Today we’ll discuss an important topic for any option trader: put option delta.

All options that have any value will have a delta.

Delta reflects the change in the value of an option for any $1 change in an underlying price.

In this brief article, we will be exploring the delta component of put options.

We will do this by answering some of the most frequent questions that beginners have.

Let’s get started!

Contents

- How Does Delta Affect Put Options?

- What Is The Range Of Delta A Put Option Can Have?

- Where Are The 30 Delta Options On A Stock?

- If I Buy A 50 Delta Put, Is That The Same As Being Short 50 Shares of Stock?

- Can I Trade Puts If I Am Bullish On A Stock?

- What Are The Best Delta Puts to Buy? To Sell?

How Does Delta Affect Put Options?

Put options give the holder the right to sell an asset at a predetermined price before a certain date.

These options reflect a bearish view.

For example, stock ABC is trading at $65, and an investor buys a 60 put option expiring in one month for $2.

For this option to have any value on expiration, the price of ABC must be below $60.

After all, who wants the right to sell something immediately at $60 when trading at $65.

Before expiration, as the stock moves around, a price increase will cause a decrease in the price of the ABC put.

This is because if ABC is now at $66, it is less likely that the $60 put will have any value than it did when it was first issued at $65.

Conversely, if the price of ABC decreases, it is now more likely the 60 put will be breached.

Thus the price of the put will increase.

Put options have a negative delta, which describes the rate of change in an options price for a $1 change spot price.

In our above example, if our $2 put on ABC has a delta of -.3, a one-dollar increase in the price of ABC to $66 will result in a 30 cent decrease in the price of our put option.

It will now be worth $1.70.

What Is The Range Of Delta A Put Option Can Have?

Put options will always have a negative delta, but this delta can vary drastically depending on where the strike price is in relation to the price of the underlying.

A put options delta can range from 0 to -1.

A put option can’t have a positive delta as it is a bearish view.

Conversely, a put can’t have a smaller delta than -1 as it can only be equivalent to selling 100 shares.

Far out-of-the-money strikes will have options deltas closer to zero, and far in-the-money options will have a delta closer to -1.

At-the-money options will have a delta around -.5.

Where Are The 30 Delta Options On A Stock?

As options have both a price and volatility component, there is not a given distance that the 30 delta options will be away from the stock price.

The greater the volatility and time to expiry, the greater out-of-the-money a 30 delta put option will be.

Finding an options delta is easy using your brokerage or an options calculator

If I Buy A 50 Delta Put, Is That The Same As Being Short 50 Shares of Stock?

A 50 delta put and 50 shares short of a stock will have a similar P&L at inception.

Though because a puts delta is not constant, they will have very different risk profiles.

A puts delta will change over time.

This change is known as gamma.

