Since the creation of futures, investors have been given access to markets and leverage which were impossible to trade before.

Despite this as the market has grown these contracts have increased dramatically.

This makes them difficult to access for the average investor.

For example, the original SP contract is 250 times the value of the S&P 500.

It was valued at a little over $3,000 in 1981.

Today that same contract is worth over a million dollars!

Thankfully, we don’t need a million dollars to trade a single futures contract.

Contents

- How much Money Do I Need to Trade Futures?

- Can Retail Investors Trade Futures?

- Equity Futures – The Micro E-Mini

- Interest Rate Futures – The Small Products

- Commodities and Precious Metals Futures

- Currency Futures

- Concluding Remarks

How Much Money Do I Need to Trade Futures?

As the original contracts have ballooned in size, new smaller futures contracts have been created.

Some of these products are perfect for the average retail investor.

These allow investors with as little as a few thousand dollars to gain access to futures contracts and leverage which would be unattainable otherwise.

That makes them available to almost all investors.

*For investors with $500 or less you may be out of luck.

Alternatively, you can simply buy shares or a leveraged ETN (which can hold futures) until you are able to grow your account further.

Can Retail Investors Trade Futures?

Before we delve into the different futures contracts it is important to answer the question of whether retail investors can even trade futures in the first place?

The most often answer is yes.

Almost all major brokers will allow retail investors to trade futures including Interactive Brokers, TD Ameritrade, Schwab and E-Trade.

There is a minor caveat though.

You will most likely need to sign a disclosure stating that you are aware of what a futures contract is and how they work.

This article will look at some of the major smaller contracts fit for small sized accounts. Let’s get started!

Equity Futures – The Micro E-Mini

As equity index futures contracts expanded in size a suite of new, smaller contracts were created for the S&P 500 as well as Dow Jones, Russell 2000 and Nasdaq 100.

The E-Mini ES contract was created at 1/5th of the value of the SP contract.

Ironically that contract has now also gotten quite large worth around $200,000.

Not so mini anymore!

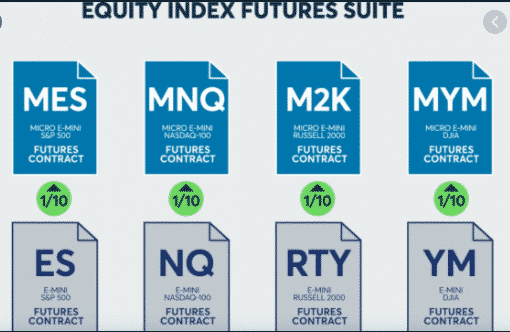

Thus, recently CME came out with a new suite of Micro E-Mini contracts shown below.

Source: CME group

These tickers are MES for the S&P 500, MNQ for the Nasdaq, M2K for the Russell and MYM for the Dow.

These offer investors exposure to 1/10th of the E-mini contracts.

As an example, that puts the value of the MES contract at $20,000 currently, with the others in the same region of $15,000 to $25,000.

Though you don’t even need $20,000 to buy one of these contracts.

One of the biggest benefits of futures is the SPAN margin which only requires contract holders to put down only a fraction of the value of the futures contract as collateral.

So, while I don’t recommend buying an MES future with only a few thousand dollars in cash it can be done.

These smaller contracts should also be considered by larger investors as it allows them to hedge their exposures more accurately.

Interest Rate Futures – The Small Products

Trading interest rates has always been challenging.

The CME offers bond futures which are large and have especially confusing options and settlements.

