Introduction

The landscape of self-managed superannuation fund (SMSF) investment has evolved significantly, with trustees increasingly exploring sophisticated investment strategies to enhance returns and manage risk.

Options trading, when properly implemented within an SMSF, can serve as a valuable tool for both income generation and risk management.

However, this strategy requires careful consideration of regulatory requirements, investment objectives, and risk management protocols.

This comprehensive guide explores the key aspects of trading options within an SMSF, providing trustees and advisors with essential information to make informed decisions and maintain compliance with superannuation regulations.

Contents

Regulatory Framework and Compliance

Investment Strategy Requirements

The cornerstone of successful options trading within an SMSF lies in its regulatory compliance.

Before implementing any options strategy, trustees must ensure several key requirements are met:

The fund’s trust deed must explicitly permit options trading.

Many older trust deeds may not include specific provisions for derivatives trading, necessitating a deed update.

Qualified legal professionals should conduct this update to ensure it adequately covers all intended investment activities while maintaining compliance with superannuation law.

Options trading must align with the fund’s documented investment strategy.

This strategy should clearly articulate:

- The role of options in achieving the fund’s investment objectives

- The specific types of options strategies to be employed

- Risk management procedures

- The maximum allocation to options-based strategies

- How these strategies contribute to member retirement benefits

The sole purpose test remains paramount.

Trustees must demonstrate that all options trading activities are conducted with the primary objective of providing retirement benefits to members.

This includes maintaining detailed documentation of how each strategy contributes to this goal.

Documentation and Reporting

Proper documentation forms the backbone of compliant options trading within an SMSF. Required documentation includes:

- Transaction Records

- Position Monitoring

- Audit Trail

- Annual Reporting

Permitted Options Trading Activities

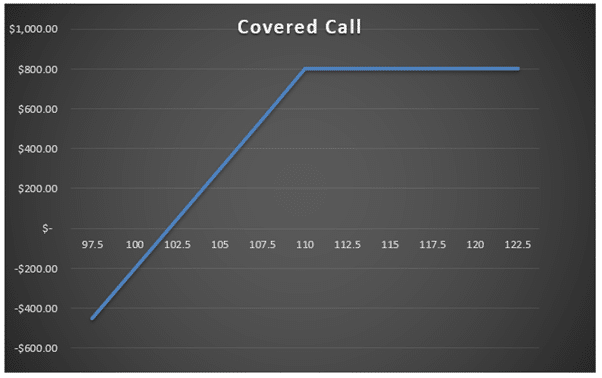

Covered Call Writing

Covered call writing is often considered the most conservative options strategy and is widely accepted within SMSFs.

This strategy involves selling call options against existing stock holdings, generating additional income through option premiums while accepting a cap on potential upside.

For SMSFs focused on income generation and willing to limit potential capital gains, covered calls can provide a reliable income stream while maintaining the benefits of stock ownership.

This strategy involves:

- Writing (selling) call options against existing stock holdings

- Collecting premium income to enhance portfolio returns

- Maintaining full coverage (no naked calls)

- Regular monitoring of position delta and potential assignment

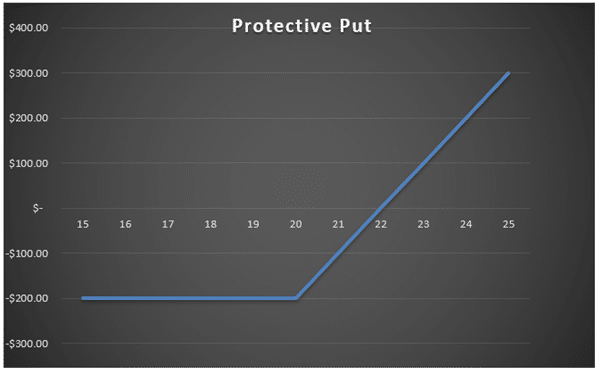

Protective Put Buying

Protective put buying serves as a cornerstone risk management strategy for SMSFs seeking to protect significant stock positions or portfolio value against market downturns.

