Today, we are discussing the role of options in diversification.

Options are arguably one of the most powerful trading tools ever created.

Many traders and investors use them as a way to gamble.

However, in this article, we’ll explore the dynamic and versatile nature of options and how they can play a role in managing risk, generating income, and optimizing returns within a well-rounded investment portfolio.

Contents

Options Recap

Before delving into their role in diversification, let’s quickly recap what options are.

They are financial derivatives that give the holder the right, but not the obligation, to buy (call option) or sell (put option) a specific underlying asset at a predetermined price (strike price) within a specified time frame (expiration date).

This flexibility forms the foundation for their usefulness in portfolio management.

Enhancing Risk Management

One of the primary benefits of incorporating options into a diversified portfolio is the ability to manage risk effectively.

Options are valuable insurance tools that protect against sudden or adverse market moves.

The primary way to do this is to own a put option on the shares you own

Let’s say you hold several stocks in a portfolio but are concerned about a potential market correction. There are two methods to hedge against this risk.

The first is by purchasing put options on a major index.

You can mitigate the impact of a market correction.

If the market falls, the gains from the put options can offset losses in your portfolio, acting as a hedge on the overall portfolio.

The second way is to purchase puts on the individual names that you hold.

This will similarly affect your portfolio if the market or your stocks suffer a correction.

The benefit of this strategy is that you don’t need to market to fall.

The protection you purchase is specific to the assets you own.

Optimizing Returns

Another use for options in a diversified portfolio is to augment your return or create additional income.

Options are uniquely suited for this based on how time and volatility affect them.

Here are three potential strategies to optimize and add to your returns.

Generating Income with Covered Calls

Options can generate outsized income in a stagnant or slightly bullish market.

Writing covered calls involves selling call options against shares you already own.

As long as the stock stays below the strike of the call you sold, you keep all the premium and your shares, enhancing your overall return on the underlying stock.

If the stock closes above the strike price, you sell your shares at the call’s strike, keeping both the premium and profit on the sale.

The Iron Condor Strategy

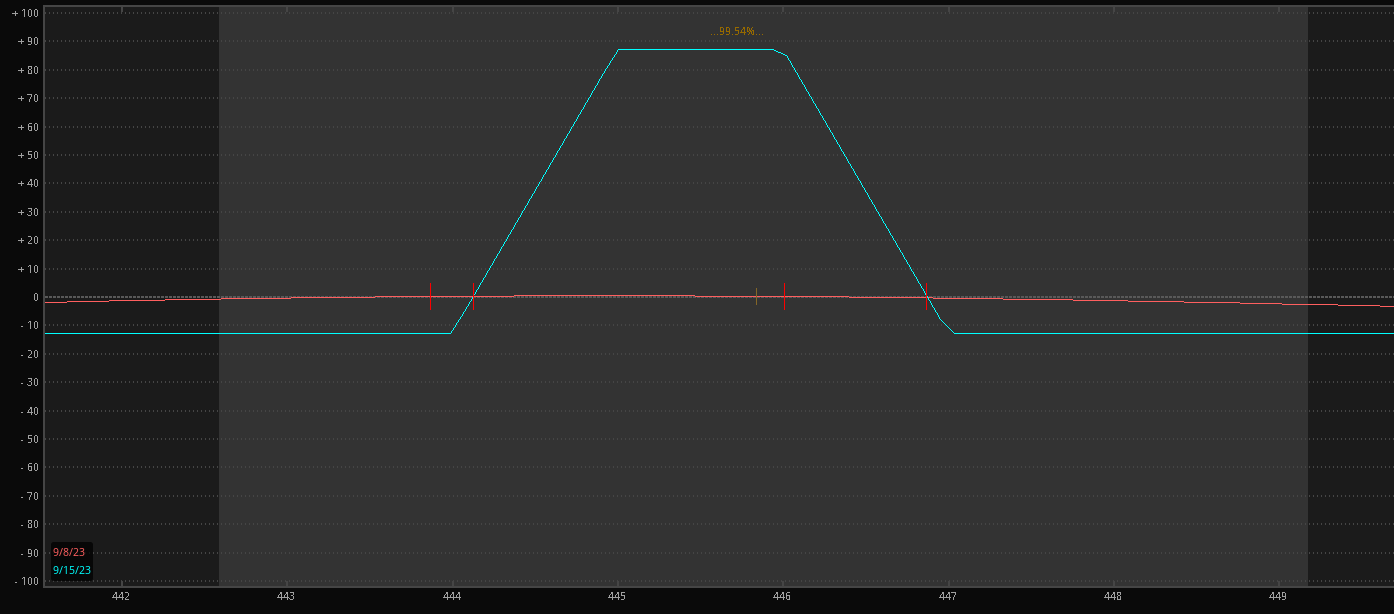

The Iron Condor is a popular options strategy that aims to profit from low volatility.

