When it comes to options trading for beginners, it’s essential to have a solid understand of some of the basics.

We talk about some advanced topics here at Options Trading IQ, so I wanted to have a post specifically for beginners.

Whether it’s greeks, basic strategies, understanding payoff graphs or doing back testing, we’ve got you covered.

So, sit back and enjoy this guide to options trading for beginners.

Contents

Options Trading 101

If you’re a completed beginner, the best place to start is here with my options trading 101 guide.

This guide will walk you through:

- What Are Options?

- Why Use Options?

- Option Features

- Use Cases of Options

- Option Pricing

- How To Read Option Quotes

- Margin Requirements

- Option Assignment and Exercise

- Option Volatility

- Option Greeks

- Payoff Diagrams

- Risks When Trading Options

- The Best Option Brokers

- Basic Option Strategies

- Option Definitions

Once you been trough the above you can start to look into some of the basic strategies.

Beginner Option Strategies

Covered calls are a logical place for beginners to start if they are already familiar with stock ownership.

Covered calls allow the investor to generate more premium from their stock holding, with the tradeoff being that the upside is limited.

Let’s walk through a quick example.

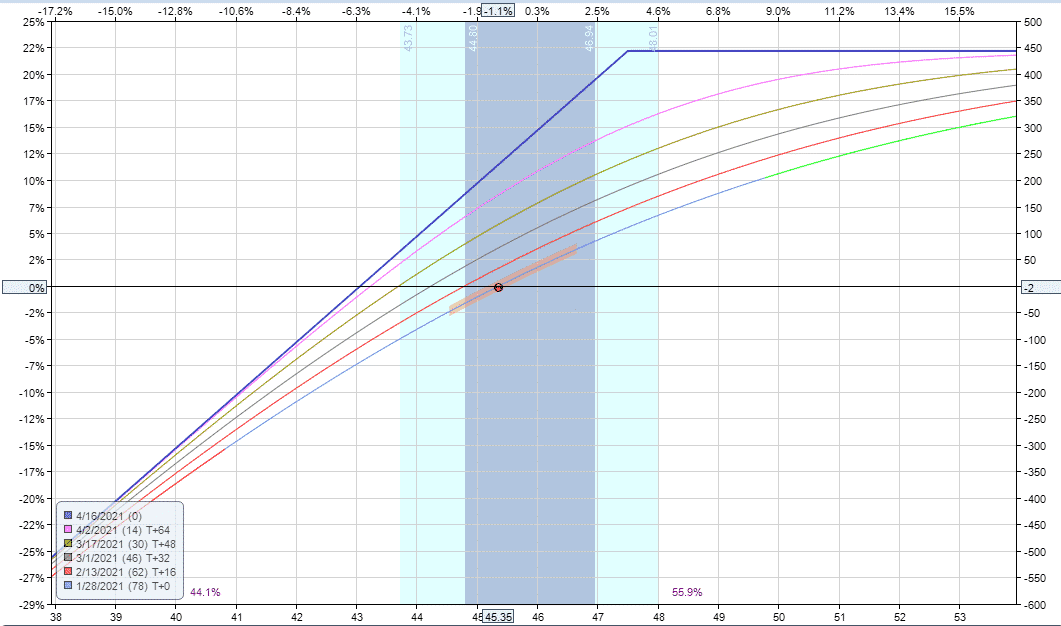

On January 29th, 2021 XOM was trading around $44.84.

At the time, an XOM April 47.50 call option could be sold for around $2.50 which would generate $250 in premium per contract and increase the annualized yield by 25%.

XOM annual dividends were around $3.48, so generating another $2.50 from covered call writing in only three months is quite attractive.

By selling a covered call, the investor receives a premium and has an obligation to sell the shares at the strike price if called upon to do so.

One call option contract represents 100 shares, so investors can sell multiple call options if they have a particularly large stock holding.

Over time, covered calls have the potential to increase returns while also decreasing the volatility of a portfolio.

The $2.50 in premium received also gives a small buffer on the downside of 5.33%.

That means Exxon stock could trade 5.33% lower between now and April 16th and the covered call trade would still break even.

The total capital at risk in the trade would be $4,350 and if XOM stock went to zero, that’s how much the trade would lose.

Here is the payoff diagram which is created using Option Net Explorer.

