Contents

Today we’ll talk about what to do with a losing call option.

Learning how to manage losing positions is a skill that every successful trader should have.

It is often how you manage losses that determines your success as a trader.

Making money is easy, though it is what you do when you start losing that counts.

There are many famous traders and hedge fund managers who have flamed out.

For many, it was not due to a lack of intelligence.

Nor was it a flawed system.

It was attributed to taking too much risk and not dealing with losers correctly.

Therefore, it is important to spend even more time managing a losing trade than a winning one.

This article will explore how to deal with our losing call options.

How Did I Get Here?

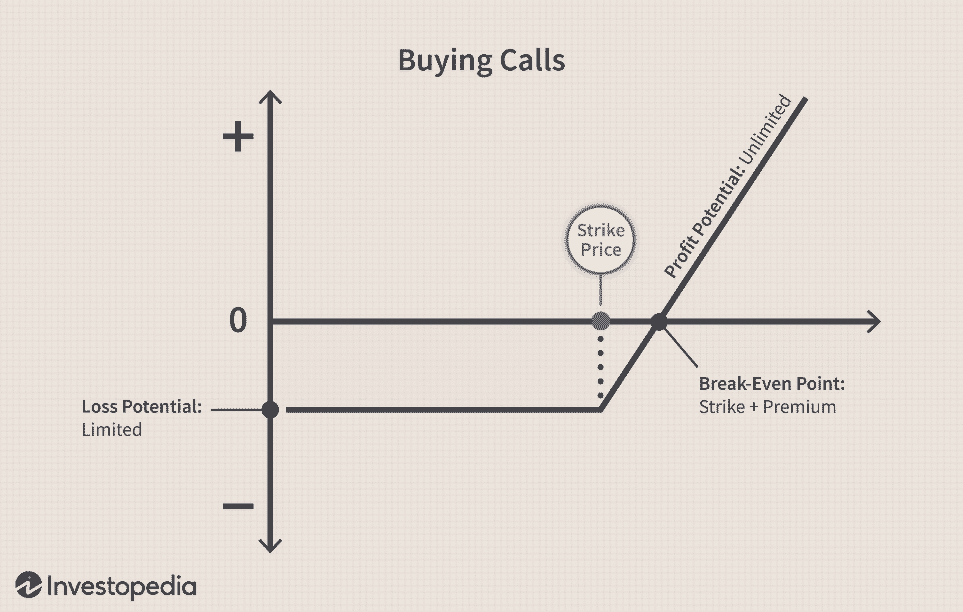

A call option gives the right to purchase a security above a specific price before a certain date.

By buying a call as a standalone trade, a person expresses two views.

- I am bullish on the security. I think the price will increase.

- I believe the price will rise faster than the market implies, and thus I believe implied volatility is undervalued.

This is the fundamental view expressed by a long call option.

If you do not have this view and are holding a long call option, close the position.

We can always have more fun (and free drinks) gambling at the casino than in the stock market.

Now let’s assume you placed the trade with the right idea initially but ended up being wrong. This will occur for two reasons.

- The stock price decreases.

- The stock price stays unchanged or increases slightly, but implied volatility was above the realized volatility, and theta decay causes the position to decrease in value.

When this happens, welcome to the club! Do not be discouraged.

This is because, with call options, we will likely lose frequently.

We need our team to win while simultaneously going over the total to use a sports betting analogy.

This combination results in a low-profit likelihood but a large payout if we are right.

Now our position is losing money.

So far, we have not been right.

The value of our call options has decreased.

First off, we need to accept the new value of our call options.

While these losses are not technically realized for tax reasons, they are definitely gone.

As a bad school lunch trade always goes, “No Takebacks!” Nevertheless, our position still has some value.

What do we do?

The simple way to answer this question is as follows:

“If I did not have a call option on this stock right now, would I buy one?”

If the answer is yes, then you should stay in the position.

After all, we still believe in our original thesis of the trade.

Perhaps the stock went down simply due to adverse market sentiment.

Or even if it was unexpected bad news, maybe we think the stock will shrug it off.

If our thesis is unchanged, there is no reason to exit the position win, lose or draw.

Furthermore, if we still believe strongly in our thesis, it may also be prudent to add to our position if our call options have lost a lot of value.

We may not have enough delta and time exposure remaining to be rewarded for the expected move up if our call position is only 10% of its initial value.

At this point, we can consider adding a closer call option (to have more delta exposure) or a longer-dated option (to have more time exposure).

Contrastingly, our thesis may have changed.

We have been wrong up till this point.

There is a good chance we have been proved wrong in our idea.

Continuing to bag hold a position and simply relying on hope is never a good option.

By cutting our losses, we retain a part of the premium to invest elsewhere in better opportunities.

There are so many potential trades out there.

There is no need to stay in a poor one.

Risk Management on Losing Call Options

Let’s talk a bit about risk management.

It is sometimes important to cut or reduce positions for short options trades even if we have the same opinion we had before.

This is due to the unlimited risk of selling options naked.

Buying call options is different because we are the buyer of that convexity or gamma.

The most a long call options positions is the premium paid.

By making this premium equal to the maximum loss an investor wants to take on the trade, the long call option has built-in risk management.

Source: Investopedia

For example, if an investor wished to risk a maximum of 2% of their capital, they could buy a call option worth up to 2% of their capital.

Of course, it is also important to be aware of your overall portfolio.

Buying fifty out-of-the-money calls with 2% each may fit into your maximum risk tolerance for each position, but the portfolio as a whole is extremely risky.

When sizing call option trade beforehand, it is important to consider that longer-dated options will have more premium than shorter-dated ones.

For example, buying shorter-dated calls on stocks with a certain amount of capital will provide a LOT more exposure than the same amount of capital for longer-dated options.

Hence they should usually be traded with far lower capital, especially if an investor is risk-averse.

Example: An investor who has a maximum risk tolerance of 2% on a position may decide to risk .5% on a call option expiring this week.

By sizing a long call option correct on inception, we can focus more on our view of the position and less on risk management.

This avoids excess hedging and transaction costs.

It also lowers stress.

Nevertheless, if we size trades incorrectly or thought our trades were a bit more diversified than they are, cutting losses and reducing position size is a prudent choice.

Concluding Remarks

Dealing with losing trades can be challenging.

It is very important to have a clear view of what you think would happen before starting the trade and then re-evaluating this as it progresses.

Being able to cut a position when an investor is wrong will help avoid further losses.

Conversely, adding or rolling a position can help maintain exposure to benefit if a move happens but is delayed.

Losing call options should be easier to deal with than other options positions.

This is that they can only decrease by their premium.

By sizing trades correctly and avoiding very large positions, traders can monitor options clearheadedly as they are already comfortable beforehand with the maximum loss if they are wrong.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.