Butterfly spreads are a popular options trading strategy that involves buying a long call and put option at the same strike price and selling two options at a higher and lower strike price.

While butterfly spreads can be a profitable strategy, they are not without risks.

One way to mitigate those risks is by adjusting the position as market conditions change.

In this article, we will explore the art of adjusting butterfly spreads and how traders can use this technique to optimize their profits while minimizing their losses.

Contents

Introduction

We assume that you are using the butterfly in an income-style non-directional delta-neutral type strategy – similar to an iron condor.

The goal of adjusting these butterflies is to:

- Keep the delta low.

- Keep the price underneath the expiration graph.

- Maintain or increase theta.

For example, adjust if the position’s delta gets too high.

Or if the delta becomes too negative, adjust.

Adjust if the price starts to go outside the upper breakeven point of the expiration graph.

Adjust if the price goes outside the expiration graph on the downside.

These are just examples.

You each have your own rules for the particular strategy as to “when” to adjust.

We are not telling you when to adjust but showing all the possible ways to adjust – well, most of the ways.

There are four categories of possible adjustments:

- Adjusting the wing widths

- Adding structure

- Layering

- Delta Hedge

- Rolling the butterfly

- Condorizing the butterfly

Adjusting The Wing Widths

The butterfly flies like the way the bird flies — by adjusting the wing widths.

The lower wing of the butterfly gives it bullish power.

The upper wing of the butterfly gives it bearish power.

This is true for all-put flies, all-call flies, and iron butterflies.

If you want to make the butterfly more bullish (that is to give it a more positive delta), you increase the size of the lower wing.

The lower wing gives it bullish power.

Another way to make the butterfly more bullish is to decrease the upper wing size.

This makes the upper (bearish) wing weaker.

If you want to make the butterfly more bearish (that is to give it a more negative delta), you increase the size of the upper wing.

Another way to make the butterfly more bearish is to decrease the size of the lower wing. This weakens the lower (bullish) wing.

The wider the wings, the more capital the butterfly requires.

Therefore, people typically perform adjustments that narrow the wing.

Remember to narrow the upper wing to make it more bullish.

Narrow to the lower wing to make it more bearish.

Two options define each wing.

One option in the middle and one of the long options.

This is more easily seen by looking at the iron butterfly.

The upper wing is the call spread.

The lower wing is the put spread.

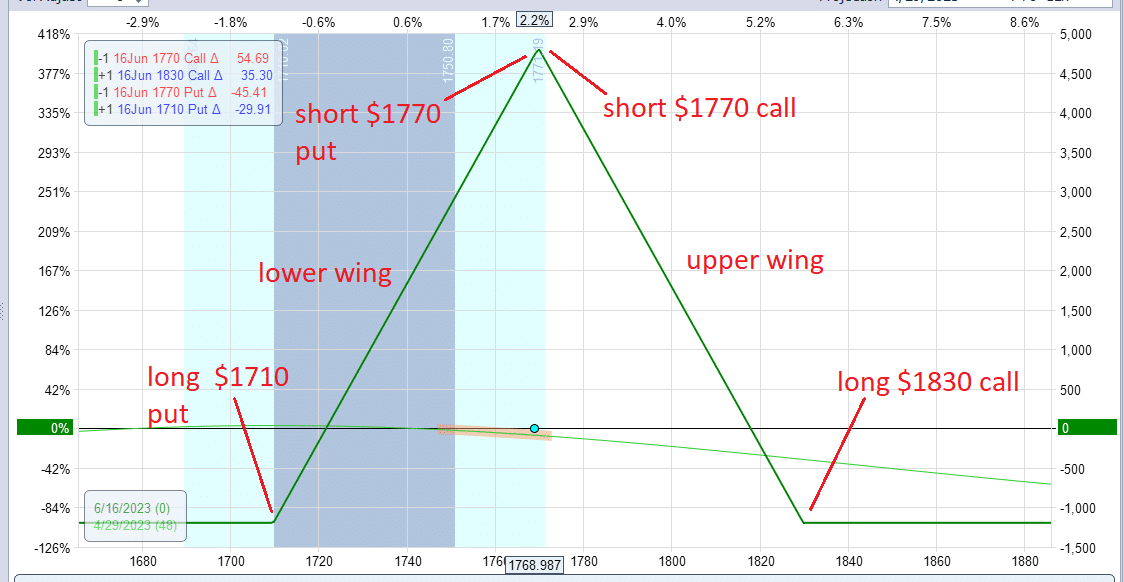

An iron butterfly with 60-point upper and 60-point lower wings on the RUT is the following.

