The Indian option market is still new so it’s best to stick to highly liquid underlying stocks in the nifty index. Let’s analyze this nifty option strategy.

Contents

Options trading in India is starting to gain massive momentum and I am regularly asked by readers about option strategies for trading the Nifty Index.

I would love to trade options on Nifty stocks and indexes but unfortunately you need to be an Indian resident to open an account with most brokerages.

Hopefully this will change soon because the time zone is very advantageous for me.

This week I’ve done a heap of research into trading options in India and in today’s article, you’re going to learn all about how to trade options on the Nifty Index and its related stocks.

What Is The Nifty Index?

The Nifty 50 is the benchmark Indian stock market index, similar to the S&P 500 or Dow Jones in the United States or the All Ordinaries Index in Australia.

The index represents the weighted average of 50 of the largest Indian companies listed on India’s National Stock Exchange.

Via this link, you can see the current list of companies in the index as well as various stock price data.

As of July 20, 2020, these are the largest stocks in the Nifty Index by market capitalization:

Reliance Industries Ltd

Tata Consultancy Services Ltd

HDFC Bank Ltd

Hindustan Unilever Ltd

Infosys Ltd

Housing Development Finance Corporation Ltd

Bharti Airtel Ltd

Kotak Mahindra Bank Ltd

ITC Ltd

ICICI Bank Ltd

When people refer to the Nifty Index, they are generally referring to the Nifty 50, but there are also many other Nifty Indexes such as:

Nifty Next 50

Nifty Midcap 50

Nifty Midcap 150

Nifty Smallcap 50

Nifty Smallcap 250

Nifty MidSmallcap 400

Nifty 100

Nifty 200

As well as this, there are many sector based Nifty Indexes:

Nifty Auto

Nifty Bank

Nifty Energy

Nifty Financial Services

Nifty FMCG

Nifty IT

Nifty Media

Nifty Metal

Nifty Pharma

The list goes on…..

Where To Get Nifty Option Data

When looking for option data on the Nifty Indexes, the first place to start would be with a reputable broker.

I use Interactive Brokers for trading in the United States and Australia. I believe they also operate in India for Indian residents but it’s best to check for yourself.

The largest local Indian broke appears to be Zerodha, but I have no experience or knowledge of them. If anyone has experience dealing with them, I would love to hear from you via email or a comment below.

The next place to look for option data would be the NSE website.

Nifty Option Trading Strategies

If you’re new to trading options, I suggest you first check out this 11,500 word guide on Options Trading 101.

If you’re a more experience trader, you should check out these strategy guides:

The Ultimate Guide To Iron Condors

The Ultimate Guide To Double Diagonal Spreads

The Ultimate Guide To Bear Call Spreads

The Ultimate Guide To Bull Put Spreads

The Ultimate Guide To Calendar Spreads

The Ultimate Guide To Double Calendars

The Ultimate Guide To Put Ratio Spreads

The Ultimate Guide To Diagonal Call Spreads

The Ultimate Guide To Diagonal Put Spreads

While these strategies all use US market examples, the same strategies can be applied to any market, even the Indian options market.

As the Indian option market is still in its infancy, it’s best to stick to highly liquid underlying stocks and indexes because smaller companies will not have enough liquidity in the option chains to make trading worthwhile.

