The list of best stocks for covered calls changes from time to time.

In addition to giving you a list of stocks at the end of the article, we will show the process of finding these stocks.

Teach a man to fish, and he will eat every day.

Speaking in generalities, the best stocks to do covered calls on are on stocks you already own — as long as you don’t mind them being called away.

Contents

- Introduction

- Step 1: Run A Screener For Technical Signals

- Step 2: Pick From Strong Sectors

- Step 3: Relative Strength Chart Analysis

- Step 4: Confirm The Technicals

- Step 5: Profit Potential Analysis

- Step 6: Technology Sector

- Step 6: Continued

- Step 6: Continued (Financial Sector)

- Step 7: Wait For Value And Time The Trade

- Step 8: Check Profile And Fundamental Stats

- Conclusion

Introduction

A covered call involves owning 100 shares of a stock and then selling a call option against it.

The covered call is a bullish strategy.

You want high-quality large companies stocks that are not going to fail.

You don’t want a volatile stock with a large beta.

You especially don’t want them to make large random down moves.

Try to stick with relatively known companies that are heavily traded so that they have good liquidity.

In general, if your stock meets these requirements, it will most likely have options available for you to trade covered calls on.

It is also nice to sell covered calls on stocks that pay a dividend.

Most investors who do covered calls and cash-secured puts will have a universe of their favorite stocks that are fundamentally sound.

Then they check their technicals every week to see if any is setting up.

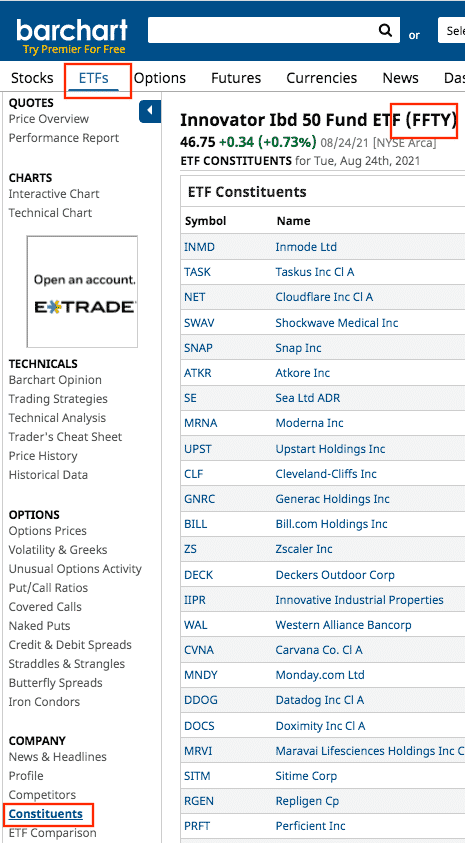

If you are new and don’t have such a list, you can build one by picking stocks from the Dow Jones Index (DIA), Nasdaq 100 (QQQ), S&P 100 (OEF), and the Investor Business Daily 50 list (FFTY), and from popular ETFs (such as ARKK).

We will be using the free tools from FinViz and Barchart, so you may want to read our reviews on those to become familiarized with them.

For example, here are stocks in the IBD 50 list, as found by clicking on the “Constituents” section on barchart.com.

Note that the list can change weekly.

Step 1: Run A Screener For Technical Signals

If you set up this universe of stocks as a watchlist on barchart.com, you can screen that list regularly for technical signals.

This feature does require a purchase of a premier membership.

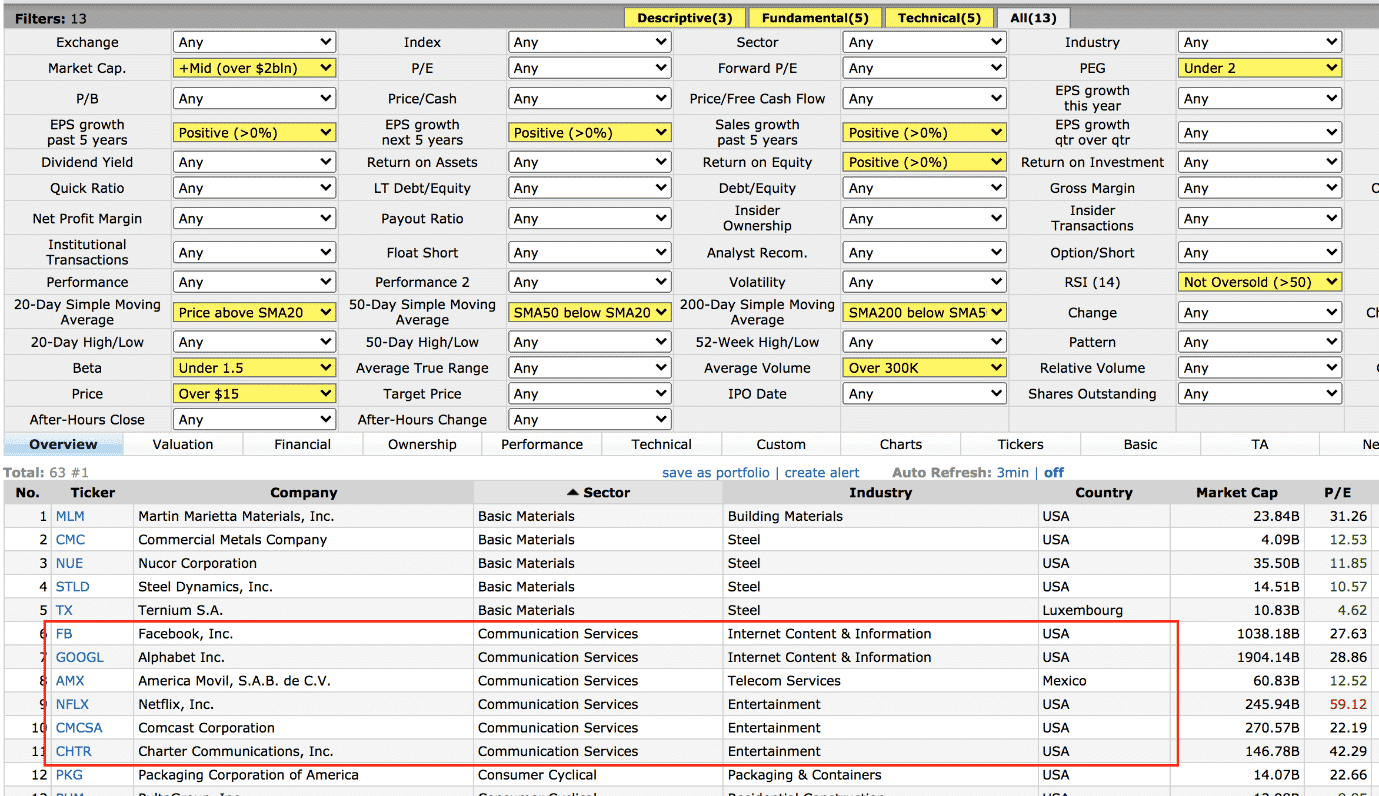

An excellent free alternative is to run the FinViz screener with these settings.

