Today, we will compare the short put vs covered call to see how similar they are.

We’ll look at some examples with historical data to see if the two trades will give the same P&L results across these three scenarios:

- Covered call and short put on a bullish stock

- Covered call and short put on a sideways stock

- Covered call and short put on a bearish stock

Contents

- Scenario 1: Covered Call On A Bullish Stock

- Scenario 1: Short Put On A Bullish Stock

- Scenario 2: Covered Call On A Stock Moving Sideways

- Scenario 2: Short Put On a Stock Moving Sideways

- Scenario 3: Short Put On a Stock Moving Down

- Scenario 3: Covered Call On A Stock Moving Down

- Conclusion

- FAQ

Scenario 1: Covered Call On A Bullish Stock

In the first scenario, we have a bullish stock such as Archer-Daniels-Midland (ADM), making new price highs.

Suppose an investor holds 100 shares on January 26, 2022, and sells a covered call near the 30-delta with 30 days till expiration.

Date: Jan 26, 2022

Price: ADM @ $71.59

Buy 100 shares ADM @ $71.59

Sell one Feb 25 ADM $75 call @ $0.75

Debit: –$7083.50

Delta: 72.90

Theta: 2.84

Vega: -6.79

Gamma: -6.30

At expiration on February 25, the price of ADM was $78.90, and the stock was called away at $75 per share.

Since $7500 – $7083.50 = $416.50

The net profit is $416.50, or 5.9% on the initial investment of $7083.50.

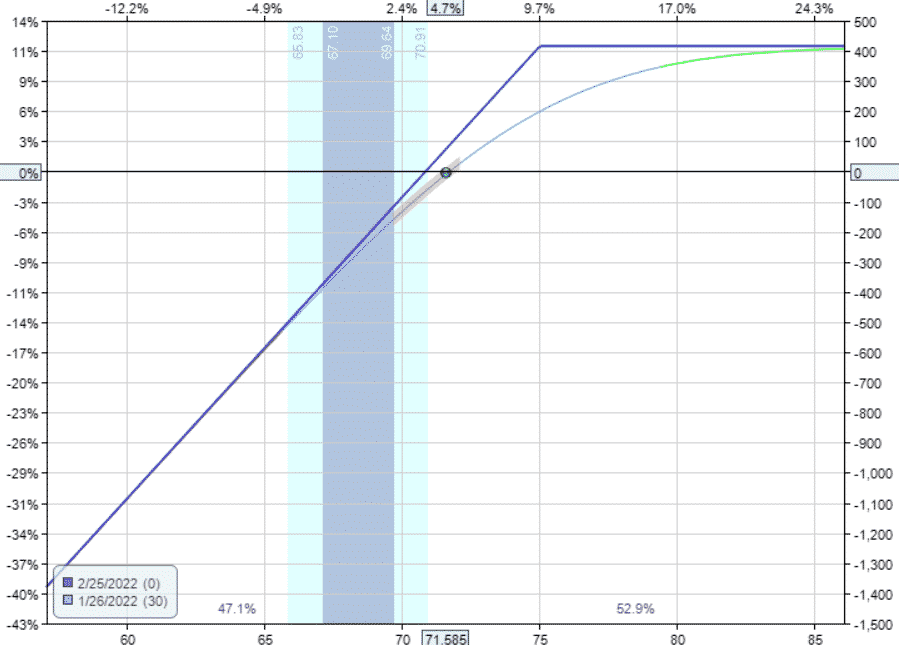

Scenario 1: Short Put On A Bullish Stock

How does that compare with an investor who does not own the stock but sells a put at the same strike and expiration?

Date: Jan 26, 2022

Price: ADM @ $71.59

Sell one Feb 25 ADM $75 put @ $4.70

Credit: $470

Delta: 72.95

Theta: 2.79

Vega: -6.79

Gamma: -6.30

By using a put instead of a call, we get a credit instead of a debit.

However, the payoff graph and the Greeks are nearly identical.

The short put was in-the-money at the time the trade was initiated.

This is not commonly done but is used here in this example to illustrate a point.

At expiration on February 25, the price of ADM was $78.90, and the short put expired out-of-the-money.

Hence the investor keeps the $470 premium initially collected.

If this is meant to be a cash-secured put where enough cash is set aside to pay for 100 shares of ADM if the short put is assigned, then the max capital used and reserved would be around $7890.

A $470 return on the use of $7890 of capital would equate to 6.0%.

While not exact to the penny, the two P&Ls (profit and loss) are similar in the two cases: $416.50 versus $470 (both around 6% profit).

