Today’s article is all about kicking things up a notch with advanced option strategies.

We’re going beyond the basics to show you some savvy techniques that the pros use.

Ready for a fun ride in the options trading world?

Let’s get started!

Contents

Introduction

Most options traders run through a typical evolution as they grow their knowledge and accounts.

This looks similar to the following: First, traders who see outsized gains are attracted to either 0DTE or weeklies to chase some insane returns.

As this starts to prove more difficult than it is worth for many, they evolve into trading monthlies and longer-term options and start using them for directional trading.

Many options traders stop here as they find a system that works for them.

Some options traders continue shorting options and using spreads to make everything more stable and predictable.

This is where we will dive into today.

Spread trades run the gambit from extremely simple to incredibly complex, but all can be incredibly useful.

While some basic strategies like verticals work fine, some more advanced strategies can help level up your trading.

These are five great advanced strategies to look into if you are looking for some additional ways to trade the markets.

Poor Mans Covered Call

This is a great strategy that can be incredibly useful for smaller accounts.

The Poor Man Covered Call involves buying a longer-dated In the Money or At the Money Call option and then selling shorter-dated calls against it.

This creates a similar risk profile to a regular covered call but often requires significantly less capital.

This strategy can be classified as advanced for a few reasons.

The first is that it’s possible to lose the entire amount put into the position.

The long option, even though it’s In or At the Money, still has the potential to expire worthless if the stock price declines significantly and stays there.

Additionally, the short leg of the trade needs to be far enough away so that the trader can benefit from the theta decay without having to worry about the long positions while at the same time being close enough to provide enough premium to make the trade worth it.

It’s a balancing act between Strikes and Dates, but this is the tradeoff to having a significantly smaller capital requirement.

Married Puts

The married put strategy is similar to having an insurance policy for your stock.

It involves purchasing a stock and buying a put option for an equivalent number of shares simultaneously.

While this strategy reduces the net profit from a position, the protection is well worth it if you are at all fearful about a market drop.

If the stock continues to climb, the put will expire worthless, which is the best-case scenario. If the stock price falls, you have two main options.

- You can keep the stock and sell the put option for any profit you may have realized. This option will help offset any loss unrealized on the shares.

- You can keep the put and let the stock get exercised away.

The determining factor for which path you should take is the magnitude of the drop. If it’s a news break and you feel the stock will bounce back and/or you want to keep it at your cost basis, then choose the first one.

If the price has plummeted below the put strike, you can always let the shares get exercised away and buy back in at a lower price.

What complicates this a little is the theta decay and strike selection on the put.

You don’t want to go too low on strike; otherwise, you will realize a larger loss, but if you stay too close to the current price, you could lose out on a potentially profitable position.

