Contents

- Contingent Orders

- Multi-Contingent Orders

- OTO (One-Triggers-The-Other)

- OCO (One-Cancels-The-Other)

- OTOCO (One-Triggers-A-One-Cancels-The-Other)

- Conclusion

Conditional orders are advanced order types that can help automate trades to some degree.

New investors should familiarize themselves with regular order types first.

Many simple conditions (such as buy if price goes above $X, but not more than $Y) can be accomplished by regular order types.

Conditional orders can do all that plus even more sophisticated triggers possibly involving multiple orders, tickers, and conditions.

There are five common types of conditional orders:

- Contingent orders

- Multi-contingent orders

- OTO (one-triggers-the-other)

- OCO (one-cancels-the-other)

- OTOCO (one-triggers-a-one-cancels-the-other)

Let’s look at exactly those are and when they might be used.

Contingent Orders

A contingent order consists of a trigger criterion and an order.

When the trigger criterion is met, the order is automatically placed.

Suppose an investor loves Apple products and would like to buy 5 shares of AAPL the next time the market is up more than 1% in a day.

The trigger criterion is as follows:

Trigger type: Index

Index: S&P 500

SPX Trigger: Day Change % Up

Amount: Greater than 1%

Time in Force: Good to Cancel

The order is as follows:

Symbol: AAPL

Action: Buy

Quantity: 5 shares

Order Type: Market

Time in Force: Day

While in this example, we used the order type is “market”, it can be any other regular order types such as “limit”, “stop limit”, etc.

The trigger type can be based on price of any stock, ETF, selected indices, or even the price of an option contract.

The order can be for an equity or ETF or a single leg option order.

For example: if FB (Facebook) goes above $290, buy one long call option.

Multi-Contingent Orders

Multi-contingent orders consist of two trigger criteria and an order.

You can indicate that the trigger criteria be both met to trigger the order, or that either criterion is met to trigger the order.

For example, an investor sets an order to sell 100 existing shares of XLE if both the Dow Jones index and the S&P 500 index are down by 2% in one day.

Another example, an investor sets an order to buy AMZN if either the NASDAQ index is up 2% today or if AMZN reaches a 52-week high.

OTO (One-Triggers-The-Other)

The OTO consists of a primary order and a secondary order.

When the primary order is fulfilled, the secondary order is placed.

On most platforms, if the primary order is cancelled, the secondary order is automatically cancelled.

If the secondary order is cancelled, the primary order remains in effect.

Depending on your broker, there may be default expiration period where if the primary order is not triggered, the whole order is cancelled.

A “Good to cancel” orders does not necessarily mean forever.

One common use of OTO is to set an automatic stop loss.

An investor sets a primary buy limit order to buy a stock at $85, and then sets a secondary stop loss order to sell the stock if it falls below $80.

The order can be used for single leg options as well.

For example, an investor sets a primary buy order to buy 100 shares of MSFT at $215 per share, and sets secondary order to sell one call option at strike price of $225 with 37 days to option expiration.

This is an automatic order for placing a covered call.

Another example:

An investor sets a primary buy order to buy 100 shares of IWM at $190, and sets a secondary order to buy one put option with strike price of $190 with 75 days to option expiration.

This is a “married put” because a protective put is placed simultaneously as the investor acquires stock (or ETF in this case).

OCO (One-Cancels-The-Other)

The OCO consists of two live orders.

If one of the orders is triggered, the other order is automatically cancelled.