It involves simultaneously selling an out-of-the-money call and put option while buying a further out-of-the-money call and put option.

The net premium received can enhance overall returns when market volatility remains low.

This is a spread trade, so your shares are never at risk.

Leverage without Overexposure

Options can also provide a way to gain exposure to an underlying asset without investing significant capital.

This leverage can amplify returns if the market moves in the anticipated direction.

This leverage does have a cost; if the price does not move, then your options expire worthless.

It is best to use this strategy sparingly and buy as much time as possible.

Diversification Beyond Stocks and Bonds

Traditionally, diversification involved spreading investments across stocks, bonds, and perhaps some real estate.

Options add an entirely new dimension to diversification by allowing you to fine-tune your exposure to specific market factors.

Commodities

Consider a scenario where you have a portfolio heavily weighted towards tech stocks.

To diversify into commodities, you can use options on commodities like gold, oil, or agricultural products.

Doing so exposes you to asset classes that may not correlate closely with equities, reducing portfolio risk.

Similar to what was discussed above, this is best used for specific scenarios or when you can afford to purchase a lot of time on the options.

Sector Rotation Strategies

Sector rotation is a popular investing strategy, and options can help you benefit from it without investing all of your capital initially.

There are two solid ways to benefit from sector rotation strategies with options. First is the cash-secured put.

Let’s assume you think the healthcare sector is lagging and is due for some price appreciation.

Selling a put on a stock or sector, ETF will let you collect the premium on the option and allow you to purchase shares at a further discounted rate if the price falls to your strike.

You can read more about cash-secured puts here.

The second method involves sector ETFs and spreads.

By leveraging vertical spreads, you can receive a credit to your account for directional-based trading on each sector.

You keep some or all of the premium as long as the price doesn’t go below/above the outside strike.

This is a great way to play both rotation and create income.

Advanced Options Strategies

While traditional asset classes provide the foundation for diversification, options can be strategically employed to fine-tune your portfolio’s risk and return profile through more advanced strategies.

The Collar

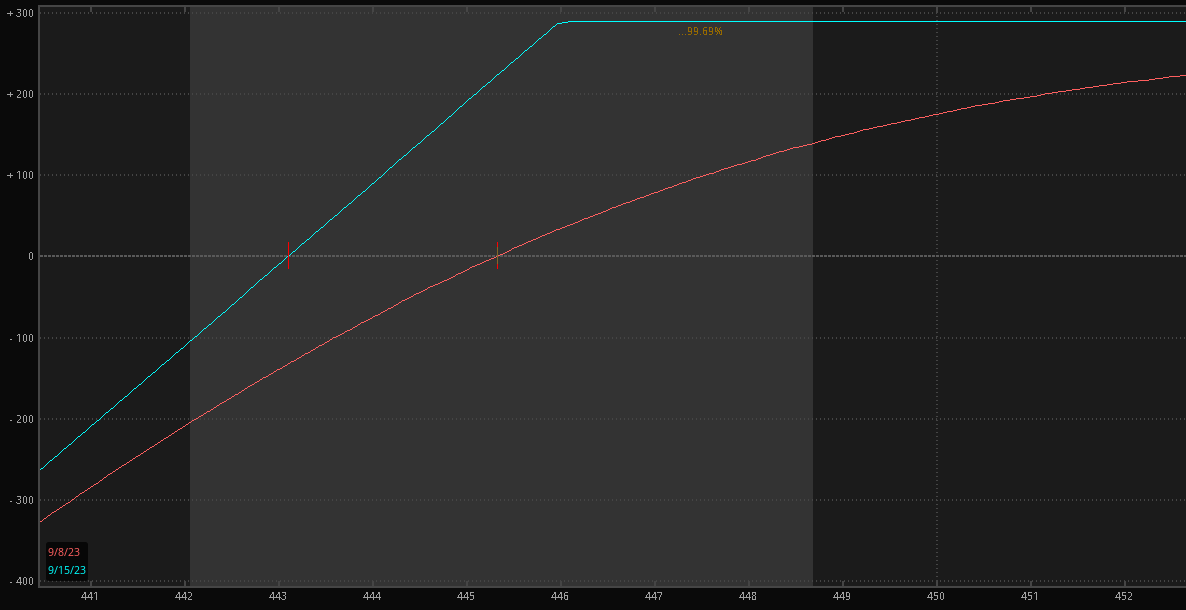

The Collar strategy combines owning a stock with purchasing protective puts and selling covered calls.

This three-pronged approach can help lock in gains while limiting potential losses.

It’s like putting the lane protectors up at a bowling alley.

You’ve capped your upside potential, but you also have capped your maximum loss.

