Contents

- Cash Secured Puts

- Back Ratio Spread

- Broken Wing Butterfly

- What About Diagonals

- Iron Condor

- Conclusion

The cost of protective puts causes investors to be reluctant to hedge their portfolio. But then they regret it when a black swan event happens.

While we ultimately will still need to pay for this insurance, here are some techniques to make this cost more palatable.

When exiting trades, keep an eye out on how you can save a protective put. Instead of exiting the entire trade, leave some protective puts behind for crash protection.

Cash Secured Puts

Some investors may sell cash-secured puts to acquire stock.

But why not buy a small 10-delta put in addition.

This reduces the margin requirements and adds a little bit of protection if things go wrong.

If things go right, you have an extra protective put.

For example,

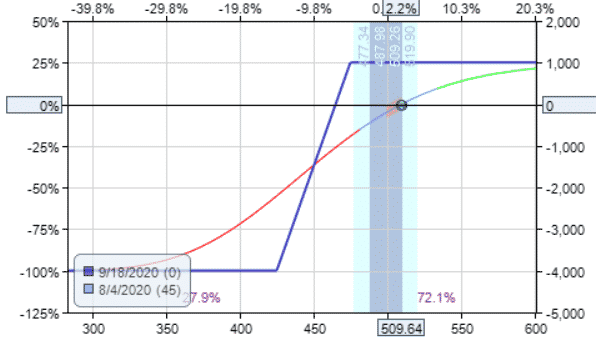

Date: Aug 4, 2020

Price: NFLX @ $509.64

Buy one Sep 18 NFLX put with strike $425 @ $4.025

Sell one Sep 18 NFLX put with strike $475 @ $14.05

Credit: $1002.50

On Aug 26, the trade has a profit of $717 which is more than 50% of the achievable max profit of $1002.50.

While the investor can close the entire trade and take the profit of $717, an alternative is to close only the short leg.

For example,

Date: Aug 26

Buy one Sep 18 NFLX put with strike $475 @ $3.625

Debit: $362.50

Total Profit so far: $640

The investor still has one NFLX put with a strike of $425, which currently has a market value of $77 (too small to sell).

It’ like the investor gets a free protective put, which has a T+0 line that goes up if NFLX falls.

This put option has gone quite far out of the money to the 2.5 delta with 23 days to expiration. However, the put does not need to be in-the-money to gain value.

Any drop in NFLX will do.

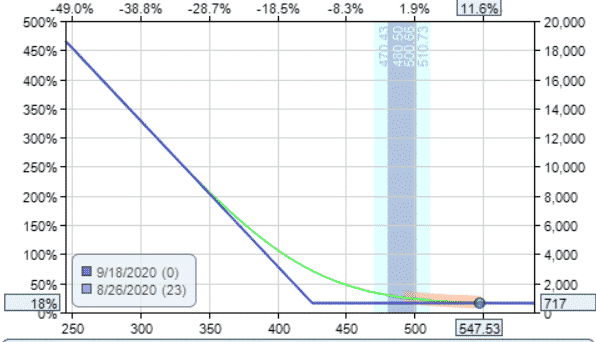

On Sept 3rd, NFLX had a bearish candle day.

The value of that protective put has gone up to $171, an increase of $93.

The investor sells this protective put to capture this profit.

Date: Sept 3

Sell one Sep 18 NFLX put with strike $425 @ $1.705

Credit: $170.50

Total Profits: $811 (calculated from $640 + $171)

This turned out more profitable than if the investor had closed the entire trade initially with the $717 profit.

Back Ratio Spread

Some investors may use back ratio spreads as hedges against a market sell-off. Here is an example of the RUT (Russell 2000 index) with crash protection on the downside and no risk on the upside.

