Heikin-Ashi strategies have been gaining popularity among traders due to their unique approach to analyzing price movements and identifying trends.

This article will dive into these unique candles and explore what they are, how they work, and some fundamental Heikin-Ashi strategies.

Contents

What is Heikin-Ashi?

It’s important to understand what Heikin-Ashi is first.

Essentially, it’s a unique type of candlestick chart that utilizes modified candles to filter out some of the noise in traditional candlesticks.

These modified candles provide a smoother representation of price trends, making it easier for traders to identify potential entry and exit points and provide a smoother visualization of the underlying trend.

By understanding the fundamentals of Heikin-Ashi, traders can enhance their trading strategies and potentially make better trading decisions.

Heikin-Ashi Basics

Understanding the basics of Heikin-Ashi candlestick charts is crucial for successfully trading them.

These charts use a modified formula to calculate a candlestick’s open, close, high, and low prices, which helps to smooth out price data and provide a clearer chart.

Each Heikin-Ashi candlestick is represented by a rectangle with an upper and lower shadow, with its color indicating bullishness or bearishness of the underlying trend.

These charts are notably different from regular candlestick charts.

Heikin-Ashi candlesticks are based on the average prices of the previous candles, resulting in a clearer look at trend direction with less noise and fewer gaps.

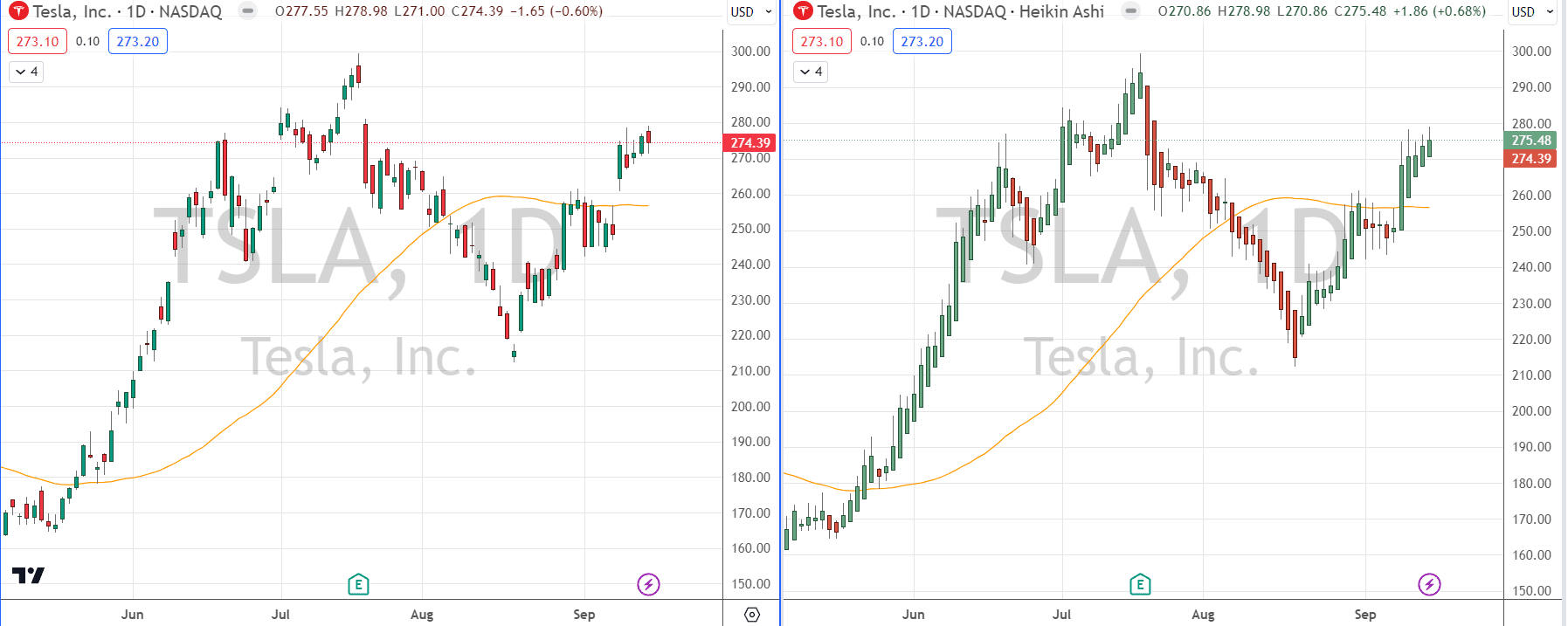

The above image shows two identical Tesla charts.

