The iron condor options strategy is likely (and should be) the first non-directional income-style strategy an option investor is exposed to.

The only prerequisite is to know and understand the credit spreads.

Once they know this, they can see the iron condor as two out-of-the-money credit spreads – one bull put spread and one bear call spread.

New options investors are encouraged to backtest and paper trade a strategy before starting to trade the strategy live.

And then start at a small size.

Contents

Mistakes Happen

Let’s be honest. When doing something new, we will make mistakes – whether cooking, cutting hair, or practicing photography.

When learning to trade, we will either make mistakes or perform sub-optimal adjustments.

This is not good enough in this game, as we are competing with many more experienced players.

For every player that wins, that money comes from a player who loses.

This is known as a zero-sum game.

This is more true in options trading than in stock investing.

At least in stock investing, we can say that a company’s value increases over time and that, in the long run, it is possible for most players to all come out ahead in the long term.

But for short-term options trading, where we are bartering options contracts with another party, one party will win, and another will lose.

The marketplace can not generate free money for everybody.

If the iron condor is a new concept, it is better to lose a small amount of money while we learn rather than lose a large amount of money and get discouraged and be out of the game.

Trading Iron Condors on ETFs

With that said, the IWM and SPY electronic traded funds (ETFs) are good candidates to start trading iron condors with.

IWM is the ETF that tracks the Russell 2000 index (RUT).

While the experienced players are trading the RUT index itself, we can start by trading the IWM, which is about ten times smaller.

SPY is the ETF that tracks the S&P 500 index (SPX), and it is ten times smaller than its corresponding index.

While the SPY trades around the $400 to $500 price range per share, the IWM trades around the $100 to $200 price range per share.

All these underlying symbols are highly liquid and are ideal for options strategies where we want to only trade on liquid symbols.

It is best to start trading iron condors on indices and ETFs because they are diversified assets.

The IWM’s price movement is determined by the price movements of 2000 different stocks.

While one stock may have an aberrant behavior or have an earnings announcement that moves the stock, the amalgamation of 2000 stocks makes the price behavior of IWM more stable than individual stocks.

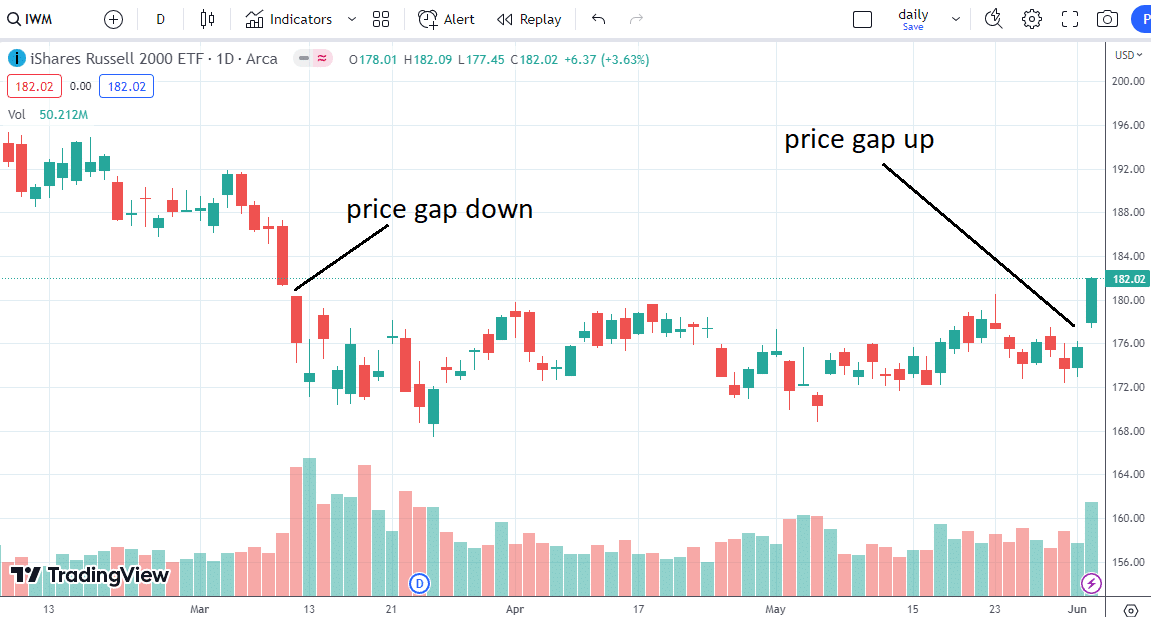

Nevertheless, it is still possible for IWM to have overnight price gaps.

