When it comes to trading options, weekly option strategies provide the biggest bang for your buck, but they can be risky.

Today, we’ll look at some of the best weekly option strategies including how to trade them, what the risks are and how to manage the trades.

We’ll even take a look at some expiration day strategies which is super exciting for an options nerd like me.

Contents

Introduction

Weekly options have exploded in popularity recently especially since many brokers have moved to a zero commission structure.

“Weeklies” are options that are available outside the regular monthly expiration cycle with popular stocks having many weeks available for trading, not just the front week.

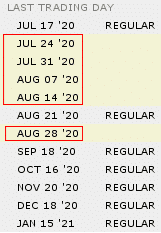

Below, you can see that AAPL has weekly options available for the next seven weeks when you include the regular monthly options.

Short term options have very high gamma, which means that price moves in the stock will have a big impact on the price of the options.

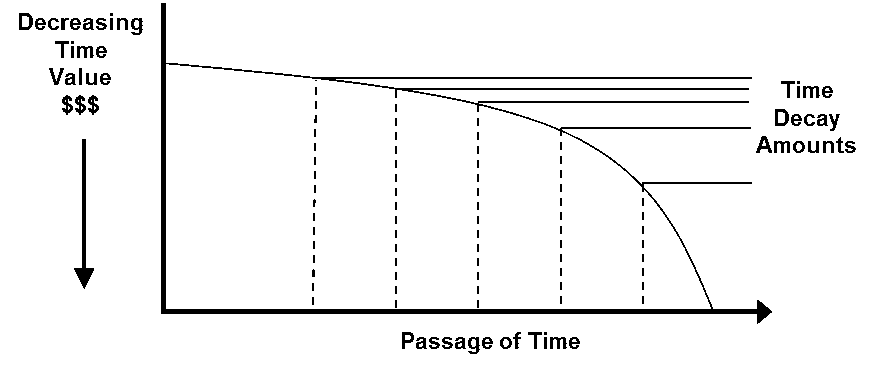

They also have very high theta which means thier value decays very quickly as the days (and even hours) tick by.

Traders that are net buyers of weekly options are long gamma and are looking for big price moves.

This also involves being short theta meaning that the position will erode in value over time if the big move doesn’t occur.

The opposite side of this trade is the theta sellers.

These are traders who are looking to profit from time decay and are hoping the stock doesn’t make a big move against them.

Image credit: CME Group

The Best Weekly Option Strategies

When it comes to weekly options, there are certain strategies that are great and others that you will want to avoid.

Let’s discuss some of the best strategies for weekly options:

Bull Put Spread

Bull put spreads are one of my favorite strategies and one of the easiest to trade.

You can read all about them here.

A bull put spread is a defined risk option strategy that profits if the stock closes above the short strike at expiry.

To execute a bull put spread a trader would sell an out-of-the-money put and then buy a further out-of-the-money put.

