Contents

- How To Trade A LEAPs Options Strategy

- Typical Example

- Comparing Returns

- First Optimization

- Second Optimization

- More Optimizations

- Payoff Diagram

- Result of Second Example

- What Happens If The Stock Goes Down?

- Theory Why This Strategy Works

- Shorter Term LEAPS Versus Longer Term

- Can This Strategy Be Done With LEAP Puts?

- Conclusion

- Related Articles

Today, we’ll look at a LEAPS options strategy using covered calls against it for extra income.

Firstly, what is a LEAP?

Options that have expiration dates around one year or more in the future are called LEAPS (Long-Term Equity Anticipation Securities).

They are no different from the shorter-term options, except for their far dated expiration dates.

How To Trade A LEAPs Options Strategy

The first step is to purchase a long-term call LEAP on a bullish stock. We will look at the advantages of using long calls as a stock replacement.

The second step is to sell shorter dated calls against this long-term LEAP to generate extra income.

Typical Example

Let’s look at a typical example to understand the mechanics of the trade before looking at the nuances and optimizations.

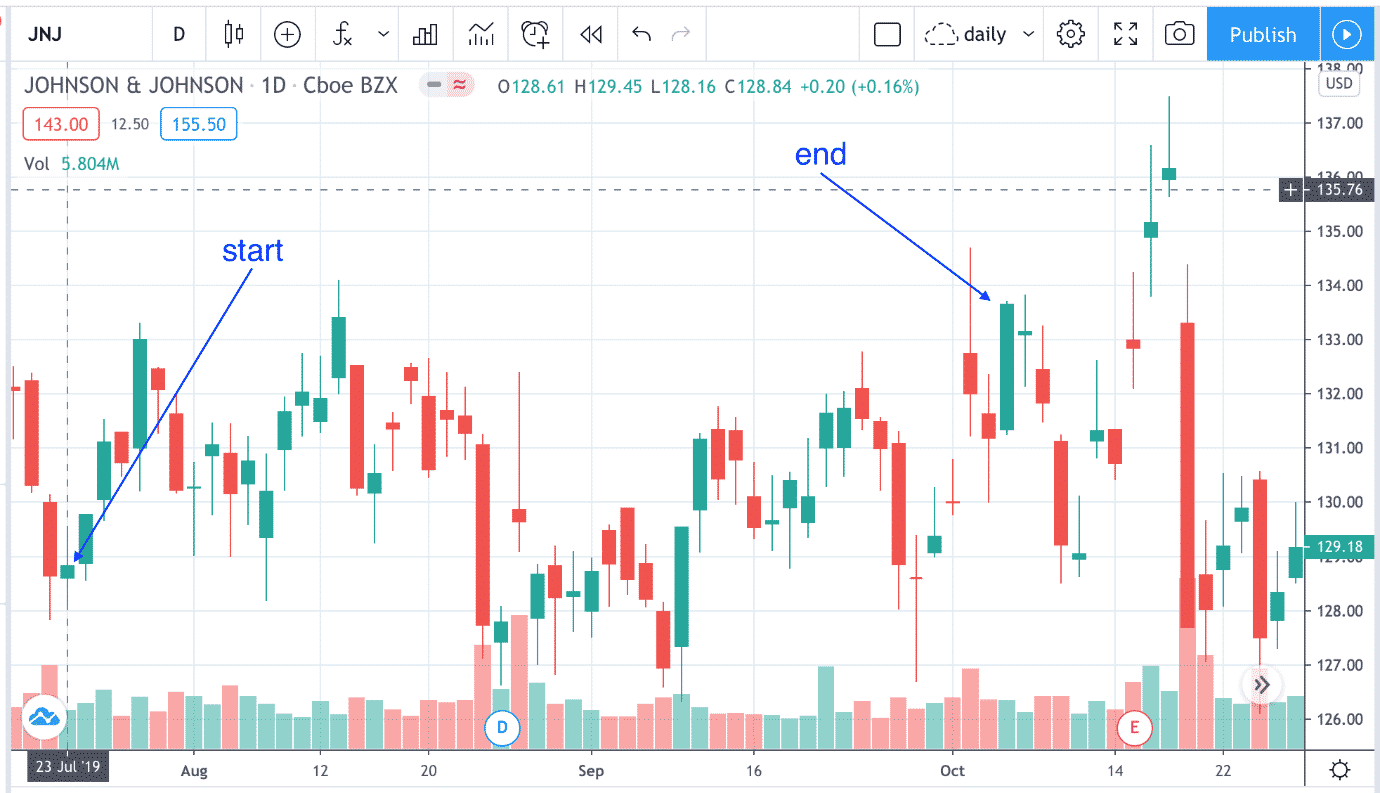

Date: Jul 23, 2019

Price: JNJ @ $128.84

Trade Details:

Buy 1 to open JNJ Jun 19, 2020 – $120 call @ $13.65

This is the LEAPS stock replacement option that expires 332 days away.

