Understanding how to read an option chain is the first step towards investing in options.

We will break down the option chain into its components and introduce some vocabulary you need to learn.

An option chain is a table of numbers.

To read an option chain is to pick out the correct table for a particular option and be able to read information about that option.

Ultimately, the goal of reading an option chain is to determine a particular option’s price.

Contents

Steps To Reading An Option Chain

Four things uniquely specify a particular option contract.

- The underlying asset, as identified by its symbol

- The expiration date of the contract

- The strike price of the contract

- The type of the contract (whether it is a call option or put option)

To look for the price of an option in an option chain, you want to specify all four pieces of information in that order.

First, pick out the symbol, then select the expiration date.

Scroll down to the strike price.

Then, look left or right for the call or put.

Example Of Reading An Option Chain

While different platforms will show the option chain slightly differently, some commonalities exist.

Without favoring any particular broker platform, we will give you an example of an option chain from Yahoo Finance.

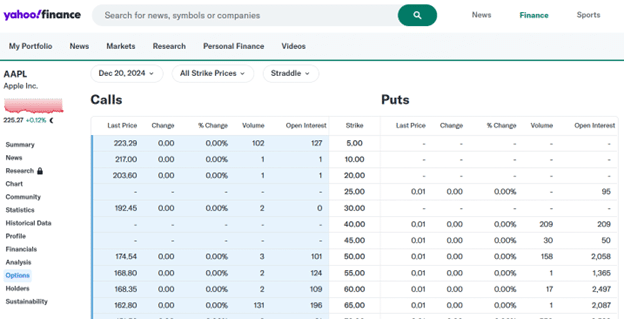

Below, we have entered the stock ticker symbol AAPL for Apple stock.

Then, we selected the expiration date of December 20, 2024, from the dropdown menu.

This screenshot shows the option chain for AAPL options expiring on December 20, 2024.

When the two option chain tables are placed side by side, the table for the call options is usually on the left, and the table for the put options is on the right.

The columns of data will differ, and platforms will allow you to configure them to show other details of the options, such as their Greek, delta, implied volatility, etc.

The two things that every table must have are the strike price of the option and the price of the option.

In our example, the strike price is the middle column, and it is for both the call option chain on the left and the put option chain on the right.

The strike price is typically listed in ascending order, with the lower strike price at the top.

The price here is listed as the last price traded.

But it can be listed as the bid, ask, or mid-price.

At The Money

If you scroll down the table, there will usually be a horizontal demarcation that you will notice:

Here, we see that the row for strike $225 is a bit different.

That is because Apple is currently trading at around $225.

The $225 strike is known as “at-the-money“.

The shaded blue indicates the options that are “in-the-money”.

The call option with a strike price of $210 is in-the-money because $210 is below the current stock price.

The put option with a strike price of $250 is in-the-money because $250 is above the current stock price.

It is in the money by $25 because it has $25 worth of intrinsic value.

The owner of the $250 put can sell the stock at $250 when the stock is trading at $225 – a $25 of moneyness.

The $245 call option is out-of-the-money because it currently has no intrinsic value since AAPL is trading only at $225.

However, it has extrinsic value because it has the potential to be in the money in the future.

Price Per Share Basis

The price in the option chain is always quoted on a per-share basis.

From the table, we see that the price of the $215 call option is priced as $13.14.

That means an investor needs to pay $1314 to buy one contract of the $215 call option on AAPL, expiring on December 20, 2024.

One contract specifies that the contract’s owner has the right to buy 100 shares.

With the option priced at $13.14 per share, the owner has to pay $1314 to buy this one contract.

Conclusion

Reading an option chain is a fundamental skill for any options trader.

Practice reading the option chain in your particular platform and see what information it gives you for an option.

For sure, it would give you the market price for the option.

Does it show the bid, ask, and mid-price?

Can the option chain be configured to show different, more advanced information?

What about the option Greeks, implied volatility, and open interest?

These are things you should explore.

We hope you enjoyed this article on how to read an option chain.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.