In today’s example, we will look at an unbalanced condor example, also known as the asymmetric condor.

Since we will be using both puts and calls in this option strategy, we can use the term “iron” as in “unbalanced iron condor,” as opposed to condors which consist of all puts and all calls.

Contents

- Unbalanced Condor Example

- The Greeks

- Checking On The Trade

- Holding For A Couple More Days

- FAQs

- Conclusion

Unbalanced Condor Example

This example consists of selling two put spreads and selling one call spread.

The fact that there are more put spreads than call spreads is what causes the condor to be “unbalanced.”

Other ways to make the condor unbalanced is to have different widths for the call spreads and put spreads. But that is for another time.

For this time, we are keeping the widths of the call spread and put spreads the same 5 points wide.

We will be selling the $500/$505 put spreads on United Health Group Incorporated (UNH). And we will be selling the $580/$585 call spread on UNH.

Below I have summarized the trade initiation transactions, which would have been placed as one single transaction to the brokerage.

While some experienced traders can initiate the put spreads and the call spread as two separate orders, we are keeping things simple for today.

Trade Details:

Date: Oct 26, 2022

Price: UNH @ $544.30

Buy two contracts Nov 18 UNH $500 put @ $2.91

Sell two contracts Nov 18 UNH $505 put @ $3.45

Sell one contract Nov 18 UNH $580 call @ $2.22

Buy one contract Nov 18 UNH $585 call @ $1.63

Credit: $168

The short call and puts are sold out of the money at around the 15-delta. Their expiration is 23 days away.

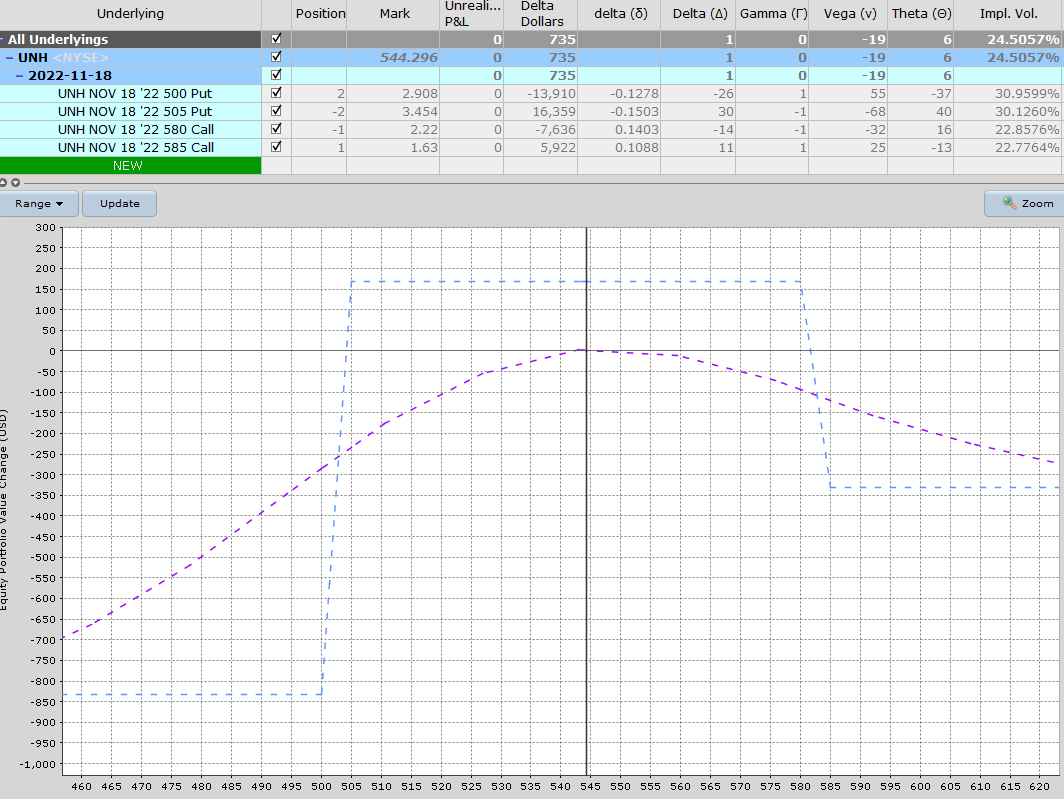

The resulting payoff diagram (also known as the risk graph) looks like this.

You can see that the max profit potential on the graph is exactly $168, which is the credit we have received for initiating the trade.

Your brokerage platform will give you the $168 number when you place your trade.

Nevertheless, for fundamental knowledge, it is good to understand exactly how that number is calculated.