As iron condor traders, we do not like prices to move too much since the strategy relies on the passage of time to make money.

The longer we can stay in the trade without having the price move too close to our credit spreads, the more money we can make.

Time To Expiration

Let’s look at an iron condor on the IWM that is 93 days till expiration.

Why is the expiration date three months out?

This is a bit on the long end of the spectrum.

That is why we call it a “long-term iron condor.”

It is good for beginners to start because the further out in time the iron condor expires, the less often you need to monitor the iron condor, and adjustments are not as time-critical.

It is still okay if one adjusts the same or the next day.

Nevertheless, the condor should be checked once every single trading day.

As you can see from the above candlestick chart of the RUT, the market is moving around quite a bit.

Like a boat in a rocky ocean, the waves are not making it a smooth ride.

We need a bigger boat. The longer time till expiration is our bigger boat.

You will realize that the more time you have in the condor, the less that a large price move will negatively affect the profit and loss of the position (the P&L of the position).

Price movement in the underlying asset (in our case, the price movement of the IWM) will negatively affect our P&L.

We prefer that the price of IWM sit perfectly still. That is not going to happen.

When a big wave hits, we don’t want it to rock our boat as much.

Start Of Trade

On April 19, 2023, IWM is trading at $177, and we initiated a two-contract iron condor:

Date: April 19, 2023

Price: IWM @ $177

Buy 2 July 21 IWM $155 put @ $1.82

Sell 2 July 21 IWM $160 put @ $2.42

Sell 2 July 21 IWM $201 call @ $0.58

Buy 2 July 21 IWM $206 call @ $0.28

Net credit: $181

Your broker platform will quote the prices of the option contract in terms of price per share. One contract controls 100 shares.

For example, we buy two put options contracts with a quoted price of $1.82 per share.

That means we have to pay $182 for one contract. Since we are buying two contracts, we pay $364 for buying the $155 IWM put options in this leg of the condor.

When we “buy” a contract, we are said to be “long” the contract or have a “long option.”

We use the negative amount in our math because the money comes from our account.

When we “sell” a contract, we are said to be “short” the contract or have a “short option.”

We show a positive dollar amount since we receive a credit for selling.

Buy 2 long puts: -$364

Sell 2 short puts: $484

Sell 2 short puts: $116

Buy 2 long puts: -$56

This is how we receive a net credit of $181 for initiating the iron condor.

We say that we just “sold” an iron condor and received $181 into our account from that sale.

The goal is to ‘buy back” to close the trade at a lower price.

Typically, we want to buy back at a price 50% less than what we sold it for.

Another way of saying this is that we want to take at least 50% of the initial credit as profit.

In our example, if we see a profit of $91, we will say it is a successful trade and close it.

This would collect 50% of the initial credit.

Composition of Two Credit Spread

You will recognize the above iron condor as composed of a bull put spread and a bear call spread.

Bull put spread:

Buy 2 July 21 IWM $155 put @ $1.82

Sell 2 July 21 IWM $160 put @ $2.42

Credit: $120

Bear call spread:

Sell two July 21 IWM $192 call @ $1.95

Buy tw2o July 21 IWM $197 call @ $1.01

Credit: $60

Both results in a credit, and the sum of that credit is the credit received for the iron condor.