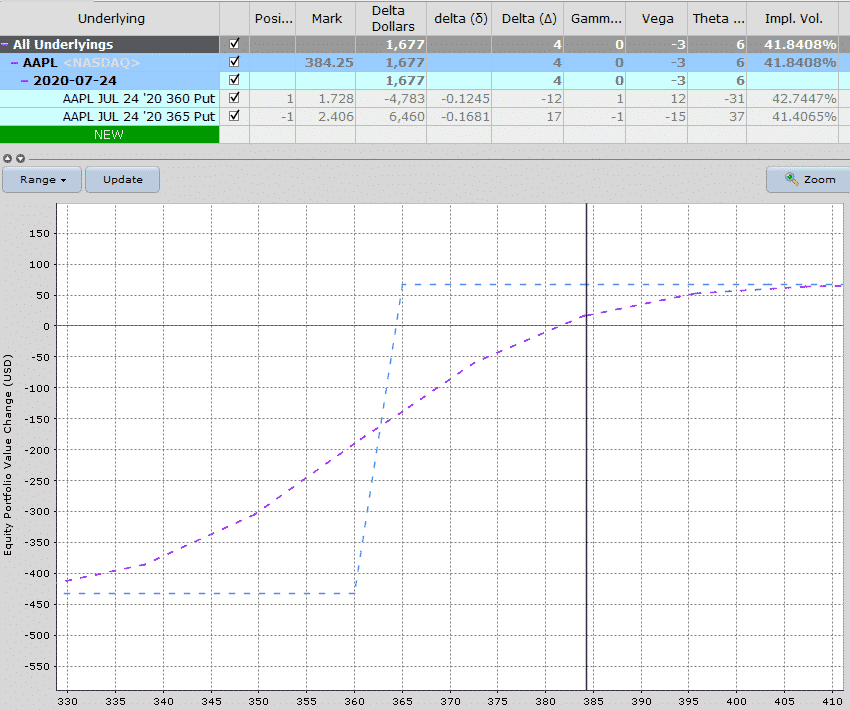

Here’s what a weekly bull put spread on AAPL might look like.

AAPL WEEKLY BULL PUT SPREAD

Date: July 16th, 2020

Current Price: 384.25

Trade Details:

Sell 1 AAPL July 24th, 365 put @ $2.40

Buy 1 AAPL July 24th, 360 put @ $1.73

Premium: $67

Max Loss: $433

Return Potential: 15.47%

The below bull put spread has delta dollars of 1,677 so this position is equivalent to owning $1,677 worth of AAPL shares.

Note that the delta dollars will change as time passes and the stock moves.

For a weekly trade like this, I generally like to trade with the trend and look for stocks which are above their 20-day moving average but not too overbought on the RSI indicator.

In terms of a stop loss I would use 2x the premium received so in this case I would close the trade if AAPL dropped and the trade was down around $130.

Looking at the interim (purple) line below that would be if AAPL dropped to around 366-367 within a few days.

Of course, this could be different depending on what happens with implied volatility.

Bear Call Spread

A bear call spread is the sister trade to a bull call spread.

Basically, the same setup but a bearish trade on the call side.

You can read all about bear call spreads in this 4,500 word guide.

To execute a bear call spread a trader would sell an out-of-the-money call and then buy a further out-of-the-money call.

Let’s look at an example using SHAK:

SHAK WEEKLY BEAR CALL SPREAD

Date: July 16th, 2020

Current Price: 49.82

Trade Details:

Sell 1 SHAK July 24th, 52.50 call @ $0.79

Buy 1 SHAK July 24th, 55 call @ $0.31

Premium: $48

Max Loss: $202

Return Potential: 23.76%

This trade has a higher return potential than the bull put spread because it has been placed closer to the money.

In this case we are short the 30 delta call and in the previous trade we were short the 17 delta put.

For weekly bear call spread, I look for stocks that are below the 20-day moving average, preferable with the 20-day average line declining.

At the time, SHAK was hitting the 20-day moving average as resistance.

A stop loss could be set at a stock price of 53 to 54 or a loss on the trade of anywhere between about $50 to $80 per contract.

Iron Condor

Weekly iron condors combine bull put spreads and bear call spreads to form a direction neutral trade.

The benefit with iron condors is that you generate two lots of premium which also helps reduce the capital at risk.

