “moons” (pun intended), here we have unlimited profit potential.

Interestingly enough, we may not even need SPCE to move up to $40 to make a lot of money.

Let’s consider the stock has a big one day move. I have increased volatility by 10%.

The price is now $31, right in the middle of our maximum loss point.

Sounds bad, right

It turns out we have $100 in profit! (as seen by the purple line).

Of course, there are multiple limitations to this trade.

As expected, we could have a small move down then get a big move late, near expiry, which may still hurt us.

Or SPCE could simply trickle up slowly.

Perhaps we are wrong, and this doesn’t have the squeeze potential as other names.

Indeed, it is not a risk-free trade.

Despite this, it is a cool structure to take advantage of a meme stock squeeze while also making money if they trickle back to earth.

Placing Short Call Ladders As A Strategy

The example on SPCE represents a potential one off-trade.

What if you want to place short call ladders as part of a strategy consistently.

Any possible trading idea?

Let’s explore an exciting trade using SPY calls.

The thesis of this trade is as follows.

The S&P 500 always has put skew.

There is a reason for this; stocks usually take the stairs up and the elevator down.

Despite this, there are numerous studies to show that this skew is overpriced over time.

This overpriced skew and investors who love to sell index covered calls can result in their volatilities getting pretty low compared to their at-the-money counterparts.

So let’s explore a short call ladder on SPY and have a look.

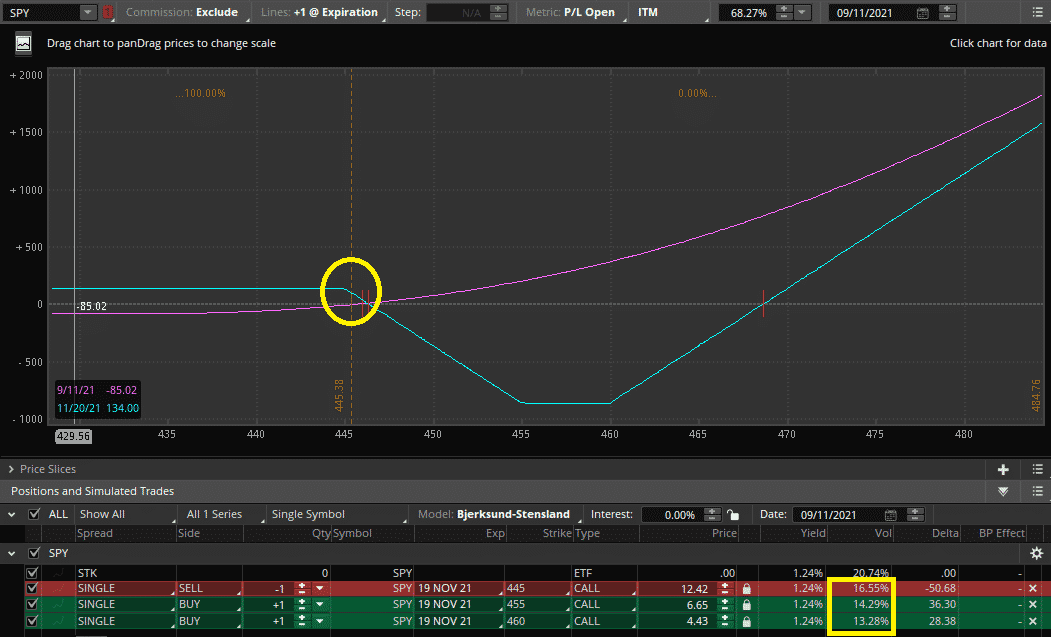

Here I have sold the 445 at-the-money call while buying the 455 and 460 calls.

For this trade, we got a credit of $134, which is also how much we will make if the price goes down by expiry.

We can see that this trade benefits from selling higher volatility and buying lower volatility (from the yellow box).

Overall the payoffs look great.

We can make a few bucks if the index goes down, lose a moderate amount if it goes up a small bit and make a boatload if we make a significant move higher.

What’s The Downside?

What is the issue with this structure?

Well, we know distributions are not normal.

More often than not, we will have flat to small up days.

This can lead to more frequent losses than may appear from the structure.

One strategy to avoid this is to try this type of trade in strong trending markets, where there is a chance that the trend will continue for another few months.

The good news is that even if the market appears overleveraged at this point, there is still no risk if things come apart to the downside.

Exploring A Trade with the Short Put Option Ladder

For trades with a short put ladder, we are looking for the potential of a large move down.

Here I thought I would look for a good opportunity to provide a good hedge for a portfolio.

I read an article from an author I follow, which was a fundamental piece.

He made the case that Coca Cola was drastically overvalued and that the share price was steep.

Despite this, he acknowledged that because Coca Cola was so highly held in index funds (such as the Dow Jones), it could just as easily stay inflated.

