Today we will discuss a controversial topic: betting against the market, or how to make money when stock drop.

Being short in the market is not free of risk, but it can also be very profitable.

Contents

- Introduction

- An Overview, Why Should I Be Bearish?

- Shorting Shares

- Selling Futures

- Put Options

- Inverse ETN’s

- So Which Bearish Instrument Should I Use?

- What About Short Squeezes?

- Additional Risks With Short Selling

- Concluding Remarks

Introduction

Making money in the stock market should not be solely dependent on the stock market’s performance.

There are numerous tools to bet against the stock market and profit from a market decline.

This article will provide an overview of some of the reasons to bet against the stock market or specific securities.

We will then explore some bearish strategies to make money when stocks decline.

An Overview, Why should I be Bearish?

Source: Hedge Trade

Bulls make money, Bears make money, pigs get slaughtered – Jim Cramer

Sometimes the most challenging part is explaining the rationale of a bearish trade to skeptical investors.

Therefore, I think it’s important first to address why you should use bearish trades in your portfolio.

While skeptical investors are correct that the stock market usually goes up, it is also true that it usually takes the stairs up and the elevator down.

These downturns can lead to monumental gains for traders willing to take the other side in certain situations.

For individual equities, the opportunities can be even more profound.

You never hear an investor asking, “which stock should I sell?”.

All of Wallstreet and Mainstreet are focused on finding the next BIG buy.

The results are a lot of competition and scrutiny over the hottest stocks.

It also results in these stocks being priced very accurately.

In contrast, the worst companies can sometimes get overlooked.

Even bankrupt car companies can have some value!

Tail Risk Hedging

Source: Barrons

Instead of looking for all the next best buy, thinking of stocks that you are bearish on may be a lot easier and provide a lot higher returns.

To this, a typical bullish investor may respond, “but stocks go up over time right, why should I bet on them going down?”.

Well, this investor is only partially correct.

While the market does usually go up, the median return for an individual security is basically zero.

It is because, over a long period of time, only a few leading stocks power the index returns with astronomical gains.

For the other thousands of stocks, whether they go up or down is virtually a crapshoot.

Still bullish, well, having some bearish bets can help diversify a portfolio, reduce volatility, and help you make money regardless of market conditions.

If you still want to stay bullish, that is fine, have a larger amount of bullish positions in your portfolio instead of bearish trades and apply leverage if needed.

So what structures can I use to place bearish bets?

Let’s explore some of them below.

Shorting Shares

Shorting shares is the simplest way to make a simple bearish bet against the price of a stock.

In a short sale, an investor first sells a security they think is overvalued or will go down in price.

They then hope to buy back this security at a later date at a lower price.

If they do so, they will profit from the difference between the price they sold the stock and the price they bought back the shares.

The advantage of short selling is that you can usually sell almost any stock you want, provided that the stock has inventory available.

Inventory is an important caveat.

To sell the stock, we need to borrow it first from a lender.

The good news is that almost all stocks will have available inventory at your brokerage; this includes many penny stocks.

For these small-cap stocks, shorting is the only option to take a bearish bet

Advantages: High liquidity, Large Asset Availability

Disadvantages: Potential Borrow Rates, Close-out Risk, High Margin Required

Selling Futures

Selling futures takes a bet on that futures contract going down over time.

In contrast to a short sale, we do not need to borrow anything to sell futures.

A futures contract is an agreement to buy or sell an index or commodity in the future, not now.

Imagine the example of a concert ticket.

Shorting the concert ticket is borrowing it from your friend, selling it on Facebook Marketplace, then hoping to repurchase it later at a lower price, returning it to your friend for a profit.

In contrast, selling a future is agreeing with someone on the price of your friend’s concert ticket in a month.

This flexibility and the margin efficiency of futures make selling them the best bet for bearish macro views on indexes and commodities.

Advantages: High liquidity, Low Margin

Disadvantage: Limited Product Selection (can only trade indexes, rates and commodities)

Put Options

Put options offer investors the right to sell a stock or index at or below a specific price before a certain date.