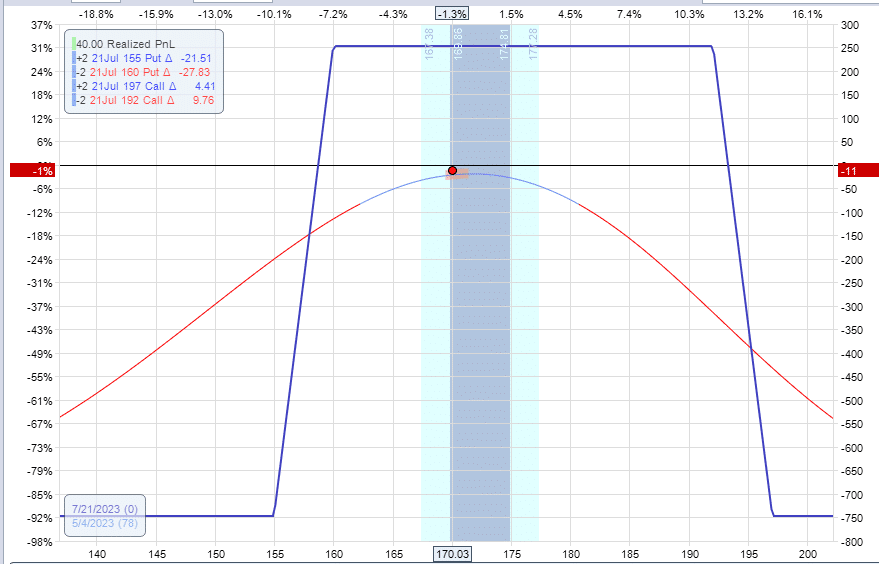

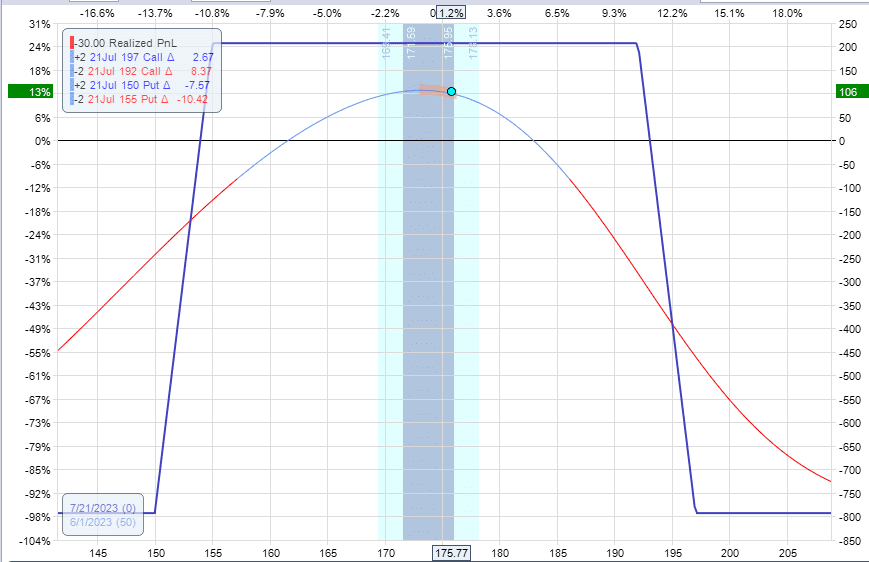

Payoff Graph

You will see the payoff graph when we enter these two spreads together into a program (either in your brokerage platform, OptionNet Explorer, OptionStrat.com, or others).

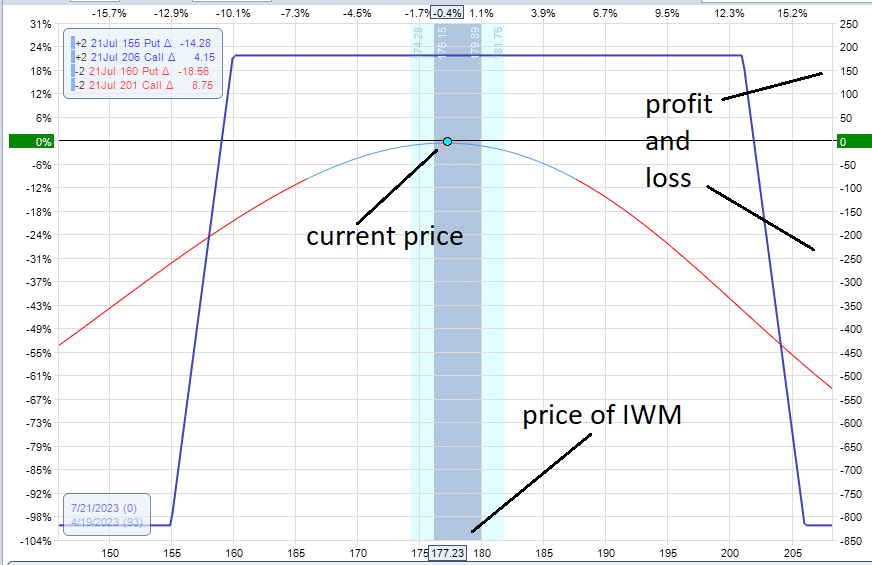

Here we have modeled the iron condor in OptionNet Explorer:

The blue line is the expiration graph, and it tells you what your P&L will be if IWM closes at a particular price at expiration.