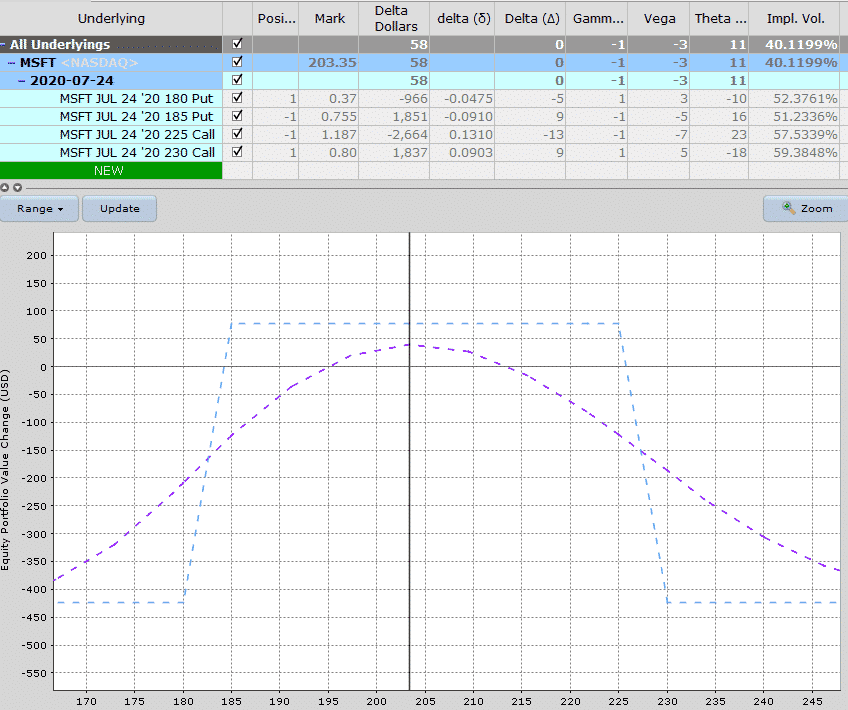

Let’s look at an example using MSFT:

MSFT WEEKLY IRON CONDOR

Date: July 16th, 2020

Current Price: 203.39

Trade Details:

Sell 1 MSFT July 24th, 185 put @ $0.75

Buy 1 MSFT July 24th, 180 put @ $0.37

Sell 1 MSFT July 24th, 225 call @ $1.18

Buy 1 MSFT July 24th, 230 call @ $0.80

Premium: $76

Max Loss: $424

Return Potential: 17.92%

With this trade we have created a delta neutral position where theta is the main driver of the trade.

Weekly iron condors don’t provide much opportunity for adjustment, so I would simply set a stop loss at 2x the credit received or around $150.

Based on the chart below, that would occur at prices around 183 on the downside or 227 on the upside.

Calendar Spread

Calendar spreads can also form part of your weekly trading arsenal.

These are positive vega strategies which benefit from an increase in implied volatility.

But… you still want the stock to stay within a specific range.

A calendar spread is created by selling the front week option and buying a back week option. For at-the-money calendars I tend to use calls.

If I’m doing a bullish calendar, I will use calls and puts for a bearish calendar.

This helps to reduce assignment risk.