This strategy effectively creates a floor price for stocks or index positions, providing trustees with a clear maximum loss potential while maintaining unlimited upside potential.

For SMSFs with substantial equity exposure or those approaching pension phase, protective puts can offer valuable insurance against market volatility while maintaining compliance with trustee obligations for risk management.

This strategy involves:

- Purchase of put options to protect existing positions

- Portfolio insurance considerations

- Cost management through strike selection

- Duration matching with investment timeframes

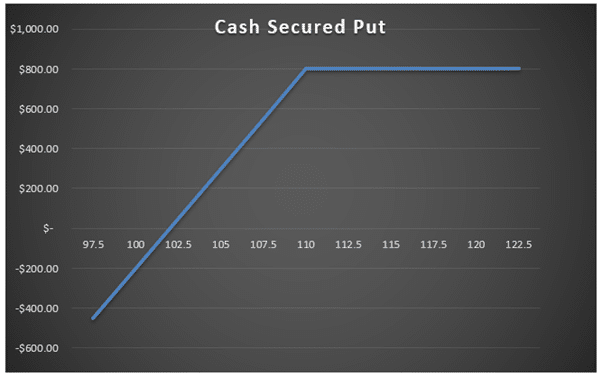

Cash Secured Puts

Cash secured puts offer SMSF trustees a methodical approach to acquiring stocks at prices below current market levels while generating income through option premiums.

This strategy requires setting aside the full cash amount needed to purchase shares at the strike price, ensuring no leverage is introduced into the fund.

Like covered calls, cash secured puts are generally considered acceptable within SMSFs due to their defined risk profile and clear alignment with investment objectives.

This strategy involves:

- Writing (selling) put options against fully secured cash positions

- Cash coverage equal to maximum potential stock purchase obligation

- Premium received upfront

- Potential to acquire stock below current market price

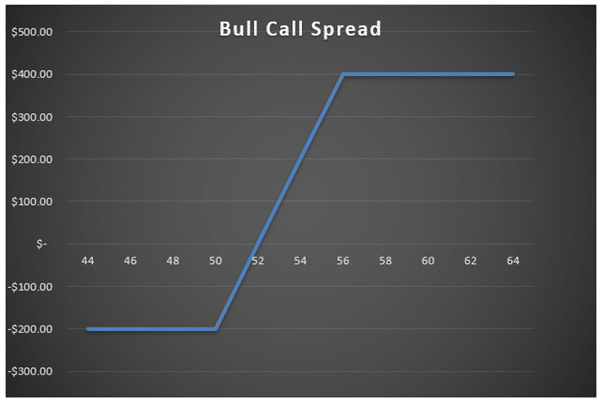

Debit Spreads

Debit spreads provide SMSFs with a defined-risk approach to implementing directional views on individual stocks or indices.

For SMSFs looking to implement directional strategies without the unlimited risk of naked positions, debit spreads are an attractive choice

Bull Call Spreads:

- Buy lower strike call

- Sell higher strike call

- Maximum loss limited to net premium paid

- Defined profit potential

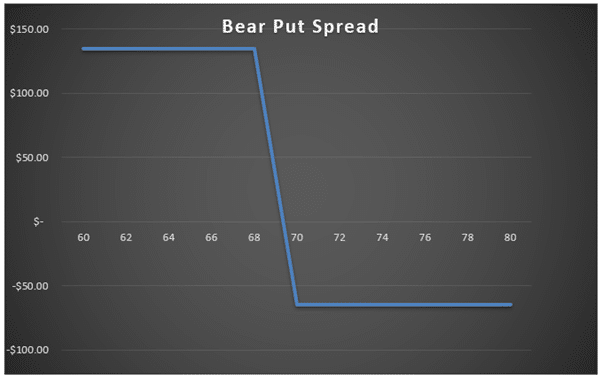

Bear Put Spreads:

- Buy higher strike put

- Sell lower strike put

- Maximum loss limited to net premium paid

- Clear risk/reward parameters

Credit Spreads

Credit spreads offer SMSFs a way to generate income through options while maintaining strictly defined risk parameters.