Source: FinViz.com

Then manually select out the ones from our list of DIA, QQQ, OEF, FFTY, and ARKK.

The FinViz settings select companies that have positive earnings and sales growth.

The price-per-earnings-per-growth ratio of less than 2 ensures that they are not over-priced.

Setting a price greater than $15 filters out any “penny stocks”.

The moving averages filter selects stocks in an uptrend where the price is above the 20-day moving average, the 50-day moving average is below the 20-day, and the 200-day is below the 50-day.

The results are stocks with charts like this Facebook chart, where the moving averages are stacked in order.

Source: tradingview.com

An RSI greater than 50 is another indication of an upward trending stock.

At the time of this writing, on August 28, 2021, we got 63 results from this screen.

We will need to reduce this number.

Step 2: Pick From Strong Sectors

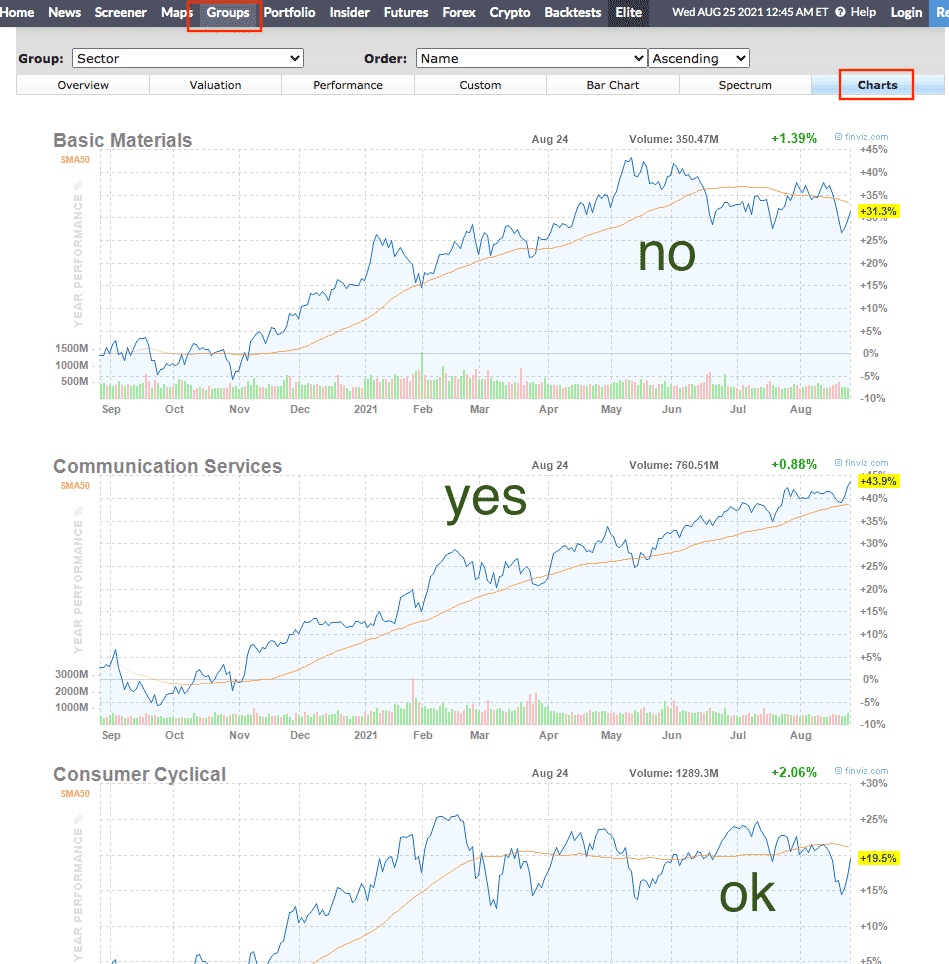

Looking at the sector charts on FinViz.

We want stocks from sectors where the orange 50-day moving average is sloping up.

At the current time of this writing, these sectors are communication services, healthcare, technology, and utilities.

For diversification, we might want to pick some from financials, consumers, industrials, real estate if we see something good.

Their 50-day moving average line is flat.

We’ll skip energy and basic materials for now due to the downsloping moving average.