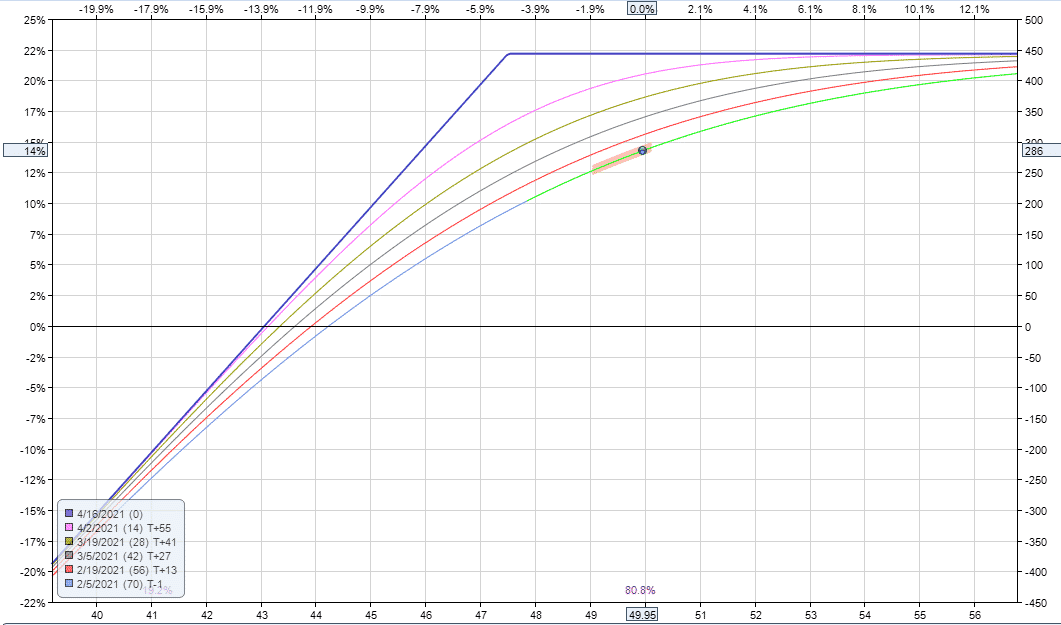

A few days later, on February 5th, XOM has risen to $49.95 and the trade is in profit by $286 or around 14%.

After learning covered calls, the next natural progression for beginner option traders is selling cash secured puts to acquire stocks below their market price.

You can read my full guide above which covers:

- Maximum Gain

- Maximum Loss

- Breakeven Price

- When Should You Sell Cash Secured Puts?

- What Is The Risk In Selling Cash Secured Puts?

- Why Sell Deep In-The-Money Puts?

- Selling Weekly Cash Secured Puts

- INTC Cash Secured Put Example

Let’s look at another quick example here.

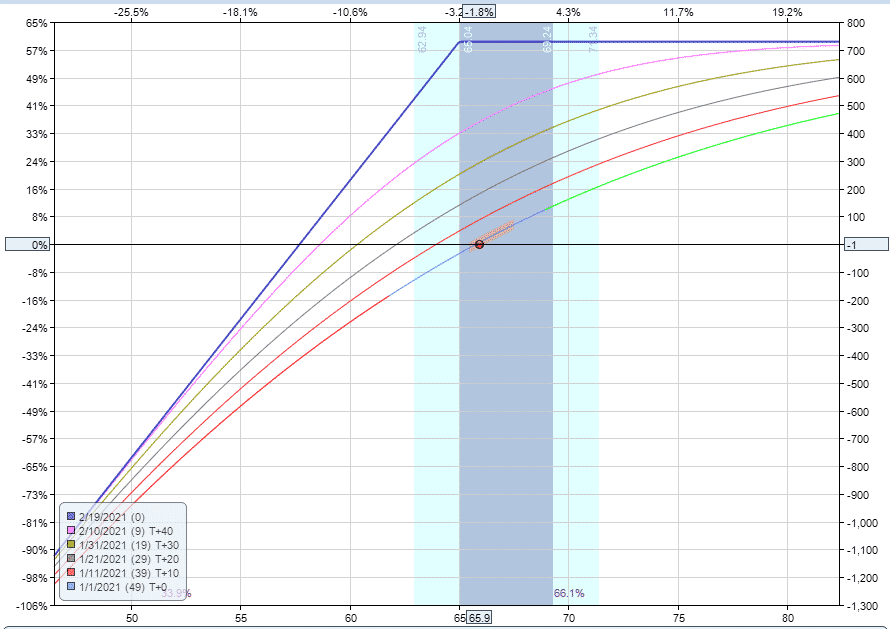

On December 31st, 2020, Pinterest (PINS) was trading around $65.90 and the February 19th, 2021 put with a strike price of 65 could be sold for around $7.30.

Selling this put would generate around $730 in premium per contract.

The put seller would have the obligation to purchase 100 shares of Pinterest stock at 65 if called upon to do so by the put buyer.

The breakeven price for the trade can be calculated by taking the strike price of 65 less the premium received which in this case gives a breakeven price of 58.70.