Date: April 28, 2023

Price: RUT @ 1769

Buy one June 16 RUT 1710 put

Sell one June 16 RUT 1770 put

Sell one June 16 RUT 1770 call

Buy one June 16 RUT 1830 call

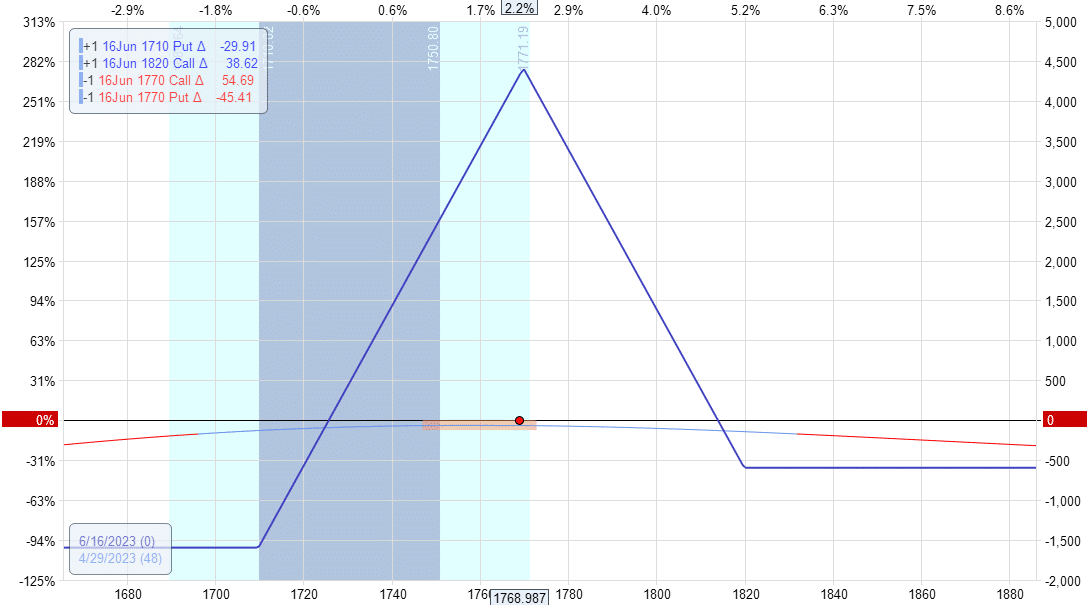

To narrow the upper wing, you can move the long call down.

Or you can move the short call up.

To narrow the lower wing, you can move the long put up.

Or you can move the short put down.

Due to put-call skew, this symmetrical butterfly has a negative delta of -4.

If you think this is too negative, you can make it less negative by narrowing the upper wing.

To narrow the upper wing, you can move the long call down.

Sell to close the $1830 call

Buy to open the $1820 call

Now you have the upper wing 50 points and the lower wing 60 points.

Delta has decreased to -0.78, which is our goal. This also happens to cause theta to decrease from 11 to 7.83.

Many will say it is worth it to decrease the delta and sacrifice a little bit of theta.

You will see in other adjustments a decrease in delta and an increase in theta at the same time.

What you have just seen is one of the more common ways to make a butterfly more bullish. It is known as the Reverse Harvey adjustment.

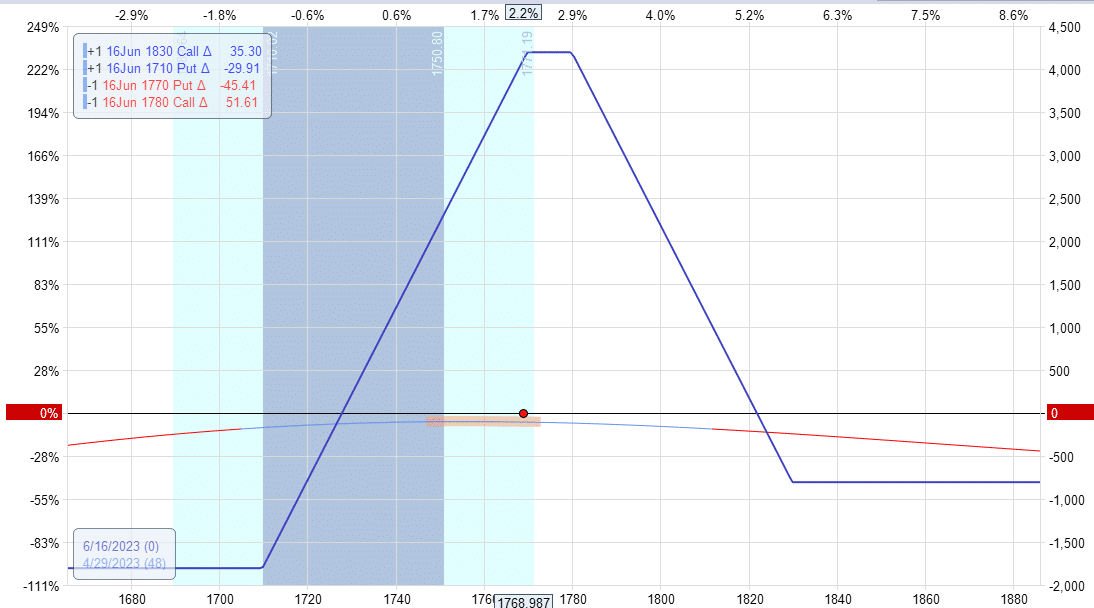

Another (less common but equally effective) way to narrow the upper wing is that you can move the short call up. Like this:

Buy to close 1770 call

Sell to open 1780 call

You still get a 50-point lower wing and a 60-point upper wing but without the pointed peak.