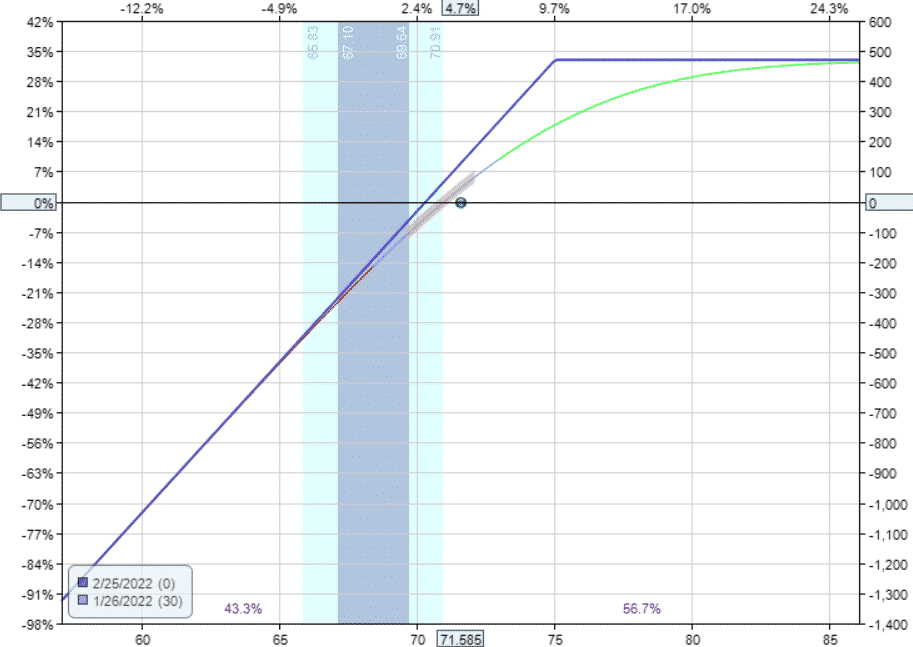

Scenario 2: Covered Call On A Stock Moving Sideways

Let’s take the example of an at-the-money covered call on Salesforce (CRM).

Date: July 13, 2021

Price: CRM @ $246.82

Buy 100 shares of CRM @ $246.82

Sell one Aug 20 CRM $250 call @ $6.25

Debit: -24,057

Delta: $55.08

Theta: 9.72

Vega: -31.49

Gamma: -2.2

Three weeks into the trade on August 3, the price of CRM is at $240.25, just slightly below where it started.

The loss on the trade is –$175.50.

Scenario 2: Short Put On a Stock Moving Sideways

Consider the investor selling an at-the-money put.

Date: July 13, 2021

Price: CRM @ $246.82

Sell one Aug 20 CRM $250 put @ $9.23

Credit: $922.50

Delta: 55.11

Theta: 9.55

Vega: -31.49

Gamma: -2.2

Note how close the Greeks are to that of the covered call.

Three weeks into the trade on August 3, the P&L on the trade is –$192.50 — very close to the other case of –$175.50.

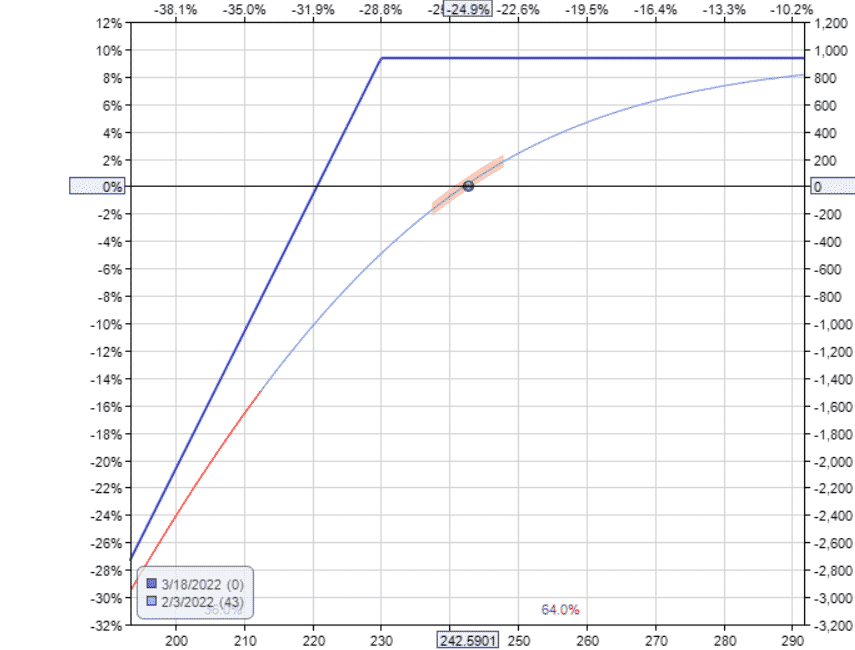

Scenario 3: Short Put On a Stock Moving Down

For scenario 3, we will switch it up a little bit and start with the short put first.

We will look at the covered call after this.

Suppose an investor decides to sell an out-of-the-money put (around 30-delta) on Meta Platforms (META) after its earnings gap down on February 3, 2022.