The T+0 line is the curved line.

It tells what your P&L would be today if IWM is at a certain price.

Right now, the price dot shows that IWM is a price of $177, and our profit is zero.

You see the dot sitting on the T+0 line, right on the “zero profit horizontal.”

Risk to Reward Ratio

This graph is also known as the “risk graph” because the lowest point of the expiration graph is around $800 loss.

This would be the max loss of the iron condor.

Our potential profit can not be above the initial credit received.

You see that the graph never gets above $200 in profits.

With a max theoretical potential reward of around $200 and a max risk of $800, we have a risk-to-reward ratio of roughly 4 to 1 for the iron condor.

Calculating Max Loss

To determine our maximum risk in the trade, you have to imagine what would happen if the price of IWM is completely outside the condor expiration graph at expiration.

If it was on the downside, the bull put spread would be completely in the money at the max loss of $1000 per spread.

The spread is 5 points wide, and we have two contracts: (5 x 100) x 2 = $1000.

The bear call spread will expire worthless.

Our initial credit of $181 compensates for the loss of $1000.

So our max loss in the trade would be $819.

You can perform the same thought experiment if IWM goes up above the bear call spread.

The max loss would come out to be the same since the width of the call spread is the same as the width of the put spread.

Adjustment

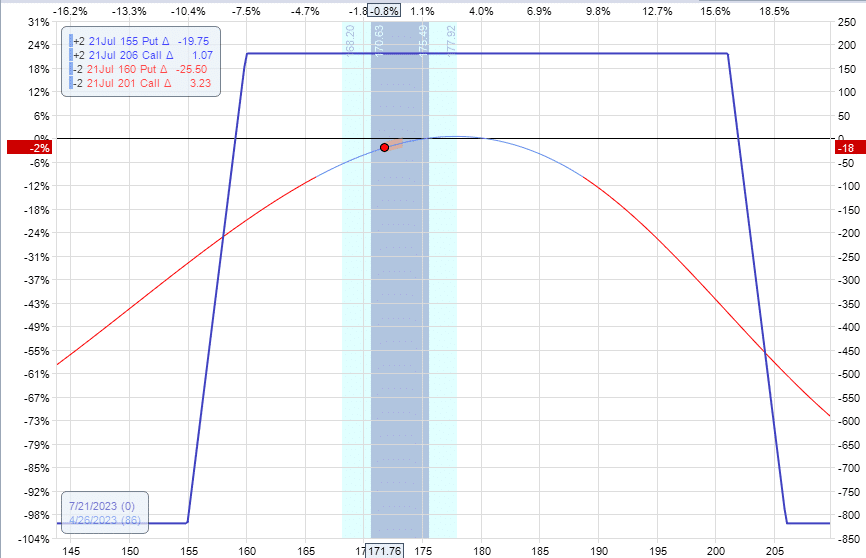

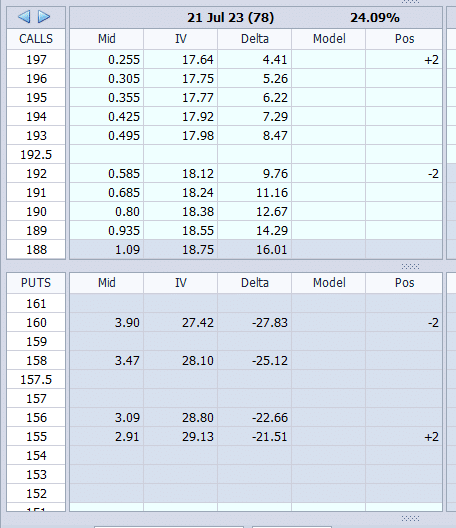

One week later, on April 26, IWM came down to $171, with our graph looking as follows:

The Greeks shown by the analytics software show the following.

Delta: 7.74

Theta: 1.3

Vega: -14

The position delta tells us how directional the trade is. Right now, 7.74 is like having eight shares of IWM stock.

The number is positive, which means that we benefit if the price of IWM goes up (just as if we had eight shares of IWM).

As one possible adjustment, we can roll two long calls down in strikes.

This adjustment would bring in around $72 extra premium and bring the trade back closer to delta neutral.