New delta: -1.1

New theta: 9.6

In this adjustment, the delta decreased not as much.

But its loss in theta is not as much, either.

For practice, perform similar adjustments to widen and narrow the lower wings by moving the long or short put.

See how it changes the delta and theta.

Adding Long Call

Another way to flatten the delta of a butterfly is to add a long call option to the butterfly.

Use a call with a delta equivalent to the negative delta of the butterfly.

In our example, the 60/60 symmetrical butterfly had a negative delta of -4.

Adding a 4-delta call option would flatten the delta.

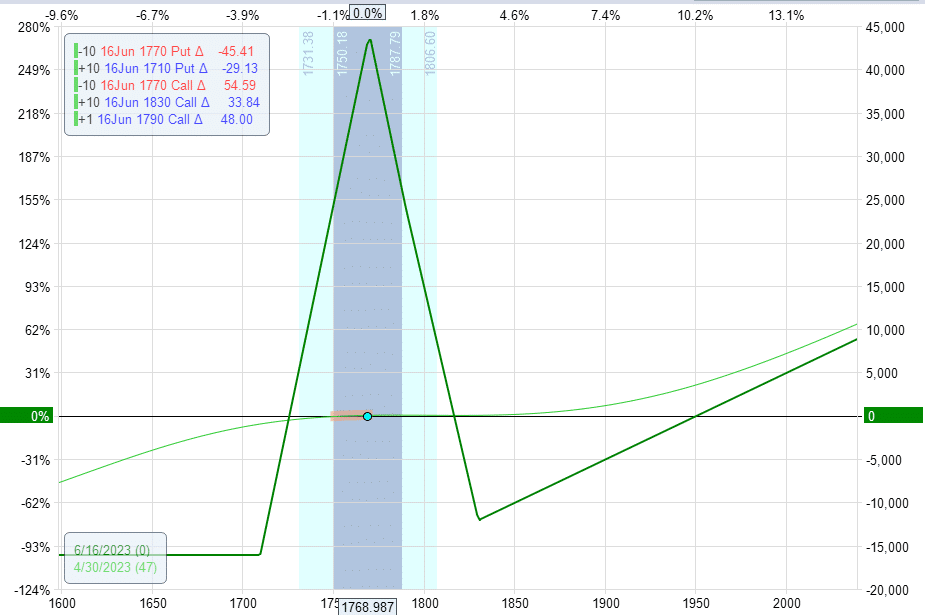

If we had a ten-lot butterfly, we would have a delta of -40 in the position (because the deltas are additive).

If we want to close the position delta to zero, we would add a call option with a delta of around 40.

Our position with a ten-lot butterfly and a single long call would look something like this:

Buy ten June 16 RUT 1710 put

Sell ten June 16 RUT 1770 put

Sell ten June 16 RUT 1770 call

Buy ten June 16 RUT 1830 call

Buy one June 16 RUT 1790 call

You can tell from the flatness of the T+0 line that the delta is close to zero.

According to OptionNet Explorer, the position delta is 4.7. For a ten-lot butterfly, this is considered fairly delta-neutral.

Some may say this looks like the profile of John Locke’s M3 butterfly.

The M3 is indeed a symmetrical butterfly with a long call.

However, this example is not according to John Locke’s specifications.

While the concept is the same, the wing width and positioning are different.

Adding Upside Calendars

Some traders like adding calendars on the upside to gain a positive delta.

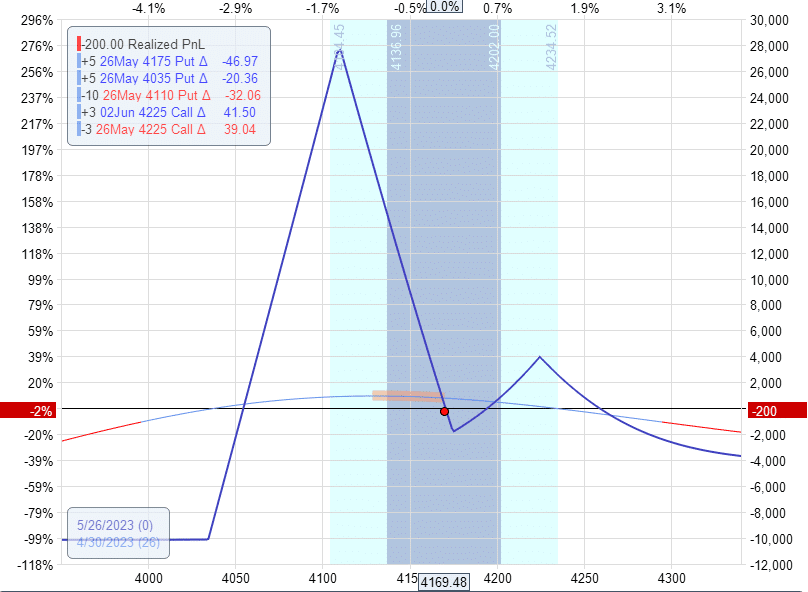

For example, suppose we had a broken wing butterfly on SPX where the price is about to head outside the expiration graph on the upside.

