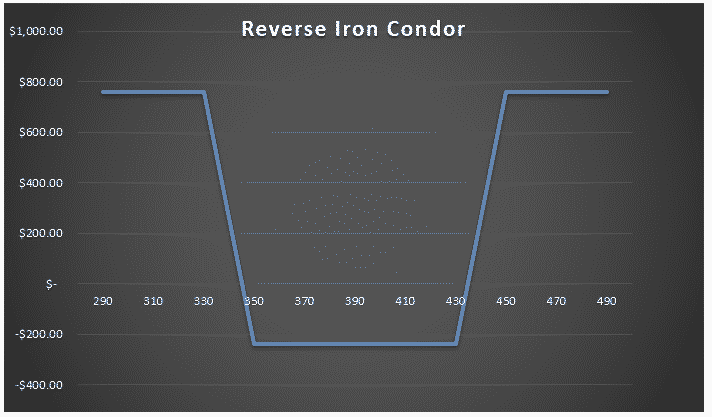

Introducing the Reverse Iron Condor. A trade that expresses a long volatility view and is the opposite of your typical Iron Condor.

Contents

- Basics

- When should I Trade a Reverse Iron Condor?

- Does a Reverse Iron Condor Have to be Directionless?

- When Your View is Flipped Upside Down

- Reverse Iron Condor vs. Strangle

- Concluding Remarks

Many people like trading Iron Condors to short volatility with defined risk.

This article will explore the opposite trade.

Let’s break it down.

Basics

A regular Iron Condor consists of selling an out of the money strangle then buying an even further out of the money strangle to cap losses on the short options.

A Reverse Iron Condor is the opposite.

To start we have a long strangle.

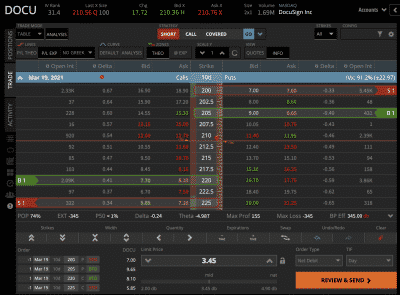

Using the example below, Docusign (DOCU) is trading at $210.

We buy the 205/220 strangle.

Then we sell a further out of the money strangle. In this example the 200/225 strikes.

This trade is put on for a debit of $3.45.

In terms of our risk to reward profile our max loss is our debt paid (i.e. $3.45).

If upon expiration DOCU stock is between 205 and 220 the Reverse Iron Condor will expire worthless.

Our max gain is the width between the long and short strikes minus the debt paid.

In this example, the difference between the long and short strikes is $5.

So, our max gain is $5-$3.45 = $1.55.

When should I Trade a Reverse Iron Condor?

Looking at the chart above we need DOCU to move in either direction to profit.

Therefore, the main view expressed when placing a Reverse Iron Condor is one on volatility.

By placing this trade, we are conveying that we expect more volatility than what the market is implying.

Upon inception, we are indifferent to whether the stock moves up or down.

Despite this, we need the stock to move. In short, we expect realized volatility to be greater than implied volatility.

Another factor to consider is the IV rank of the stock or ETF.

As a Reverse Iron Condor is a positive vega strategy, the best time to enter these is when the IV Rank is low.

Does a Reverse Iron Condor Have to be Directionless?

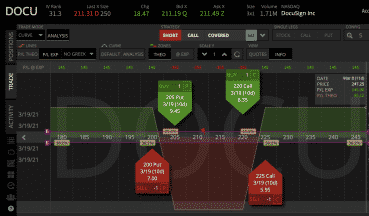

A Reverse Iron Condor is placed directionless but the unique thing about options is you can express any view you want.

Let’s say you think volatility is underpriced and you have a slight bearish bias on the stock price.

By skewing the body slightly, you can express a directional view. In the example above the trade is skewed bearish.

To realize full profit the stock has to move $15 up but only $10 down.

Hence on inception, I am expressing a slight directional view in addition to my view on volatility.

Once the trade is placed our exposures will constantly change as the price moves.

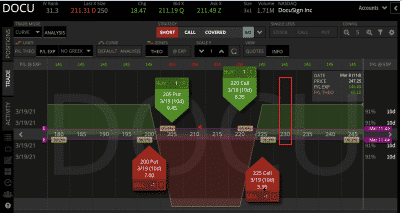

Imagine we placed the trade above with our negative view yet DOCU moves to $215.

Now the trade has a positive delta.

If we want to stay directionless, we can simply short shares of the stock or readjust the strikes of the options.

Though a word of caution.

As a general rule for most retail traders, minor adjustments of this sort should be kept to a minimum, especially with a long options position.

As our max loss is our debt paid constantly readjusting adds slippage and commissions.

These costs will eat into any positive edge we had in the trade. That being said there are certain times when adjusting a position is necessary.

When Your View is Flipped Upside Down

Using the example above.

DOCU rallies hard to the upside tomorrow.

Turns out we were right.

The stock is now trading at $230.

What are our exposures now?