-2 x $2.908 x 100 = -581.60

2 x $3.454 x 100 = $690.80

1 x $2.22 x 100 = $222.00

-1 x $1.63 x 100 = –$163.00

Total: $168.20

We are using negative numbers to represent dollars coming from our account.

Positive numbers are dollars being received into our account.

We need to multiply by 100 because the prices listed (such as $2.91, $3.45, $2.22, and $1.63) are prices of the option on a per-share basis.

One contract (which is the smallest unit that you can buy or sell) represents 100 shares.

The Greeks

We see on the Interactive Brokers platform that the combined Greeks for this unbalanced condor are:

Delta: 1

Theta: 6

Vega: -19

There is just a slightly positive delta, which means that the trade will benefit if the underlying price goes up.

It is a slightly bullish trade to start because we have two bullish put spreads instead of only one bearish call spread.

Like the traditional balanced condor, the strategy is positive theta and negative vega.

The positive theta capitalizes on the passage of time.

With all other things being equal, the longer we stay in the trade, the more money the trade makes.

The short vega means that if the implied volatility of the underlying drops, it will also benefit us.

Checking On The Trade

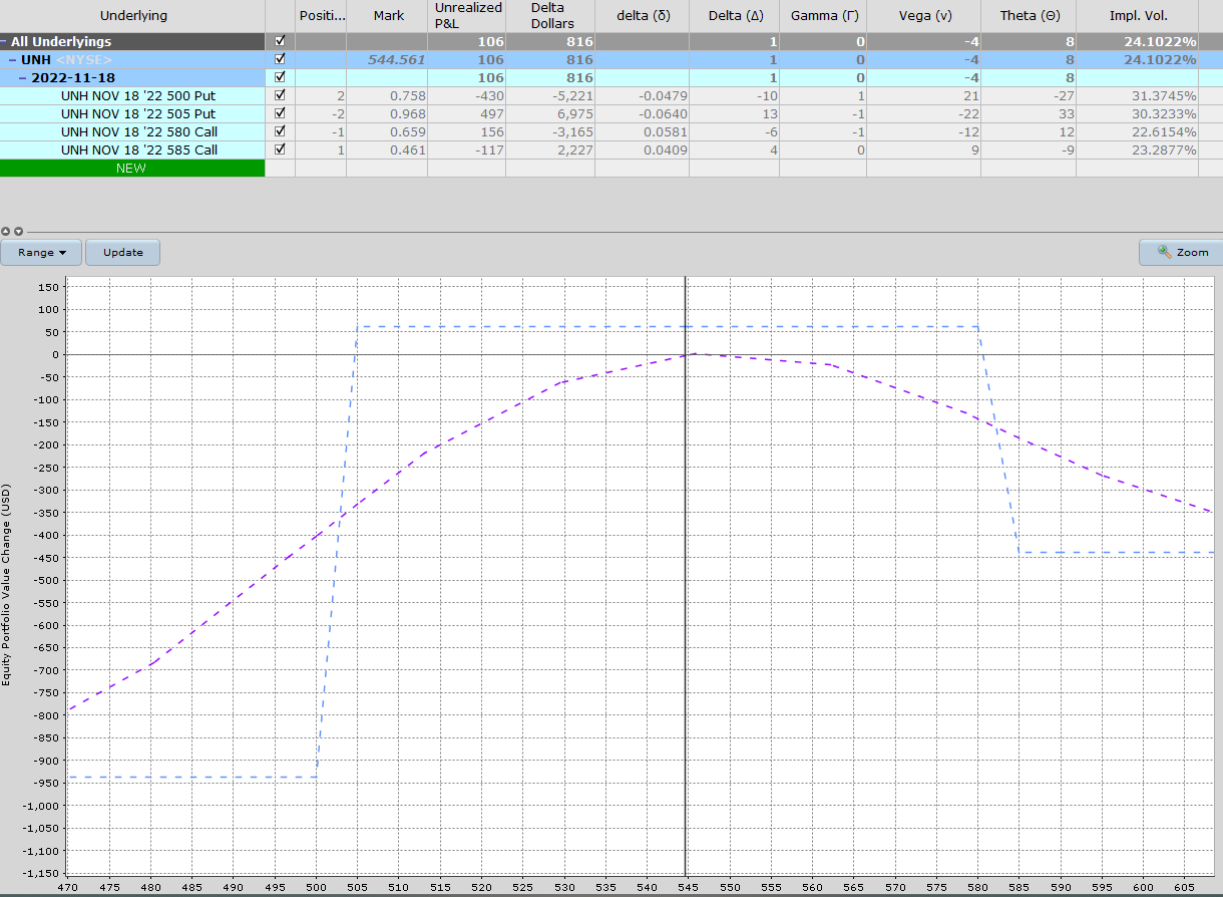

Checking on the trade on Nov 7, we see:

Looking good here at +$106 in P&L and with no adjustments so far.