The call is in-the-money at 68 delta.

Anything around 60 to 70 delta is good, and I’ll sometimes go as high as 80 delta.

The higher the delta, the more like a stock this option will behave.

It is a far-dated option which decreases time decay.

At the same time, we sell a near-term call about 45 days away. (Anything between 30 to 60 days is fine).

Trade Details:

Sell to open 1 JNJ Sep 20, 2019 – $135 call @ $1.26

This is an out-of-the money short call.

This can be mechanically chosen at a certain delta, say 30-delta.

Or we can use discretion to sell closer to the stock price (at 40-delta) when chart looks less bullish.

And sell further out-of-the-money if chart looks very bullish (say at 20-delta).

We will exit this short call under two conditions.

The first condition is a profit exit when profit reaches 50% of max profit of the short call.

In this case, when the value of the short call drops below $0.63 (which is half of $1.26).

This occurred on Aug 28, 2019, therefore the short call is bought back.

Aug 28, 2019:

Buy to close 1 JNJ Sep 20, 2019 – $135 call @ $0.43

At this point in the example, the profit and loss is showing a profit of $95.50, about 7% of the initial capital invested ($1365).

Once the investor exits the short call, another write cycle is repeated. A “write” is a sale of an option contract.

So, let’s sell another call option to generate more income.

Aug 28, 2019:

Sell to open 1 JNJ Oct 18, 2019 – $135 call @ $1.50

Then….

Sep 9, 2019:

Buy to close 1 JNJ Oct 18, 2019 – $135 call @ $0.62

The trader buys to close on Sep 9 because the short call had reached more than 50% of its max profit.

After the completion of each write cycle, we check the P&L of the entire trade.

The P&L is now showing only a $21 profit, or about 1.5%.

Okay, let’s continue with another write cycle.

Sep 9, 2019:

Sell to open 1 JNJ Oct 18, 2019 – $130 call @ $2.00

Then….

Oct 4, 2019:

Buy to close 1 JNJ Oct 18, 2019 – $130 call @ $4.52

On Oct 4, the short call had only 14 days left till expiration.

The investor closes the short call even though it had not reached 50% of max profit.

This is the second condition in which to exit the short call.

It is a timed exit.

Whenever the short call reaches less than 15 days till expiration, it is closed no matter what.

While this strategy is similar to a stock owner selling covered calls on the stock, here the investor does not actually own the stock.

Hence it is even more important that the investor does not get assigned on the short call.

If that happens in this case, the account will show -100 shares of JNJ.

The investor will have to buy 100 shares of JNJ at market price to pay off this debt — that could be about $13,000.

If investor has that in the account and is able to pay that, then fine.

If not, investor will need to (or be forced to by the broker) to exercise the long LEAP call (which is the protection leg).

However, since the LEAPS still has a lot of time till expiration (a significant extrinsic value left), the investor gives up a lot of money.

The LEAP that was purchased for $1,365 would be completely used up.

That’s expensive insurance and why it’s important that investors understand the process and position size accordingly.

It is almost always a financial disadvantage to exercise long options early.

On Oct 4, we are now two and half months into the trade and P&L is showing $236.50 in profit, about 17%.

Since we have greater than a 15% profit, the investor decides to close the entire trade by selling the remaining long call LEAP.

Oct 4, 2019:

Sell to close 1 JNJ call Jun 19, 2020 – $120 call @ $1683

TOTAL PROFIT: $236.50

Comparing Returns

Let’s compare the returns to that of a stock owner.

If JNJ stock was held the entire year of 2019, the stock investor would have gained 14%.

The LEAPS investor made the same return in less than 3 months.

Looking at the chart in which the LEAPS investor was exposed to the market, the investor made money even while the stock chopped around and moved sideways.