Date: Feb 3, 2022

Price: META @ $242.59

Sell one Mar 18 META $230 put @ $9.15

Credit: $915

Delta: 33.54

Theta: 15.82

Vega: -30.35

Gamma: -1.21

The stock continues to go down from there.

On February 22, the price of META was at $202.61, and the P&L on the trade is a loss of –$1942.50.

Since this is more than double the premium received, the investor decides to exit the trade with this loss.

Scenario 3: Covered Call On A Stock Moving Down

Suppose an investor decides to buy 100 shares of META after its earnings gaps down on February 3, 2022.

The investor sells an in-the-money covered call for greater downside protection to collect a greater premium.

This call option is at the 66-delta.

Date: Feb 3, 2022

Price: META @ $242.59

Buy 100 shares of META @ $242.59

Sell one Mar 18 META $230 call @ $21.95

Debit: –$22,064

Delta: 33.59

Theta: 15.98

Vega: -30.35

Gamma: -1.21

On February 22, the P&L on the trade was –$1920.51, or about 8.7% of the initial investment.

The typical covered call writer may not be used to selling such an in-the-money covered call.

However, there should be nothing strange about doing so.

This trade is nearly identical to the last example, which the short put seller does all the time.

As you can see, both investors are at a loss by nearly the same amount at the same time in the trade.

Conclusion

The short put is the equivalent trade as a covered call of the same strike and expiration.

While one is for a credit and the other is for a debit, the payoff graph and the Greek are nearly identical.

The resulting P&L is nearly the same.

Selling an out-of-the-money covered call is just like selling an in-the-money short put.

Most investors will do the former.

Selling an out-of-the-money short put is just like selling an in-the-money covered call.

Most investors will opt for the former.

In this case, you should do what most investors do.

Why?

Because out-of-the-money options tend to be more liquid than in-the-money options due to the fact that more investors trade those.

Hence, you will likely get better fill prices and quicker fills by working with out-of-the-money options.

In the last two examples, the bid and ask price for the out-of-the-money short put is $9.05 and $9.25 — a $0.20.

The bid and the ask price of the in-the-money call are $21.80 and $22.10 — a $0.70 difference and a wider bid/ask spread.

We are using historic data from OptionNet Explorer and assume fills at mid-price in our examples.

In real trading with less liquid stocks, the fills may not get executed at mid-price (especially for the in-the-money options).

Hence, you may see greater disparity in the P&Ls than in our examples.

FAQ

Is selling a put the same as a covered call?

Selling a put is very similar to a covered call. They both have the same shaped payoff graph.

However, there are some subtle differences.

Selling a covered call involves selling a call option on a stock position that the trader currently owns.

Selling a put involves a “naked” option, and the trader will be assigned shares if the stock drops below the short put strike at expiration.

The covered call trader receives dividends from their stock holding, while the put seller will not receive any dividends.

The profit from selling puts is limited to the premium received, whereas a covered call trade usually involves some capital gain in addition to the option premium.

Is selling puts better than selling covered calls?

Selling puts is not necessarily better than selling covered calls.

Selling puts is generally used as a strategy to acquire a stock at a lower price.

Covered calls are used to generate extra income from an existing stock holding.

Why would you short a put?

Traders will short a put to generate option premium and potentially take ownership of a stock for less than the current stock price.

A short put is a neutral to bullish trade.

The trader expects that the stock will stay flat, rise, or not decline by too much.

How do you cover a short put?

The initial trade for a short put is to sell to open the put.

The trader would need to submit a buy to close order to cover or close the trade.

How do you hedge a short put?

A short put is a trade that has positive delta.

To hedge the positive delta, traders can implement another option strategy with negative delta.

For example, this could be a bear call spread or a bear put spread.

Other traders will look to sell short the stock to hedge the delta from a short put.

Let’s look at an example.

Trade Date: June 6, 2022

Stock: AAPL

Short Put Details:

Sell to open one AAPL June 17th 2022 $145 put @ $3.90

Premium Received: $390

Delta: 47

To fully hedge the positive delta of this AAPL short put, the trade could sell short 47 shares.

Some traders will prefer to place a 50% hedge by selling 24 shares.

Short-selling stock can be prohibited in some cases and may require special trading permission.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Related Articles

Selling Covered Calls – A Detailed Guide

How To Write Covered Calls: 2024 Ultimate Guide

Weekly Versus Monthly Covered Calls

How To Make Money With Covered Calls

When to Roll Covered Calls

Selling Deep In The Money Covered Calls: Why Do It?

Covered Calls For Dummies

Covered Calls With LEAPs Options Strategy

Supercharge Your Covered Calls Using LEAPS

Selling Weekly Covered Calls

Covered Calls 101

I believe you may have an error in what you wrote. Look at the examples using FB and CRM. Looks like the symbols are switched up.

Thanks Mark, fixed.