This price is known as the strike price.

At expiration, if the stock price is below the strike price, the option is in the money, and the investor will profit from the difference between the strike and trading price, minus the premium paid.

The unique thing about put options is that an investor can express a specific view.

For example, if a trader feels a particular stock will not only go down but crash, they can buy a large amount of far out-of-the-money puts for a relatively low price.

If the traders’ view is correct, they can make significantly more money than a simple short-sale due to the leverage they can employ.

Options can work as great tools for many indexes and single stocks, but my lesser-known stocks may not have options or have illiquid options.

Options also have an added volatility component which can be an advantage or a disadvantage.

You can reduce the volatility by trading different bearish options structures.

For example, an at-the-money put debit spread has much smaller volatility than simply buying a put.

Advantages: Low Margin, Customizable, Risk Defined

Disadvantages: Often Overpriced, Lower Liquidity

Download the Options Trading 101 eBook

Inverse ETN’s

Inverse ETN’s aim to replicate the opposite or inverse of an index.

They are often structured to sell futures or swaps to do so.

Despite their complicated holdings, the products themselves are easy to trade and are very liquid.

This peculiarity usually makes them accessible for novice traders who do not have the level of permission for shorting stocks or trading derivatives.

Inverse ETN’s often work well for short-term bearish bets.

Unfortunately, they are rarely a good long-term hold due to the products’ transaction costs and expense fees.

Advantage: High leverage, High Liquidity, Easy to trade

Disadvantages: Limited Product Selection, Long Term Underperformance vs. Benchmark

So Which Bearish Instrument Should I Use?

With all these different choices, it can be daunting to know which bearish structure to pick.

Despite this, once you know what you think will happen, it can become very simple to choose the correct structure for your view.

Let’s take the example of John, who is Bearish on Apple.

John feels as though the price of Apple will decline moderately to around $140 over the next few months from its current trading price at $145.

Firstly we can already eliminate a few of our above choices.

There are no futures or inverse Apple ETN’s.

Thus we are left with two options: short selling Apple or buying a put option. Let’s explore both.

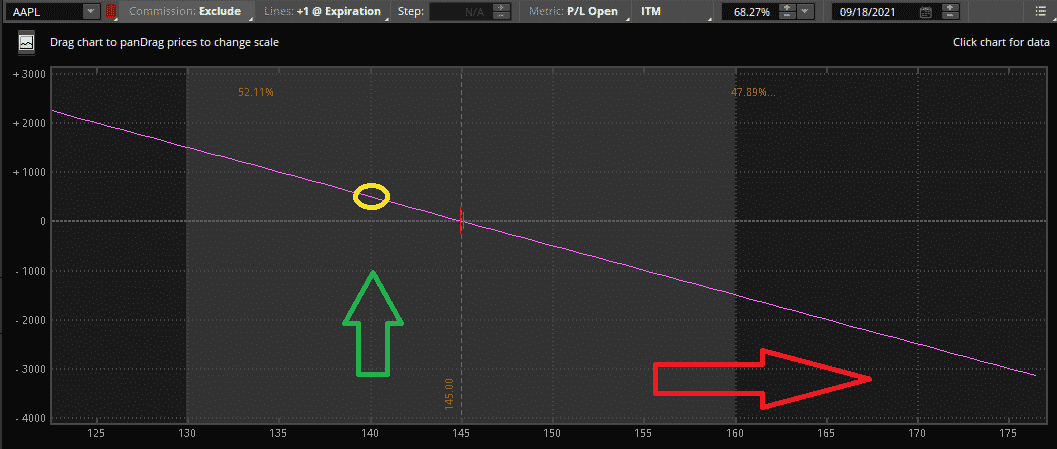

Here we have the example of shorting 100 shares.

If our view is correct and the price moves down to $140 (at the yellow circle), we will profit $5 as we sold the shares at $145 and bought them back for $5 less. Not bad!