Well, naturally we have some long delta.

We don’t want the stock to go back down.

But our whole trade has now flipped.

If the price stays where it is at expiration, we make our full profit.

Thus, we also benefit if the stock doesn’t move.

We are now short volatility.

Trade Has Flipped To Short Volatility

When we entered the trade we were long Gamma, Vega and short Theta.

Now we are short Gamma, Vega and long Theta.

The question to ask yourself is that after this move do you now want to flip sides and short volatility?

The answer is probably no. In this case, the best thing to do is to remove the position and take profit.

The same idea is true for a regular iron condor when the realized move takes the stock outside of its wings.

The investor initially wanted short volatility.

Yet because of the realized move, they are now long volatility. Many investors will leave the position in hope that it will come back.

Commonly you will hear them making an excuse such as “I am prepared to lose X.”

Yet the trade still has time to expiry.

They are now taking the opposite view they originally had on volatility.

If these traders had so little conviction in their trades to flip flop, they probably didn’t have enough conviction to take the trade in the first place.

One may wonder.

Though I think more likely they are simply unaware of their new exposures.

Alternatively, they are aware but emotionally avoiding taking a loss.

Ultimately, they could close the position for a small loss while still collecting some of the remaining time value in their long leg.

More often than not they end up holding the bag on this new long volatility position till expiration praying it comes back.

For a Reverse Iron Condor falling into the opposite trap where you wait to collect that last few pennies of Theta is just as ill-advised.

If your trade is not expressing the view you want to have, there is no point expressing the trade.

Hope is not an investment strategy.

Reverse Iron Condor vs. Strangle

At this point, it is valid to discuss the alternatives to take a long volatility view.

Why place a Reverse Iron Condor when one can simply place a strangle?

Why would you cap your gains?

These are fair questions.

One of the major proponents for the Iron Condor over the Short Strangle is that it takes an undefined risk and caps it.

Those wings are tail risk protection.

In contrast, the most we can lose on a long strangle is the debt we paid.

Thus, if we have a high conviction long volatility trade the strangle makes sense over the Reverse Iron Condor.

There is no reason to cap your gains.

Who wants a slice of pizza when you could have the whole pie to yourself?

Yet by giving up the opportunity for unlimited gains, we receive a credit which reduces our cost basis for the trade.

So, while our upside is capped we have offset the debit we paid substantially.

Another advantage of selling the wings is that historically these are the most overpriced options.

While they are cheap in price, they are expensive in terms of volatility.

Everyone wants to buy tail risk protection.

Even people shorting volatility are buying the wings as protection.

Hence sometimes the trade can make sense.

Here are my thoughts for when to pick a Strangle vs Reverse Iron Condor

Pick Strangle if:

- High conviction trade

- Illiquid underlying (or illiquid wings)

- Low priced underlying

- Relatively flat vol surface

Pick Reverse Iron Condor if:

- Lower conviction trade

- Liquid underlying

- Higher priced underlying

- Very smiley vol surface

Regarding points 2 and 3, the reason we want to avoid lower-priced and illiquid stocks for Reverse Iron Condors is that there is simply not enough juice to justify the higher commissions and transaction costs.

Trading four legs of options will have higher transaction costs than trading two.

If the wings have a volatility of 1,000% that is irrelevant if the option is worth 2 cents.

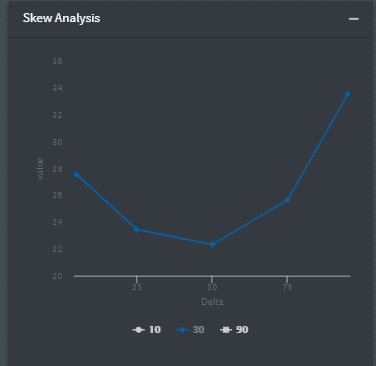

Volatility Skew

In terms of the volatility surface the more of a smile we have the better.

This means that the implied volatility of the wings is a lot more expensive than that of the body (shown below).

This OTM skew will be overpriced.

There is a premium called skew risk premia which is an additional premium you can harvest over time by selling these options.

Almost always the high skew is there for a reason.

Maybe a biotech stock coming out with a new drug or a company has a big release.

In these situations, we should expect a very smiley skew as the returns will not follow a normal distribution.

It can be a tough pick between the two but often you may see yourself on the side of the strangle just in terms of price and liquidity.

In either case, the most important view is that of volatility.

By trading a Reverse Iron Condor, you are taking the view that you believe implied volatility is underpriced relative to what you think realized volatility will be.

Perhaps you did some technical analysis, or you have a feeling you could see a piece of blowout news on earnings.

Or maybe you are just buying vol where you think it’s cheap.

Either way, your primary expression is made through volatility.

Otherwise, just trade the stock.

Concluding Remarks

The Reverse Iron Condor can provide a unique exposure where one is long volatility while paying a modest debit.

While not so popularly used it can provide a good alternative to a long strangle in certain situations where the investor believes volatility is cheap, but the skew is overly expensive.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.