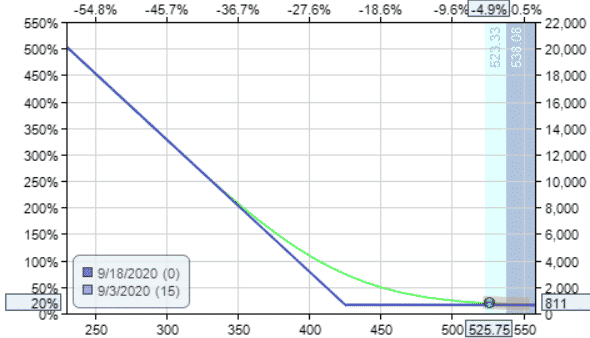

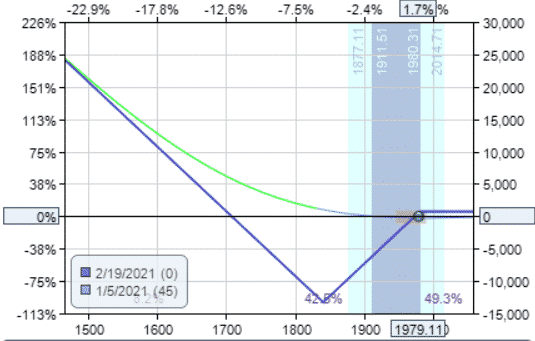

Date: Jan 5, 2021

Price: $1979.11

Buy two Feb 19 RUT puts with strike $1840 @ $35.15

Sell one Feb 19 RUT put with strike $1980 @ $77.55

Net Credit: $725

In this case, RUT keeps going up and the hedge gets weaker and weaker.

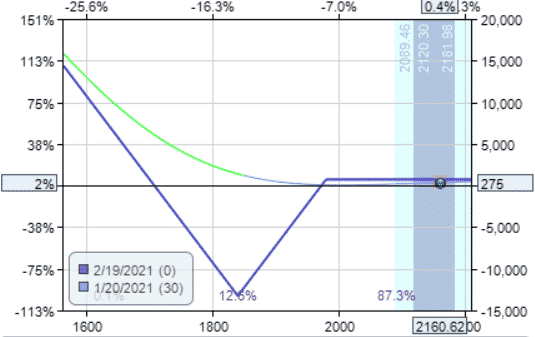

On Jan 20th, with RUT at $2160.62, the payout diagram looks like this.

The price has moved so far away that the market would have to drop at least 12% before the crash protection of the back ratio spread starts working.

At this point, the ratio spread has a profit of $275 and is a good place to close the trade and maybe put on a new ratio spread.

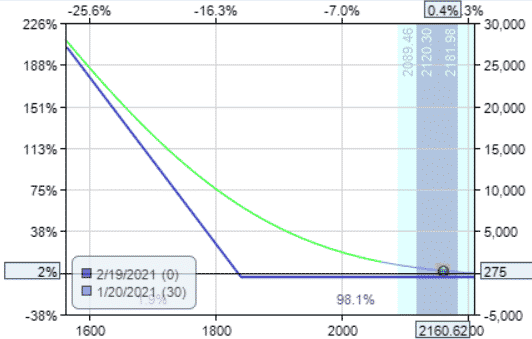

Since the put back-spread is a bull put spread plus an extra put option, the investor can just close the bull put spread and keep the extra put as crash protection.

Date: Jan 20

Sell one Feb 19 RUT put with strike 1840 @ $7.85

Buy one Feb 19 RUT put with strike 1980 @ $20.20

Net Debit: $1235

Now the investor is left with one protective put in place that provides immediate crash protection:

This Feb 19 RUT put option with strike $1840 and 30 days till expiration has a market value of $785.

But considering the initial credit of the ratio spread, the investor paid out only $510 (as calculated by $1235 minus $725).

More than half off is a good deal. This only worked if the investor receives a good credit for the ratio spread and the market rallies up at the start of the trade.

Here the long put was used in the back ratio spread as crash protection. But when it was no longer needed or useful, we re-purposed it as a single protective put.

Broken Wing Butterfly

Similar results can be achieved with the put broken-wing butterfly that receives a good initial credit. For example,

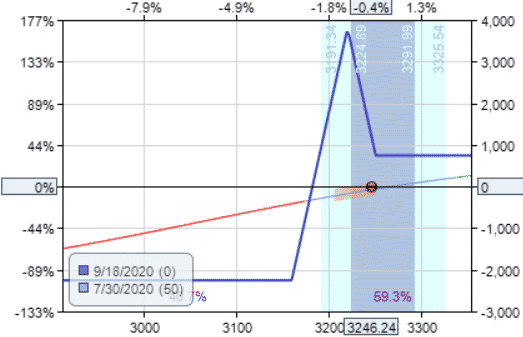

Date: July 30, 2020 Price: SPX at $3246.24

Buy one Sep 18 SPX put with strike $3160 @ $78.05

Sell two Sep 18 SPX puts with strike $3220 @ $96.75

Buy one Sep 18 SPX put with strike $3250 @ $108.00

Net Credit: $745

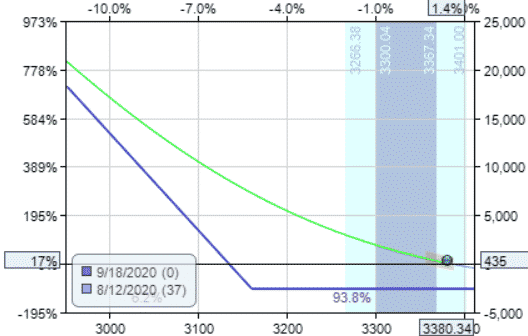

On Aug 12, the trade is showing a profit of $435, which is more than half of the initial credit of $745.