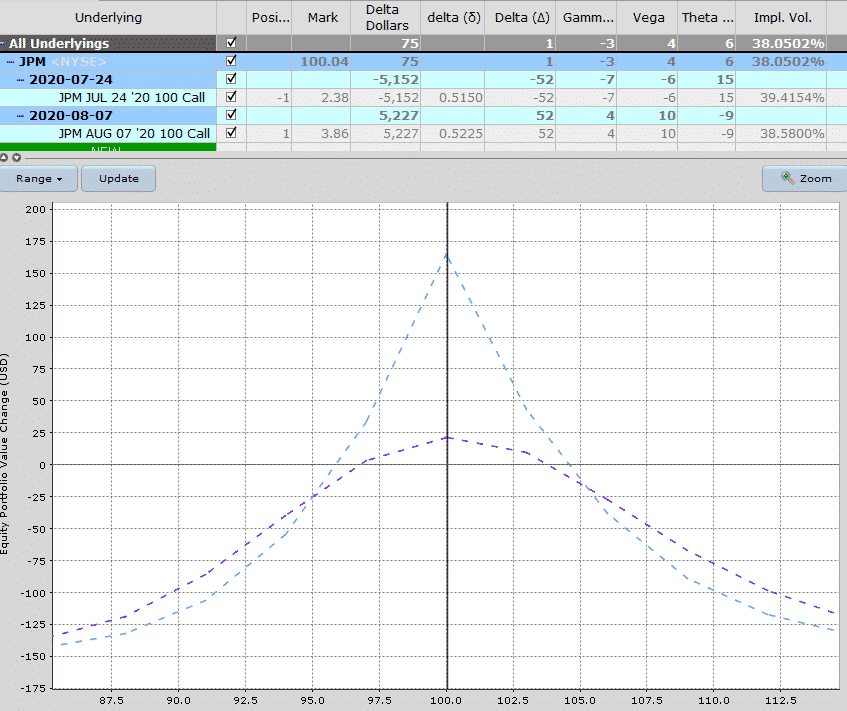

Let’s look at an example using JPM:

JPM WEEKLY CALENDAR SPREAD

Date: July 16th, 2020

Current Price: 100.04

Trade Details:

Sell 1 JPM July 24th, 100 call @ $2.38

Buy 1 JPM August 7th, 100 call @ $3.86

Premium: $148 net debit

Max Loss: $148

Max Gain: Estimated at $165

Return Potential: 111.49%

Even though the return potential is estimate at 111.49%, there is no way to know the maximum return due to changes in implied volatility in the back month option.

If volatility rises the return could be higher and if it falls, it would be lower.

Also, it is quite rare that the stock will pin the exact price of 100, so a trade like this may not achieve more than about $75 profit at most.

With weekly calendar spreads, I set a stop loss if the stock hits either of the breakeven prices so around 96 and 104.50 in this case.

Otherwise a 20-30% stop loss is also a good idea which would be $30 to $45 per contract on this trade.

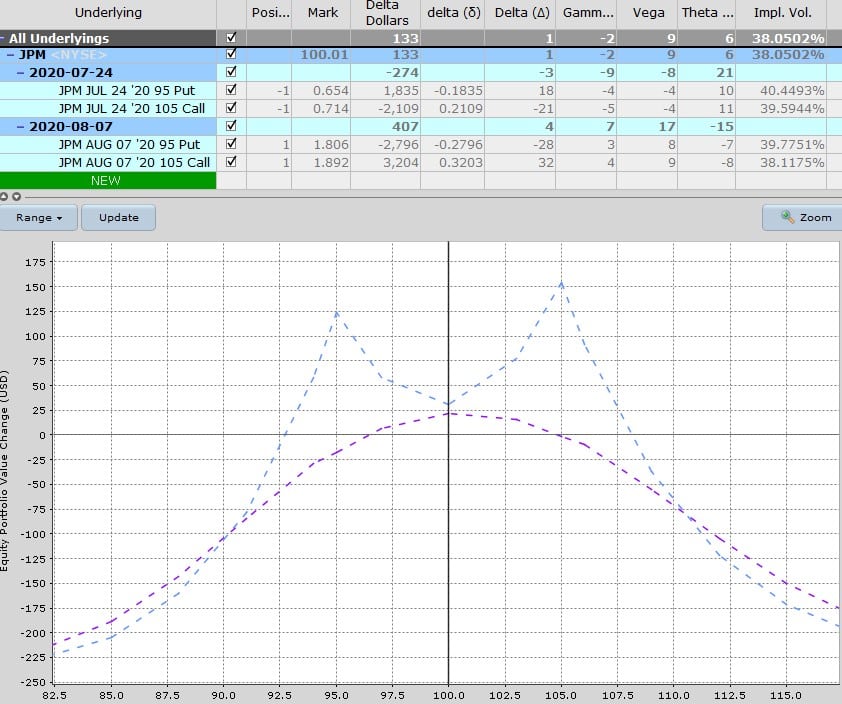

Double Calendar Spread

Rather than doing a single calendar, another possibility is to trade a double calendar, which widens out the profit zone.

A double calendar will cost more in terms of capital at risk and will also have a larger vega exposure.

It is created by buying a put calendar below the market and a call calendar above the market.

Let’s use JPM again to set up an example.

