Today we are going to talk about something different. We will look at some advanced option trading strategies to provide some food for thought for some of our readers.

One of the strategies that I do like is the Trapdoor Iron Condor.

However, I also want to scour the web to look for some other exotic options strategies to satisfy the thirst for knowledge.

Contents

Trapdoor Iron Condor

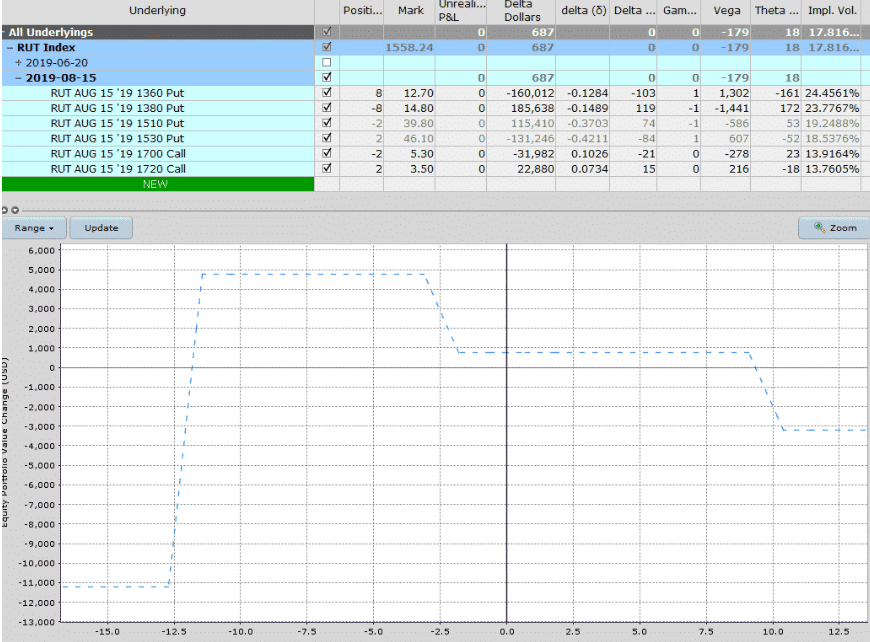

The Trapdoor Iron Condor is based on the traditional iron condor but with an additional debit spread embedded within it.

It consists of six option legs which you need to enter in three separate orders.

However, the extra complexity is worth it because it provides some additional beneficial characteristics to the traditional iron condor.

Here is what a Trapdoor Iron Condor looks like on the RUT.

The Rope Trade

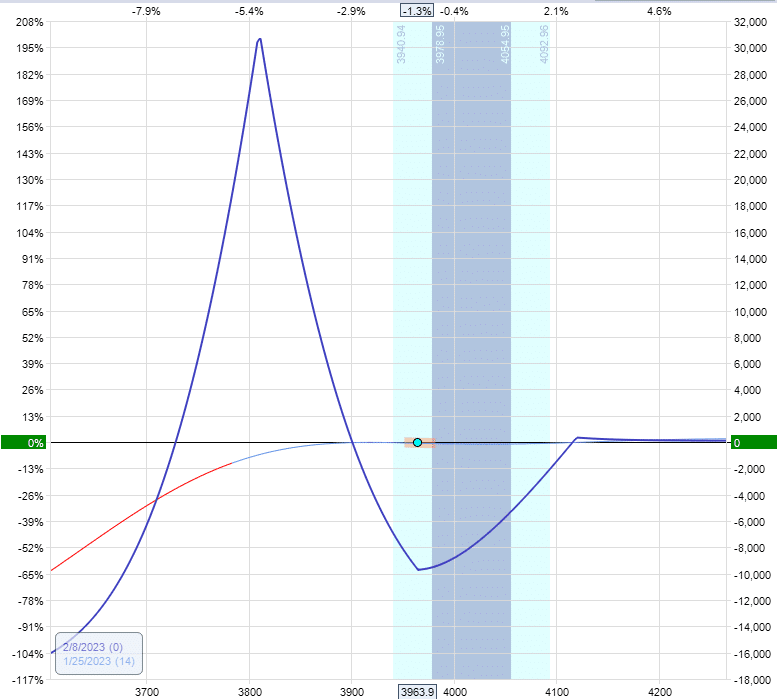

The Rope trade is an options structure invented by Wayne Klump, consisting of six legs.

Any options creature with more than four legs must be initiated with two separate orders into your broker.

In the case of the Rope, it consists of two symmetrical butterflies nested within each other.

The main fly is an at-the-money put fly.

And the secondary fly is a slightly out-of-the-money call fly.