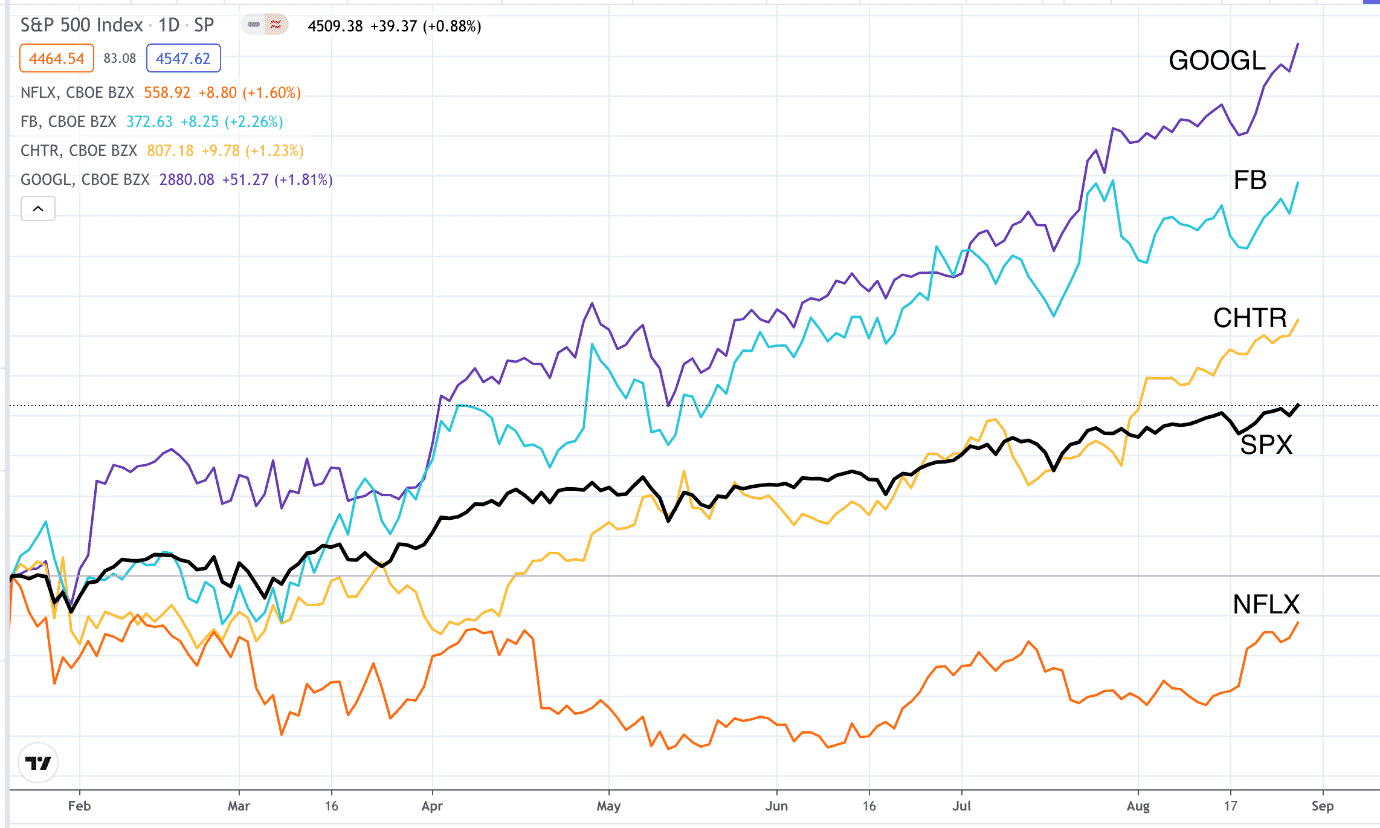

Sorting by sector the result list, we see six candidates in Communication Services.

Picking out the ones that are also in our lists of DOW, QQQ, FFTY, OEF, or ARKK, we have CHTR, FB, GOOGL, NFLX, and CMCSA to work with.

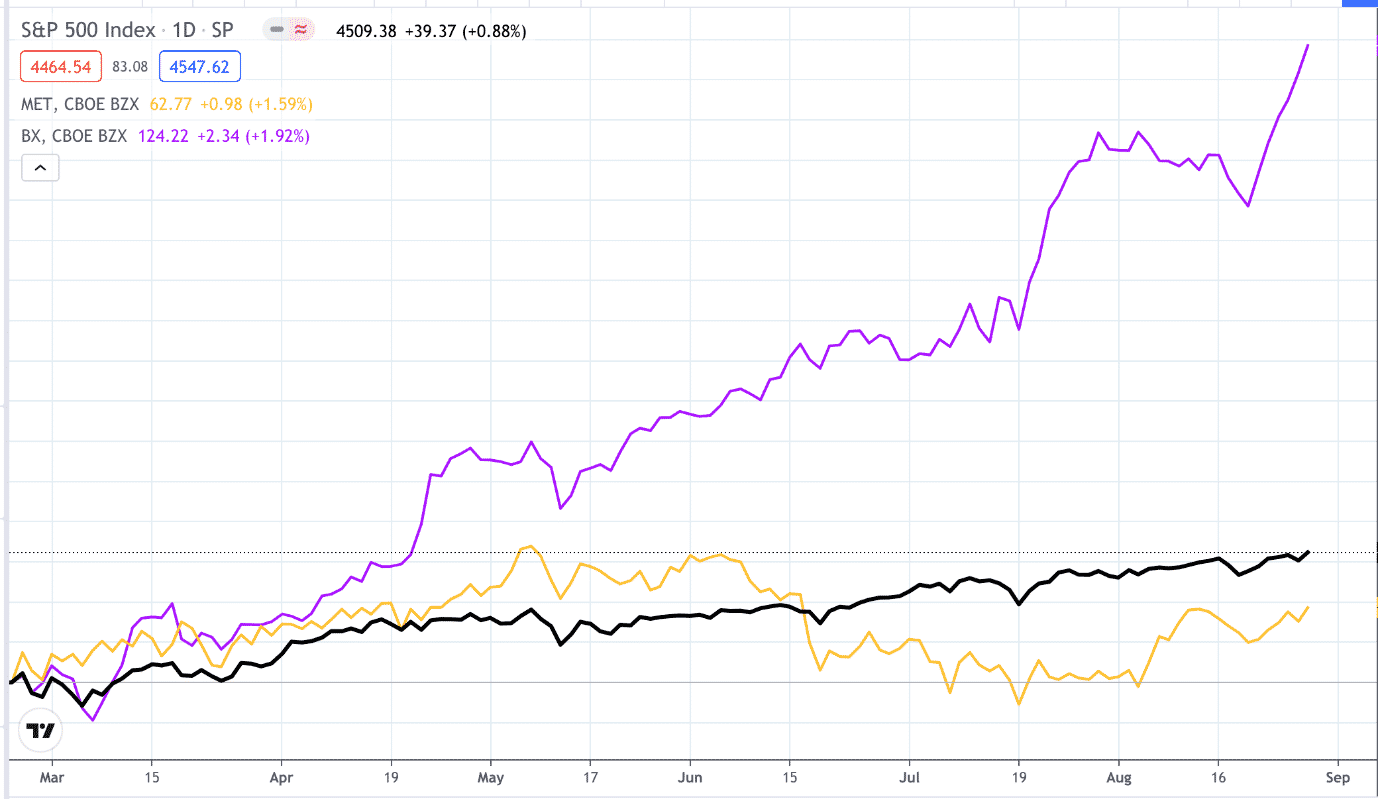

Step 3: Relative Strength Chart Analysis

We already know from the screener that the moving averages and RSI is going to be good on these charts.

Next, we want to see how the stock does in relation to the overall market.

