AMD (AMD) is showing elevated implied volatility with an IV Percentile reading of 98%.

That means that the current level of implied volatility is higher than 98% of all other readings in the past twelve months.

In part, that is because the company is due to report earnings after the closing bell on Tuesday, and we typically see elevated implied volatility around that event.

Traders that think AMD stock will not move too much following this earnings report, could look at an iron condor earnings trade.

Let’s look at an example of how we might set up an iron condor over earnings.

As a reminder, an iron condor is a combination of a bull put spread and a bear call spread.

The idea with the trade is to profit from time decay while expecting that the stock will not move too much in either direction.

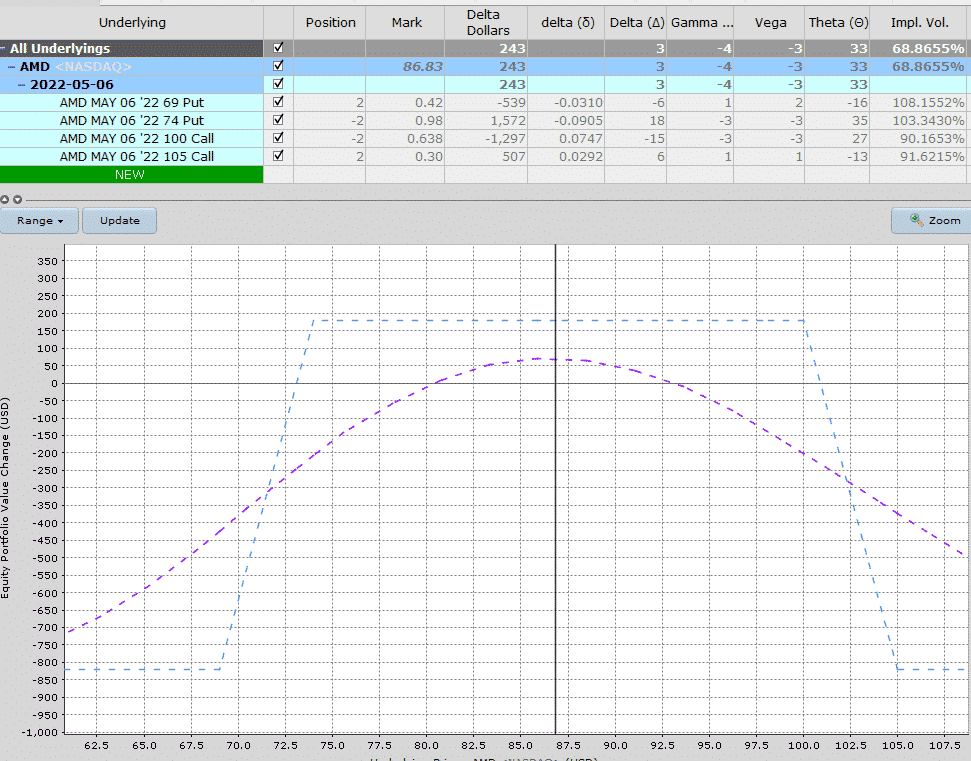

First, we take the bull put spread. Using the May 6 expiry, we could sell the 74 put and buy the 69 put. That spread could be sold on Friday for around $0.55.

Then the bear call spread, which could be placed by selling the 100 call and buying the 105 call. This spread could be sold on Friday for around $0.35.

In total, the iron condor will generate around $0.90 per contract or $90 of premium.

The profit zone ranges between 73.10 and 100.90. This can be calculated by taking the short strikes and adding or subtracting the premium received.

As both spreads are $5 wide, the maximum risk in the trade is 5 – 0.90 x 100 = $410.

Therefore, if we take the premium ($90) divided by the maximum risk ($410), this iron condor trade has the potential to return 21.95%.

If price action stabilizes, then iron condors will work well. However, if AMD stock makes a bigger than expected move, the trade will suffer losses.

Trades held over earnings allow little room for adjusting, so they can be a bit hit or miss. AMD has stayed within the expected range following five of the six recent earnings releases. Although as we know, past performance doesn’t guarantee future performance.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.