You can see the strikes and expiration in the below info panel.

The Greeks are:

Delta: -15

Theta: 75

Vega: -207

If we add three call calendars at $4225 with the short front call expiring on the same expiration of the butterfly and the long call expiring one week later, then we get this new expiration graph:

The delta has decreased by about half to -7.86.

Theta has increased to 97 due to the positive theta of the calendars.

The vega has almost been completely neutralized to a low value of -22.

This is because the long vega of the calendar balanced the short vega of the butterfly.

While this is one of the adjustment techniques in Amy Meissner’s A14 system, this is not the A14 butterfly.

The DTE (days to expiration) and the wing size are quite different.

We are not here to teach any specific strategy but to illustrate fundamental adjustment concepts that apply to all butterflies.

Adding Butterflies

Some traders don’t like calendars, perhaps claiming their behavior is less predictable.

In that case, they may add additional butterflies instead.

This is fine.

However, adding calendars on the upside makes sense because volatility tends to drop as the market goes up.

And calendars become less expensive when volatility drops.

On the other hand, for downside adjustments, when the price is going down, butterflies become less expensive.

A down move in the market is usually accompanied by increasing volatility.

Butterflies are less expensive when volatility is higher (due to higher premiums on the center strikes).

So it would make sense to add butterflies as additional structures on the downside as the price goes down.

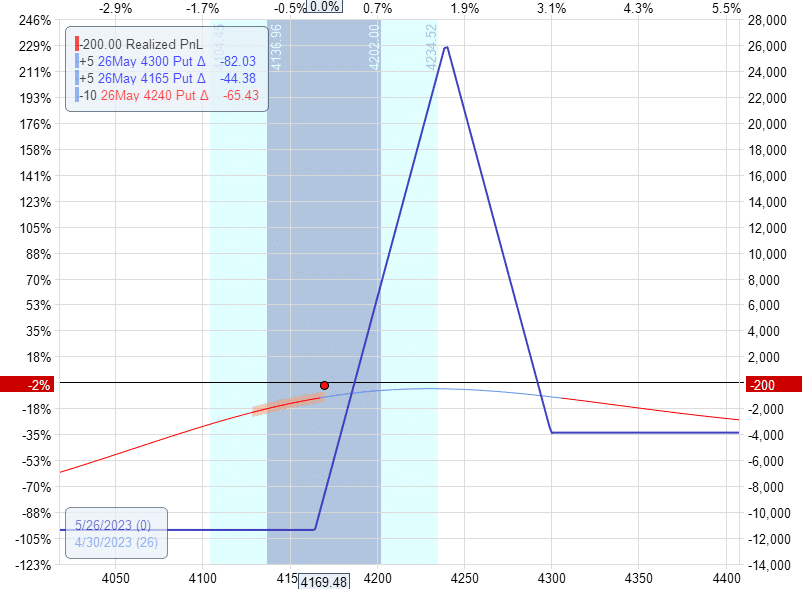

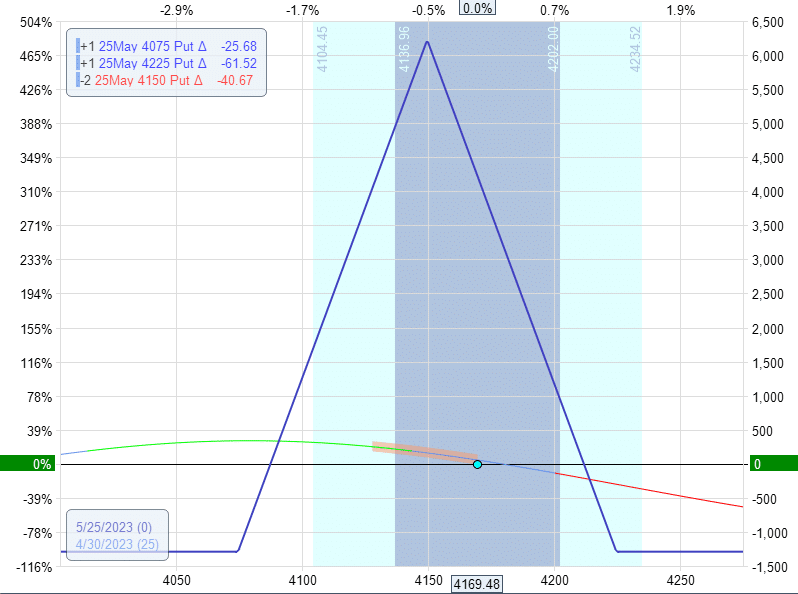

Here is a five-lot butterfly where the price had gone outside the expiration graph on the downside.