The stock investor during that same time would have made only 3.7%

First Optimization

In our example, we saw that the P&L of the entire trade can change a lot after each write cycle:

After the first cycle: $95.50 (7%)

After the second cycle: $21.00 (1.5%)

Following the third cycle: $236.50 (17%)

Instead of checking the P&L after each write cycle, a more active investor would be checking the P&L each day.

There are many factors that affect the price of the short and the long option causing the P&L of the entire trade to swing quite significantly.

Checking more frequently increases the chance that we catch the take profit threshold of 15% much earlier.

Or better yet, put in an automatic order.

The broker will then automatically close the trade for us if profit targets is reached.

Second Optimization

The second optimization to consider is exiting the entire trade prior to three weeks till expiration.

You don’t want to hold the long call in the last three weeks because of accelerated time decay on the long call and the increased gamma risk.

While it is a financial disadvantage to exercise a long call early; it is perfectly fine and often advantageous to sell back a long call early.

When you get rid of the long call, you have to get rid of any short calls you have at the same time.

More Optimizations

This is a bullish strategy.

An investor using this strategy would want to find a stock they think will rise in value with a bullish view with a 2 to 3 month timeframe.

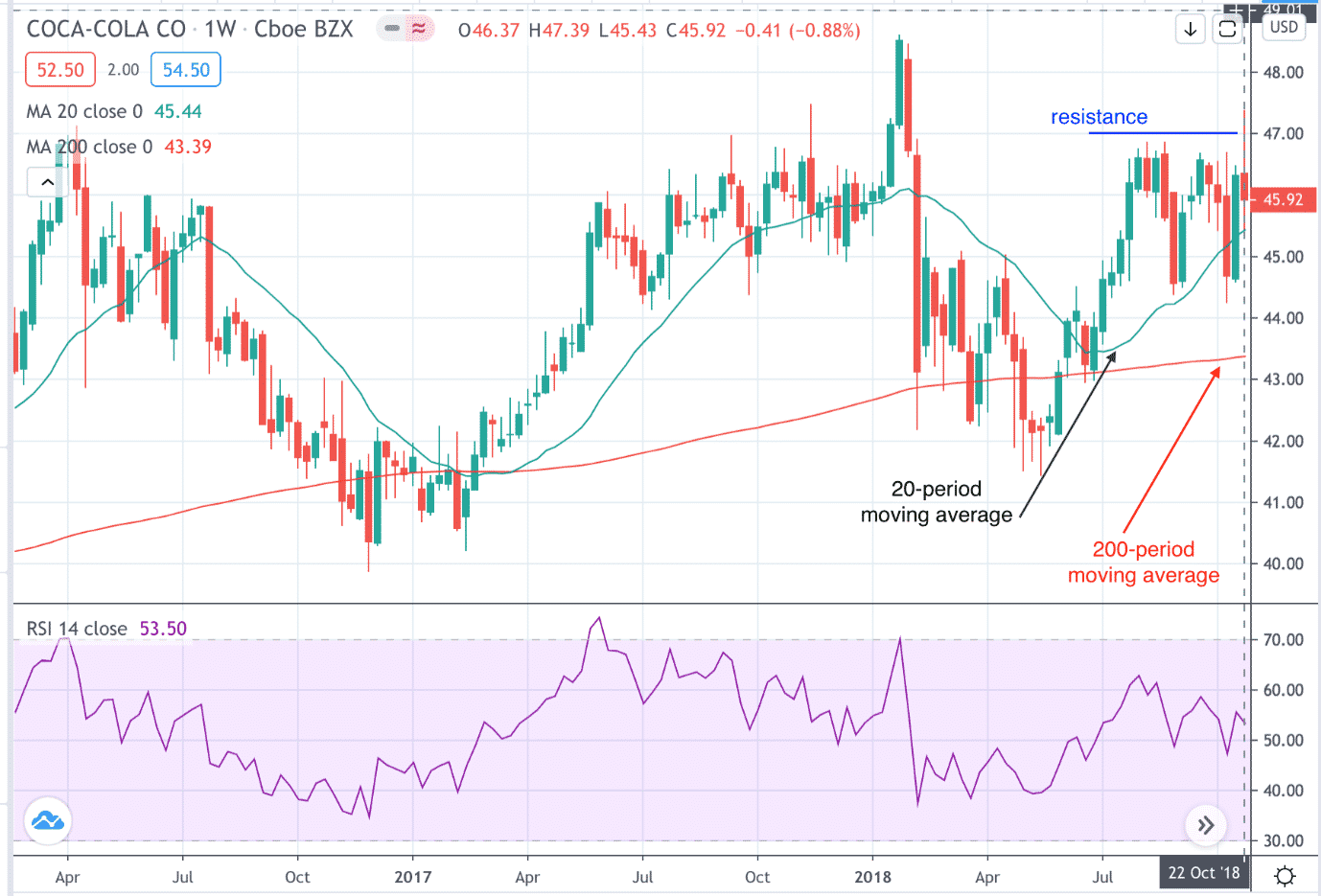

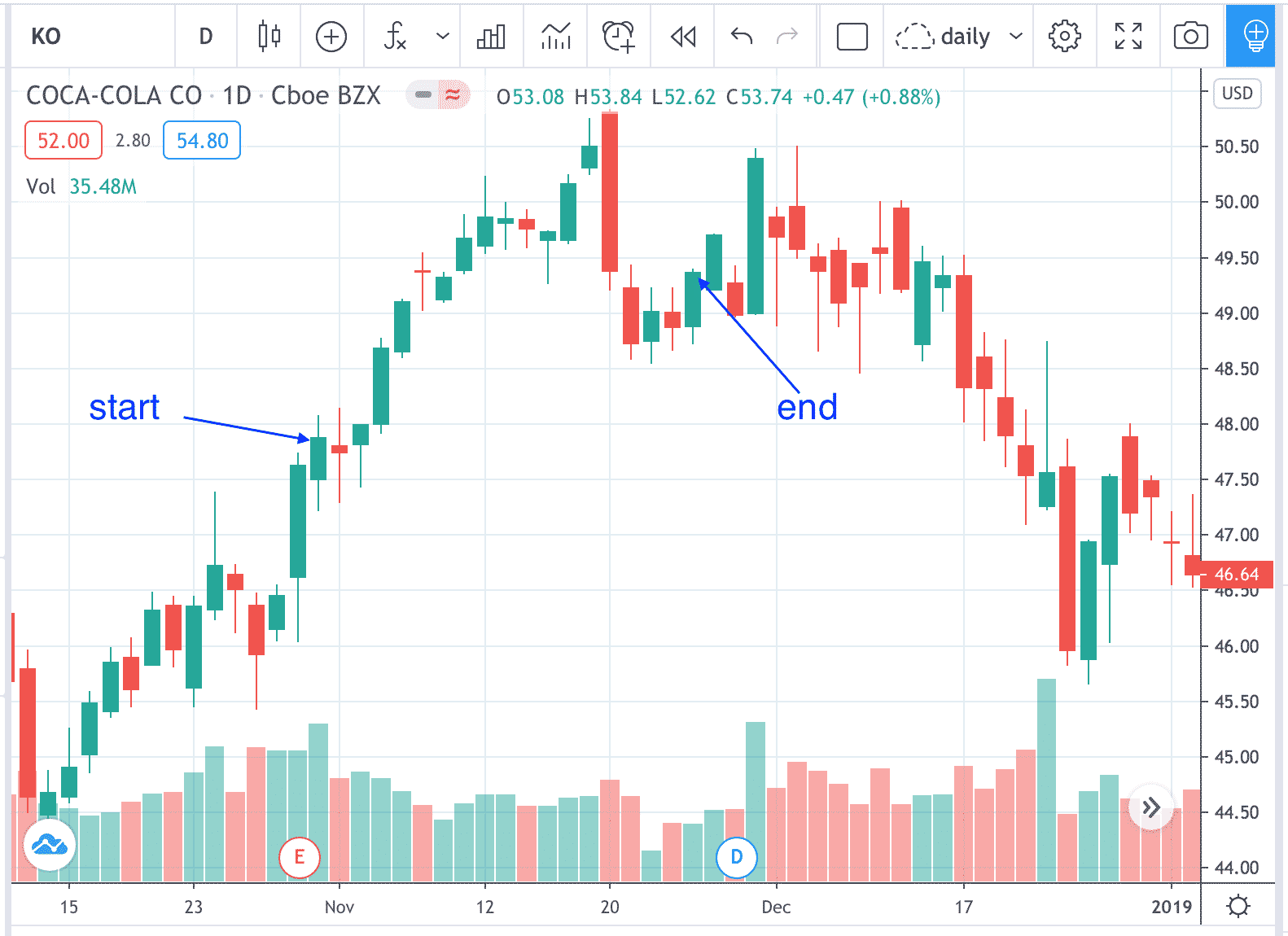

Here is a weekly chart of Coca Cola (KO) where each candle represents a week.

