Contents

What Is It?

The Put-Call Ratio is simply a ratio of the number of puts to the number of calls on a particular stock, fund, or market.

Let’s define some of these specific terms to make the concept easier to understand.

A put is an option contract that gives the buyer the right to sell an asset at a particular strike price.

A call is an option contract that gives the buyer the right to purchase an asset at a particular strike price.

The ratio that we’re looking at divides the number of puts purchased over the number of calls purchased.

For example, a ratio of .5 is bullish because it means that there is only one put being purchased for every two calls.

Keep in mind though through all of this that whoever sold those two calls has a bearish outlook, which is what makes the put/call ratio such a great contrarian indicator.

Individual retail traders who are not sophisticated enough to sell options as part of a larger strategy will be the ones who are over-represented by the put/call ratio.

The put/call ratio can be viewed for individual stocks or ETFs that have option trading.

The ratio that is most commonly referred to is the SPX ratio which is of course as good a benchmark for the market that we have and is the same ticker that’s used for calculating the CBOE Volatility Index (VIX).

Another popular ratio that’s referred to is the CBOE Equity ratio or the CBOE Total ratio.

The CBOE Equity ratio is the CBOE Total ratio ex-index funds.

Another thing to keep in mind about the ratio is that volume or inactivity can move the ratio and potentially lead to a misreading of the market.

For instance, if there is uncertainty in the market and call option buying drops dramatically, this is going to increase the ratio.

This will lead to the perception that the market sentiment might be bearish when it might just be not bullish–which are two different things.

Doing nothing is a valid course of action in trading and so a lack of call volume should not be confused with an increase in put volume.

What Can We Learn From It?

By looking at the put/call ratio we can get an idea about the overall sentiment of the market or of an individual stock.

The put/call ratio is best used as a contrarian indicator, meaning that when the sentiment is overly bullish it’s time to be careful and vice versa.

The concept here harkens back to Warren Buffett’s famous quote, “Be fearful when others are greedy and greedy when others are fearful.”

It can also be simply summed up as “fade the public.”

It’s often said that 80% of options expire worthless which makes them some appealing to sell.

If it’s true that 80% of options expire worthless, then this makes the put/call ratio a fantastic way to tell exactly what’s not going to happen.

If the public is lining up in a really big way on one side of the market, it’s a huge red flag that means you need to either be on the other side or at least hedged if you are going with the crowd.

The put/call ratio is most reliable when it’s at extreme levels.

If it’s trapped inside a range it will be less reliable.

