Today, we’re looking at how to buy leap options as a stock substitute.

Buying leaps calls if effectively like trading with leverage, allowing you to control a large number of shares with less capital.

Contents

- Introduction

- LEAP Options – What Are They?

- Getting Started With LEAP Options

- The Disclaimer

- Picking A Number

- Comparing Leap Options With A Stock Position

- Waiting And Summary

Introduction

Purchasing long-term calls, often known as “LEAPS,” is a strategy that may be employed using calls and offers potential for success for novice options traders.

The idea is to obtain returns equivalent to those you would receive if you owned the stock while limiting the risks you would encounter if you included the stock in your portfolio. In practice, your LEAPS call serves the role of “stock replacement.”

LEAP Options – What Are They?

Options with a longer-term expiration are referred to as LEAPS. Leap options are a short form of “Long-term Equity Anticipation Securities” and refers to a particular sort of investment.

And just in case you’re the kind to wonder about such things, the capital P in “Anticipation” was not an error.

LEAPS are a form of option with more than nine months remaining till expiration. Do not be deceived by the fact that they are known by a different name. It is merely another way of emphasizing that their “shelf life” is considerable.

Getting Started With LEAP Options

Select a stock to invest in to begin. It is strongly suggested that you follow the same approach as if you were purchasing the shares.

Barchart and Finviz have some good research tools you might like to consider.

You must now choose the price at which you will strike. You are interested in acquiring an out-of-the-money LEAPS call option. (When discussing calls, “in-the-money” indicates that the strike price is more than the current price of the underlying stock.)

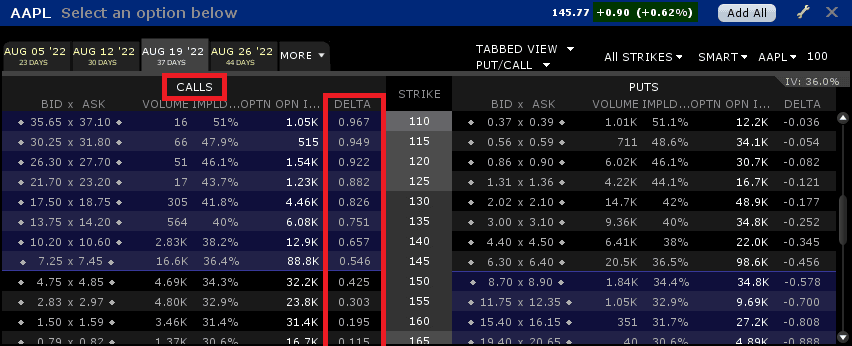

A decent rule of thumb to follow when applying this approach is to look for a delta at the strike price that is more than or equal to 0.80.

Keep in mind that a delta of 0.80 signifies that the price of your option will increase by $0.80 if the underlying stock’s price increases by $1.

If the delta of your options is 0.90, then for each $1 change in the stock price, your options should increase by 0.90, and so on.

Most broker’s will show the option delta, this example is from Interactive Brokers.

Consider as a starting point a LEAPS call that is at least 20% of the stock price in the money. This will give a stable basis upon which to grow. (If the underlying stock is $100, for example, you should acquire a call option with a strike price of $80 or less.)

To obtain the desired delta, you may need to go deeper in the money for options on highly volatile stocks.

The cost of your choice will grow proportionally as you get further into the money. This is because it will have a greater value in and of itself.

This has the advantage of resulting in a larger delta. And the greater your delta, the more your option will behave like a stock replacement when the price of the underlying stock fluctuates.

The Disclaimer

You must remember that even alternatives with a long-term commitment have a limited duration. If the stock price skyrockets the day after your option expires, then purchasing it was a waste of money.

In addition, as the expiration date approaches, the value of options continues to drop at an accelerated rate. Consequently, pick your time range with care.

Consider obtaining a call option with an expiration date that is at least one year away. This is an excellent rule of thumb to adhere to. This makes the strategy appropriate for investors with a longer-term outlook.

Ultimately, we are considering this strategy as a prospective investment, not a mere gamble.

Picking A Number

After determining the strike price and the month the option will expire, the following step is to select the number of LEAPS calls to purchase.

When trading options, you should normally trade the same amount of contracts as you would when trading the underlying shares.

Buy one call option if you would otherwise purchase 100 shares. If you would ordinarily acquire 200 shares, you should instead get two calls, etc.

Caution is advised, since if your call options become worthless, you may lose the whole amount invested.

Comparing Leap Options With A Stock Position

Leap options will perform in a similar manner to a 100 share position with some key differences.

Let’s look at an example.