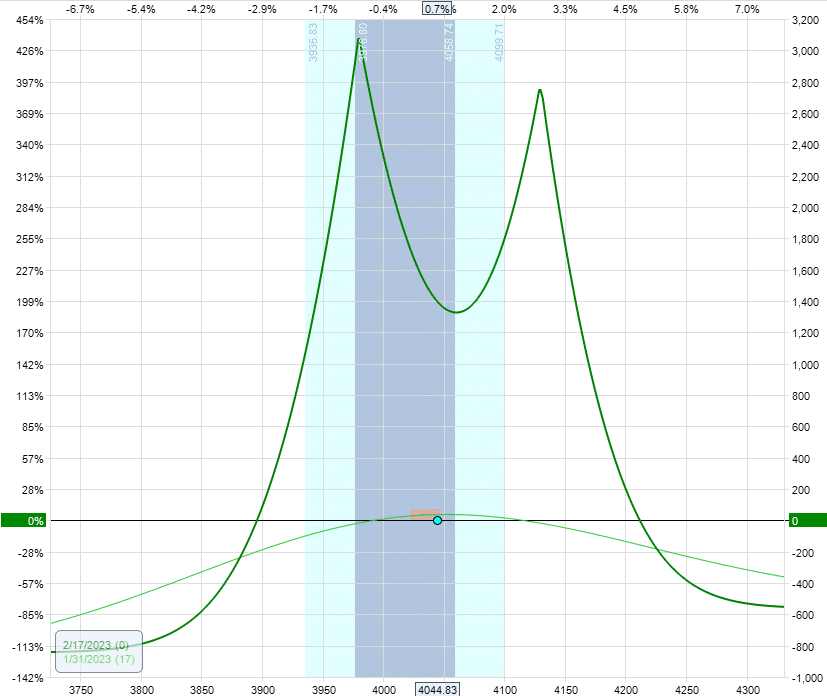

The Surf Trade

The Surf is another option creature that is the brainchild of Wayne Klump from Environmental Trading Edge.

It consists of a calendar coupled with a call debit spread.

Let me see if I can reconstruct a rendition of this trade structure based on his video presentation.

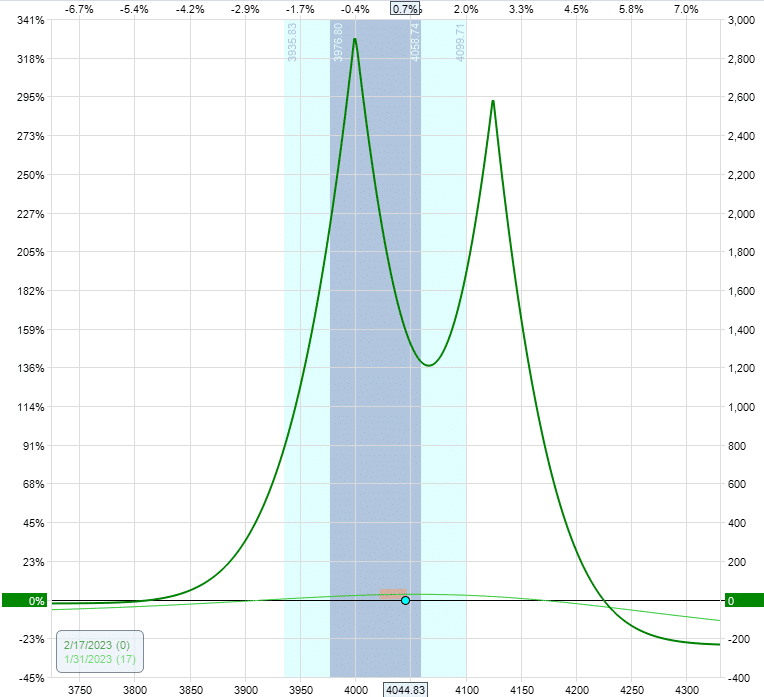

The Double Long Diagonal

With two diagonals of varying widths and each of which can have varying days to expiration as well as the distance from the current price, the double diagonal is considered the most flexible four-legged options structure.

The traditional double diagonal has the shorts closer to the money than the longs, as in this example here:

However, if you put the long options closer to the money than the shorts, as in this example here:

Then this is what Dan Sheridan and Mark Fenton call the “double long diagonal” instead of “double diagonal.”

The double-long diagonal has a flatter T+0 line.

The tradeoff is that when the double-long diagonal buys the long closer to the money, it buys more extrinsic value.

This means that the long options closer to the money decay faster than if they were further out of the money.

The net result is that the double-long diagonal has less theta decay than the traditional double diagonal.

This makes sense since you are buying more hedge of the short strangle.

To understand these advanced options strategies, one must learn the interplay between the intrinsic/extrinsic value with the Greeks and how they change as you move closer to the money and further out of the money.