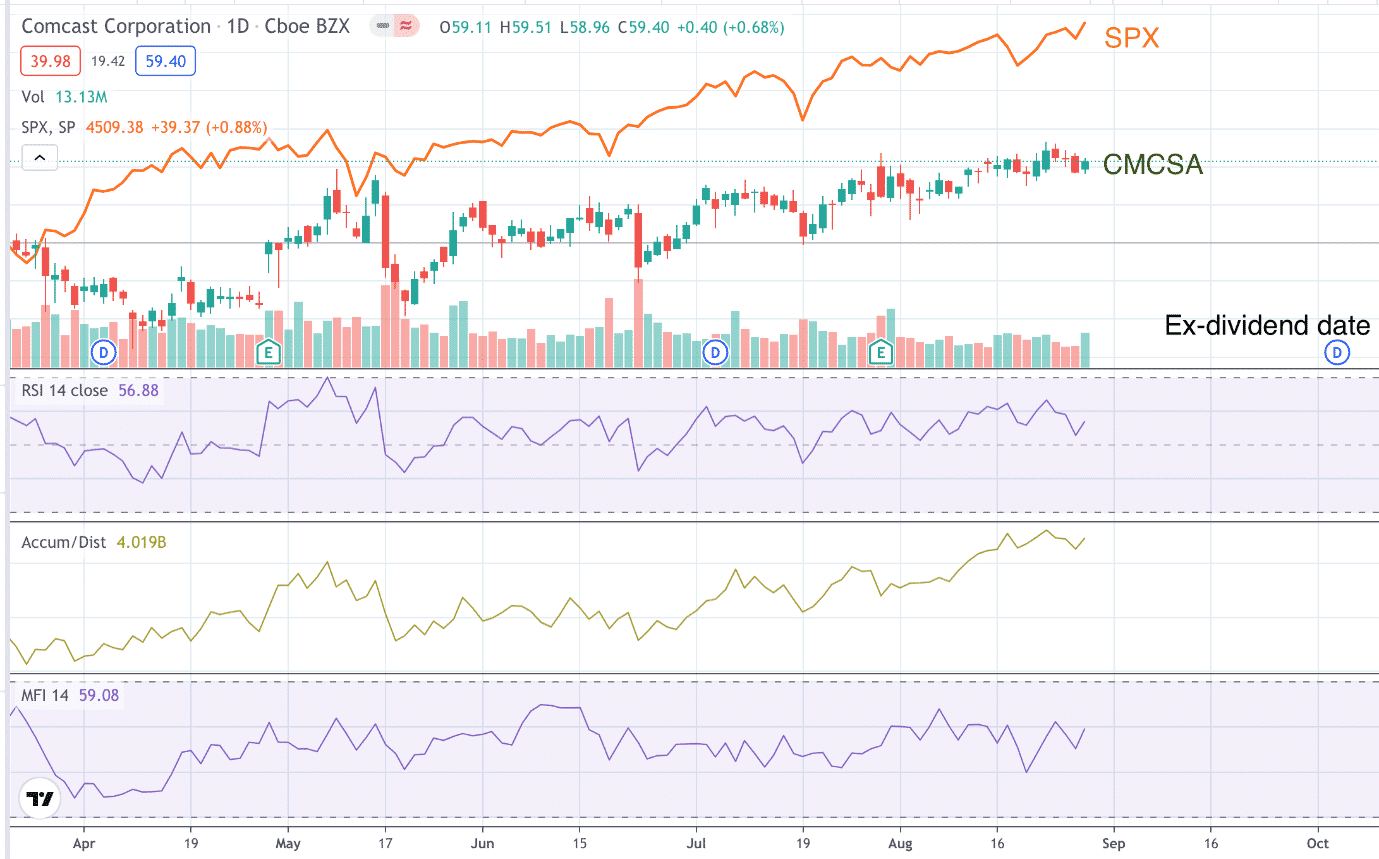

We compare the stock with the S&P 500 Index (SPX) on TradingView in a three to 6-month timeframe.

Here we see that Comcast (CMCSA) has weak “relative strength” in relation to the overall market.

Here “relative strength” is not to be confused with RSI.

It just means that CMCSA underperformed the market during this period.

We also pan the chart forward to see if there are any upcoming earnings or ex-dividend dates.

Here we see a chart that has an upcoming ex-dividend date.

If our covered call spans an ex-dividend date, there is a risk that our stock will be called away early, just before the ex-dividend date.

Then, not only would we not get our dividend, we will end up paying a dividend so that the investor who now owns our stock will get the dividend.

We also don’t want our covered call to span an earnings report.

It might drop on bad earnings.

We also can eliminate NFLX on the count that it underperformed the market.

The remaining CHTR, FB, and GOOGL in the Communication Services result set are considered, with GOOGL having the greatest relative strength.

