There are numerous options structures an investor can choose. This article will provide an overview of one of these structures, the Short Call Ladder.

First, we will give an overview of the position. We will then discuss when it is best to implement them in a portfolio.

Let’s get started!

Contents

- The Basics, What is a Short Call Ladder?

- The Short Call Ladder Visualized

- What View Am I Expressing With A Short Call Ladder?

- Tips To Optimize Short Call Ladder Trades

- Managing And Closing Short Call Ladders

- Concluding Remarks

The Basics, What is a Short Call Ladder?

A Short Call Ladder Consists of 3 parts or legs. To create a Short Call Ladder, we have the following.

Short 1 in-the-money call

Long 1 at-the-money call

Long 1 out-of-the-money call

The Short Call Ladder Visualized

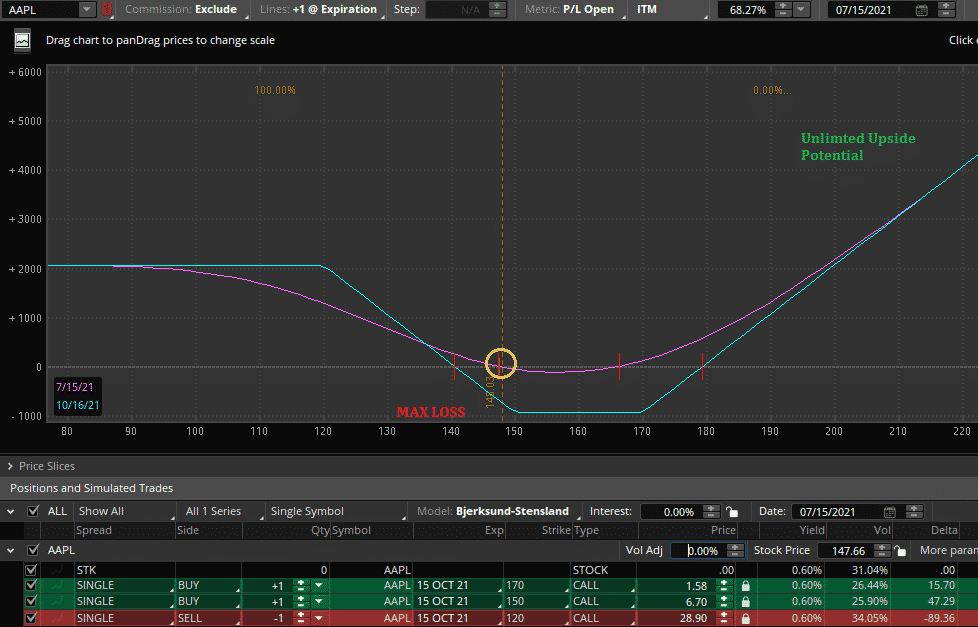

An example can be seen below on Apple. Here we have a structure of a short 120 call, a long 150 call, and a long 170 call.

As we can see, our Short Call Ladder has a risk-defined structure.

Our maximum risk on this trade would occur with Apple trading in the $150-$170 range at expiration.

This would result in a loss of slightly less than $1000.

On the downside, we can make 2-1 Risk to Reward if Apple drops below $120.

On the upside, we have the potential for unlimited profits after our break-even point of $180.

So what are the greek exposures of this structure?

Well, most importantly, we are long volatility.