The Short Straddle

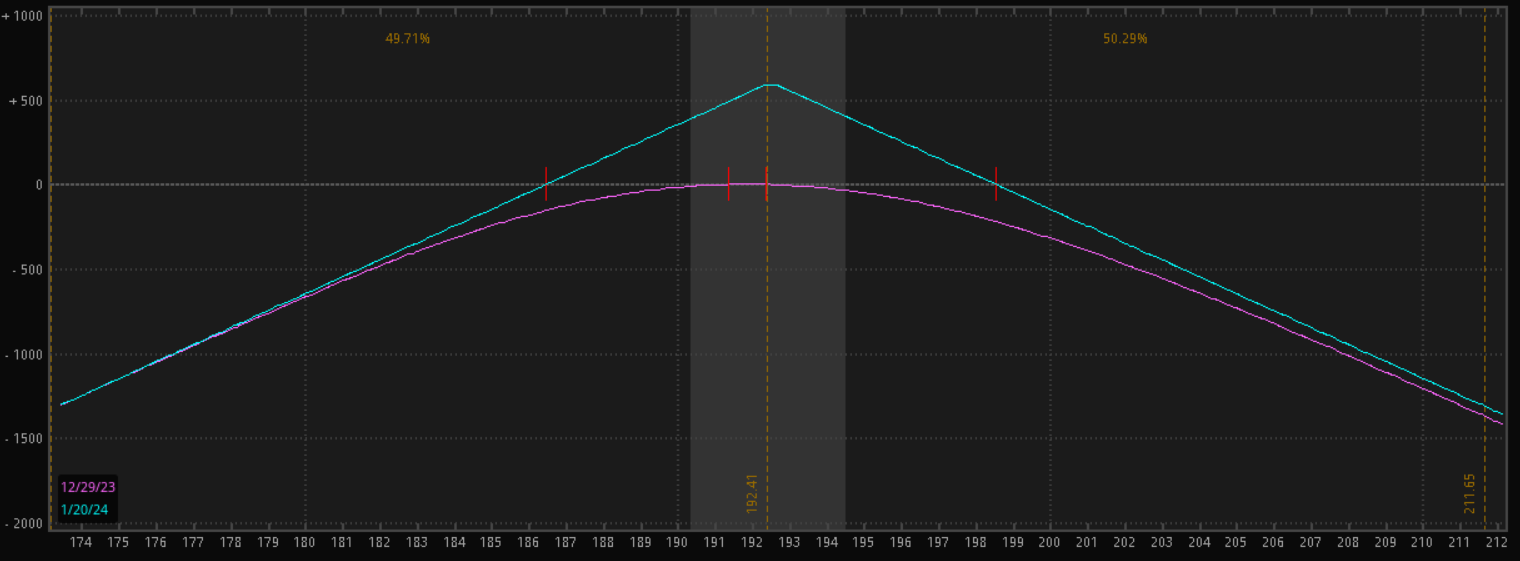

The short straddle is a net credit options strategy that is best performed when a trader believes that the price of a stock will remain stagnant until the options expire.

The trade is set up by selling a call and a put on a stock.

This gives this strategy a risk profile that looks like an “A,” with the top part being where you profit.

This can be a great strategy for short-term trades to capitalize on the theta decay of both the short call and short put.

The downside is that it puts you at unlimited risk if the stock moves violently in either direction.

Below is a risk profile for a Short Straddle on AAPL for the January 2024 expiry.

Your max profit will be roughly $500 if the stock price does not move over the next month.

Suppose the stock moves up or down by more than a few dollars, though you will start to realize a loss on the trade.

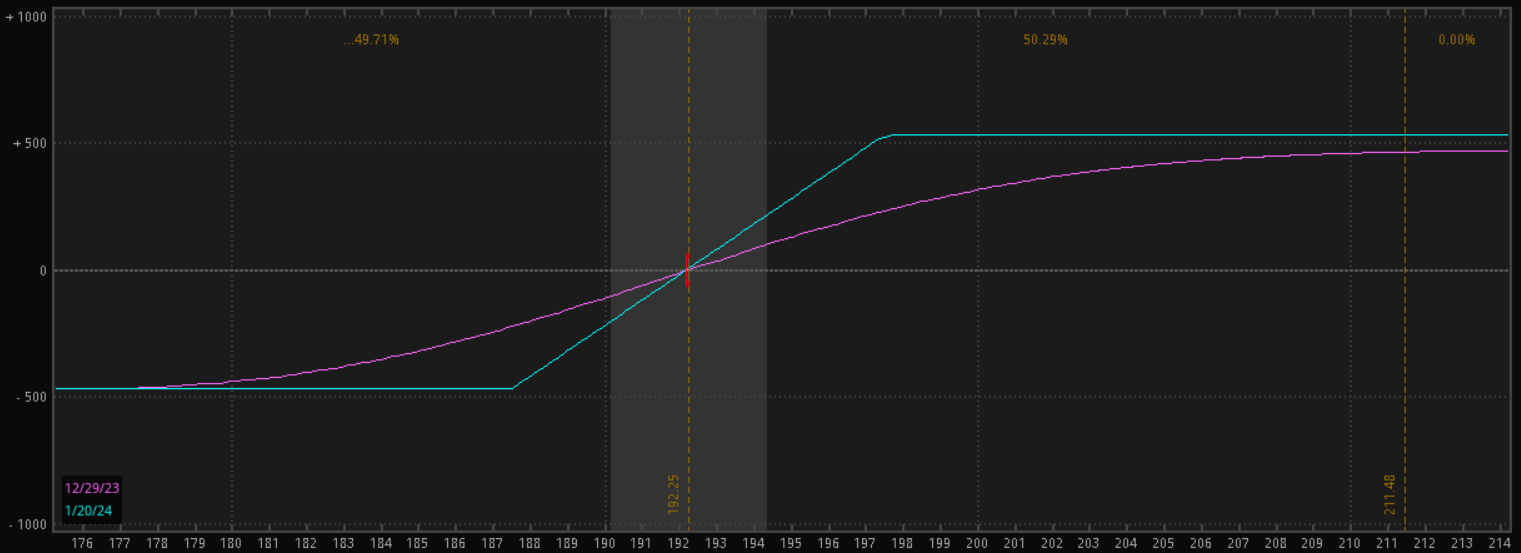

Short Calendar Spread

The short calendar spread is a great strategy for a fixed reward trade that captures potential volatility in a name.