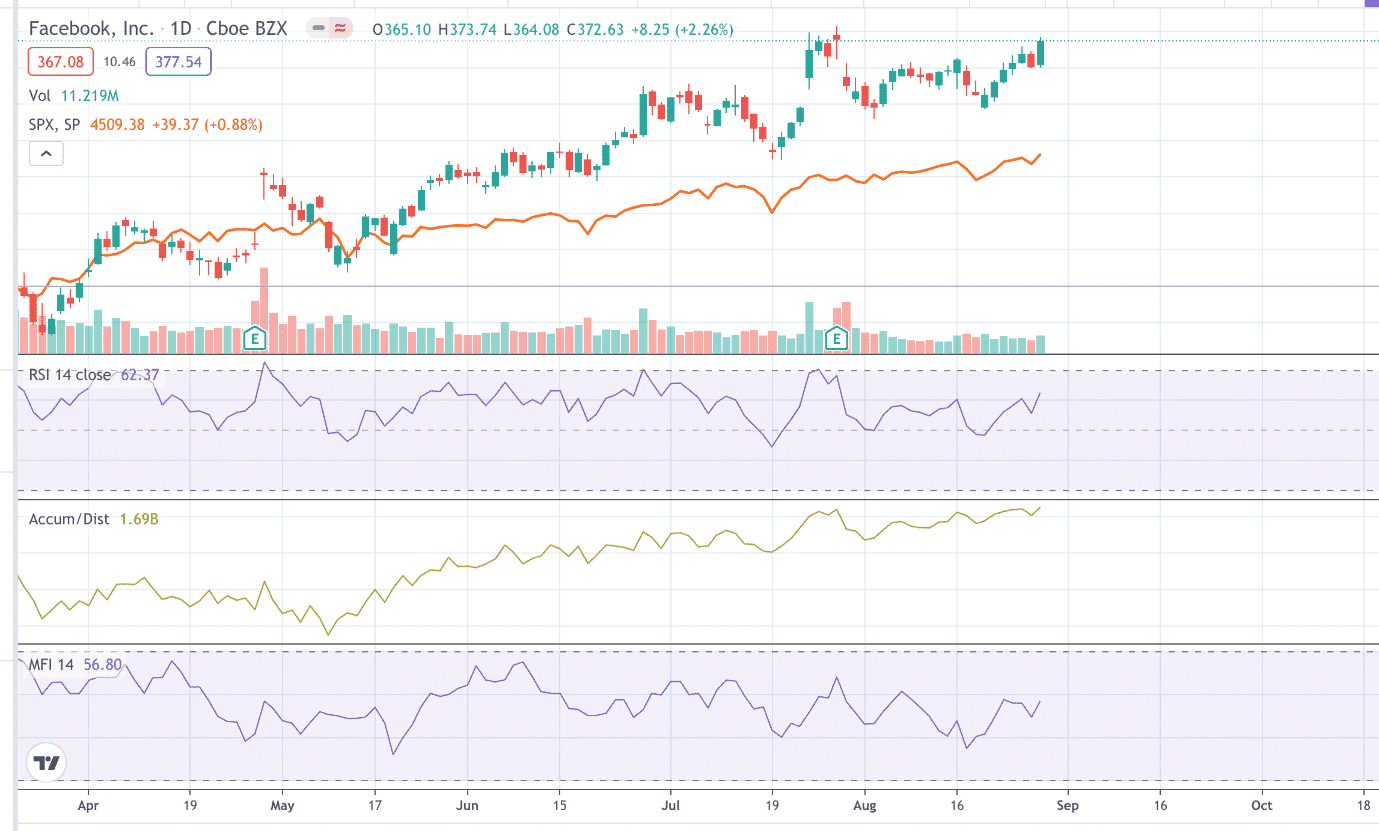

Step 4: Confirm The Technicals

At this point, we look more closely at the chart and indicators to see any red flags.

Here we see Facebook looks fine with nice Accumulation/Distribution sloping up.

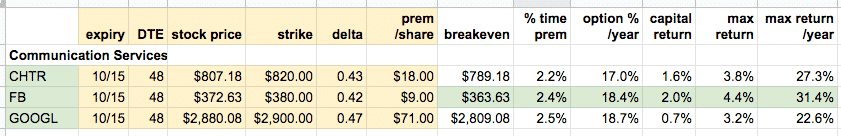

Step 5: Profit Potential Analysis

The next step is to perform the following calculations in the spreadsheet by picking out-of-the-money call options on a monthly expiration cycle with 30 to 60 days till expiration (DTE).

You can choose weekly expirations to avoid earnings and dividends.

We want to pick a strike price that has at least 2% of “time premium” in it.

For Facebook (FB), the October 15, 2021 call option with a $380 strike has a 2.4% of time premium.

Under the current market conditions, this typically ends up with a strike around the 40-delta.

Strikes closer to the money will have more significant time premium or extrinsic value.

Extrinsic value is the part of the option value that we are selling, and this is the part of the option value that will decay or lose value with time.

Facebook’s call option costs around $9 (pick a price somewhere between the bid and ask price).

We would get to keep the $900 at expiration if FB did not move (or wiggled around and ended up at the same price).

Since we would pay $372.63 per share to buy 100 shares, our profit would be 2.4% ($900/$37263).

It would take 48 days for us to make this amount, so annualized would be 18.4% a year.

We are targeting for this annualized number to be around 15% to 20%.

If the Facebook price goes higher, we will make more than this because we would be gaining on the capital appreciation of the Facebook stock and the return on the option premium.

The max profit potential is when Facebook reaches the strike price of $380 at expiration.

In this case, we profit:

$900 + 100x($380 – $372.63) = $1637

In percentages, it would be:

$1637/$37263 = 4.4%

Or 31.4% annualized.

Facebook can go higher than $380; that won’t hurt us.

It is just that we will still make only $1637 (not any more).

We start losing money when the stock price drops below the breakeven point, which is calculated by the current stock price minus the price of the call option.

The larger the time premium, the greater distance the stock price has to fall before it goes below the breakeven point.

In the case of FB, breakeven is at $363.63, a drop of 2.4% from its current price of $372.63.

The covered call is an unlimited risk strategy.

In the unlikely event that Facebook price goes to zero, we are still better off than the stock investor by $900.

Comparing CHTR, FB, and GOOGL, the numbers are pretty similar.

Going with any of the three would be perfectly fine.

Although GOOGL had the highest relative strength, its high price may be prohibitive for some investors when following the general principle of not allocating more than a small percentage of one’s portfolio to any one position.

At the minimum of 100 shares, it would cost $288,008 for a GOOGL covered call position.

Hence, we prefer going with Facebook instead.