Instead of closing the entire trade, exit all legs except for the far out-of-the-money put.

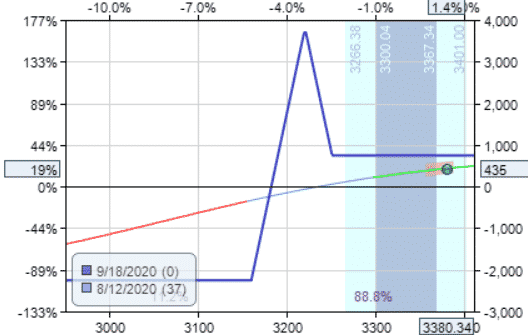

Date: Aug 12

Buy two Sep 18 SPX puts with strike $3220 @ $38.30

Sell one Sep 18 SPX put with strike $3250 @ $43.45

Net Debit: $3315

Now investor is left with one protective put which has a market value of $3005. The investor paid out only $2570 (calculated by $3315 minus $745).

While we understand that we are just using the proceeds from a profitable trade to help pay for the protective put; psychologically, it feels much easier to do this way.

What About Diagonals

Does this work for diagonals? Of course. Diagonals are the most flexible two-legged option structure in the world.

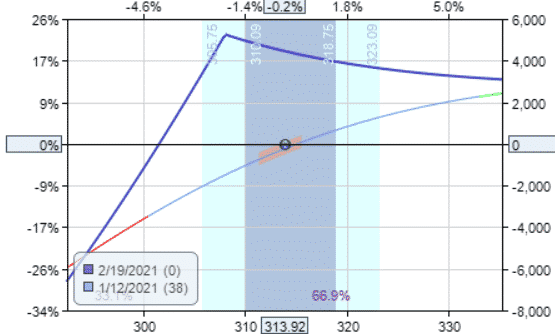

Date: Jan 12, 2021

Price: QQQ @ $313.92

Buy 10 Mar 19 QQQ puts with strike $282 @ $5.52

ell 10 Feb 19 QQQ puts with strike $308 @ $8.265

Credit: $2745

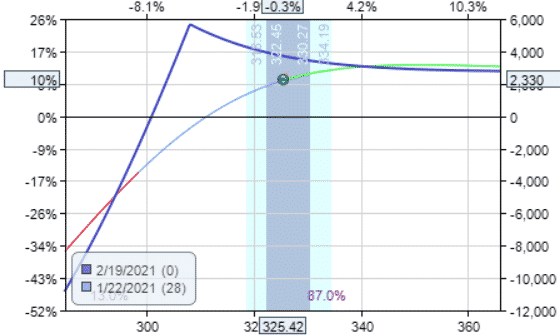

Looking at the payoff graph for Jan 22 (shown below), this is a good point to take profits which have reached $2330.

Instead of exiting the full position, the investor can keep half of the long puts for crash protection:

Date: Jan22

Sell five Mar 19 QQQ puts with strike $2=482 @ $3.30 Buy ten Feb 19 QQQ puts with strike $308 @ $3.715

Debit: $2065

Total Credit received: $680 ($2745 – $2065)

The investor had received a total credit of $680 and still has five Mar 19 QQQ puts on hand.

The market has paid for those puts. The value of those 5 puts in late Feb was $1650.

Those puts became useful when the market dropped and the QQQ’s closed at $314.56 on January 29th. The value of those five puts ballooned to $3035, at which point the investor can sell.