The one on the left is the standard candlestick chart, and the one on the right is the Heikin-Ashi Candlestick chart.

You should instantly be able to notice the things we discussed above, noting how much cleaner the Heikin-Ashi chart is by comparison.

A word of caution, though, on using Heikin-Ashi charts, they are prone to hindsight bias, meaning that the candle’s opening can float all the way until the candle is closed since there is an active calculation.

This issue does not make them a bad option for candle type; you just need to adjust your strategies for this possibility.

Why Use Heikin-Ashi Trading Techniques?

Heikin-Ashi trading techniques offer several benefits for traders over standard candlesticks.

First, it provides a smoother representation of price action compared to regular candlesticks, incorporating and smoothing all available data.

This smoothing effect helps identify trends and reduces the impact of short-term volatility, making it easier to spot potential entries and exits in your trades.

The second real benefit of this smoothing is that the coloring of the candles will help keep you in a trade even if the price goes against you.

The average previous closes often color the candle, so it’s possible to still be trending up (green candles) even if the price shows a slight pullback.

This is a huge advantage for trend traders because it’s almost like putting a moving average into your candlestick coloration.

Popular Heikin-Ashi Trading Strategies

Now that we have the basics of what Heikin-Ashi is and how it’s advantageous to use, let’s talk about some strategies you can employ to utilize it.

There are typically four main tactics when using Heikin-Ashi candles.

Trend Following, Breakout, Pullback, and Crossover. You’ll notice that no scalping strategies are included.

Due to the Heikin-Ashi candles formula’s nature, it is disadvantageous to scalp with this candlestick type.

1. Heikin-Ashi Trend-Following Strategy

The Heikin-Ashi trend-following strategy is perhaps the most widely used trading approach that capitalizes on the nature of the candles.