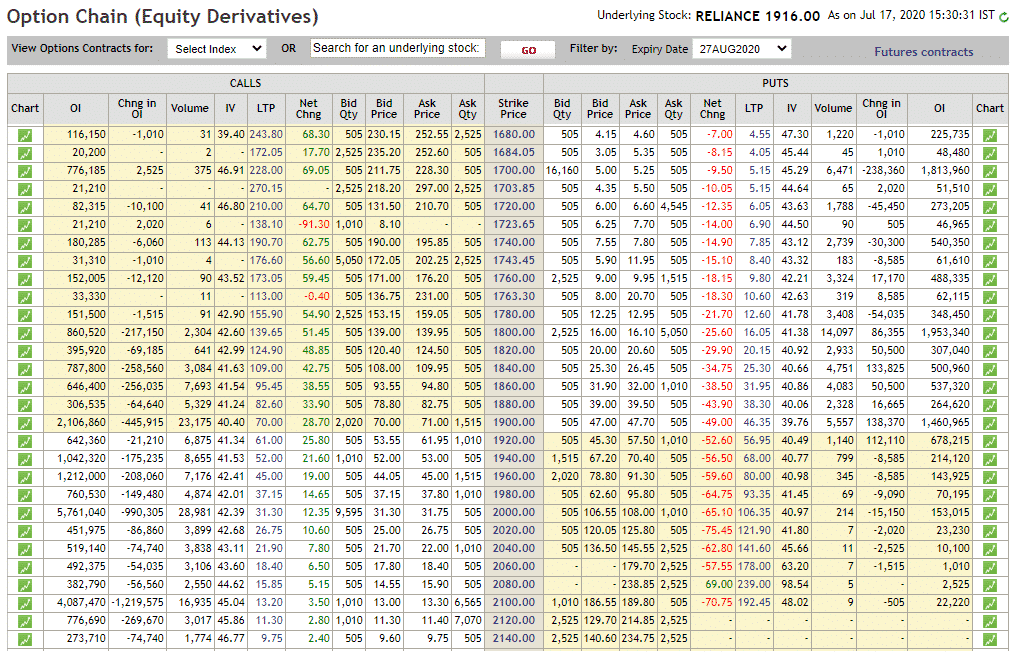

Reliance Industries Ltd is the biggest stock by market cap and looking at the options data from the NSE website, shows that there is plenty of volume in the options for this stock.

If you’re not sure how to read option chain information, you should refer to this post.

Selling Put Options on Nifty Stocks

Selling put options is a really simple way for Indian traders to get started with options.

When a trader sells a put option, they are obliged to take ownership of the stock at the strike price.

For taking this obligation, they are paid a premium which is theirs to keep.

Let’s look at an example using Reliance Industries Ltd.

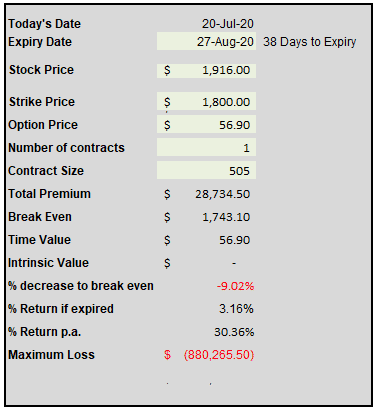

RELIANCE INDUSTRIES LTD CASH SECURE PUT

Date: July 20, 2020

Current Price: 1916

Trade Set Up:

Sell 1 RELIANCE August 27th, 1800 put @ 46.90

Contract Size: 505

Premium: 28,734.50 Rs Net Credit.

Breakeven Price: 1743.10

Maximum Profit: 28,734.50 Rs

Maximum Loss: 880,265.50 Rs

The premium is the put sellers to keep no matter what happens, but they will be forced to buy 505 shares of the stock at 1800 if the stock drops below that level.

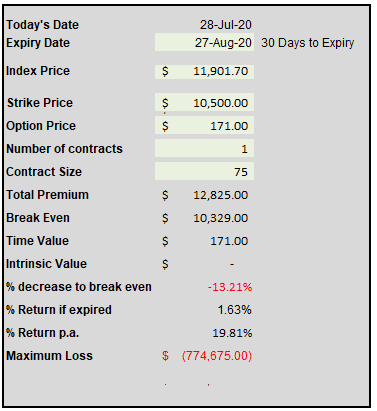

Of course, you if you prefer not to have stock specific risk, the same thing could be done on the Nifty 50 Index.

NIFTY 50 CASH SECURE PUT

Date: July 20, 2020

Current Price: 11901.70

Trade Set Up:

Sell 1 NIFTY August 27th, 10500 put @ 171.00

Contract Size: 75

Premium: 12,825 Rs Net Credit

Breakeven Price: 10329

Maximum Profit: 12,825 Rs

Maximum Loss: 774,675 Rs

Conclusion

Option trading in India is increasing in popularity and that trend is likely to continue over the next few years.

Stocks in the Nifty 50 and the Nifty Indexes themselves provide the greatest opportunities because they are the most liquid options with the best volume. This makes it easier for traders to enter their trade with a good price.

Option trading provides the ability to trade many different strategies on Nifty stocks, but it is important to understand these strategies in detail first.

Before getting started it is best to paper trade or find a mentor who can guide you on the process.

In this article we looked at a simple strategy of selling cash secured puts on Reliance Industries and the Nifty 50 Index.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Great post sir. Very inspiring.

Thanks Sandeep, I appreciate the kind words and feedback.