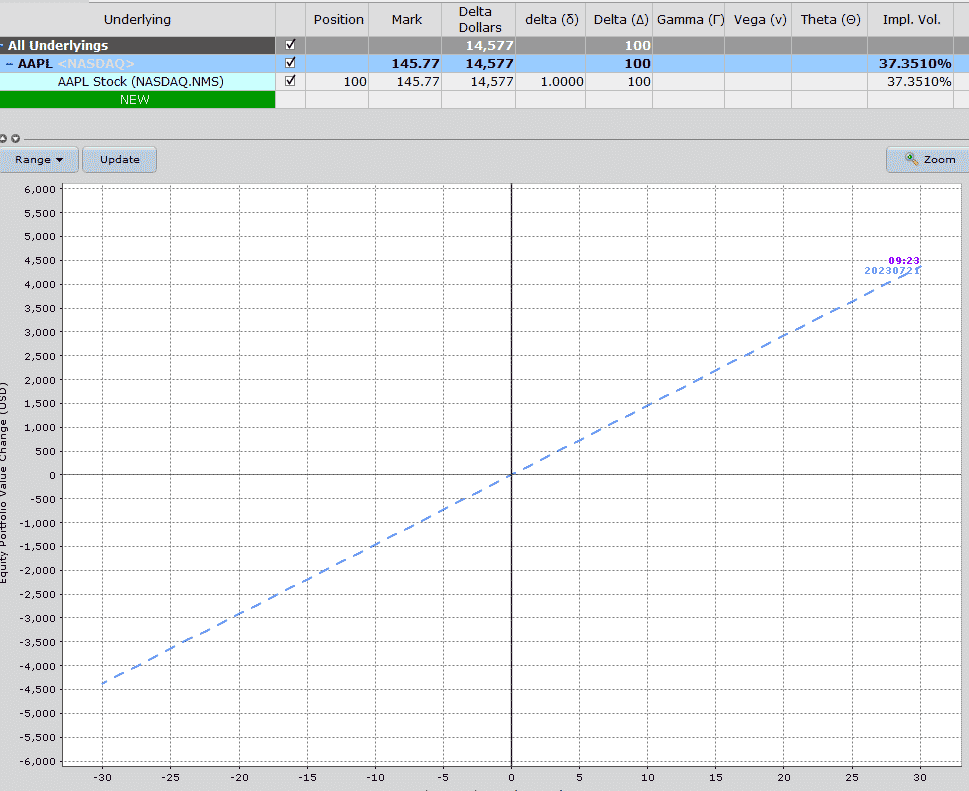

First, let’s evaluate a simple stock position of 100 shares of AAPL stock.

We can see that a pure stock position has a linear payoff.

The stock goes up we make money, the stock goes down we lose money. he delta is 100 and there is no exposure to the other option greeks.

The maximum loss is $14,577 in the (unlikely) event that Apple shares go to $0.

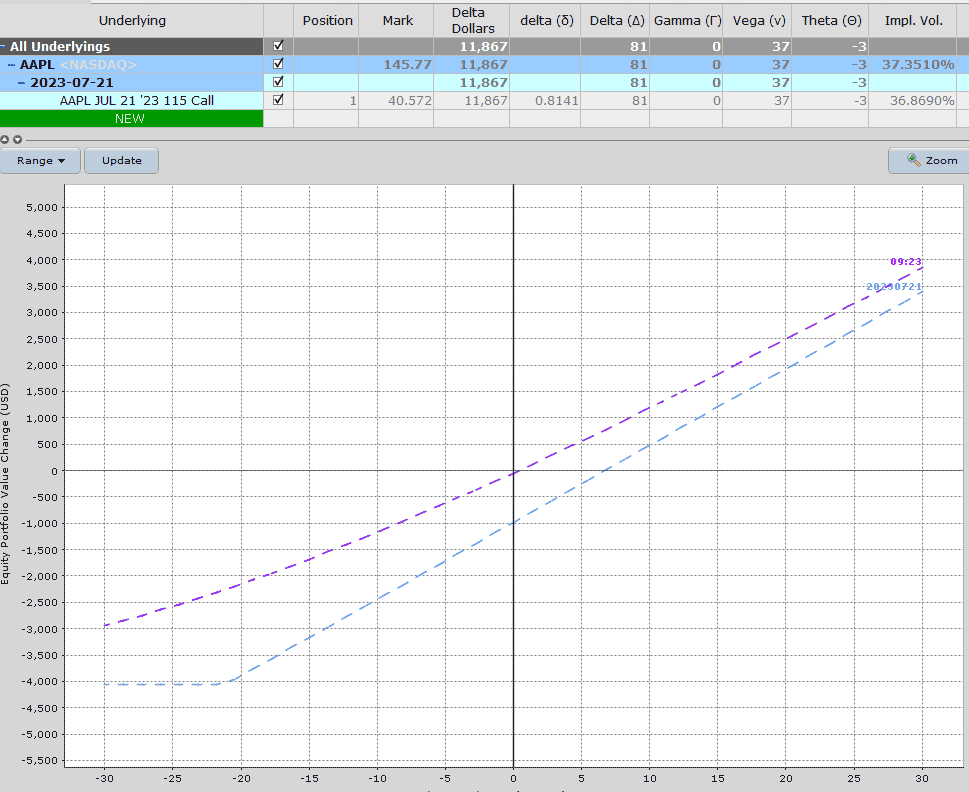

Now, let’s look at a leap call option on AAPL.

We can see that the gain is similar if the stock rallies. Here, we stand to make around $2,000 to $2,500 if the stock rallies 20%. The pure stock position would make around $3,000 in profit.

The delta exposure is 81, versus 100 and we now have exposure to vega, gamma and theta.

Another key difference is that the loss is capped at the premium paid of $4,057.

Income investors can also turn their leap call into a poor man’s covered call by selling short-term calls against the long call.

Waiting And Summary

After acquiring one or more LEAPS calls successfully, it is time to settle down for the long haul.

With trading options, like when trading stocks, you must have a predetermined price at which you will be satisfied with your option winnings and close your position.

This is the selling price for your selections. In addition, you must have a predetermined stop-loss in place in case the price of your option (or options) decreases dramatically.

Trading psychology plays a key influence in determining whether an options investor will be successful. Be consistent. Maintain your values. Try not to lose your cool. And avoid being overly greedy.

We hope you enjoyed this article on buying leap options. If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.