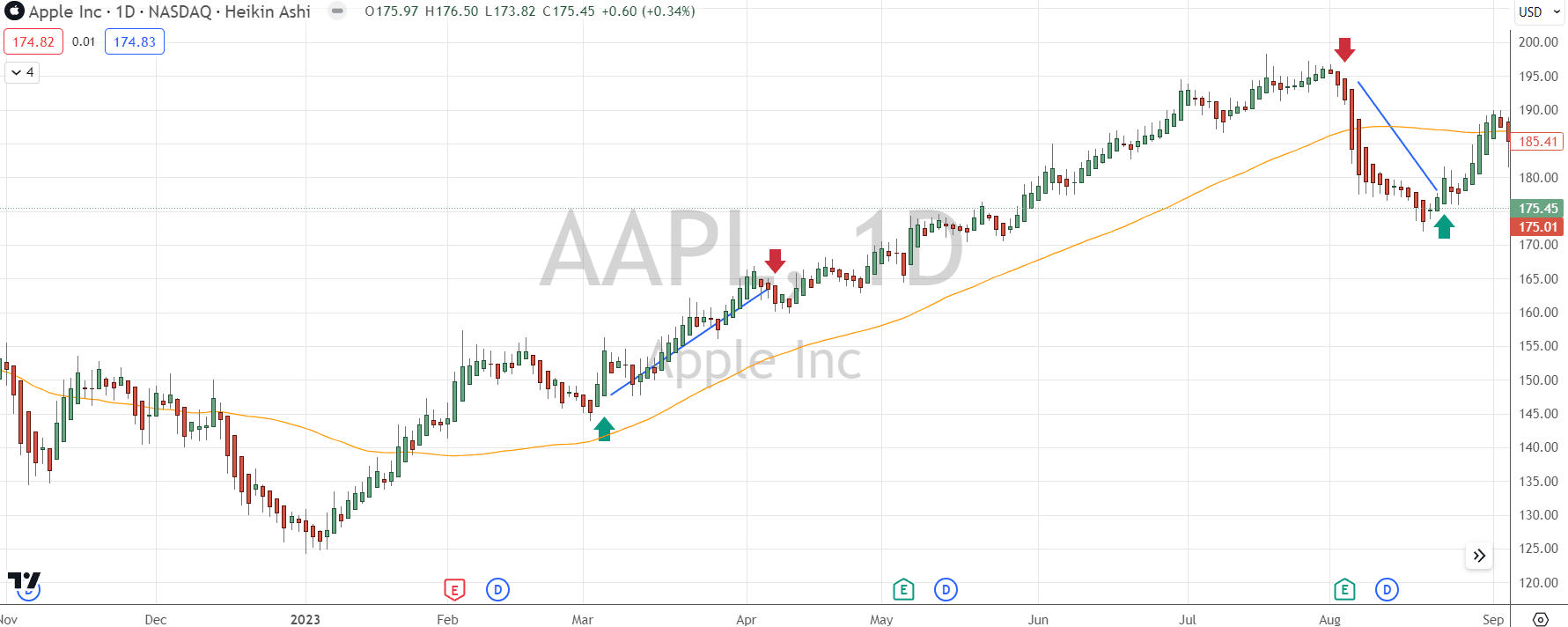

To execute this strategy, traders first pinpoint the prevailing trend by observing a sequence of bullish or bearish Heikin-Ashi candlesticks.

The trend’s strength is gauged by the length and color of these candlesticks; the longer and darker the candle, the stronger the momentum and trend are.

Once a strong trend is confirmed, traders enter the market in the trend’s direction, often setting stop losses under the recent swing low of the chart.

As with all trend strategies, some form of moving stop is recommended to protect you from potential news breaks.

While you can trade with a take profit with this strategy, many traders simply exit when two candles close, showing momentum in the opposite direction.

This strategy is uniquely tailored to the formulation of the Heikin-Ashi candles.

Below are a few examples on an Apple chart.

