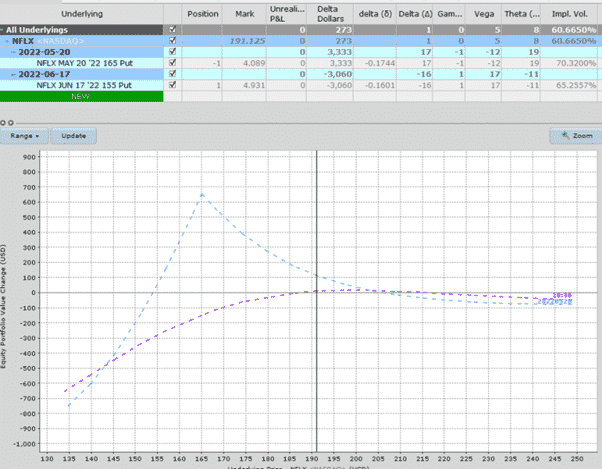

Netflix has been crushed lately after a disappointing earnings announcement which has seen the stock drop from 350 to 199. When a quality company has a big drop like this, I like to use a strategy called a diagonal put spread.

This option strategy is an advanced strategy because it utilizes options over different expiration periods and different strike prices.

You can read more about diagonal put spreads here, but let’s take a look at the setup on NFLX.

Trade Date: April 28th

Details:

Sell 1 NFLX 165 May 20 Put @ 4.10

Buy 1 NFLX 155 June 17 Put @ 4.90

Net Debit: $80

Max Loss: $1080

Max Gain: $650

Notice how there is every little risk to the upside.

In fact, if NFLX jumps higher, the worst that can happen is both the puts expire worthless.

This leaves the trade down the premium paid of $80.

The T+0 line (purple) is quite flat initially and the greeks are pretty neutral allowing the trade to generate some positive Theta.

Time Decay

Time decay will occur fast on the short-term put than the long-term put.

The main risk with the trade is a sharp drop in price early in the trade.

For this reason, I usually set a stop loss if the stock breaks through the short strike.

However, you can see that a lower stock price can actually be a good thing if it occurs closer to expiry.

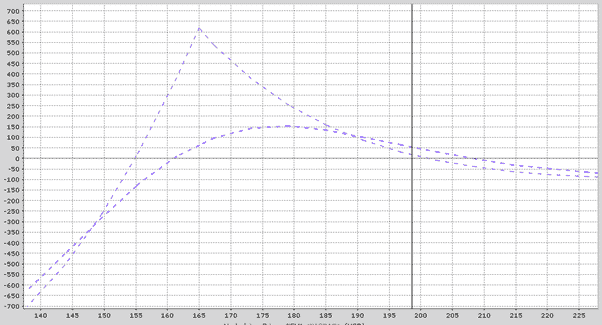

Here we can see the payoff graph with a T+14 line rather than a T+0 line.

Notice there is profitability from 160 to around 207 fourteen days from now.

Aiming for a return of around 10-15% makes sense and I would set a similar stop loss.

We like using Diagonal Put Spreads on stocks that have suffered a severe drop.

If you have any questions on this, let us know.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.