These strategies benefit from time decay and can be structured to profit from both bullish and bearish market views, while requiring less capital than outright stock positions.

For SMSFs seeking income generation with quantifiable risk, credit spreads can serve as a valuable alternative to traditional yield-focused investments.

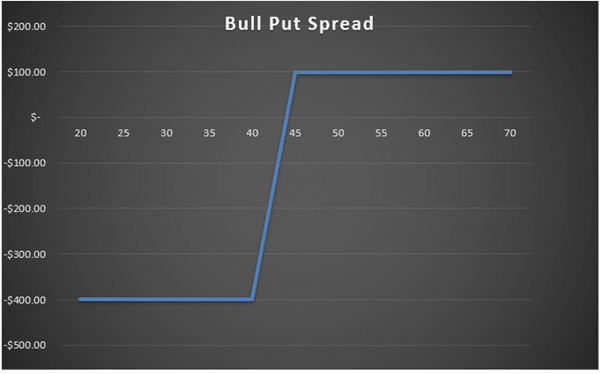

Bull Put Spreads:

- Sell higher strike put

- Buy lower strike put

- Maximum loss is spread width minus premium

- Requires appropriate margin/cash coverage

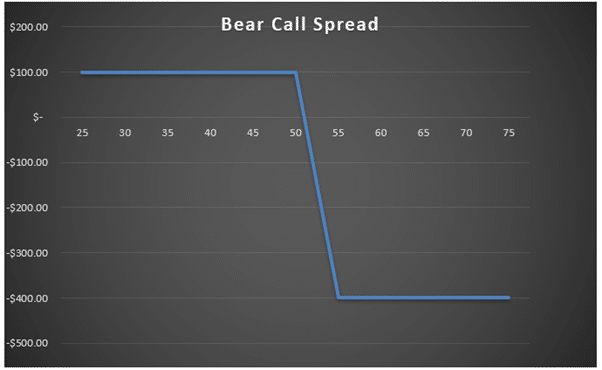

Bear Call Spreads:

- Sell lower strike call

- Buy higher strike call

- Maximum loss is spread width minus premium

- Must align with portfolio objectives

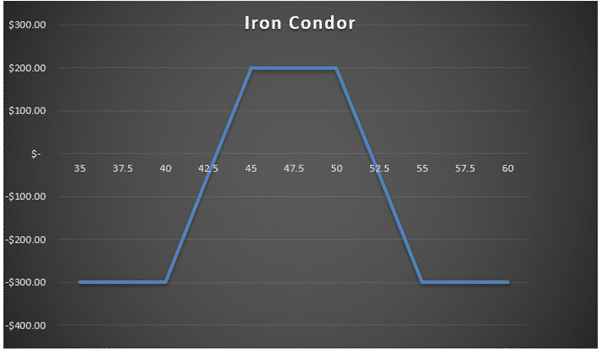

Iron Condors

Iron condors combine two credit spreads to create a market-neutral strategy that profits from range-bound price action and time decay.

This strategy appeals to SMSFs seeking to generate consistent income without taking a strong directional view on the market.

The defined risk nature and potential for regular income make iron condors particularly suitable for funds in pension phase seeking consistent returns.

This strategy involves:

- Bull put spread

- Bear call spread

- Defined maximum loss

- Income generation focus

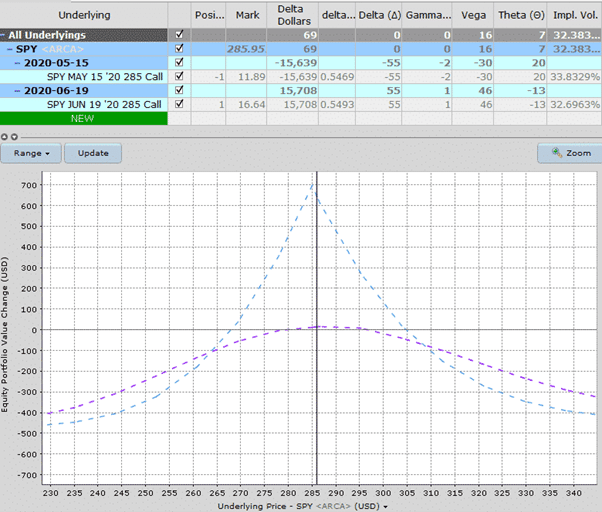

Calendar Spreads

Calendar spreads exploit the different decay rates of options across time, offering SMSFs a sophisticated way to benefit from time decay.