Delta: 21.4

Theta: 61.3

Vega: -450

Time to make an adjustment to lift the lower part of the T+0 line.

We added a second butterfly centered at 4150 with the same five-lot size.

The wing widths can be adjusted slightly to get the delta to where we want it.

The new position would look something like this:

Delta: 9.5

Theta: 161

Vega: -802

We have decreased the delta and expanded the profitable range of the structure. The additional butterflies increased theta.

Because we are adding negative vega butterflies to an already negative vega butterfly, the resulting vega is quite large at -802, which can hurt the trade if volatility goes up against us.

When we add additional structures such as a long call, calendars, or butterflies, we increase the risk in the trade because all these structures require a debit initiate.

In particular, adding the butterflies increased the risk from $12,000 to $20,000 (by looking at the graphs).

Layering

Adding structures such as calendars and butterflies above or below the current structure is often done when the price starts to move outside the expiration graph.

If you need to adjust deltas while the price is still fairly centered within the graph, and if you have capital and want to scale up the trade, then you can layer in another butterfly.

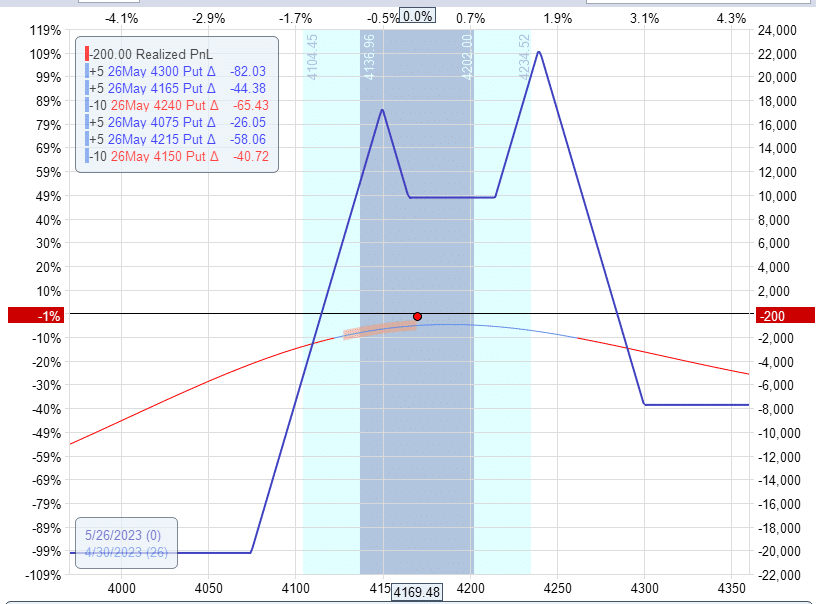

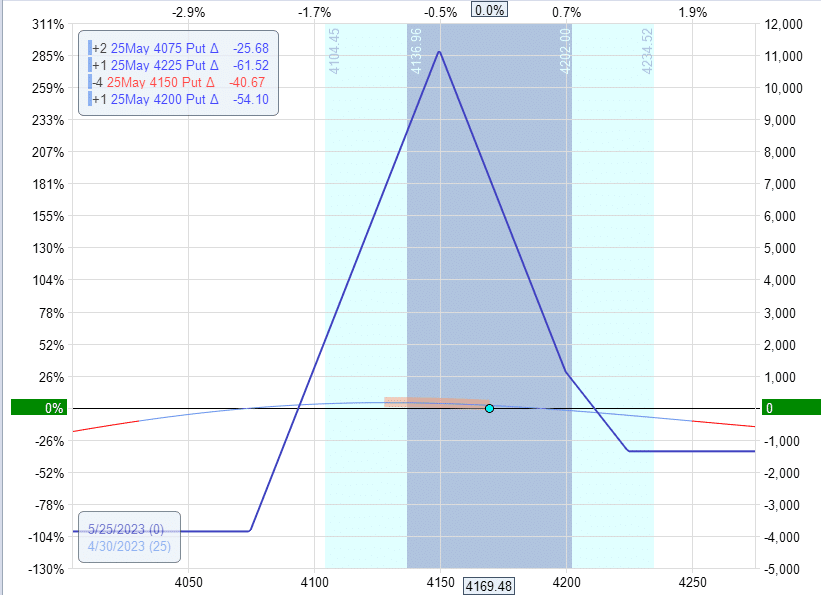

For example, suppose we had initiated a one-lot symmetrical butterfly on SPX with 75/75 wings because we felt that the market would go down tomorrow.

