This free call option profit calculator will allow you to visualize the payoff graph and see the profit at various price points. Read the article or jump straight in and download the calculator below:

Contents

Options are increasing in popularity by the day due to commission free brokers such as Robinhood and celebrity day traders like Dave Portnoy.

Long calls are probably the easiest strategy for beginners to understand but you may be wondering how to calculate the profits?

In today’s article, I’ll show you just that and even provide a nice calculator for you that you can download and use for yourself.

What Are Call Options?

A call option is a contract between a buyer and seller. The contract will be for the right to purchase a certain stock at a certain price, up until a certain date (called the expiration date).

Up until the contract expires, the buyer of a call has the right to purchase the stock at the agreed price.

On the other hand, the seller of a call option has an obligation to sell the stock if the buyer exercises the option.

If you’re new to options, you may want to check out my 11,000 word beginner guide by clicking the button below.

If you’re a more advanced trader, you will want to check out these articles.

Call Option Premium

For receiving the right to buy the underlying shares, the call option buyer must pay to the seller a premium.

This is the seller’s to keep no matter what happens.

When determining the profit for the call option buyer we need to take into account to cost of the premium.

Calculating Profits For Call Options

When calculating the profit on a call option, there are two different scenarios depending on whether you are the buyer or the seller of the option.

CALL OPTION BUYER

For the buyer, the return on the trade is calculated by taking the ending stock price, minus the strike price and the premium paid.

Let’s say a trader purchased a $22 strike call and paid $2 in premium.

If the stock finished at $26 on the expiration day, the profit would be:

26 – 22 – 2 = $2 per contract

As each contract represents 100 shares, the total profit to the investor would be $200.

The breakeven price on the trade is $24 because we need to add the premium paid to the strike price.

Breakeven Price = Strike Price + Premium

Which in this case is:

22 + 2 = 24

If the stock moves lower, the most the trade can lose is the premium paid which would occur if the stock finishes below the strike price of $22.

CALL OPTION SELLER

The profit scenario is reversed for the call option seller because the maximum profit they can achieve is equal to the premium received and the potential losses are unlimited.

The breakeven price for the call seller is also $24 and anything above that level will see them suffer losses on a one to one basis.

If the stock rises to $30, the call seller would lose $6 per contract or $600 in total.

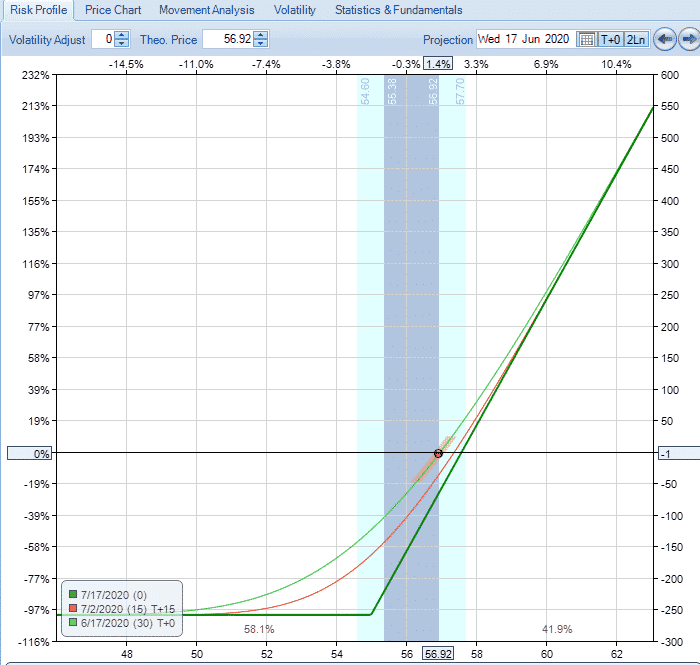

The profit calculation above is at expiration only. The calculation for interim profits is much more difficult to predict and is best done with options software such as Interactive Brokers Risk Navigator or Option Net Explorer or the tools provided by your broker.

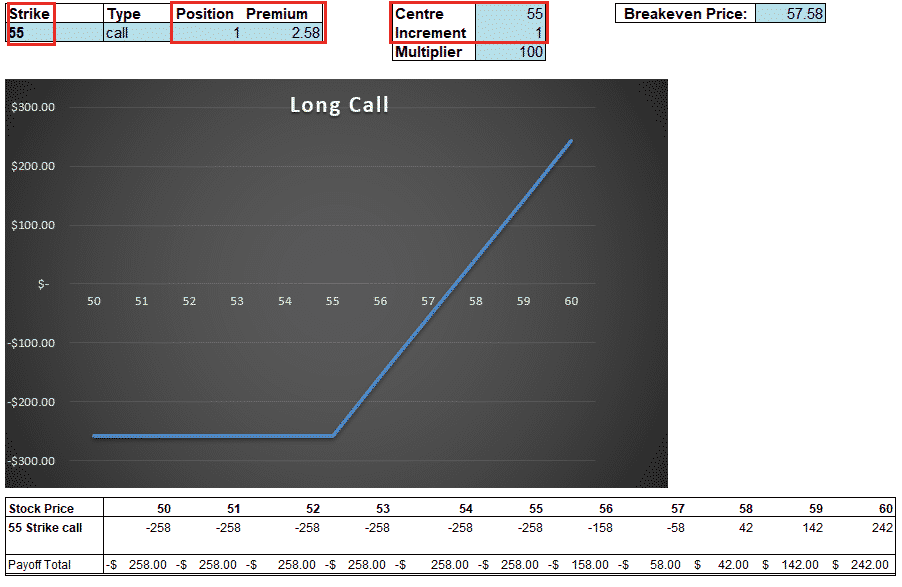

Excel Call Option Profit Calculator

The calculations above are all quite straight forward, but if you want to visualize this in excel along with the payoff graph, you can download the handy calculator below.