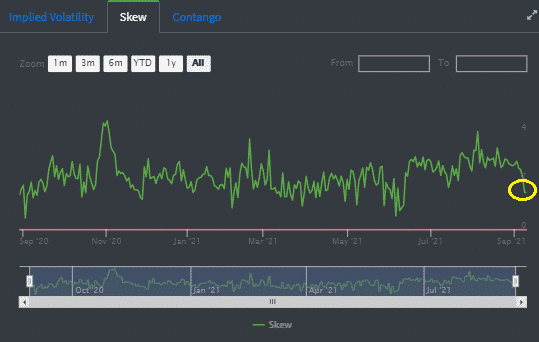

Interested, I checked the skew on Coca Cola.

Some analysis is nice, but if investors are already worried about Coca Cola’s fundamentals and buying up puts, our short put ladder might not pay off.

Thankfully we can see while we do have put skew, it is a lot less than usual.

In addition, the implied volatility rank is relatively low, which means that we will not need a massive move lower to get paid.

Given our agreement with the author, this trade may make sense.

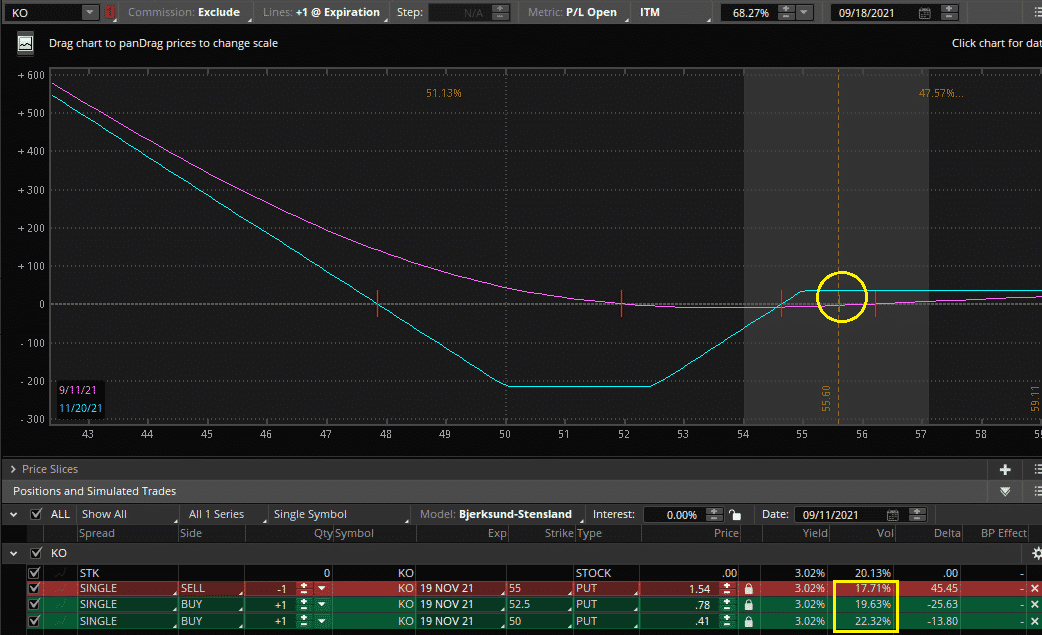

Let’s have a look at it.

Here we make a modest credit if Coca Cola stays flat or moves higher while our profit is uncapped to the downside.

All while risking $200 in our worst-case scenario.

A type of structure like this could benefit if Coca Colas fundamentals get a reality check or a major market correction that affects all sectors.

While we are buying our puts at a higher implied volatility level than the put we sold, we feel like this may still make sense based on our view.

An alternative to this structure would be to buy a put on Coca Cola.

This trade is a good pure play but will suffer from theta decay if we are wrong.

We may eventually end up giving up buying these puts, oftentimes right before we will need it the most.

In many cases, there will be other ways of expressing a trade.

Establishing whether a ladder is preferable to another options structure is important in making the best choice for your view on what you think will happen.

Concluding Remarks

This article talked about some trading strategies and real-world examples of using short call and put ladders.

In our first example, we explored using a short call ladder to take advantage of a unique opportunity for a short squeeze in a meme stock.

In our second example, we looked at a structural risk premia trade.

We used a short call ladder in an index that could be used profitably over time.

In our third example, we explored using a short put ladder to agree with a fundamental view we have while also potentially providing some portfolio protection in a market crash.

The examples above illustrate only a few of the different potential ways to use ladders while trading.

Do you have any ways you like to trade options ladders?

I would love to hear in the comments below!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

thanks for sharing this content, its really helpful for us.

You’re welcome

I see your are on Predicting |Alpha – great site 🙂

Yep, glad you like it too.