You can see from the slope of the T+0 line that this has a negative delta, so if, in fact, the market does go down, we would profit.

However, the next day, the market goes up instead.

We were wrong.

Now we don’t want the negative delta.

We need more positive delta.

So we add a bullish 50/75 butterfly on top of the existing one.

We use the same expiration.

We use the same strikes for the center and the lower leg.

Placing the following order:

Buy one May 25 SPX 4075 put

Sell two May 25 SPX 4150 put

Buy one May 25 SPX 4200 put

This will result in our new position with a somewhat flatter T+0 line.

This decreases the magnitude of our delta from -5.66 to -3.8.

Adding this second butterfly would naturally increase our theta and vega.

But because we have decreased our delta, the position’s overall Theta/Delta ratio has improved from 4.7 to 10.8.

The wings of the second fly can be adjusted to get the deltas we want.

We like to overlap as many strikes as possible.

Here we have overlapped the center strikes and the lower strike. We have two different upper strikes.

That’s why you see a bend in the upper expiration graph.

It also means we cannot exit the entire position in one order. We have to exit one of the layered butterflies at a time.

Delta Hedge

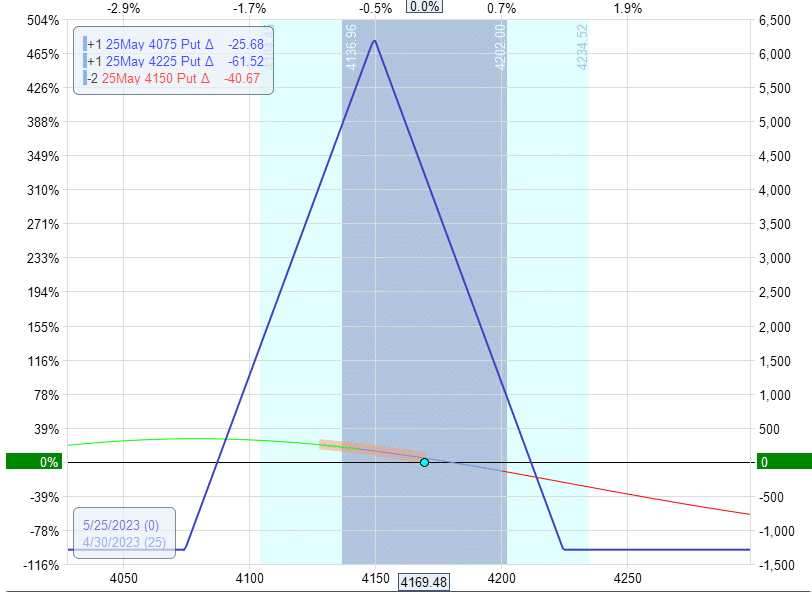

Instead of layering, another trader in the same situation could use a delta hedge.

While this is most often done on butterflies on stocks, we will use the same example where we were bearish on the SPX index and had this butterfly with a negative delta of -5.66.

If we are wrong and the market rips up to 4200 tomorrow, we can lose about $200 (just by eyeballing the T+0 line).

Afraid that the market will go up tomorrow, we want to hedge our delta by buying five shares of SPX.

However, SPX is an index.

It cannot be bought. Instead, we have to buy SPY (the equivalent ETF). SPY is one-tenth the size of SPX, so we have to buy 50 shares of SPY.

If SPX does, in fact, rip up to 4200, SPY will also go up to around $420. We see from the profit-loss graph of 50 shares of SPY that we would make about $200 from SPY going up to $420.

The nice thing about buying stocks and ETFs is that you can put the order in advance to trigger if the asset goes above a certain price.

We could have placed a good-til-cancel order to buy 50 shares of SPY if and only if SPY exceeds the price of 417, for example.

And if we do end up with shares of SPY, we can add a stop loss to remove our hedge if the market drops.

Rolling The Butterfly

We’ve seen that adding structures and layering adds risks to the trade and uses up additional capital.

To avoid this problem, it is often a better option to roll the butterfly down if the price breaks the expiration tent on the downside.

If the price breaks the expiration tent on the downside, rolling the butterfly down is frequently a better option to prevent this.