The bonus is you can also use the calculator for most of the major option strategies.

Step one is to download the file using the button below.

If you’re a call buyer use the Long Call tab and if you’re a call seller use the Short Call tab.

Then simply enter the strike price, the number of contracts (position) and the premium. Depending on the stock price, you will likely have to adjust the values in Centre and Increment.

Don’t worry about anything else, the calculator will do the rest.

Calculating Interim Profits

As mentioned this excel sheet will help you visualize the profit at expiry, but if you want to estimate the interim profits it’s best to use some more advanced software.

The below screenshot is from Option Net Explorer and gives you an estimate of the profit at interim dates which you can specify.

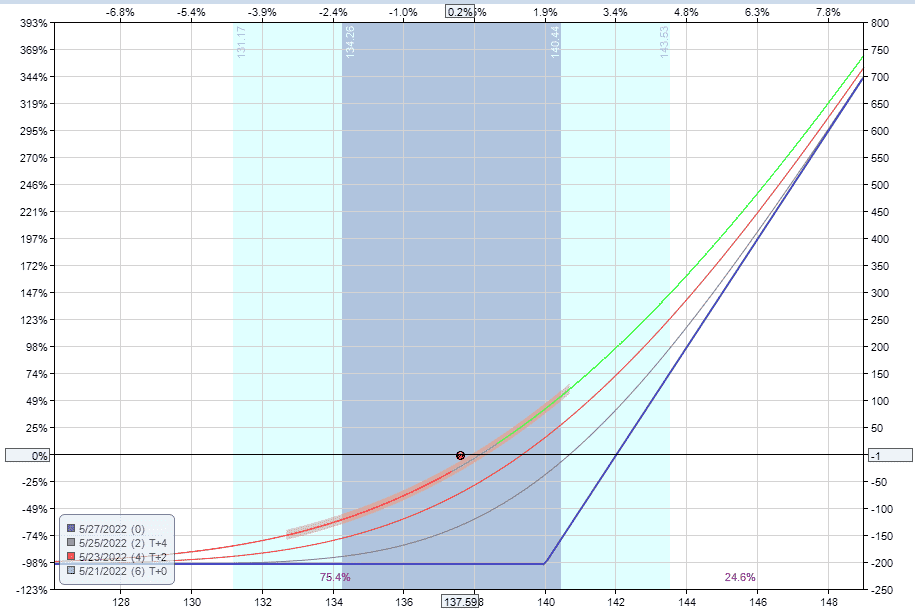

Call Option Profit Example

Let’s look at a call option profit example firstly from the call option buyer’s perspective.

Date: May 20th, 2022

Price: AAPL @ 137.59

Buy 1 AAPL May 27, 2022 140 call option @2.05

Net Debit: $205

Source: OptionNet Explorer

The breakeven price can be calculated by taking the strike price (140) and adding the premium paid (2.05).

Therefore, the breakeven price is 142.05.

A profit can be achieved at lower prices if AAPL makes a move higher early in the trade, as can be seen in the image above.

On the expiration date, AAPL closed at 143.78 leaving the trade with a profit of $173.

The profit can be calculated by taking the ending price (143.78), subtracting the breakeven price (142.02) and multiplying by 100.

FAQ

How do you calculate profit on a call option?

To calculate the profit on a call option, take the ending price of the stock, less the breakeven price of the long call and multiply the result by 100.

The breakeven price is equal to the strike price, plus the premium paid.

If the call option is sold before expiration, the profit can be calculated by simply taking the sale proceeds of the call option less the purchase cost.

Can I sell a call option before it expires?

To sell a call option before it expires, simply place a sell to close order.

When the long call option trade was opened, it would have been a buy to open order.

So, to sell the position we need to make the opposite trade which is a sell to close.

What happens when a call option hits the strike price?

If you are long a call option, you want the stock price to be higher than the strike price on expiration day.

If the stock is below the strike price on the expiration day, the call option is essentially worthless.

To achieve a profit on a long call option at expiration, you need the stock price to be above the breakeven price.

The breakeven price is calculated by taking the strike price and adding the premium paid.

What happens if I don’t sell my call option?

What happens if you don’t sell your call option prior to expiration depends on the location of the strike price compared to the stock price.

Out of the money call will expire worthless on the expiration date.

In the money call options will be automatically exercised by your broker.

You broker execute an order to buy 100 shares of the stock for each call option that you own.

You need to make sure you have the capital available in your account, otherwise you may receive a margin call.

Ther may be fees payable to the broker for processing the option assignment.

Why do investors buy call options?

Investors buy call options in the hope that the stock will experience a rapid increase in price.

In this scenario, the investor is bullish on the stock and is using call options to gain a leveraged exposure to the stock.

Call options offer large gain potential for a very small outlay.

The maximum loss is limited to the premium paid which makes them attractive to speculators.

Potential returns on a percentage basis are much higher for bought call options that simple stock ownership.

Summary

The profits and losses on call options will vary depending on whether you are the buyer or seller of the options.

Call option buyers have limited risk and unlimited gain potential whereas the opposite is true for call sellers.

Profits and losses at expiration can be easily calculated using the handy excel tool available for download above.

Calculating the interim profits is more complicated and requires advanced software such as Option Net Explorer.

We hope you enjoyed this article on our call option profit calculator. If you have any questions, please send us an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.