Date: April 26, 2023

Price: IWM @ $171

Buy to close 2 July 21 IWM $201 call @ $0.20

Sell to close 2 July 21 IWM $206 call @ $0.10

Sell to open 2 July 21 IWM $192 call @ $0.84

Buy to open 2 July 21 IWM $197 call @ $0.38

Net credit: $72

Note that we maintain the same distance in strikes for long and short calls.

We kept the wing width of the call spread the same.

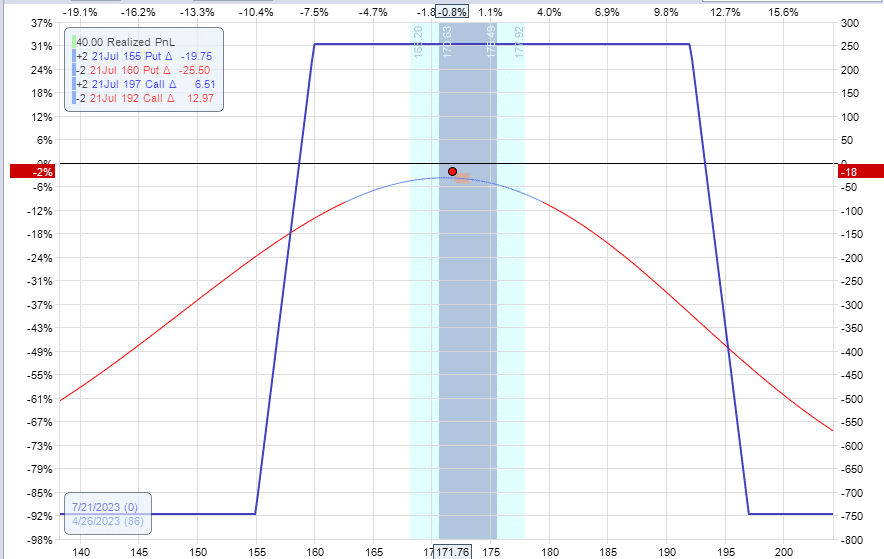

The resulting graph after the adjustment looks like this.

And the Greeks show that the delta is closer to zero.

Delta: -0.80

Theta: 2.31

Vega: -21.6

By better centering the condor, we also increased our theta.

We want theta to be positive for income-style non-directional strategies such as the iron condor.

The larger the number, the more we make each passing day in the trade (as long as all the other factors are unchanged).

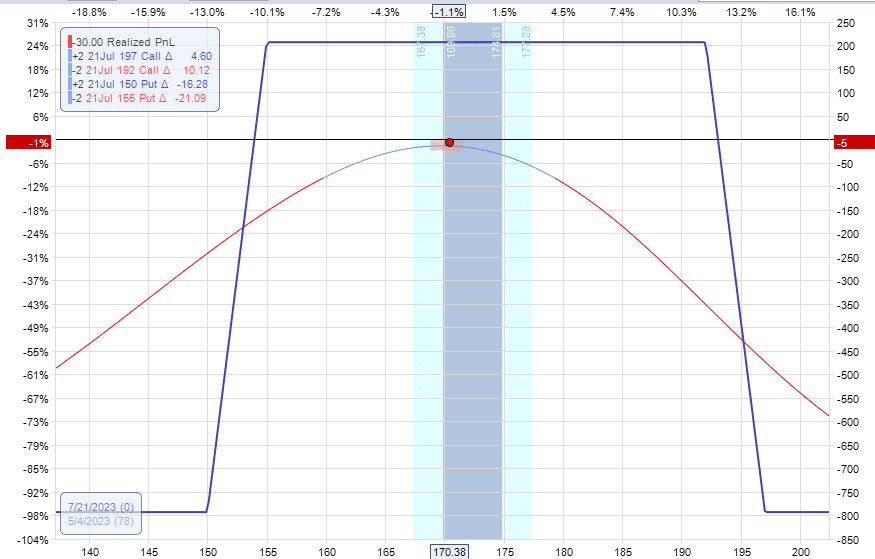

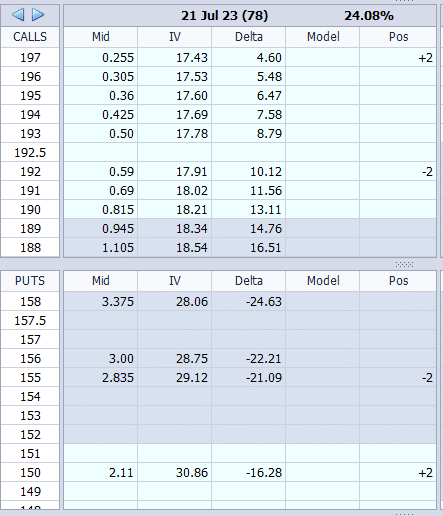

Rolling Tested Side Out

On May 4, IWM dropped to 170.