Step 6: Technology Sector

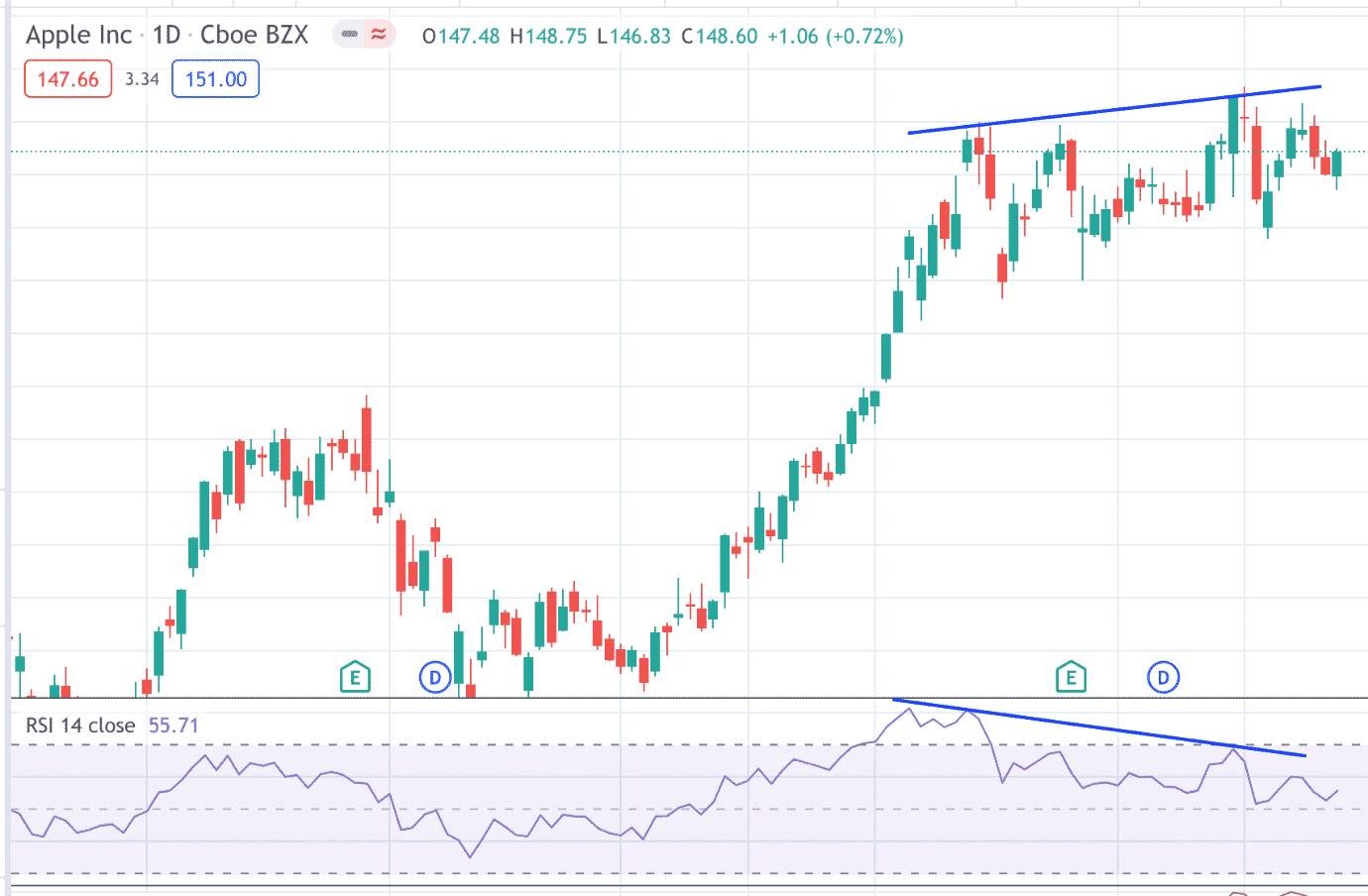

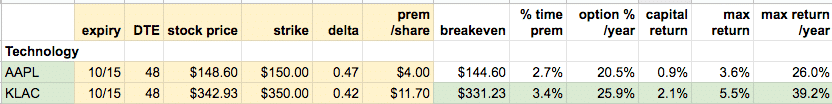

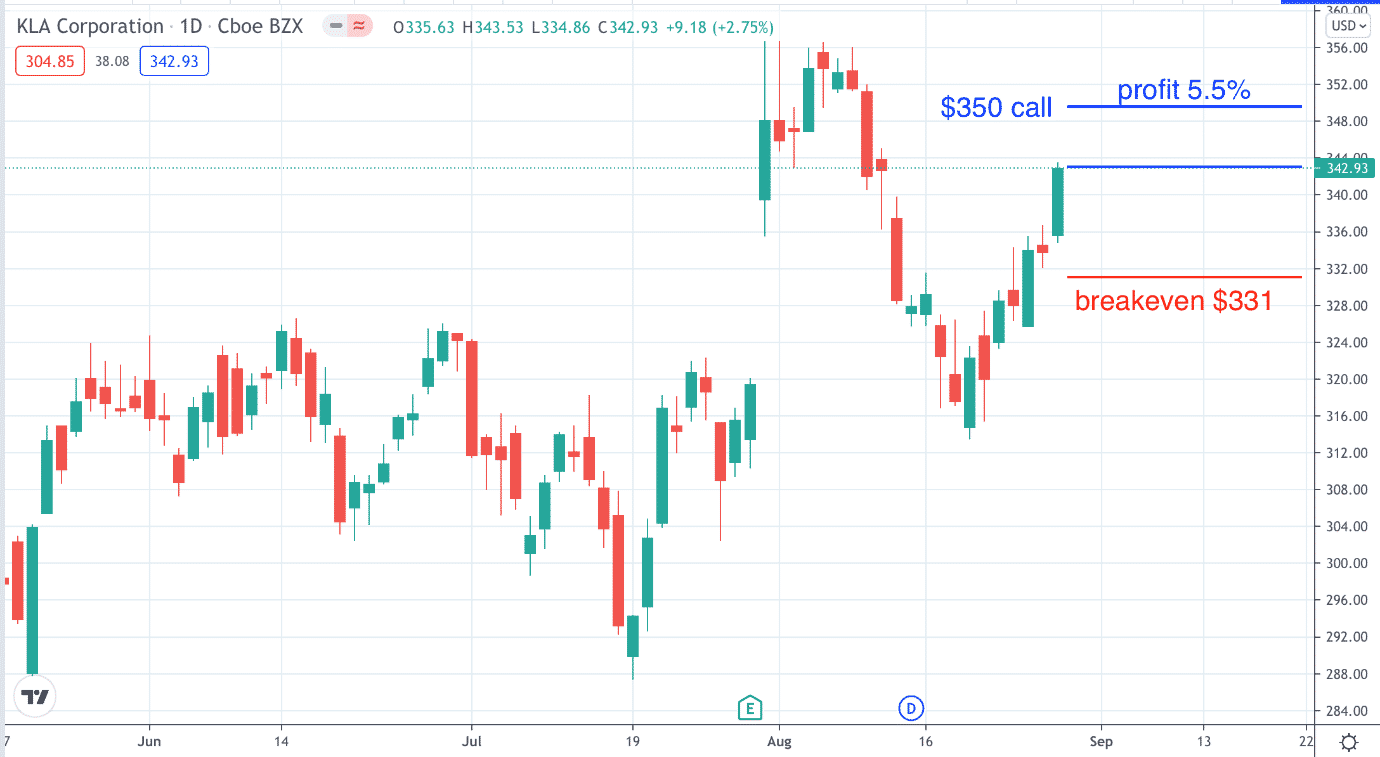

For the technology sector, FinViz found AAPL, KLIC, KLAC, ORCL that intersect with our lists.

KLIC has an upcoming Ex-dividend date.

ORCL has upcoming earnings.

AAPL is showing a negative RSI divergence at the current time.

The negative RSI divergence does not mean that AAPL will go down.

It only means that its upward momentum might be slowing.

So we’ll go with KLAC in the technology sector.

If we sold the $350 call expiring on October 15, 2021,

We would make 3.4% at expiration if KLAC didn’t move.

We would make an additional 2.1% if it moved to $350 or above.

At this point, our stock will also be called away.

But that’s fine because we get to pocket a 5.5% return (39% annualized) when the stock only moved 2% = ($350-342.93)/$342.93.

But if the stock falls below $331.23, we would lose money — how much money depends on how far the stock falls below the breakeven.

Step 6 Continued

There were no Finviz results in healthcare that were also on our lists.

For the industrials sector, CPRT was the only candidate.

But it has upcoming earnings.

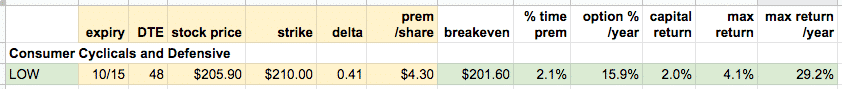

The only result in the Consumer Cyclicals and Consumer Defensive on our list are EBAY and LOW.