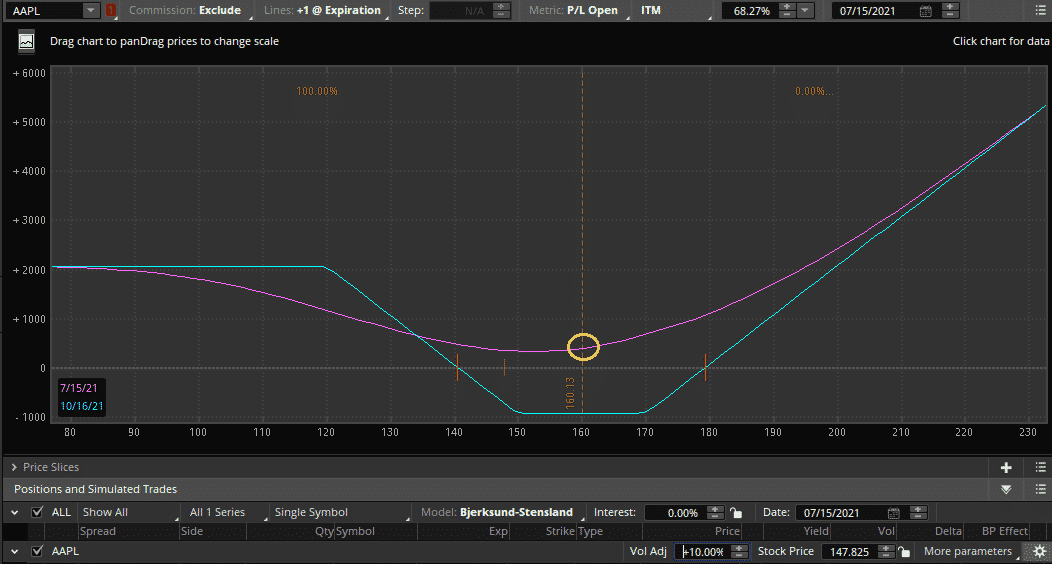

To show this, I increased volatility 10% while also moving Apple’s price up to $160.

While this is now right in the middle of our max loss section, our position is already up considerably, as shown below.

We can see with a 10 point increase in volatility, we would already be up over $300!

Now, of course, a 10 point increase in Apple volatility would be a big move.

So please don’t get too excited, but it looks terrific.

Now let’s look at the opposite scenario.

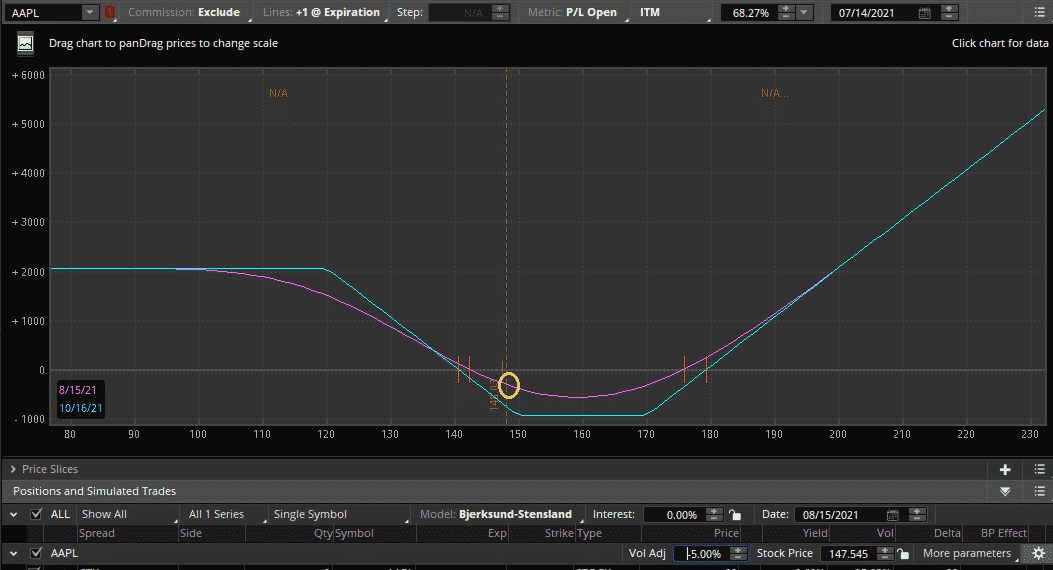

Implied volatility has decreased 5 points, and we have moved forward a month in time with no price change in the position.

We can see below we are now losing money.

Our instantaneous P&L has started to converge upon our blue expiration P&L.

Although this structure may still look visually appealing, we have to remember we would need a massive move in a low volatility large-cap stock in a short period of time.

Most likely, this position is headed towards a loss or a break-even at best.

What View am I Expressing with a Short Call Ladder?

As we can see from above, the Short Call Ladder expresses a long volatility view.