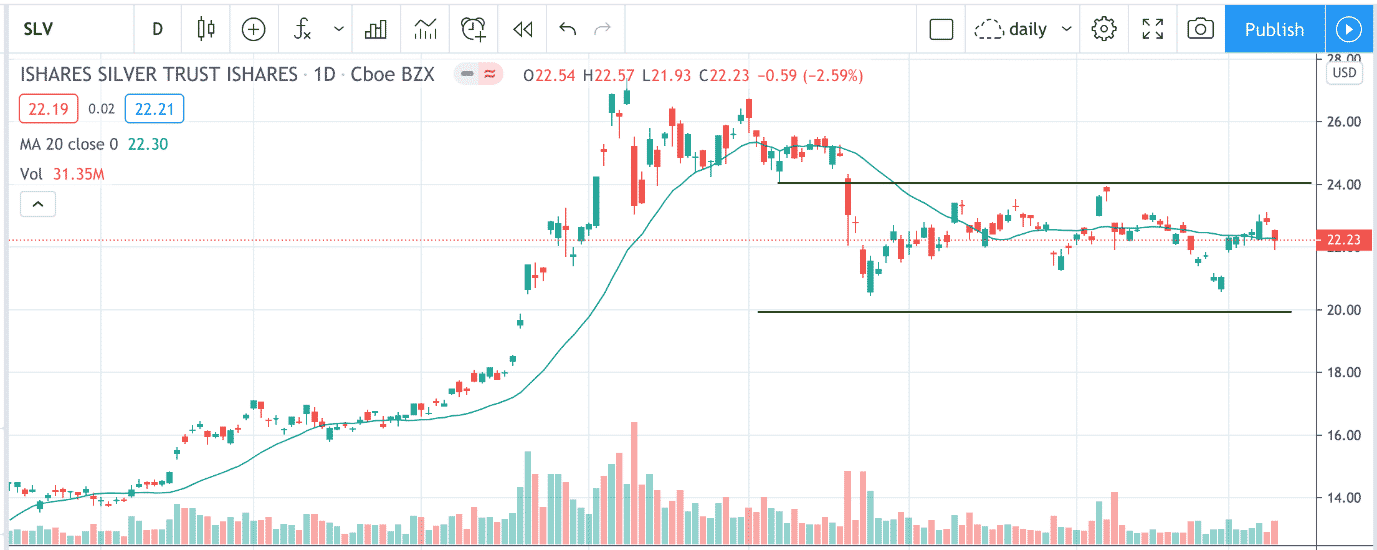

Suppose an investor already owns 50 existing shares of SLV and sees that SLV has been trading in a range.

The investor would like to sell if SLV drops significantly below the support level.

The investor would also like to sell to take profits if SLV reaches the top of the range.

The following OCO order would be placed.

Symbol: SLV

Action: Sell

Quantity: 50 shares

Order Type: Stop Loss

Stop Price: $20

Time in Force: Good to Cancel

Symbol: SLV

Action: Sell

Quantity: 50 shares

Order Type: Limit

Limit Price: $24

Time in Force: Good to Cancel

This is also known as a bracket order.

The two orders bracket the current price.

An investor with this order in place can just go on vacation without looking at the position.

No matter what the stock price does, instructions have already been given to the platform to take the necessary action.

OTOCO (One-Triggers-A-One-Cancels-The-Other)

The OTOCO consists of a primary order and two secondary orders.

When the primary order is fulfilled, the two secondary orders will be placed.

If either one of the secondary orders is executed, then the other secondary order will be cancelled.