Looking at the week of Oct 22, 2018, the shorter term 20-week moving average is peeling up and away from the longer term 200-week moving average.

This is a bullish sign.

With RSI slightly above 50, but not over-bought, the investor decides to go long on KO as soon as it closes above the resistance level of $47.

On Oct 30, 2018, KO breaks out with a strong bullish candle closing above $47.

Before buying a long call, doing a quick check of the Implied Volatility shows moderate volatility.

That’s fine, as long as it is not high.

Ideal conditions would be low IV, which means option prices are cheap and gives room for IV to increase.

Option values increase as IV increases.

Or more precisely, the volatility portion of the option value increases as IV increases.

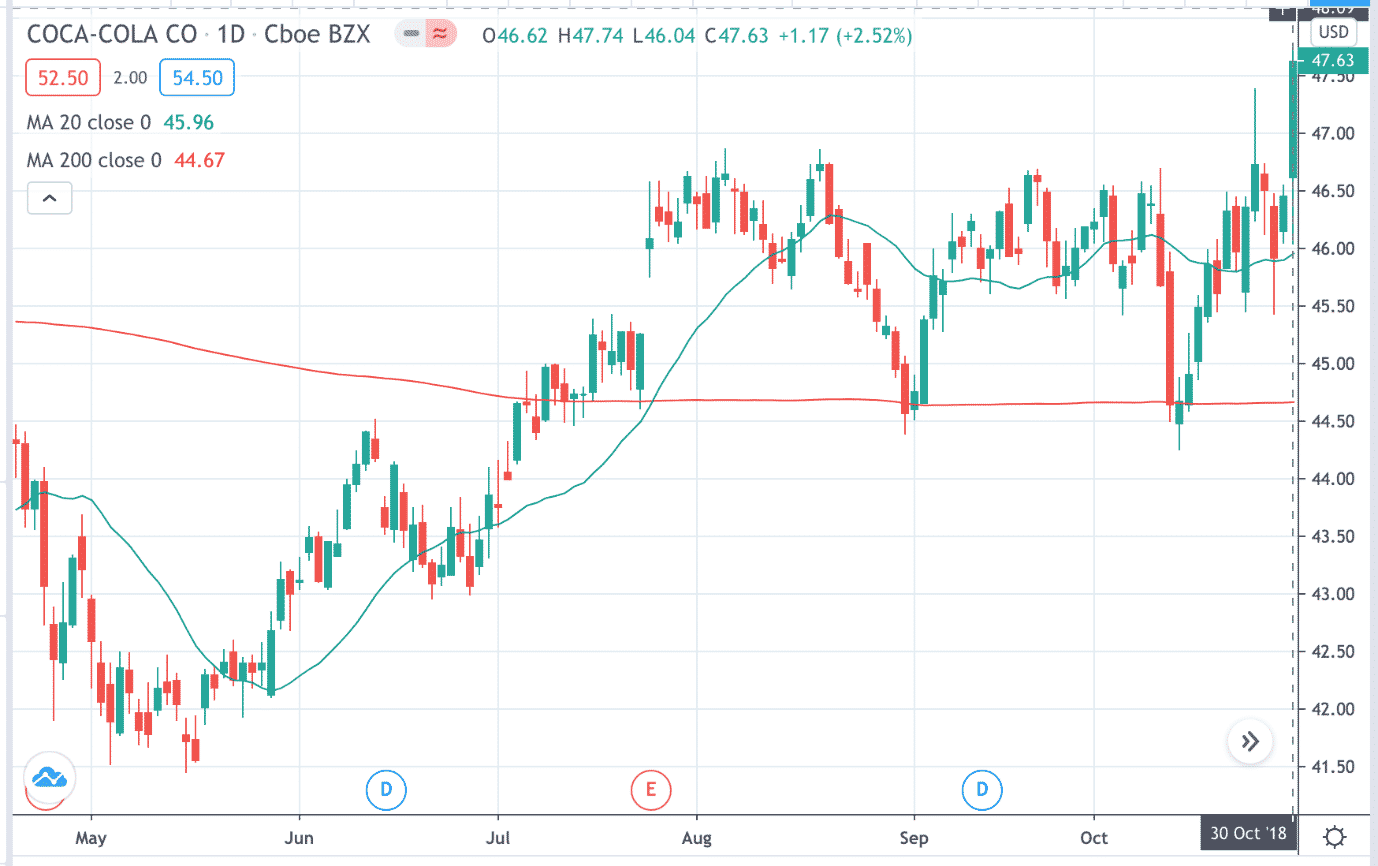

The next day near market close on Oct 31, the investor buys the LEAPS expiring 443 days away.