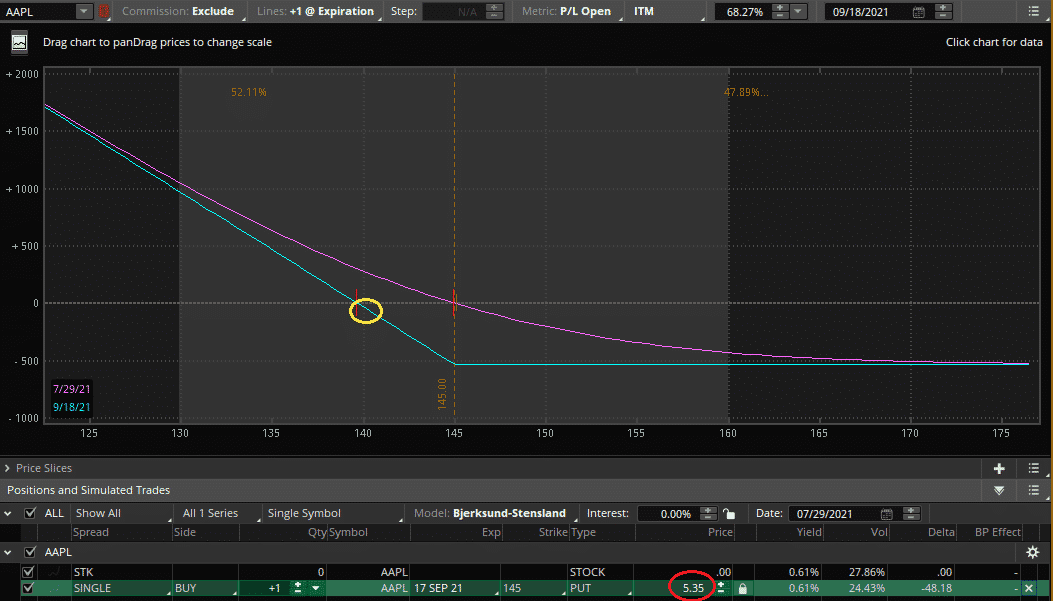

Now let’s see if a Put option works better.

In this example, we buy one at-the-money put with a two-month expiry to show our view.

Yikes! It turns out we lost money.

While we were right about the direction of the trade, because the volatility we bought was too high, the premium we paid outweighed our benefit.

We lost $5.35-$5= .30 cents.