Though the view itself is more specific, after all, many other structures express a long volatility view, such as a Straddle or Strangle.

What makes a Short Call Ladder unique?

As seen from the position itself, we are expecting a large move.

We do not expect the stock to do nothing or slowly trickle up (towards our maximum loss zone).

We believe that the stock could shoot to the upside.

For this reason we do not sell an additional call to make a Reverse Iron Condor.

Despite this, we cap our potential gains on the downside.

This expresses the view that while we could see a significant move down in the security, we do not expect a severe crash.

This view is important as it is very specific.

If we do not have this view, a Short Call Ladder may not make sense, and another options structure may be better suited for our view.

For example, if we have no opinion on the skew and feel as though an extreme move to the upside and downside are equally probable, a Long Straddle may make more sense.

Contrastingly, if we feel like a move to the upside will happen and are extremely bullish, a simple Long Call could provide higher returns if we are right.

Tips to Optimize Short Call Ladder Trades

While an individual’s view on the underlying direction is specific to that person, there are a few conditions that generally make Short Call Ladders more effective.

Low Implied Volatility

If Implied volatility is low, we can place this trade on for cheaper.

We will then also benefit if implied volatility increases.

This is as our long legs will gain more in value as volatility increases than our short leg will lose.

Lots of Put Skew

Put skew causes out-of-the-money put options to trade at higher implied volatility than the same delta call options.

This allows us to take advantage of selling higher implied volatility for our in-the-money call and buying lower implied volatility for our out-of-the-money call.

Significant Jump Risk

If a stock has jump risk, especially to the upside, a Short Call Ladder can work especially well.

This is as we have unlimited profit potential.

A few examples of these stocks would be biotechs and meme stocks.

Despite this, these stocks often have call skew, making Short Call Ladders less effective and contrasts our second point.

Liquid Strikes

All complex orders consisting of more than one leg increase transaction costs and slippage.

As a Short Call Ladder has three legs, this can wrack up transaction costs, especially on illiquid underlyings.

Focus on underlyings that have good liquidity in their options chains for lower transaction costs overall.

Choose Longer Dated Options

Choosing shorter-dated weekly options may be better if an investor feels as though a specific event is imminent and there is a market mispricing.

If not, it may be better to choose longer-dated options as this gives more time for an investor’s view to be correct and reduces the transaction costs of frequent trades.

Managing and Closing Short Call Ladders

As Short Call Ladders are risk-defined trades, managing them is relatively easy.

At inception, it is best to have the maximum loss as the actual maximum loss you can accept on the trade.

If you close the position early, it is unlikely to experience a full loss.

However, being prepared for one is important.

This allows for a lot less additional trading and transaction costs as we can let our position move.

This contrasts with many short options strategies, for example, which may need to be delta hedged frequently.

Despite this, as the position evolves, and depending on your view of the underlying, changes may need to be made.

For example, nearing expiry, if the underlying moves up or down considerably, our original trade becomes almost a delta bet in the continued movement of the stock.

If we do not want this altered exposure, the best thing to do is take profits and either roll the position or look for a new position in another security.

Choosing not to do so and holding is akin to simply hoping while negating the value you place on your view in the first place.

Concluding Remarks

Short Call Ladders allow investors to express a unique view.

Investors can bet on a large move in an underlying security while still having a risk-defined structure.

It also gives the uniqueness that while to the downside, there is a maximum profit, the upside gain is unlimited.

Hence it allows an investor to express a very specific opinion on the potential terminal outcomes of a security.

Taking advantage of low implied volatility, high skew, and jump risk can help optimize Short Call Ladders as a strategy in the long run.

Despite this, the most optimal trades will likely not be systematic but take advantage of unique events and views that an investor has.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Very good article Gav! Thanks.

Hi, thanks for the wonderful explanation. Would a extremely low volatility situation be a good point in time to initiate this strategy?

Regards,

BS

Yes, it’s positive Vega, so a low vol environment is a good time to enter.

Can legging out of the profitable bought leg and leaving the spread on for the move down be done?

Yep, no reason why you can’t do that.