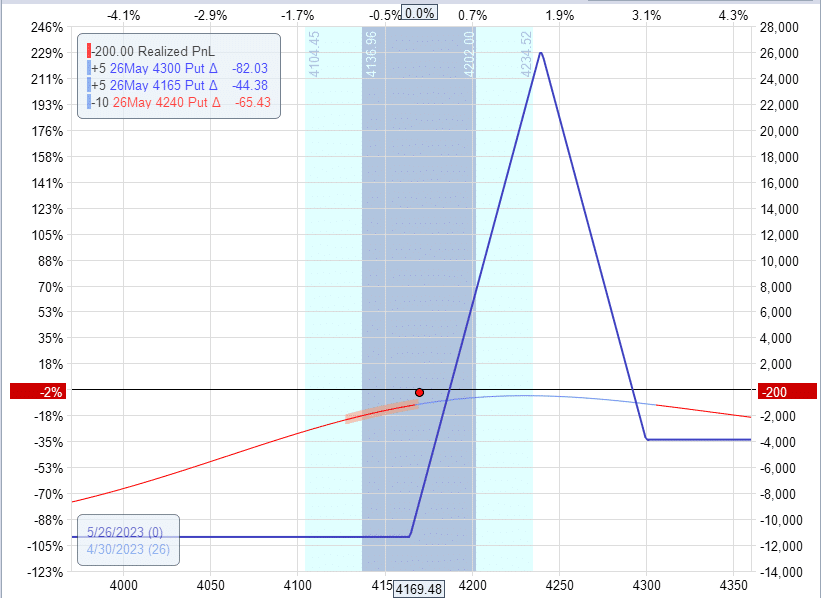

Suppose we have a five-lot position looking like this:

We sell to close the entire butterfly and open the same butterfly centered at where the price is.

Date: April 28, 2023

Price: SPX @ 4169

Sell to close five May 26 SPX 4300 @ $129.30

Buy to close ten May 26 SPX 4240 @ $87.75

Sell to close five May 26 SPX 4165 @ $53.55

Buy to open five May 26 SPX 4230 @ $82.10

Sell to open ten May 26 SPX 4170 @ $55.35

Buy to open five May 26 SPX 4095 @ $34.65

Net credit: $130

The important thing to note is that we usually can get a net credit for performing this adjustment.

This is great.

We are paid to move our butterfly from a bad position (as shown above) to a good position (shown below).

Delta: -1.1

Theta: 94

Vega: -396

We have neutralized the delta.

Theta increased.

And we have not increased vega to any significant amount.

Most importantly, there is no increase in the risk of the trade.

It remains the same at $12,000.

For these reasons, rolling the butterfly down is the primary go-to adjustment technique for a downside move by price.

Condorizing the Butterfly

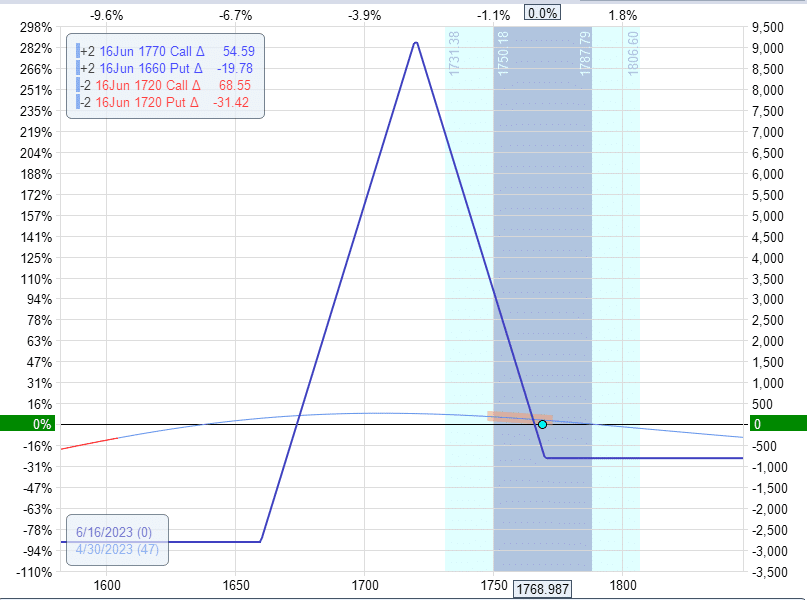

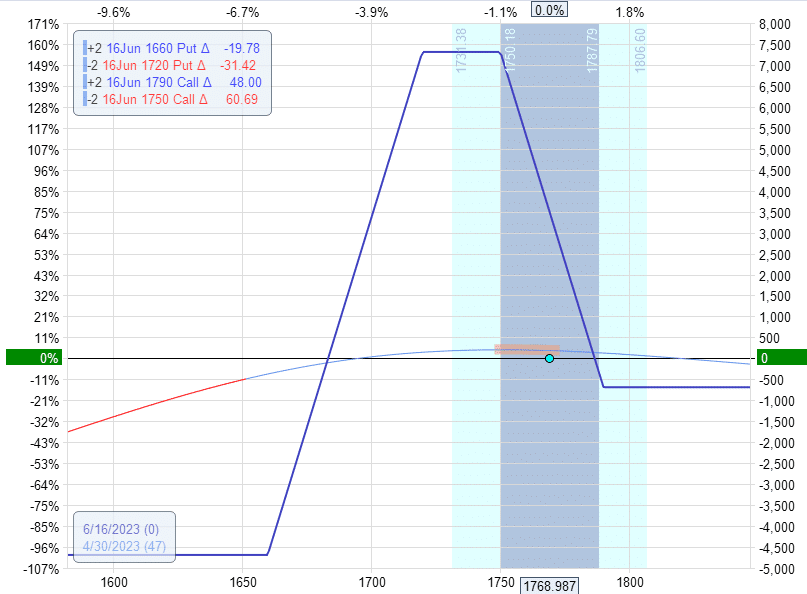

Suppose we have this iron butterfly on the RUT.