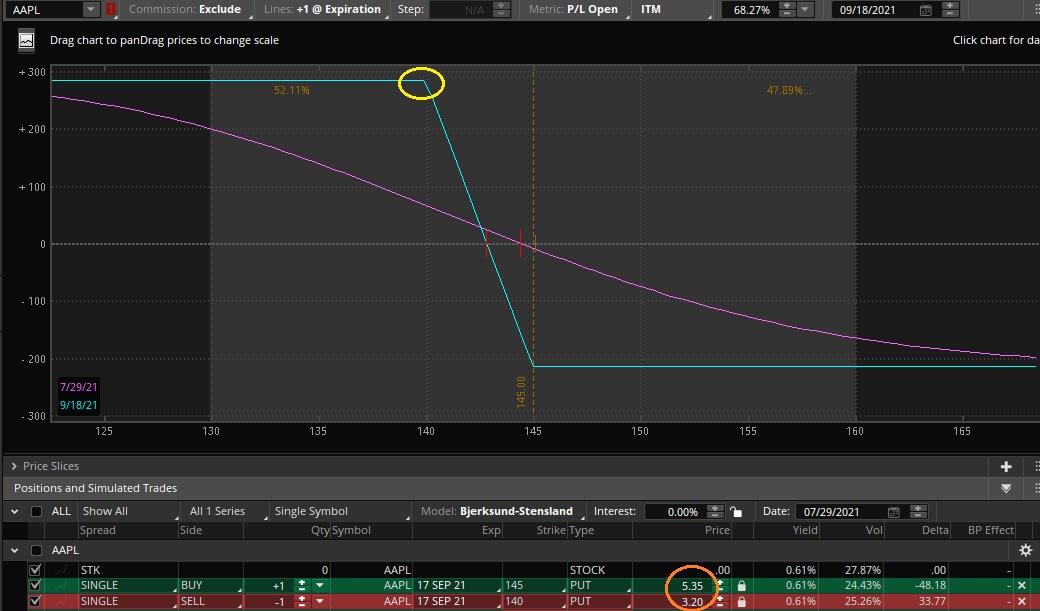

What if we used a put debit spread instead.

Here we bought a 145 put, and since we believe the price will only go down moderately, we sold a 140 put.

It looks a lot better.

We profit $2.85 now if our view is correct.

It seems like the short shares are still the winner.

Despite this, we need to consider the fact that we could be wrong on the trade.

If that happens, we have unlimited loss potential if we short the shares but only lose the debit paid ($2.15) if we trade the put spread.

Verdict:

A simple long put is a bad option here.

In this case, we would evaluate whether, if we are wrong, we believe it is possible Apple could move up significantly.

If so, a put debit spread may make more sense.

If not, then shorting shares will provide the best return.

What About Short Squeezes?

Despite the plethora of choices we have to make money when the stock market falls, there is still added risk when placing most bearish trades.

The reason is simple.

The lowest an asset can go is zero (aside from rare instances).

That also coincides with the most a trader can lose on a trade.

Yet, there is no cap to the upside.

By short selling a stock, the price can, in theory, go to infinity.

For fundamental investors shorting stocks such as GMC or AMC can be a challenge.

When the stock price continues to go up, the thesis often continues to get stronger, as does position size.

This adds risk.

Remember, the market can remain irrational longer than you can remain solvent.

Prolonged or drastic short squeezes will bankrupt bearish investors at the worst possible moment.

Using bearish options spreads can mitigate this risk when options are readily available.

If not, having a hard P&L stop, however painful, you can avoid having your next lunch at the soup kitchen.

The good news is that events like short squeezes are actually relatively uncommon and only occur on heavily shorted stocks.

After all, to have a short squeeze, you need many investors who are short in the first place.

The reality is that nothing much is happening in the majority of the market most of the time.

Often we only selectively see what is trending and newsworthy.

In summary, if you are scouring WallStreet Bets reddit channel, expect some short squeeze potential, but if you are shorting Pepsi, there is much less to worry about.

Additional Risks With Short Selling

There are some additional risks of short selling specifically that should be noted.

The first is that shares can get called away at any time, which is not a concern for most major tickers, but this can be an issue for heavily shorted or small-cap stocks.

You may be forced out of a position at the most inconvenient time.

Usually, instead of having your shares called away for an in-demand stock, the borrow rate to short will increase.

This change should decrease the demand for shorting the shares as the borrow fee directly impacts the profitability of the trade.

The borrow fee itself can prevent what would otherwise be a great trade from being profitable.

If an investor thinks a stock will go down 20% in the next year, but the borrow rate is 30%, shorting it is not a good idea, which is unfortunate as usually, the borrow rate will be highest on the worst stocks, precisely the ones we would want to short.

These risks are unique to short selling and make it more difficult than buying shares.

Despite this, these constraints can be seen as a good thing as it helps keep lower competition for short selling.

By regulatory restrictions, many funds cannot engage in short selling, mainly because of the risks.

Even better for us!

Concluding Remarks

Many investors are at the whims of the market and global sentiment.

This can lead to prolonged periods of steady growth, which can fall apart when the market sours.

By having bearish bets, traders can profit when the market falls.

Moreover, smart traders can search for overpriced stocks or create long-short hedge fund-like portfolios.

This can help reduce drawdowns and correlations within a portfolio.

While additional risks need to be considered when making bearish bets, these in themselves help the space to be less developed and can allow for higher profits if strategies are used selectively.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.