JPM WEEKLY DOUBLE CALENDAR

Date: July 16th, 2020

Current Price: 100.04

Trade Details:

Sell 1 JPM July 24th, 105 call @ $0.71

Buy 1 JPM August 7th, 105 call @ $1.89

Sell 1 JPM July 24th, 95 put @ $0.65

Buy 1 JPM August 7th, 95 put @ $1.81

Premium: $234 net debit

Max Loss: $234

Max Gain: Estimated at $125 on the downside and $155 on the upside

Return Potential: 66.24%

This trade has a slightly lower profit potential in dollar and percentage terms than the single calendar, but has a much wider profit zone.

Breakeven prices for this double calendar are estimated at 93 and 108.

Notice that this trade has much higher vega at 9 compared to the single calendar which has vega of 4.

For this trade, I would also set a stop loss of 20-30%, or if the stock breaks through the breakeven prices.

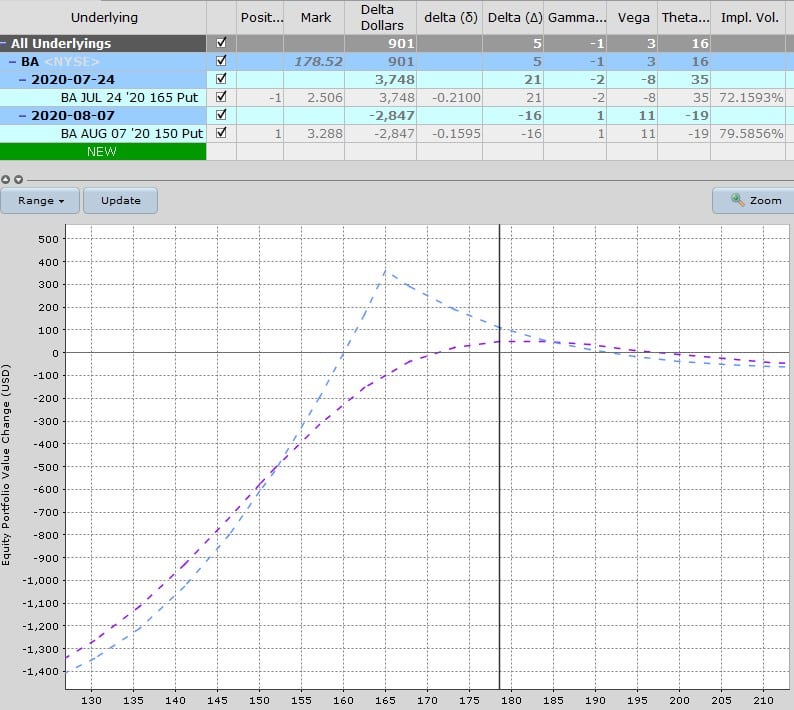

Diagonal Put Spread

Diagonal put spreads are a nice trade that have the potential to generate some income from stocks that don’t decline by too much.

They are an interesting trade because they start with positive delta and do ok if the stock stays flat or rises initially, but then also do well towards then end of the trade if the stock drops, as long as it’s not by too much.

You’ll see what I mean when you see the payoff graph below.

These trades are long vega which can help offset any short vega in the rest of your portfolio and can help limit the damage if the stock does drop.

One thing I like about this trade is you can set them up to have no risk, or very little risk on the upside.

You can read about them in more detail here, but let’s also look at an example using BA:

BA WEEKLY DIAGONAL PUT SPREAD

Date: July 16th, 2020

Current Price: 178.50

Trade Details:

Sell 1 BA July 24th, 165 put @ $2.50

Buy 1 BA August 7th, 150 put @ $3.29

Premium: $79 net debit

Max Loss: $1,579 (difference in the strikes plus the premium paid)

Max Gain: Estimated at $360

Return Potential: 22.80%

Similar to calendar spreads, we can’t calculate in advance what the maximum gain will be, but in this case, it’s estimate at $360 for a potential return on risk of 22.80%.

The trade has very little risk to the upside and is limited to the premium paid.