2. Heikin-Ashi Breakout Strategy

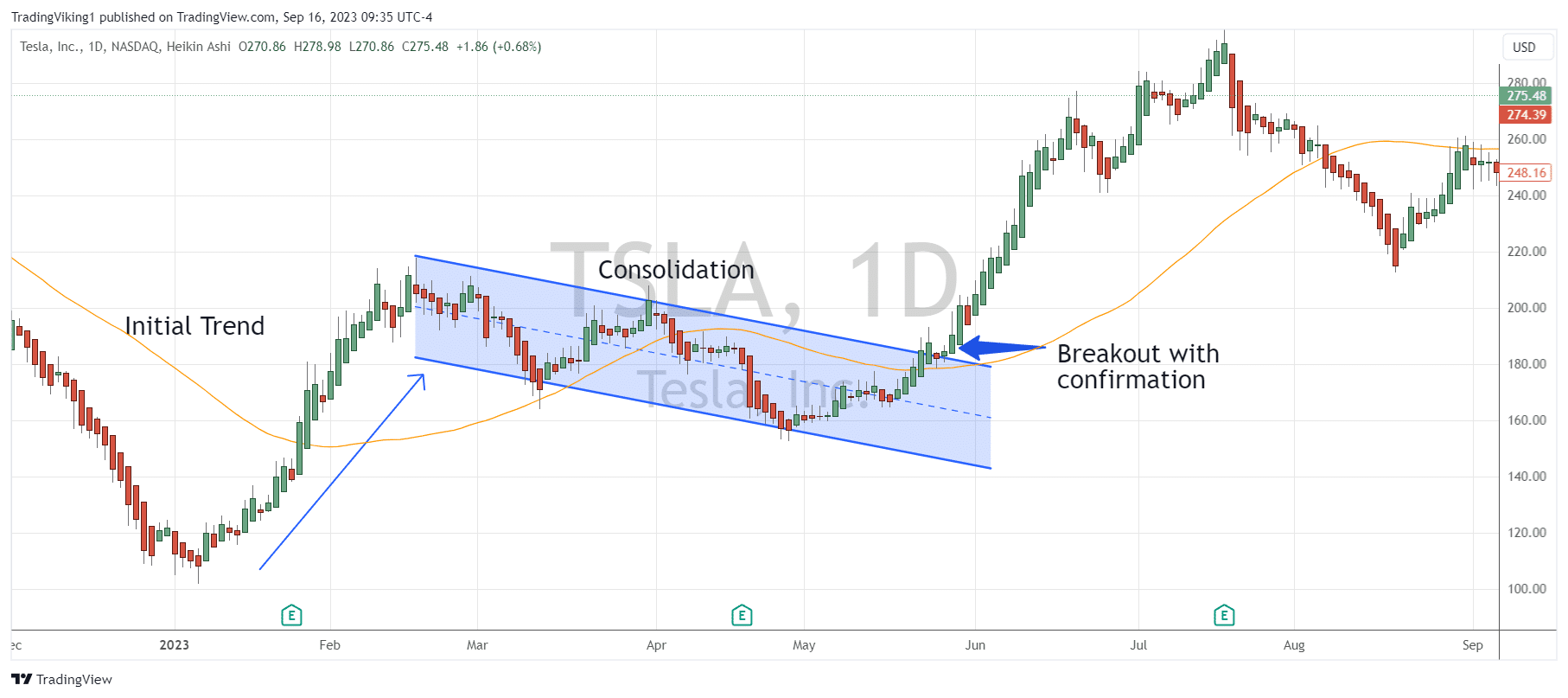

The Heikin-Ashi breakout strategy utilizes Heikin-Ashi candlestick charts to detect potential market breakouts.

To implement this strategy, traders watch for an initial trend on the chart, either upward or downward; they next watch for the price to start to consolidate and trade in a range.

Once the range has been identified, they will look to identify support and resistance levels to watch for a breakout.

When prices breach these levels, traders wait for a strong Heikin-Ashi candle in the trade direction and then enter a trade.

Stop losses on this type of trade are typically beneath the breakout level to minimize risk.

Again, taking profits can be set by either a goal location on a chart, like a previous high, or by watching the momentum and trend shift in the candle coloration.

A lot of traders favor breakout trading due to its ability to set clear entry and exit rules; the Heikin-Ashi candles just help to simplify the process.

3. Heikin-Ashi Pullback Strategy

In keeping with the overall theme so far, this strategy also utilizes the trending nature of Heikin-Ashi bars.

The Heikin-Ashi pullback strategy looks to capitalize on brief price retracements within a broader trend.

Using what we know from the trend-following strategy above, we look to identify a trending market. A

fter identifying the trend, You wait for the price to retrace to look for an entry to continue in the direction of the prevailing trend.