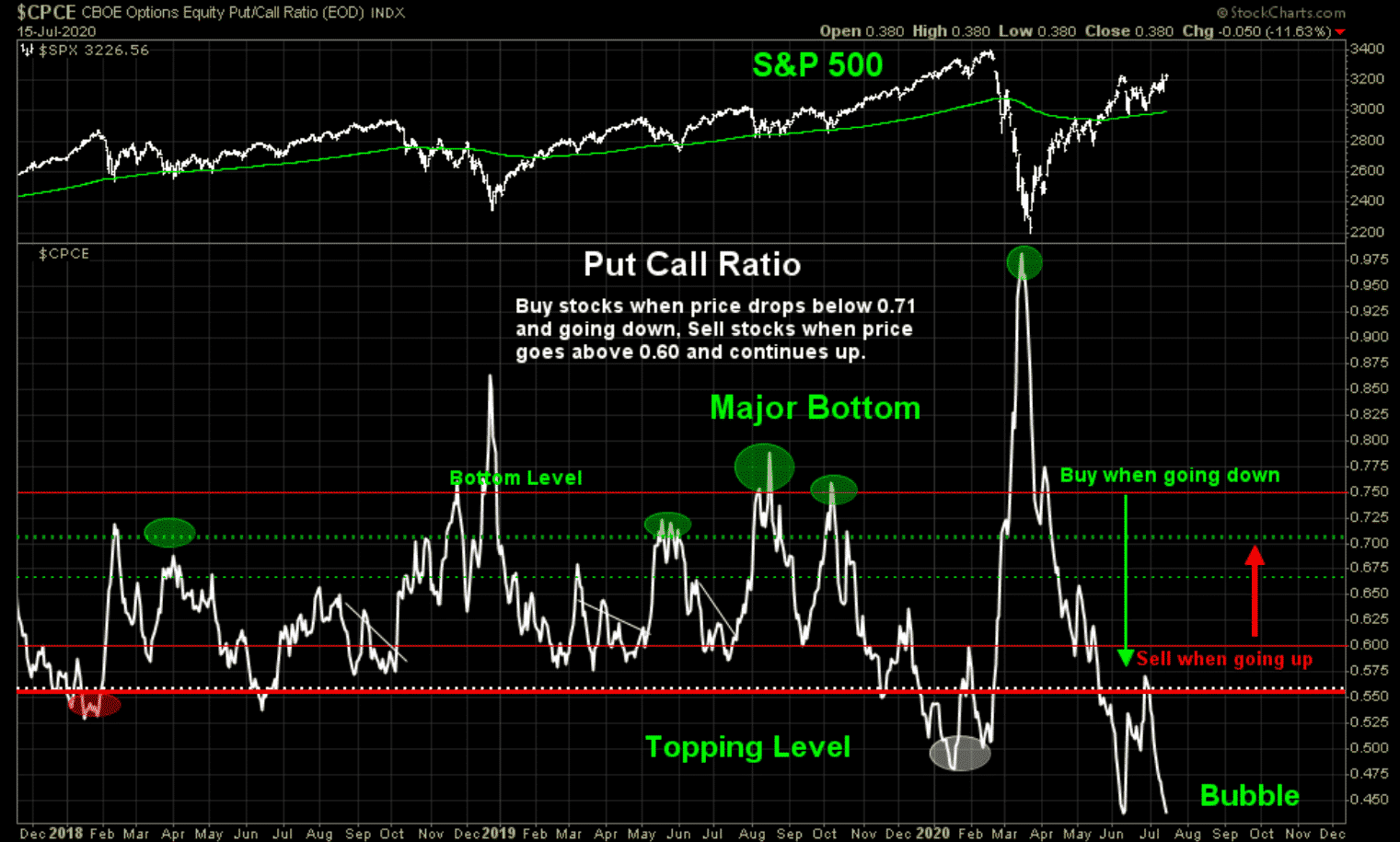

For example, in 2018 before the correction in December, there were some clues in the put/call ratio.

Three times in the preceding fall the put/call ratio fell to extremely low levels and were followed by sharp moves in the other direction.

This action culminated with the ratio finally topping out in the third week of December which was the exact bottom of the correction.

So, the best time to buy was when everyone else was putting their money into put options and betting that the market was going to continue going down.

Image Credit @ThinkTankCharts

What Is It Telling Us Right Now?

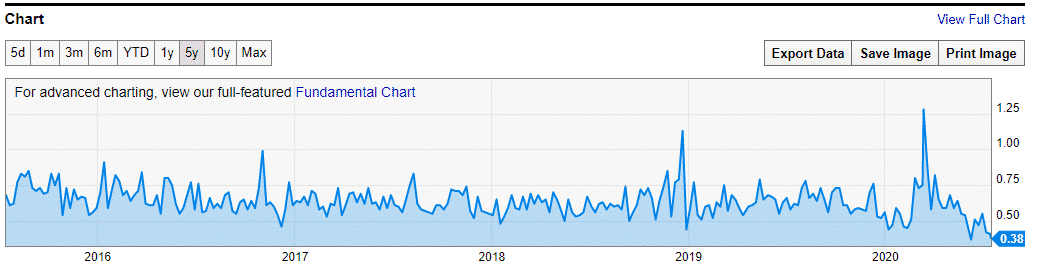

The put/call ratio at the moment is deeply in the extreme territory and is telling us that we should be very careful.

The CBOE Equity ratio is currently 0.38 which means that 19 put options are being purchased for every 50 call options.

This is an extremely low ratio.

The last time that the ratio was this low was on June 8th of this year when it was 0.37.

June 8th was the post-COVID top of the market.

The following days were very volatile and many of the bull-market skeptics finally felt that the bear-market was set to resume.

Despite the selling in early June, we’re almost right back where we were.

We know that retail trading is very popular right now so it’s safe to assume the put/call ratio is being driven down by this activity.

It’s also a good assumption that institutional money is on the other side of all these trades.

This is what happened on June 8th before quad-witching on June 19.

Which side do you want to be on?

It’s also interesting that this put/call ratio could’ve been used to indicate the bottom in March.

The ratio shot up to 1.28 on March 12th.

If you’d started buying at that moment, you’d have done very well.

It wasn’t the exact bottom, but if you’d had the stomach to sit through some more selling you’d have made up for it over the last few months.

There is rampant speculation in the market right now and fundamental investing has basically been thrown out the window for the time being.

Some analysts comment that this is exactly what the Federal Reserve is trying to accomplish–to disconnect the financial markets from the economy like using anesthesia on a patient before surgery.

If that’s the case, then it means that the waters are dangerous right now and we need to be careful and make sure that we’re using strategies that hedge and limit downside.

Selling uncovered options, is not advisable in this market unless you really know what you’re doing.

With a put/call ratio at this low of a level, we should be keeping our eye out for a sharp pullback and increased volatility that will provide great opportunities for selling credit spreads.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.