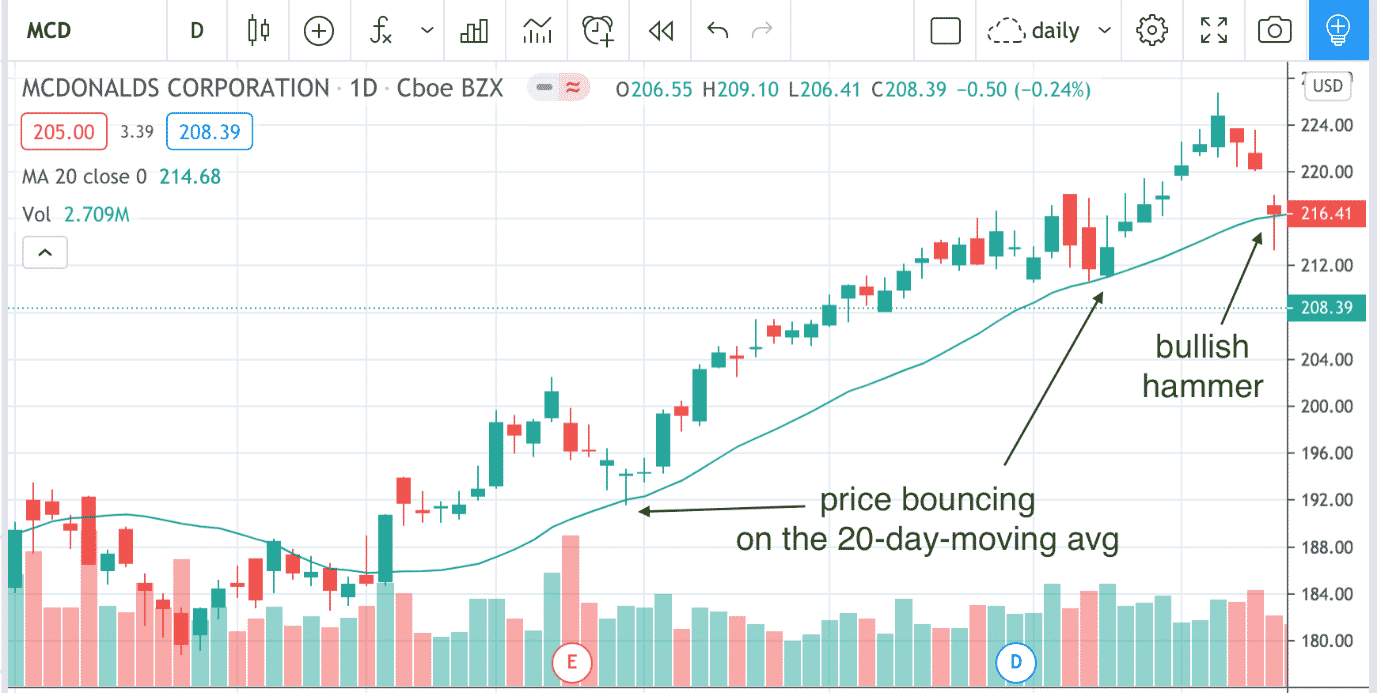

Suppose an investor sees a bullish hammer candle sitting on the 20-day moving average.

Even though this candle is red, it signifies bullish sentiment.

Read more about the bullish hammer here.