In our analytics software, we can see that the delta location of the short put is at -27.83.

We prefer that our short strikes not exceed plus or minus 22 deltas. So -27.83 is a bit risky.

Note that this location delta of the short put is not the same as the positional delta of the Greeks, which shows:

Delta: 2.6

Theta: 2.2

Vega: -19

One can argue that we can leave the trade as is without making any adjustments since the position delta is not too large, and we still have quite a number of days from expiration with 78 days left.

However, as a matter of practice, we stick to our rules and perform the adjustment by rolling the bull put spread further out of the money away from the current price.

We will perform the roll in two separate orders, one after the other.

Close bull put spread:

Buy to close 2 July 21 IWM $160 put @ $3.79

Sell to close 2 July 21 IWM $155 put @ $2.84

Net debit: $191

Open new bull put spread:

Sell to open 2 July 21 IWM $155 put @ $2.84

Buy to open 2 July 21 IWM $150 put @ $2.11

Net credit: $145

The net debit for rolling the puts out is $46.

The new graph after adjustment:

The new Greeks are:

Delta: -0.86

Theta: 2.43

Vega: -19

Note that our location delta of the short put is now down to -21, which is acceptable:

We monitor the P&L and deltas daily and see that we continue to be fine.

Closing Trade

On June 1, we saw a P&L of $106 profit, which is more than 50% of our initial credit received.

We close the trade:

Date: June 1, 2023

Price: IWM @ $176

Sell to close 2 July 21 IWM $150 put @ $0.58

Buy to close 2 July 21 IWM $155 put @ $0.85

Buy to close 2 July 21 IWM $192 call @ $0.41

Sell to close 2 July 21 IWM $197 call @ $0.18

Net debit: $101

Summary

Initial credit received: $181

Credit for rolling calls in $72

Debit for rolling puts out: -$46

Debit for closing the trade: -$101

Net profit: $106

Note that the margin or max risk in the trade can change as we perform adjustments.

However, in our example, our max risk never exceeded $820.

A profit of $106 on a capital usage of $820 is about a 13% return.

This is a good return considering that we have been in this trade for a month and a half.

FAQs

When we closed the trade, we didn’t buy it back at a 50% lower price than what we had collected. How did we achieve 50% of the initial credit received?

We collected $181 initially. But then we collected another $72 and paid $46 for two adjustments.

So our net credit is $207.

Buying it back at $101 is less than half of that.

When would we want to trade the iron condor on RUT?

RUT is a larger index. When you get comfortable trading on IWM with ten contracts, you can graduate to trading it on the RUT.

Trading one contract on RUT is like trading ten contracts on IWM.

You would save on commissions.

Another benefit of RUT is that you do not get assigned stock because the RUT is cash-settled, whereas, in IWM, you can get assigned shares of IWM near expiration.

Can we trade iron condors on QQQ?

Sure you can. QQQ is the ETF tracking the Nasdaq.

How close to expiration should you get before exiting?

For these long-term iron condors, I would try not to get closer than 21 days till expiration.

Conclusion

This is one to bookmark.

There are a lot of takeaways in this example.

As you gain knowledge and experience, come back to re-read this, and you might find that you pick up new information not in the first reading.

We hope you enjoyed this article on the long term iron condors.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Why we have to close before it’s expiration (21 days prior to its expirations)?

To reduce gamma risk. When we get closer to expiration, we get larger moves in P&L for the same move in the underlying. The T+0 line becomes much steeper. Let me know if that makes sense.

This strategy is more suitable for high IV over than low IV?

Ideally you want slightly higher vol yes. But volatility terms structure can also work in your favor. If the market is in heavy Contango, vol is low in the front months and higher in the back months, So by selling longer-term Condor, we are naturally trading the higher vol. More info here:

https://optionstradingiq.com/everything-you-need-to-know-about-vix-term-structure/

I think this is a great place to start if you’re looking to invest in long term iron condors.