EBAY is showing a negative divergence, leaving us with Lowe’s Companies (LOW) for the Consumer sector.

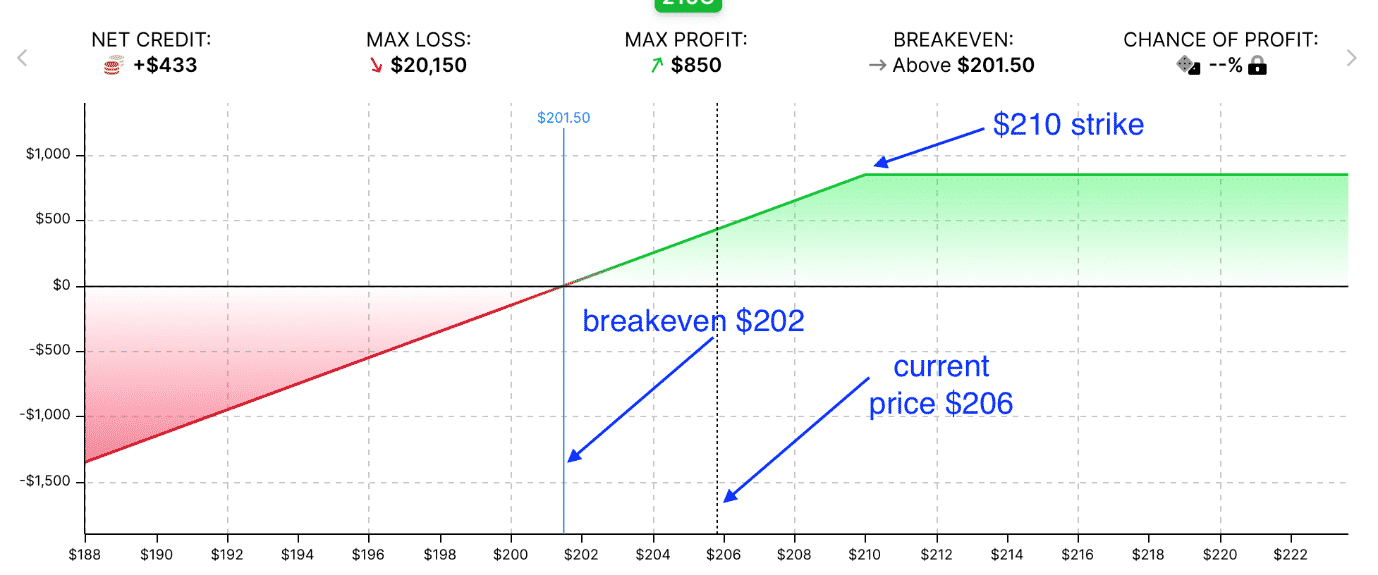

If we own 100 shares of Lowe’s and sold the $210 strike expiring October 15, the payoff diagram will look like this:

source: OptionStrat.com

We lose money if Lowe’s is below $202 at expiration.

We would make our premium of $430 if Lowe’s stayed where it is at $206.

We make $850 if Lowe’s is above $210 at expiration.

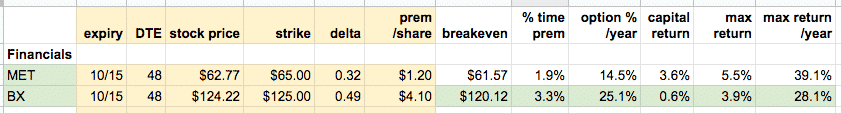

Step 6 Continued (Financial Sector)

The Financials sector has five candidates, two of which had upcoming earnings, and another had bid/ask prices that are too wide and not liquid enough.

We are left with MET and BX.

Of which we selected Blackstone (BX) because it performed better than MET.

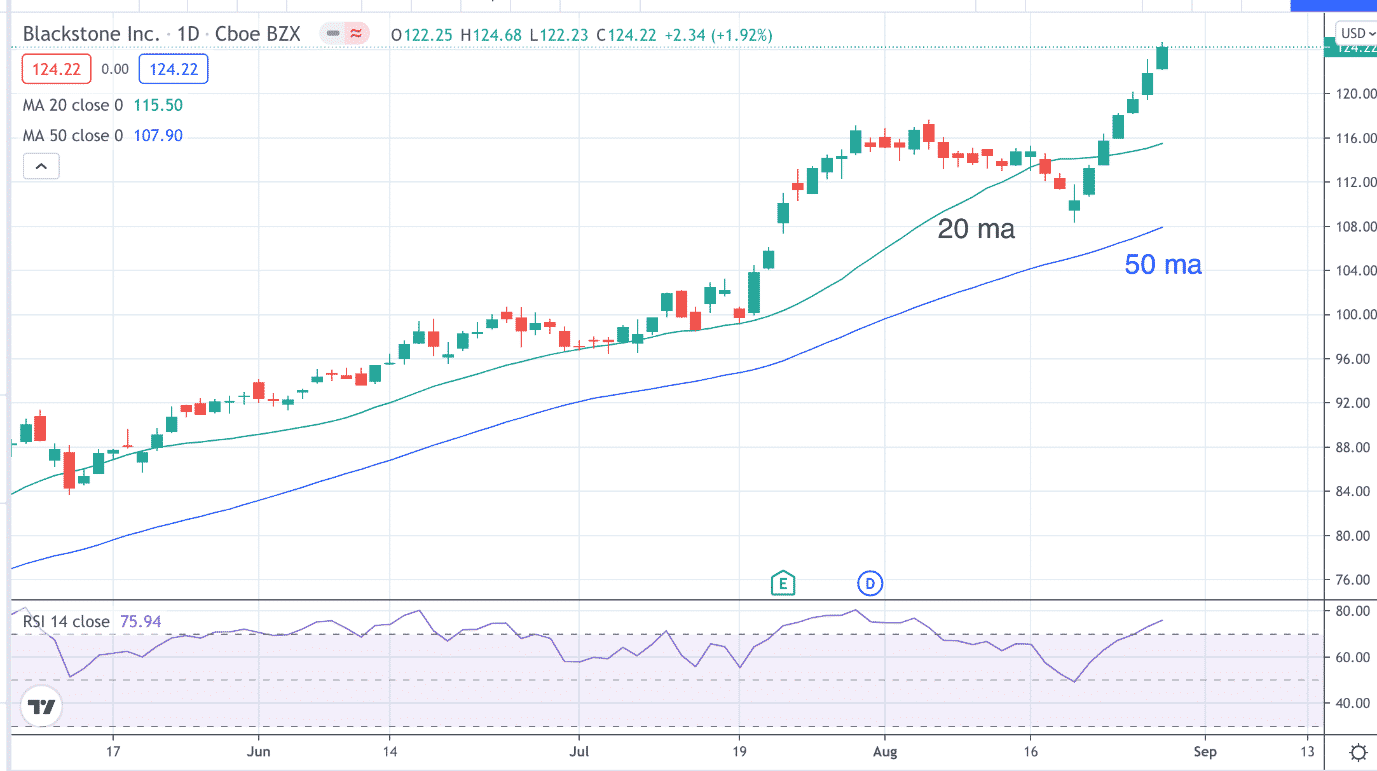

Step 7: Wait For Value And Time The Trade

Although at the moment, BX is at a local high after putting in seven green candles in a row.