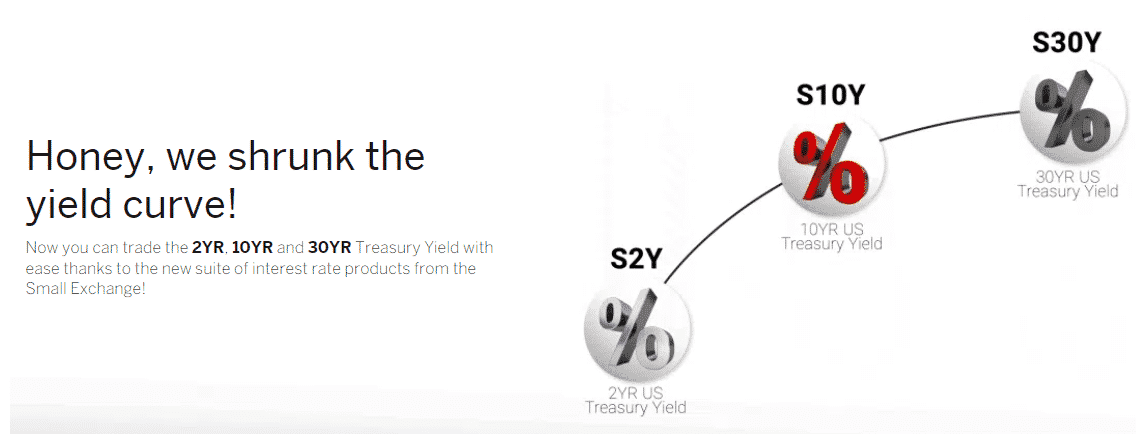

A recent product from Tastytrade and the Small Exchange provides a solution.

They allow investors to directly bet on yields for the 2, 10 & 20 year treasuries using futures.

Now instead of using the treasuries inversely you can bet on the yields directly.

Source: The Small Exchange

How these products work is the current yield is multiplied by 10.

For example, if the 10-year treasury yield is at 1.69% the small future will trade at $16.90.

Multiply that by 100 and one futures contract is worth $1,690. With only a few hundred dollars required in Margin!

So how do I express my view?

To bet on rising yields traders simply buys the small yield future, to bet on lower yields (or have synthetic treasury exposure) the trader sells the future.

Traders can also bet on the changing shape of the yield curve.

For example, if I felt the yield curve was going to flatten, I could buy the S2Y future and sell the S10Y future.

Commodities and Precious Metals Futures

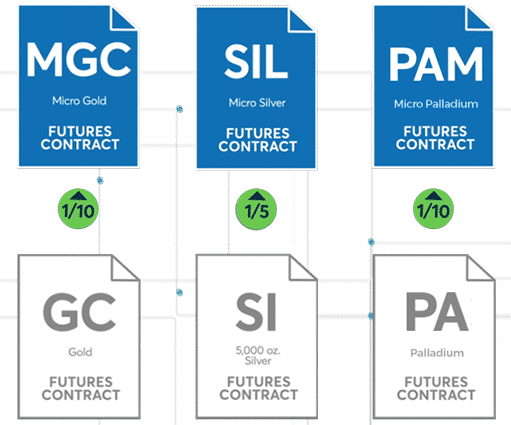

In terms of commodity futures unfortunately it is slightly more limited for the small investor.

On the precious metal front there is a micro gold contract MGC which has a value of approximately $17,000 and a Silver Contract worth approximately $25,000.

That still makes these contracts a bit large for retail investors wanting a small exposure to precious metals.

Source: CME Group

The mini oil contracts are even worse.

There are some of the soft commodities such as corn that have mini contracts which are reasonable.

Despite this their volumes are often a bit light which is a downside.

Thankfully, there are a plethora of ETN products that can give an investor an exact small dollar amount of exposure to whatever commodity they like.

The structure then buys the futures for you.

The downsides of these are their management expense fees, and their sometimes large and usually negative tracking error.

Despite these if you want a few thousand dollars or less exposure into a commodity they are still the best choice available.

Currency Futures

I have rarely heard of people trading currency futures aside from the forex crowd. Despite this they work as a great tool for hedging.

There are many currencies available for small traders with sizes around $10,000.

The most popular of these are against the dollar for the Euro (M6E) Aussie Dollar (M6A) Canadian Dollar (MCD) and Japanese Yen (MJY).

These contracts are quite liquid and great for hedging currency exposure or speculating.

They only require a few hundred dollars of margin as collateral.

Concluding Remarks

Sometimes the market can seem like it is skewed against the small guy.

This can especially be the case with some futures.

Thankfully for the retail trader there are many smaller micro futures that can allow the access to leverage that the big players have while avoiding pesky fees.

Adding this leverage is like fire; it can ignite a portfolio.

Though remember with too much fire, or a lack of knowledge on how this leverage works and your house can burn down.

So go out, have fun, but stay safe!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.