Oct 31, 2018:

Buy to open 10 KO call Jan 17, 2020 – $45 call @ $4.83

Note that options further out in time generally have wider bid-ask spreads.

Investors should take some time to “negotiate” a good fill price, by making several attempts in your favor before settling on the fill price. Because this is a larger size purchase and a longer-term position, it is fine to wait hours just for a good fill.

It will make a big difference in the long run.

The ten calls in this example cost the investor $4,830 and acts as a stock replacement.

One call behaves almost like 100 shares of the stock.

The more the call is in-the-money, the more it behaves like the stock.

A 70-delta call behaves about 70% like the stock.

The advantage of using a call is that it uses less capital.

Here 10 calls uses 10% of the capital that would be needed to purchase 1000 shares of stock (which would cost $47,880).

For a more volatile stocks like TSLA, using options as a stock replacement reduces the capital usage by 26.7% — not quite as much of a reduction as less volatile stocks such as KO.

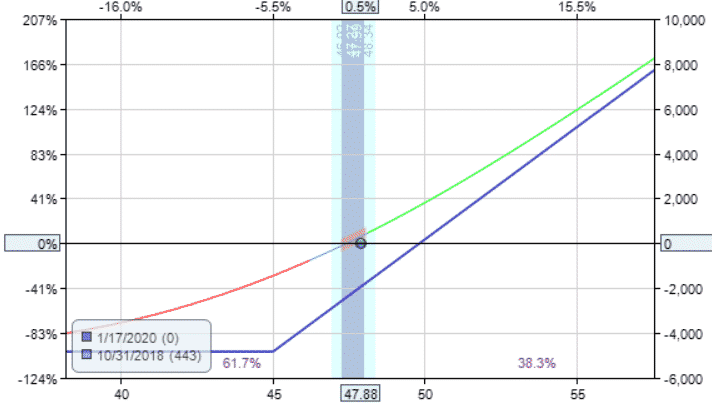

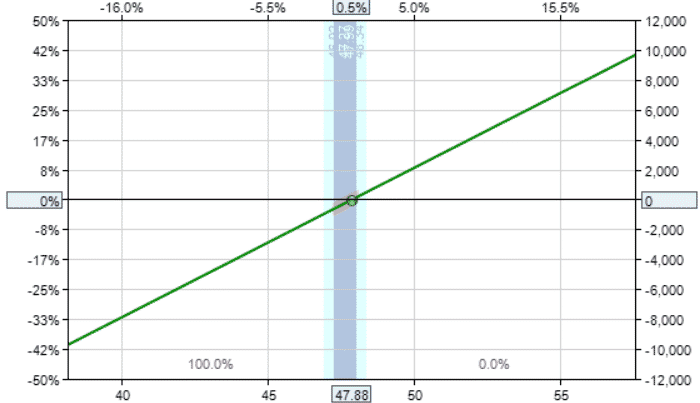

Payoff Diagram

This is the payoff diagram of owning the ten KO calls.

The blue line is the profit-loss at expiration.

The maximum a LEAPS investor can lose is the cost of the calls — in this case $4,830.

The curved line is the profit-loss at start of trade.

It is curved in such a way that as price goes up in favor of the investor, the long call options gains value at a greater rate — the snowball effect.

As the price goes down against the investor, the options lose value at a slower rate.

This is because the long call has a beneficial characteristic of positive gamma.

As price increases, the delta increases.

This increases the exposure of the investor’s money to the market.

As price decreases, the positive gamma automatically helps reduce investor’s exposure.

An investor owning stocks does not have this advantage.

This is the payoff diagram of owning 1000 shares of KO stock.

Note that if KO drops from $47.88 to $43 (a drop of 10%) over the course of about a year, the stock investor would have lost $4880 (more money than the maximum loss of the LEAP call investor).

The trade-off is that the stock investor will make more if the stock goes up.

Due to the cost of the call, the LEAPS investor needs KO to go up at least above $49.83 at expiration in order to just break even.

Result of Second Example

Let’s see how this strategy plays out for KO example.