The risk on the downside is $1,579.

The initial T+0 line is quite flat but the trade will do well if the stock drops down to around 165-170 right near expiration.

0 DTE SPX Trades

Trading expiration day options has become very popular recently and I wrote a detailed post on the topic which you can read here.

The idea is that traders sell credit spreads or iron condors on options expiring on the same day.

These options experience massive time decay as the hours tick by on that final day and as long as the SPX index doesn’t make a big move, you’re golden.

I know a few traders who use this as their main strategy to trade for a living.

There are also methods you can use to create stop loss orders so the trade should never experience a max loss even if it is a particularly volatile day.

Using SPX options has an advantage in that there is no assignment risk because the options are cash settled.

They are also highly liquid with tight bid-ask spreads.

There is also no overnight risk and we’ve seen recently that markets tend to make large moves overnight and then trade relatively quietly during the day.

FAQ

How Do You Trade Weekly Options?

You trade weekly options just like you would monthly options.

They are exactly the same, just shorter-term.

Weekly options offer the highest return potential, but with high returns comes high risk.

Traders can lose a lot of money in a short space of time if they don’t know what they are doing.

Our favorite weekly option strategy is the Bull Put Spread.

Are Weekly Options More Profitable?

Yes, weekly options are more profitable.

The returns available are much higher.

However, anyone with a basic understanding of finance should understand that with high returns, comes high risk.

Option sellers can make significant income through time decay, but the tradeoff is gamma (price) risk.

With weekly options, a small move in the underlying can have a big impact on the option price.

Option buyers can also make high returns, if their opinion turns out to be correct.

However, if the trade does not work, it can suffer from severe time decay.

When Should You Trade Weekly Options?

You should trade weekly options according to your trading plan, and then only once you have gained significant experience.

Periods of high volatility can offer great opportunities for weekly option sellers and buyers alike.

Are Weekly Options Better?

Are weekly options better? Well, it depends of your goals and risk tolerance.

If you are a high risk trader, that is able to accept high fluctuations in profit and loss, then yes weekly options may be better.

Risk averse traders may be better suited to monthly or longer-term options which move a bit slower.

Time decay occurs much faster on weekly options, which means they are favored by some option sellers.

Is It Better To Sell Weekly Or Monthly Puts?

Selling weekly puts will offer a much higher return on an annualized basis.

But, like everything, high returns can come with high risk.

Conclusion

Weekly options provide a lot of flexibility for traders, but they are not without risks.

Small price moves in the underlying stock can potentially have a large impact on a weekly trade.

Monthly trades tend to move a lot slower, but the time decay is also slower.

It’s best to find a trading style that suits you. Weekly option strategies can be great for active traders who have the time to place and manage lots of different trades.

For those that are working full time or not in front of a computer much during the day, weekly strategies become much more difficult.

As with any strategy, it’s important to map out in advance where you will take profits, and where you will be stopped out of your trade.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Excellent article thank you Gav!

This article covers so many strategies extremely well. I have printed the article to keep in my educational files. Nice job and thank you.

Regarding calendar spreads, could using 35 deltas work the same on the P/L diagram, or be an even better payoff?

The payoff will be better, but you’ll need the stock to move as the trade would have a directional bias.

Thank you for showing the deltas in your trade analysis. Double calendars have a nice Risk/Reward on the Profit & Loss graph. I assume the purple line represents the stock price “today” and the blue line is assuming the stock price “at expiration.” To be clear, if the stock price is outside of the blue line at expiration, then that is a total loss of the debit, correct? If so, then it makes sense that most traders don’t hold until final expiration. Maybe take it off at 60-75% when it goes profitable? And a stop-loss of 20-30%? [I look forward to you possibly showing information on LEAPS spreads in the future as well.] Thanks again.

The reference to your favourite weekly as the bull call spread correct? You mean the bear call spread or the bull put spread as you have illustrated?

Yes, bull put spread it should say. Thanks John.