Iron Condor

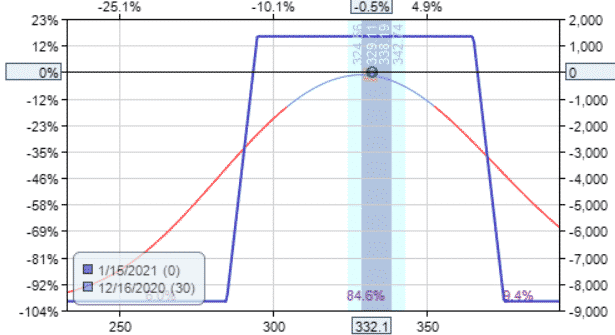

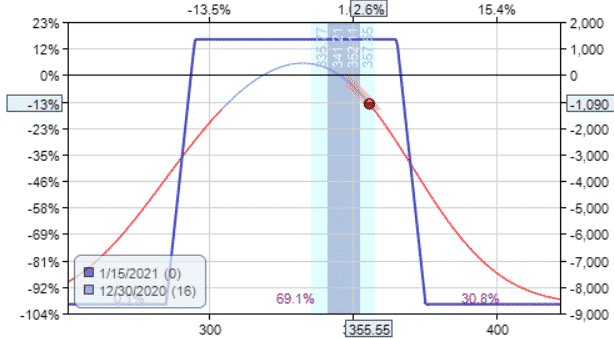

Consider the following iron condor that did not work

Date: Dec 16, 2020

Price: MA @ $332.10

Buy 10 MA Jan 15 put with strike $285 @ $1.155

Sell 10 MA Jan 15 put with strike $295 @ $1.815

Sell 10 MA Jan 15 call with strike $365 @ $1.375

Buy 10 MA Jan 15 call with strike $375 @ $0.69

Credit: $1345

As per our iron condor rules, we need to take action if the short strike gets higher than the 25-delta or when the price comes within 3% of the short strike.

Both of these happened on Dec 30 when MA (Mastercard) closed at $355.55 and the iron condor is at a loss of $1090.

The investor decides to close the position for a loss since MA is no longer range-bound.

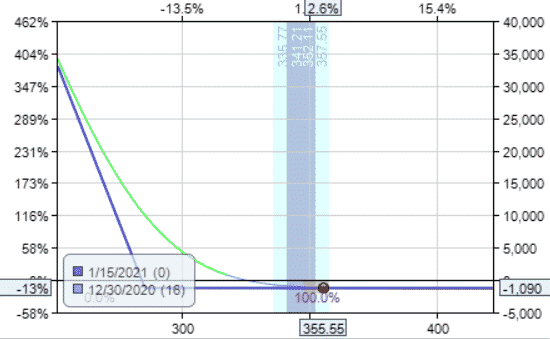

Instead of closing all four legs, the investor keeps the far out-of-the-money put.

That put is worth at this point $16 per contract — not even worth it to sell.

Date: Dec 30, 2020

Buy 10 MA Jan 15 put with strike $295 @ $0.245

Buy 10 MA Jan 15 call with strike $365 @ $4.525

Sell 10 MA Jan 15 call with strike $375 @ $2.175

Debit: $2595 Total Debit so far: $1250

The remaining 10 puts still have a market value of $160 and will most likely expire out of the money at expiration.

However, they can recoup some profits if MA decides to reverse down at some point. At what point to sell is at your discretion.

For example, on Jan 5th, MA closed down at $347.42, at which point the 10 puts have increased in value to $640.

Selling them back to the market at this point yields:

Date: Jan 5, 2021

Sell 10 Jan 15 MA puts with strike $285 @ 0.64

Credit: $640

Final Profit/Loss: –$610 (–$1250+640)

The final loss of $610 is much better than if the investor had closed the entire iron condor earlier for a loss of $1090.

Conclusion

Keeping low-cost long puts around does not incur much risk, and can help you re-coup profits in the event of sell-offs.

In a back ratio spread, keep an eye on the profit of the embedded bull put spread.

If it made 50% of its potential profit, sell it and leave the long put in place as a hedge.

In an all-put broken wing butterfly with no risk on the upside, if the price moves up and too far from the body of the butterfly, take the trade off for a profit and leave the furthest out-of-the money put in place. It is of little value to sell anyway.

If you are selling a cash-secured put, consider adding a far out-of-the-money long put even if you plan to have the stock assigned. It will act as a lottery ticket in the event of a market sell-off.

If your trade structures are in good profits due to market rallies, let some of the market’s money help pay for your protective puts. Due to market cyclicality, prices will reverse and then those puts will reap profits. And they do not need to be in-the-money to do so.

While it is true that many of these puts will expire worthless, having various puts scattered around and accumulated from various trades will become useful in the event of a market crash.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.