If the stock stays above 65 at expiry, the put expires worthless leaving the trader with a juicy 12.44% return on capital at risk in just under seven weeks.

This is calculated by taking the $730 premium received divided by the $5,870 capital at risk.

Here is the initial payoff graph, notice that it is almost identical to that of a covered call.

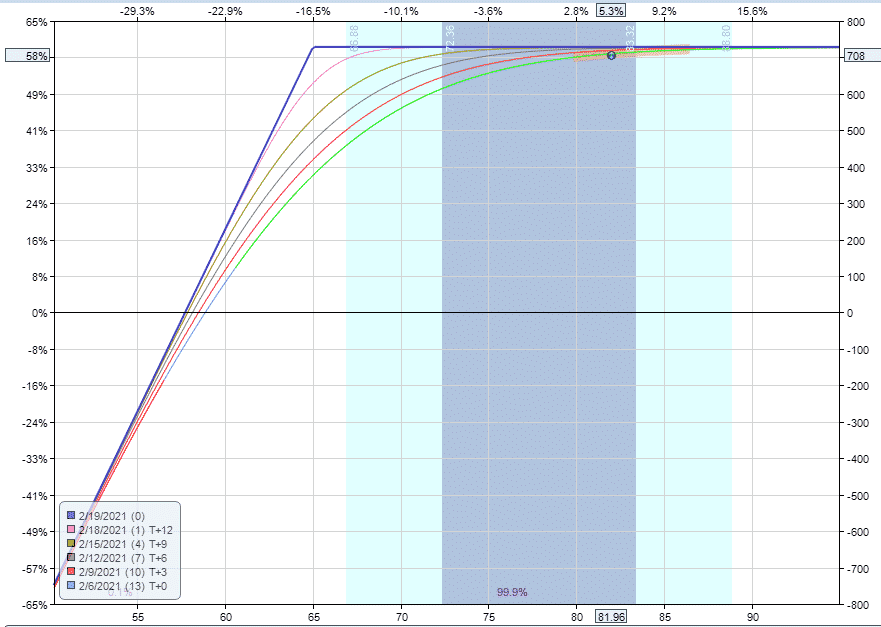

By February 5th, PINS is trading up at 81.96 and the put could be bought back for around $0.20 leaving the trade with a profit of $710.

This can be seen in the payoff graph below:

Selling put options is a great strategy for beginners once they understand the mechanics.

The key is to not over leverage yourself and make sure you always have enough cash in your account to cover assignment.

From there, advanced traders can move on the The Wheel Strategy.

Other Beginner Strategies

Other beginner strategies include the long call, long put, bull put spread and bear call spread.

One important thing to remember is not to spread yourself too think by trying to learn too many strategies at once.

Stick to one strategy at a time and go from there.

It’s a marathon not a sprint.

Option Greeks

Option greeks can be very confusing for some beginners, but they’re pretty easy once you get the hang of things.

DELTA

By far the most important greek is delta.

Delta tracks the degree in which an option price changes in relation to the price of its underlying asset.

For example, if you buy a call option, you will have positive delta which means if the stock rises you make money and if the stock falls, you lose money.

Let’s say you buy a 0.60 delta call.

For every $1 the stock rises, your call option will rise by $0.60.

This delta figure is constantly changing as the stock price moves.

VEGA

Vega is another important greek.

Vega measures the response of an option’s price to a change in the implied volatility of its underlying security.

Positive vega means you benefit if volatility rises after placing the trade.

Negative vega means you benefit if volatility falls after placing the trade.

THETA

Theta measures the change in the price of an option as time passes and the expiration date approaches.

Theta is commonly expressed in absolute values and an option could have a negative or positive Theta.

A negative Theta of say -0.30 indicates that each day that passes the option’s price will decrease by $0.30.

Most option traders aim to have positive theta, so they are making money through time decay.

That’s enough to get you started on the option greeks, but if you want to learn more, you can go here.

Conclusion

If you’re a beginner option trader, it’s important to understand options first before diving in and risking real money.

Paper trading is definitely recommended as is back testing using Option Net Explorer.

From there one of the easiest places to start is with covered calls and cash secured puts, before moving on to more advanced strategies like credit spreads.

So much of trading is a mental game. One of the most important things is focusing on the PROCESS rather than the MONEY.

Get the process right and the money will take care of itself.

Best of luck with your trading and reach out any time with questions!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi, when I click the covered call link it takes me to Options Trading 101

Fixed, thanks for letting me know. Here is the correct link – https://optionstradingiq.com/covered-calls-101/

I absolutely love Gavin’s writings => Clear, Crisp and To-the-Point. I have bought all his books and keep on reading and referring them often. Thanks Gavin for enlightening the retail traders with your writings.

Thanks, much appreciated.