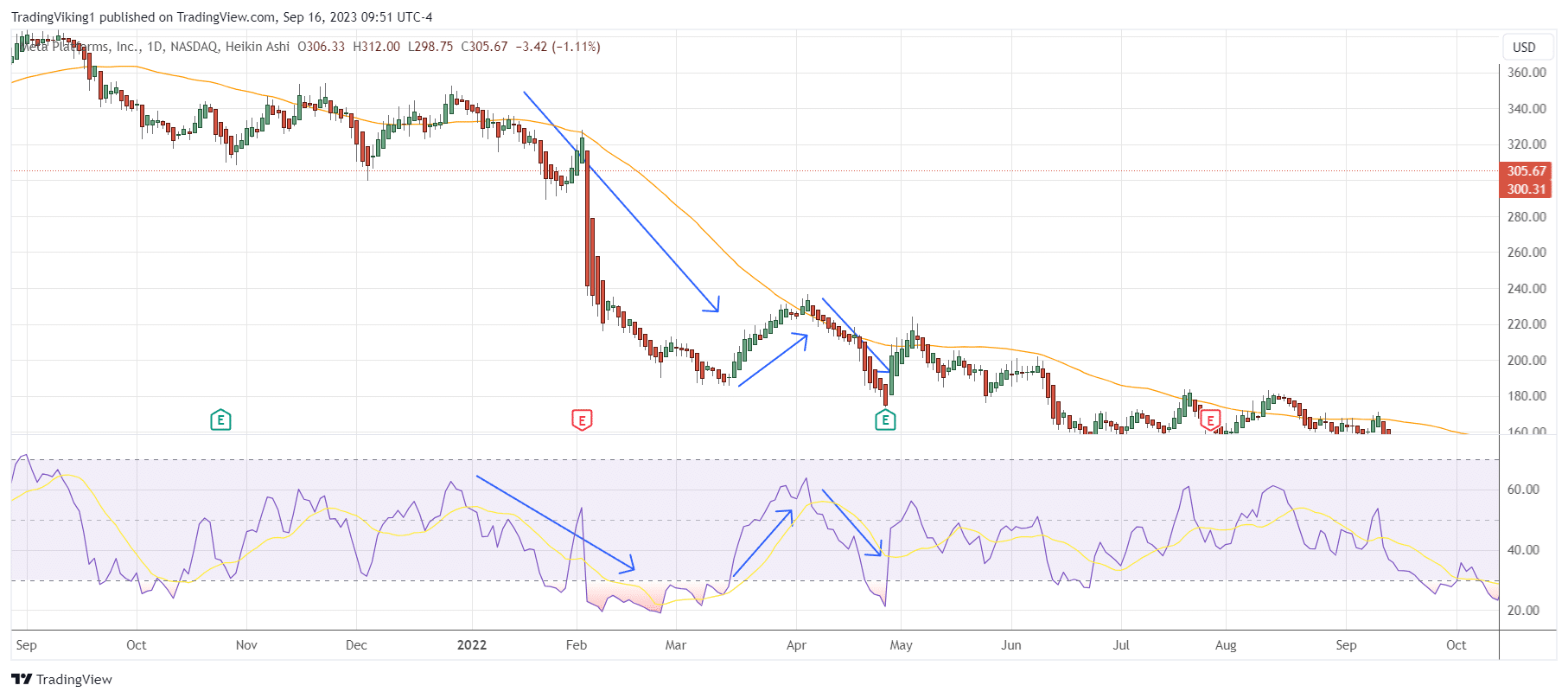

This strategy becomes most powerful using another indicator or group of indicators.

The RSI is an excellent tool to help filter out poor entries and exits.

Let’s suppose the RSI is in an “oversold” position in a down-trending market.

This would be an instance where you would look for a pullback on the Heikin-Ashi chart, and once the candles resumed momentum in the trending direction and the RSI was rolling over to the sell direction, you would enter.

Again, the stop loss would be the recent swing low of your pullback. Check out the below example on META stock.

The initial price trend is down, there is a pullback, and once the RSI crosses over and the candles resume a red momentum, the price makes a new low.

4. Heikin-Ashi Moving Average Crossover Strategy

The Heikin-Ashi Moving Average Crossover Strategy is a derivation of the trend-following strategy above but with a popular system overlaid in addition to it.

This strategy employs two moving averages: a short-term and a long-term.

Buy signals are initiated when the short-term average crosses the long-term, while sell signals arise when the reverse happens.

While you can adjust the length of the averages to fit your desired trade holding length, the longer the averages, the better the signals are often.

The Heikin-Ashi candles come in to confirm the trend of the signal.

Let’s assume you have an 8 and 13 moving average cross happening, showing a possible signal up.

There are two potential ways to trade with the Heikin-Ashi bars.

The first is to take the trade as soon as a strongly bullish candle closes once the trade happens.

This is the “original” entry criteria but could put you far beyond the MA’s.

The second option is to wait for the price to retrace and then enter long once you get another candle going in your direction.

This method is often preferred for anyone wanting to keep their risk tight.

Using the Heikin-Ashi Strategies with Options

As you can see from the above, many of these strategies are just derivations of a trend-following system.

While each strategy has its quirks and entry criteria, they all rely on analyzing the underlying trend with the Heikin-Ashi candles.

Futures and equities traders use these types of systems, but I think options are uniquely suited for these Heikin-Ashi systems.

First, because options can offer fixed risk on a trade, you can afford to enter almost regardless of how far the price has traveled in the signal bar.

It’s still recommended to wait for a valid signal, but if you go long a call or put, your loss is maxed out at what you paid for it.

Second, and perhaps where the real magic is in some of these strategies, is the ability to collect premiums.

Breakout trades long are great for selling puts or put spreads.

They help keep you on the correct side of the entry but also remove the need to guess the magnitude of the coming move.

It can create income for your account and potentially allow you to purchase the stock at a lower price.

The third potential way to play the trending nature of Heikin-Ashi strategies is to utilize LEAPS.

If you want a happy medium between capital expenditure and leverage on a move, LEAPS will give you the most bang for your buck.

This is also potentially the most risky as LEAPS will expire worthless if you hold them for a long enough period of time and you are wrong on the trade.

Tying It All Together

Heikin-Ashi candles are a powerful potential tool to add to your trading, and the Strategies that the candlesticks open up could be a game changer for trend traders.

We have discussed how the candles are formed, what makes them different from regular candlesticks, four strong strategies to utilize, and finally, how to incorporate options into them.

Heikin-Ashi candles are a real hidden gem in trading and can help make your setups more consistent.

We hope you enjoyed this article on heikin-ashi strategies.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.