The ViPars Trade

ViPars is pronounced just like the viper snake.

The name comes from the words “volatility pairs trade,” It is its creator, Scot Ruble’s favorite trade.

It involves buying a put option on the VXX when volatility is high and hoping to make money when VXX drops back to normal.

However, when volatility is high, there is a possibility that volatility may go higher or remain high for a long time, in which case the put option will lose money.

Therefore, the strategy also involves buying a put debit spread on the SPX as a hedge. If volatility goes up, SPX will likely have fallen, and we would make money on the debit spread to offset the loss on the put option.

However, if we are correct in the premise that VXX drops, then the asymmetric return of the put option would make more money than the cost of the SPX debit spread hedge.

This strategy is a bit advanced because it involves two underlying symbols, SPX and VXX.

These two symbols make for a good pairs trade because VXX is an exchange-traded fund (ETF) that tracks the short-term volatility of the SPX, which is the S&P 500 index.

The VXX is used instead of the VIX because it has a natural decay due to the way it is constructed.

In the video, Scot Ruble explains how harvesting profits from the trade is possible as the market moves up and down.

Harvesting profits and scaling into trades are also advanced techniques that can be applied in many options strategies.

For example, Amy’s A14 weekly income butterfly trade scales into calendars like the Rhino trade.

Frequently Asked Questions

How is the A14 butterfly different from the Rhino?

The A14 is a shorter-term trade at 14 DTE, whereas the Rhino is a 77 DTE trade.

The A14 does not scale into butterflies. It only scales into calendars.

The Rhino scales into butterflies and calendars.

Which is better? The traditional double diagonal or the double long diagonal?

The double diagonal has more theta decay, but the long double diagonal has a flatter T+0 line.

Which you think is better depends on if you think more theta decay is better or a flatter T+0 line is better.

If you wanted a flatter T+0 line than the double diagonal but didn’t want to buy as much hedge as the double long diagonal, you got it.

It is called the double calendar.

The double calendar is a good medium between the two.

Neither is better; the double calendar is the best (just kidding).

Why do option strategy creators give peculiar names to their strategy?

It is much easier to say “ViPars” than “Short volatility and use the index as a hedge in a pairs trade.”

The brevity makes it easier to refer to during conversation and easier to type when writing articles.

More importantly, it provides a short label of the strategy to put in your trading logs so that results can be more easily sorted and analyzed.

What are advanced option trading strategies?

Advanced option trading strategies are options trading techniques that go beyond basic buying and selling of calls and puts, and involve more complex strategies such those discussed above.

How do advanced option trading strategies work?

Advanced option trading strategies involve combining various option contracts to create a customized risk/reward profile.

These strategies can be used to take advantage of a wide range of market conditions, including bullish, bearish, and neutral market environments.

They all tend to focus on generating income through time decay.

What are the benefits of advanced option trading strategies?

The main benefit of advanced option trading strategies is that they offer traders more flexibility in managing their risk and reward profiles, compared to basic options trading techniques.

These strategies can also be used to generate income, hedge against market movements, and limit potential losses.

What are the risks of advanced option trading strategies?

The main risk of advanced option trading strategies is that they involve a higher level of complexity than basic options trading techniques, which means that traders need to have a deep understanding of the options market and the potential outcomes of their trades.

Additionally, these strategies can involve significant transaction costs and may not be suitable for all investors.

How do you manage advanced option trading strategies?

To manage advanced option trading strategies, traders should closely monitor the greeks including Delta Dollars and the T+0 line.

Traders should have a clear exit strategy in place and be prepared to close the position if their stop loss is hit.

Conclusion

Advanced options strategies are constructed in two ways.

They are either modifications of existing option strategies or they are combinations of two basic option structures that work well together.

Don’t be deceived by my simplistic explanations.

These advanced options strategies require a nuanced understanding of some of the details and characteristics of the strategies.

For example, what are the proper portions of SPX and VXX in the ViPars to “pair” them properly?

When is it the proper time to put on the Rope versus the Surf based on the market environment?

That is why the inventors’ company’s name is “Environmental Trading Edge.”

When might you consider legging into the double-long diagonal instead of immediately putting the full trade?

These are frequently asked (but unanswered) questions.

Perhaps if one of these advanced options strategies particularly appeals to you, you might find out these questions on your own as you study and practice the trade.

We hope you enjoyed this article about advanced option trading strategies.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Ciao Gavin,

La spiegazione di strategie avanzate che stai spiegando ultimamente sono molto

interessanti e aiutano molto a comprendere meglio il difficile mondo delle opzioni

continua cosi. Ti Rinrazio Molto per quello che Fai.

Un Caro Saluto

Enzo

Sei il benvenuto Enzo, sono contento che ti abbiano aiutato.