Oct 31, 2018:

Buy to open 10 KO call Jan 17, 2020 – $45 call @ $4.83

Sell to open 10 KO call Dec 21, 2018 – $49 call @ $0.50

Nov 27, 2018:

Buy to close 10 KO call Dec 21, 2018 – $49 call @ $0.79

Sell to close 10 KO call Jan 17, 2020 – $45 call @ $5.85

Checking on the P&L on a daily basis, the profit target of 15% was reached on Nov 27, at which point the entire trade was closed for a profit of $725.

Not bad for being only in the trade for one month.

The trade was exited even before the first write cycle had completed. This is not an entirely bad problem to have.

But if you feel that you are not getting enough write cycles out of your LEAPS, you can increase the profit target to suit your personal preference.

This is an example of when the trade works, because the stock moved up right from the start.

What Happens If The Stock Goes Down?

But what happens if the stock goes down?

Because the long call acts as a stock replacement, you manage the long call like a stock.

If the stock price breaks below a major support, or if distribution is happening, or if short-term moving averages are crossing underneath longer-term averages, or whatever technical indicator you prefer, then exit the long call.

If you exit the long call, you have to exit the short call as well.

Refer to the article on why you should not hold a naked short call for more details.

Or if you think the sell-off is only temporary, then you can maintain your position and buy a short-term protective put.

Or use other hedging strategies.

Theory Why This Strategy Works

There is an edge in buying longer term options while selling shorter term options.

That is because long term options cost less in terms of price-per-day than short term options (with all other things being equal).

So, we are buying an option that is cheap (in terms of price per day) and selling an option that is expensive (in terms of price per day).

Like home or auto insurance, if you buy a long-term plan, you pay less per days covered than if you buy on a short-term month to month basis.

You get savings when buying in bulk.

This leaps option strategy is like buying at wholesale prices and selling back at retail prices.

Or it is like buying a house and renting it out month by month.

Use whatever analogy you like.

However, don’t buy LEAPS too far out in time (even if you have the money).

Shorter Term LEAPS Versus Longer Term

Let’s compare.

Date: Dec 17, 2020

Price: AXP @ $117.51

Shorter-term LEAPS:

$105 call with expiration Jan 21, 2022 (400 days away)

Cost: $22.65 bid / $23.25 ask

Cost per day: $0.0574

Delta: 70

Theta: -1.88

Vega: 43

Vega/Theta ratio: 23

Longer-term LEAPS:

$105 call with expiration Jan 20, 2023 (764 days away)

Cost: $25.55 bid / $28.70 ask

Cost per day: $0.0355

Delta: 70

Theta: -1.32

Vega: 60

Vega/Theta ratio: 45

As you go further out in time… the bid/ask spread increases (bad), the cost per day decreases (good), the vega exposure increase (generally bad), the vega/theta ratio increases (generally bad).

When your LEAP is too far out in time, it is more affected by volatility changes which are difficult to predict.

Can This Strategy Be Done With LEAP Puts?

Technically, yes.

But I would only do it with calls in the bullish direction.

This is because over the longer term, the market has a positive upward drift.

Longer term strategies should have a bullish bias.

Statistically, we see that most of the LEAPS being purchased are calls, rather than puts.

Conclusion

I hope you enjoyed this article looking at a LEAPS options strategy using covered calls.

This is a powerful strategy, but needs to be used with appropriate position size due to the inherent leverage in the LEAP call options.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Related Articles

Selling Covered Calls – A Detailed Guide

How To Write Covered Calls: 2024 Ultimate Guide

Weekly Versus Monthly Covered Calls

How To Make Money With Covered Calls

When to Roll Covered Calls

Selling Deep In The Money Covered Calls: Why Do It?

Covered Calls For Dummies

Covered Calls 101

Supercharge Your Covered Calls Using LEAPS

Selling Weekly Covered Calls

Covered Calls: How to Adjust to Changing Market Conditions

Thanks for the great article. What are your thoughts on instead of selling a short term call, selling a short term put? While buying the long term call on something you are over the long term, very bullish on?

Yep, good strategy if you are very bullish. It’s called either a Risk Reversal or a Synthetic Long Stock depending on where you place the strikes:

https://optionstradingiq.com/ultimate-guide-to-the-synthetic-long-stock-strategy/

https://optionstradingiq.com/risk-reversal/

Thanks for the reply! Good to know, I will check out the links.