RSI is in the overbought condition.

We would want to wait for BX to pull back before buying.

Remember, we are buying 100 shares; mind buying at a good price when the chart comes back to a zone of value.

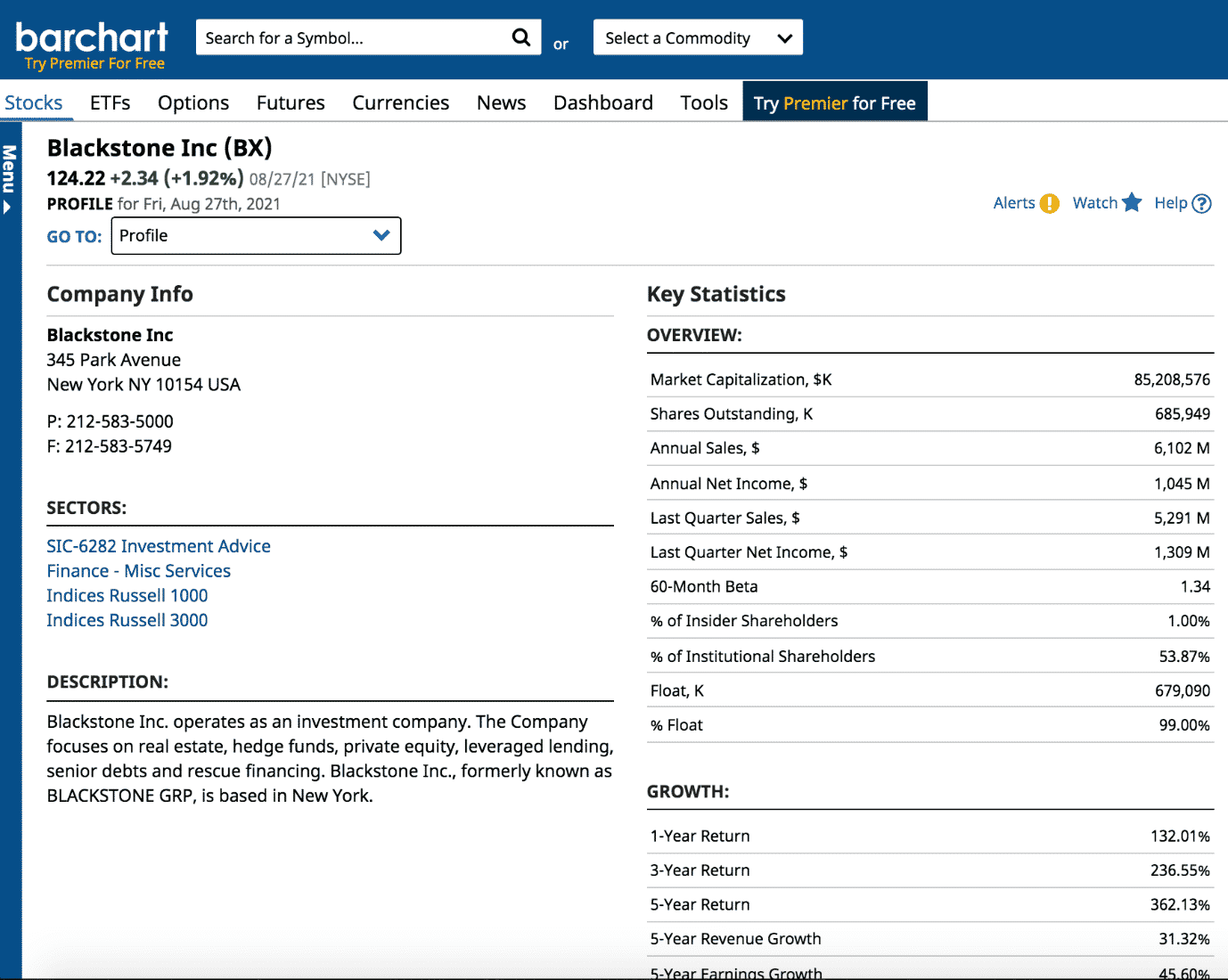

Step 8: Check Profile And Fundamental Stats

And finally, check the profile and fundamental stats to see if this is a company you don’t mind owning.

You can see this on Barchart.com

Conclusion

While this is not a recommendation to buy or sell, the top stocks for covered calls from September 2021 were:

1. Facebook (FB) is one of the top 5 constituents of Nasdaq ETF (QQQ) and makes up about 4% of the fund. Based in “Silicon Valley” of California, it operates a social network and provides a platform for software developers.

2. K L A-Tencor Corp (KLAC) is also part of the QQQ, and the company headquarters are in California. It provides equipment and services throughout the electronics industry that are too numerous to mention here.

3. Lowe’s (LOW) is a home improvement company based in North Carolina. It is part of the S&P 100 index, consisting of the largest and most established companies listed in the United States stock exchange.

4. Blackstone (BX) is currently listed as part of the IBD 50, the top 50 growth stocks that Investor’s Business Daily publisher felt are the most attractive based on earnings, performance, and their CAN SLIM selection criteria.

The process at which we arrive at these results depends on the price performance, sector rotation, option prices, and index and list inclusion at the current time.

It is a very dynamic result set that can be different every week or month.

But at least now you know how to find the best stocks for covered calls.

Remember not to over-allocate your portfolio to any one particular sector.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Related Articles

Selling Covered Calls – A Detailed Guide

How To Write Covered Calls: 2024 Ultimate Guide

How To Make Money With Covered Calls

When to Roll Covered Calls

Selling Deep In The Money Covered Calls: Why Do It?

Covered Calls For Dummies

Covered Calls With LEAPs Options Strategy

Supercharge Your Covered Calls Using LEAPS

Selling Weekly Covered Calls

Covered Calls 101

Excellent info. Thanks for all the work.

You’re welcome.

Is there a place I can find in a monthly basis the list is stocks for your method

Hi Jose,

You would need to use an option scanner, like the one available at Barchart.com