This trade is set up by purchasing a shorter-dated call and then selling a longer-dated call at the same strike price.

The short calendar spread is a form of credit spread, which means your maximum profit is what you are paid for the trade.

This occurs as the price moves farther away from the strike price you sold the spread at, so you are only hoping for the underlying stock to be as volatile as possible.

Since you are short the longer-dated all option, your risk for this particular trade is technically unlimited.

If the short-dated call expires and you stay open in the longer-dated option, you are now naked shorting a call; this can be an extremely dangerous trade if you aren’t careful, so if you plan on trading a short calendar spread, it’s best to keep a close eye on the position and try and close out both legs simultaneously so you are never in an uncovered position.

Protective Collar Strategy

The protective collar strategy is similar to the married put we discussed above.

It exists to help provide some protection to an underlying stock position.

The setup for this trade is pretty simple: first, you must own at least 100 shares of the underlying stock.

Next, you purchase an out-of-the-money put option on the stock; this protects your downside exposure.

Finally, you sell an out-of-the-money call option on the stock to help offset the purchase put’s cost. Another way to think of this trade is that you have a covered call with some downside protection.

It is called a collar because the long put and short call cap the stock’s movement in both directions, thereby “collaring” the position to the strikes bought and sold.

The benefit of this strategy is that it removes a lot of potential volatility from your position and does so for a very limited cost when compared to a married put.

The tradeoff is that your potential profit is capped as well.

Below is a sample collar risk profile; it looks very similar to a bull spread, with the only difference being you own the stock in the middle.

Wrapping it Up

Strategies like the Poor Man’s Covered Call, Married Puts, Short Straddle, Short Calendar Spread, and Protective Collar offer more advanced methods to navigate market risks and capitalize on market opportunities.

Each of these comes with its unique tradeoffs but can be a great way to improve portfolio profitability when more conventional strategies aren’t working for you.

Embracing these advanced strategies requires more than just basic knowledge.

Traders must proactively manage these strategies, especially those like the Short Straddle and Short Calendar Spread, which carry the risk of unlimited losses.

By integrating these complex strategies into their portfolio, traders can achieve a more refined control over risk, paving the way for potentially greater returns.

However, like all trading endeavors, balancing the potential benefits against the inherent risks and costs is crucial, adapting each strategy to fit individual trading styles and market cycles.

We hope you enjoyed this article on advanced option strategies.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

I wonder this:

If you were to buy an all stock portfolio, let’s just day 1000 shares of VTI (just to keep it simple), and immediately buy protective puts on the whole thing (10 puts) that last one year each. And do that over 10 years. And look at the total growth at the end of those ten years, minus the cost of the puts, we’ll call that number “X”.

Then compare that to a portfolio of the same initial starting amount, but instead of 100% stock it was 80/20 with bonds. Or 70/30. Or whatever.

And you take the amount at the end of that 10 year period, (because the 20% bonds has decreased the portfolio’s growth by many percentage points). So see what that final number is at 10 years, call it “Y”.

How will X compare to Y?

Basically a full stock portfolio with constant protective puts compared to a reasonable stock/bond portfolio with the same starting amount.

Do you know if anyone has done that study?

Possibly, but I don’t have anything handy.

Can you do an article comparing vertical credit spreads (like bull put/bear call) to horizontal/calender credit spreads (short calender?)?

Specifically, talking about when you would choose one style over the other, and differences in deltas and gammas and entry and exit and take profit etc etc

Ok will add it to my list.

Could you explain this statement to me?The short calendar spread is a form of credit spread, which means your maximum profit is what you are paid for the trade.

Yes it’s basically the opposite of a regular calendar spread.