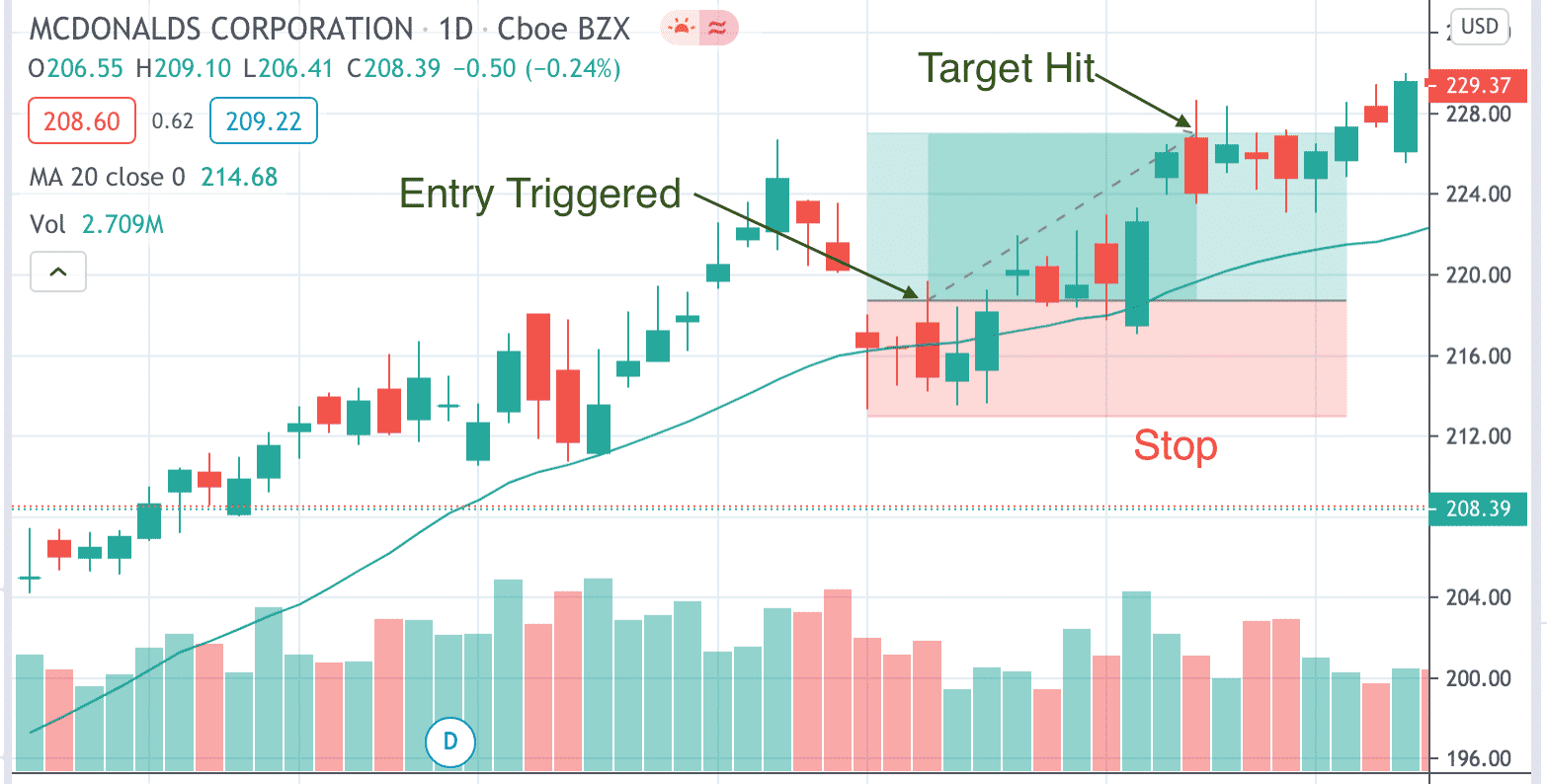

The investor places the primary order to buy 10 shares of MCD if the price goes above the head of the hammer candle.

Symbol: MCD

Action: Buy

Quantity: 10 shares

Order Type: Stop Limit

Stop Price: $218.25 (trigger price above the head of the bullish hammer)

Limit Price: $218.50 (will buy only if price does not exceed $218.50)

If this order gets filled, the investor would like to have a “take profit level” automatically set as well as a “stop loss”.

These two will be the secondary orders.

Symbol: MCD

Action: Sell

Quantity: 10 shares

Order Type: Limit

Limit Price: $227 (take profit if price gets up here)

Symbol: MCD

Action: Sell

Quantity: 10 shares

Order Type: Stop Loss

Limit Price: $213 (stop loss if price drops below the tail of the hammer)

If the take profit is hit, the stop loss is automatically cancelled.

If the stop loss is hit, the take profit is automatically cancelled.

The investor did not just randomly set the take profit and stop loss.

They have been designed to have a reward-to-risk ratio of 1.5. Because…

($227 – $218.5) / ($218.5 – $213) = 1.54

Would this trade would have work out for the investor?

Yes, indeed it would.

Conclusion

As you can see, brokerage platform orders can get fairly sophisticated these days.

Not all features mentioned above may be in all platforms, and the details of the order condition rules may vary.

If an investor is unable to be at computer during market hours and wants to partially automate some trade placements, it would be wise to read the fine print on conditional orders for the particular broker platform that the investor is using.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi,

Great article what platforms do you recommend to use these orders I have been searching for sometime but have not found many platforms that offer what you talk about in your article. Thank you

Try ThinkorSwim or Interactive Brokers.