It is very similar to an iron condor.

Because if we “break its heart” by separating the middle options using this order.

Buy to close two June 16 RUT 1720 call

Sell to close two June 16 RUT 1770 call

Sell to open two June 16 RUT 1750 call

Buy to open two June 16 RUT 1790 call

Then we result in a broken heart butterfly:

The “broken heart butterfly” was a term that was used by TastyTrade back in 2020.

However, the term never caught on because it is just an asymmetric iron condor.

And people would rather say “condor” instead.

In this adjustment, we slide the bear call spread up and, at the same time, narrow the spread to decrease our deltas.

This adjustment changed the delta from -4.7 to -1.9.

Theta increased from 11.45 to 17.

Since it was a debit adjustment of -$1880, we lost some of the initial credit received from our original iron butterfly.

We see this because the max potential profit had decreased from $9190 to $7310. The butterfly lost its peak.

We have also increased the max risk by doing so.

This adjustment is sometimes known as “condorizing” the butterfly.

Frequently Asked Questions:

Why do we often get a credit when we roll a butterfly down?

We are rolling a butterfly closer to the money.

In general, butterflies at the money are less expensive because we are collecting higher premiums in the center strikes.

The at-the-money strikes have the highest extrinsic value.

Also, we are performing this move when the price of the underlying is dropping, which means volatility has increased.

Butterflies are less expensive during high volatility (also because we are collecting more premium in the center strikes).

So it is a good time in general to buy butterflies.

Overall, when we sell our existing butterfly to buy a new one at-the-money, we tend to get a credit.

Do we always get a credit for rolling the butterfly down?

No.

It depends on how far the underlying price movement changed and how volatility changed and skew and things like that.

Conclusion

There are so many ways to adjust a butterfly.

No guide is 100% complete.

Instead of breaking the heart of the butterfly, some traders might break the wing.

Some might go to the extremes of removing part of the wing (especially when the trader is about to scale out of the trade).

In a multi-contract iron butterfly, this is done by removing one or more call spreads to add a positive delta.

If we have a multi-contract dual fly, we may decrease the number of contracts in one of the flies.

Once you learn the basic principles, you can combine adjustment techniques.

In an upside adjustment, performing a Reverse Harvey along with adding calendars is a nice combination.

Other traders might calendarize the lower leg and narrow the lower wing at the same time.

Some traders will calendarize the long upper leg of a butterfly.

This is equivalent to adding a calendar at the same strike as the upper leg.

And on and on.

Hopefully, this provides a fairly comprehensive view of the various ways butterflies can be adjusted.

We hope you enjoyed this article about adjusting butterfly spreads.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Awesome article, Gavin!

Especially since there is so little literature about the Butterfly.

I only know one e-book about Butterflies without all the bullsh*t 🙂

This is handy to have on hand while backtesting.

Thanks again!

You’re welcome Peter. Glad you found it helpful. Let me know if you have any questions.

I know this is several months after the article was written, but I just came across it. Thank you! The amount of knowledge shared is awesome! So helpful as I am just learning about and beginning to appreciate butterflies, which I have avoided until recently. Thanks again!

You’re welcome Jeff, glad you enjoyed it. Reach out any time with questions.

We would need a program that, once a butterfly with the data feed from the broker has been inserted, analyzes the possible corrections when one side is tested and proposes them based on a target that you want to obtain, i.e. increase or reduce the delta while keeping the tetha high (butterfly is a theta strategy) or choose to reverse vega if volatility is increasing, possibly increasing theta. In the corrections you did not mention the credit spreads, the diagonals, which often also reduce the margin request on the account. This is why I repeat that if someone makes a similar program with a nice graphical interface like OptionStrat or ONE… they will become rich!

Doing all this manually with broker programs is a nightmare.

Considering we now have AI why not use it for this.

Thanks for your teachings.

This is a darn good idea.

Thank you.

Do you hear of OptionStrat service?

I like it because it has a better GUI (graphical user interface) than others options analyzers available in the net.

I’m suggesting them to add (to the “HistoricalChart” button that calculate the value of saved positions) also a graph of Theta and Vega on the saved positions, so it could help to manage neutral positions.

They have the 1 minute ticket feed data on Greeks.

What do you think about?

Hello Gavin

I found Beetrader.eu software.

I suggest to try it and review it.

They have also a WEB that is named Playoptions.it where you can download both Beetrader (montlhy pay) for trading automation and also Fiuto (free) for Options strategies analysis.

Their software do a lot of programmable automation on trading (like autohedging and adjustments on options positions) and send orders directly to many Brokers.

Keep me informed. Thank you.