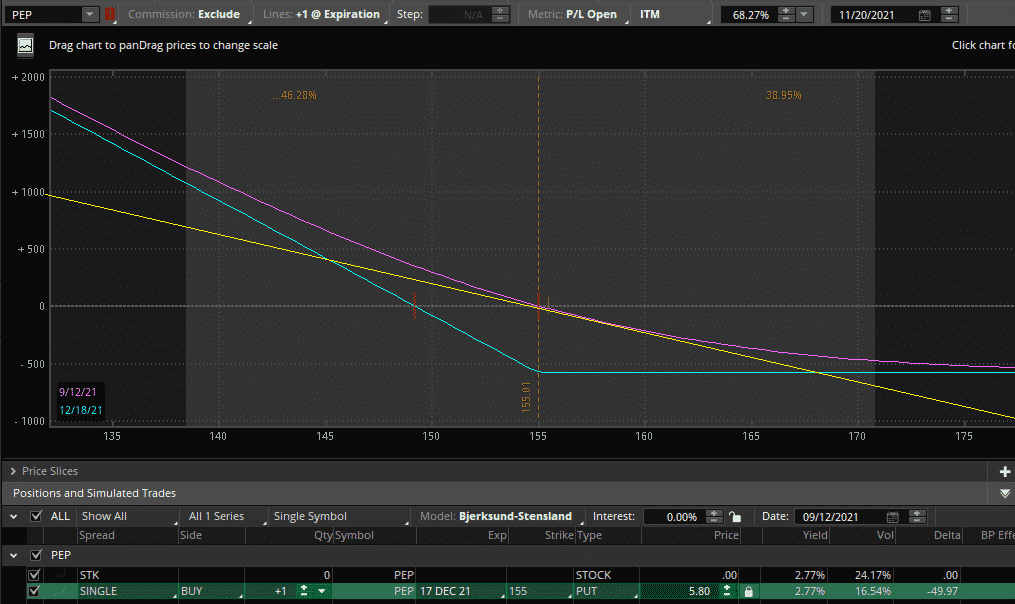

To illustrate this point, we have the risk profile of a long 50 delta put in blue and 50 shares short as the yellow line.

At inception, we can see that the P&L line of the options contract (shown in purple) is identical to the yellow line.

Despite this, if the spot price moves up or down, the P&L now looks different; this is gamma in effect.

Can I Trade Puts If I Am Bullish On A Stock?

Yes, by selling puts you can benefit as you collect the premium if the stock remains above the strike price at which you sold.

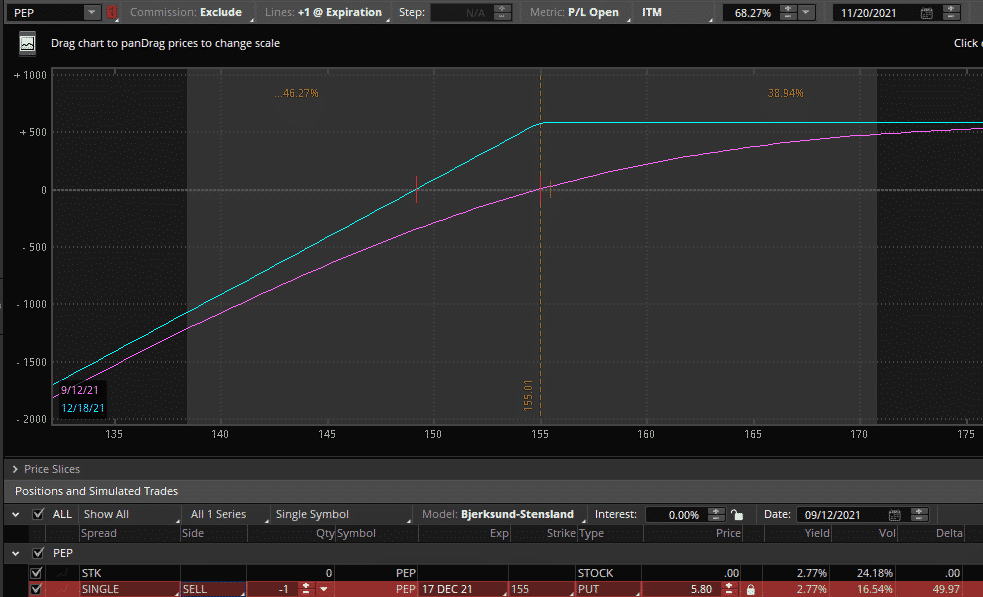

If you sell a put, your risk profile is exactly the opposite of the person who bought the option, as illustrated below.

As puts have a negative delta, you have a position with a positive delta by selling puts.

What Are The Best Delta Puts to Buy? To Sell?

There is no “best” delta to either buy or sell puts.

Hedgers generally like to purchase out-of-the-money puts for protection.

This should bid up their price, but likewise, sellers often like selling these puts as income.

This may result in better liquidity in these puts but doesn’t necessarily equate to an advantage.

It is far better for both buyers and sellers to trade the puts that best express their view on what will happen.

In our example of ABC stock, there is no use buying a put for $50 if you only think it will go down to $55.

Trade the view you want to take.

Do you have more questions about put options?

If so, please feel free to ask them below in the comments!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thank you

Is this a typo error?

“After all, who wants the right to buy something immediately at $60 when trading at $65.”

Correct, it should say sell, not buy. Fixed now.

Thank you for your excellent, instructive articles.

Always enjoy and appreciate your clarity of explanation, Gavin, thank you.