This strategy involves simultaneously buying and selling options with the same strike price but different expiration dates, creating a position that can profit from sideways or slowly trending markets.

Calendar spreads can be particularly effective in low-volatility environments when implemented as part of a diversified options strategy.

This strategy involves:

- Sell near-term option

- Buy longer-term option

- Same strike price

- Can be implemented with puts or calls

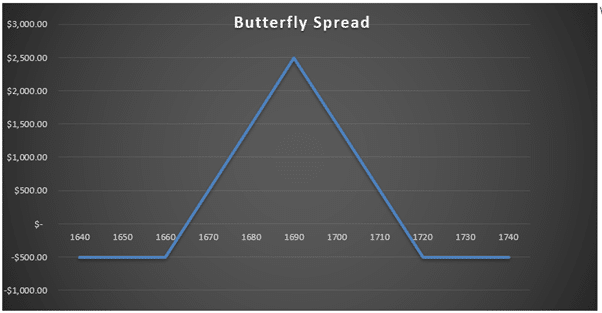

Butterfly Spreads

Butterfly spreads provide SMSFs with a precise way to target specific price levels while strictly limiting potential losses.

This strategy involves:

- Buy one lower strike option

- Sell two middle strike options

- Buy one higher strike option

- Can be implemented with calls or puts

High-Risk and Cautioned Activities

Understanding activities that may conflict with SMSF trustee obligations is crucial for maintaining compliance.

While there aren’t explicit legislative prohibitions on specific options strategies, certain activities require careful consideration due to their potential conflict with trustee obligations under the Superannuation Industry (Supervision) Act 1993 (SIS Act).

Key Legislative Considerations

Sole Purpose Test (Section 62 SIS Act)

- All investment decisions must align with providing retirement benefits

- High-risk strategies that could jeopardize retirement savings may conflict with this test

- Trustees must demonstrate how each strategy serves members’ retirement interests

Trustee Obligations (Section 52 SIS Act)

- Exercise due care, skill, and diligence

- Act in the best interests of beneficiaries

- Maintain a suitable investment strategy

- Consider risk and return appropriate to retirement purposes

Investment Strategy Requirements (Regulation 4.09 SIS Regulations)

- Consider risks in the context of the whole investment strategy

- Maintain appropriate diversification

- Ensure adequate liquidity

- Account for members’ circumstances

High-Risk Strategies Requiring Careful Consideration

Naked Call Writing

- Presents theoretically unlimited risk exposure

- May conflict with trustee obligations due to risk level

- Could be challenging to justify under the sole purpose test

- Generally avoided by SMSFs due to risk profile

Complex Multi-leg Strategies

- Must be carefully evaluated against trustee obligations

- Require comprehensive risk management documentation

- Need clear alignment with investment strategy

- May need specialist advice to implement properly

Margin Lending and Leverage

- Limited recourse borrowing arrangements (LRBAs) have specific requirements

- Leverage through options must be carefully considered

- Need clear documentation of risk management

- Must align with overall investment strategy

Conclusion

Trading options within an SMSF can provide valuable benefits when properly implemented. Success requires careful attention to regulatory requirements, risk management, and ongoing monitoring.

Trustees must maintain appropriate knowledge levels and engage necessary professional support to ensure their options trading activities contribute positively to member retirement benefits while maintaining full compliance with superannuation regulations.

Disclaimer

This article is for informational purposes only and does not constitute financial advice.

SMSF trustees should seek professional advice from qualified advisers before implementing options trading strategies within their fund.

Options trading involves significant risks and may not be suitable for all SMSFs.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Excellent summary. Majority part of my SMSF here in Australia for 20 years.