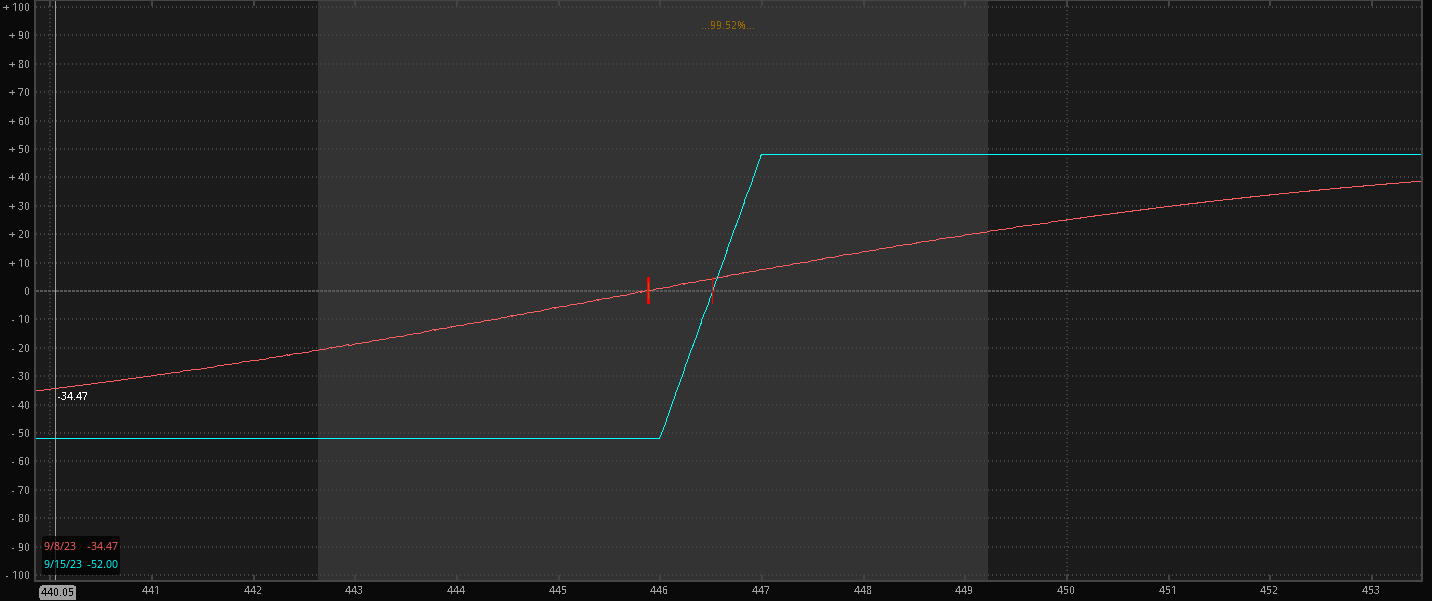

Risk Reversal: An Asymmetric Play

For those with a bullish outlook, the Risk Reversal strategy involves selling out-of-the-money puts to finance the purchase of out-of-the-money calls.

This asymmetric approach allows you to profit from an upward price movement.

It’s a strategic way to express a strong market conviction but carries significantly more risk than any other strategies discussed.

Examples Using Options

Let’s take a moment to draw inspiration from real-life scenarios and how options help them.

Protecting Gains – Scenario 1

You are a seasoned investor with a substantial holding in a tech company with impressive gains.

Worried about a potential market correction, you decided to implement a protective strategy.

You purchased put options on your stocks, effectively safeguarding the gains.

When the market did not experience a downturn, you lost the premium paid on the puts, but since you were still in the stock itself, you captured all of the additional upside of the move.

The loss on the options was more than covered by the stock’s gain, and you were completely protected against a sudden correction.

Income Booster – Scenario 2

You are nearing retirement and looking for ways to generate additional income from your investments.

You hold a diverse portfolio of dividend-paying stocks but wanted to enhance your income stream.

By writing covered calls on some of your holdings, you can collect premiums while retaining ownership of your stocks.

This strategy provides a steady income source without sacrificing the long-term potential of your investments.

The key here is to not write calls against your entire portfolio so that in the event the shares are sold.

You still have a base position.

Final Thoughts

As you can see, options are a dynamic and versatile tool that can significantly enhance the diversification and effectiveness of your portfolio.

They offer ways to manage risk, generate income, optimize returns, and fine-tune your exposure to various markets and factors.

However, it’s essential to approach options trading with caution and a clear strategy.

Constantly learning and refining your options strategies will help keep you ahead of the curve and your portfolio growing.

Risk management is paramount with options, so if you don’t yet have a solid risk management plan, make it your number one priority!

We hope you enjoyed this article on the role of options in diversification.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.