We are halfway through the duration of the trade with only 11 days to expiration.

It could be closed now or maybe held for another day or so.

Holding For A Couple More Days

We hold on for two more days to see if we can squeeze out a bit more time decay out of the trade.

Hopefully, it doesn’t make a big price move on us.

And it does not.

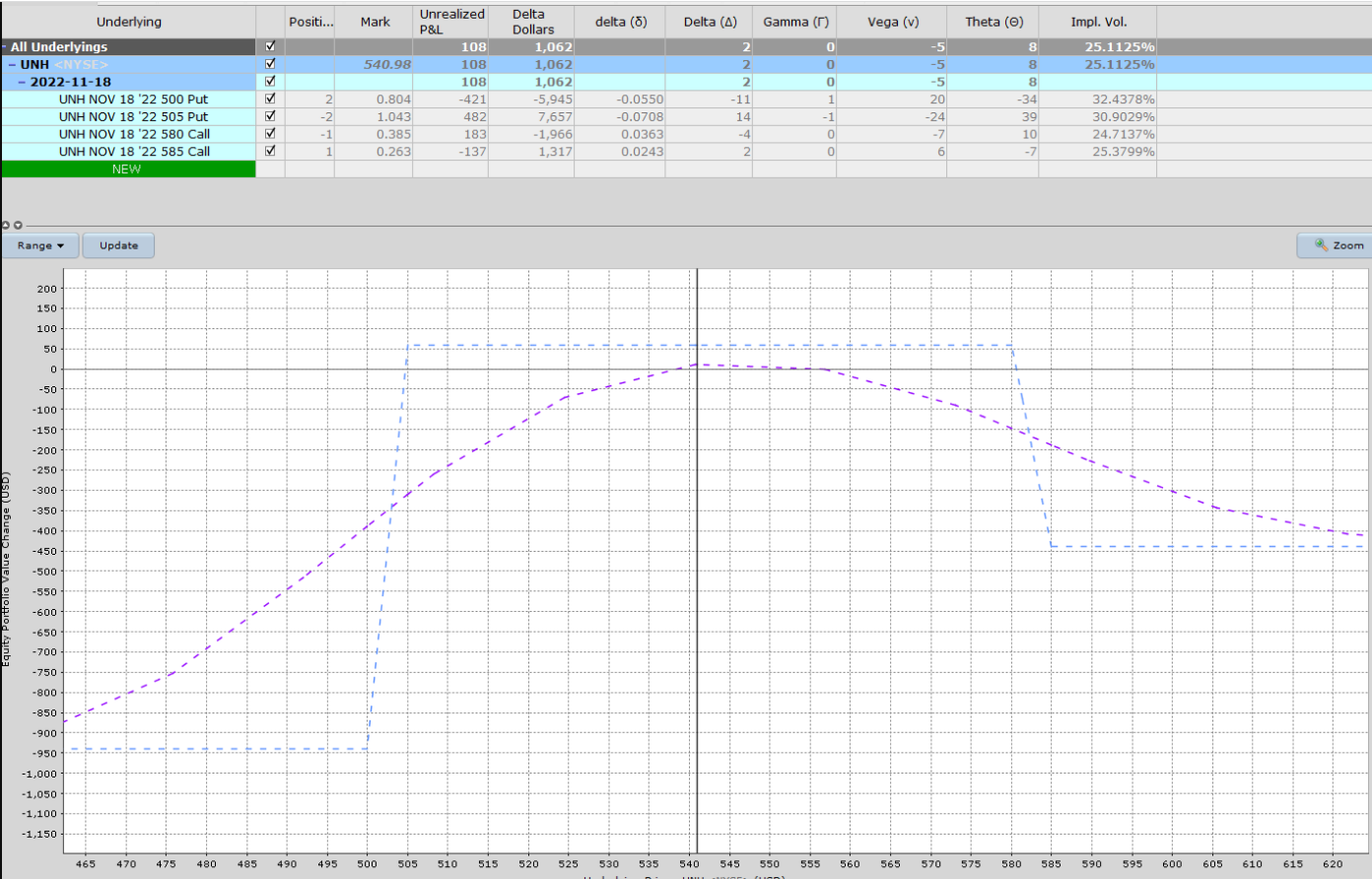

It remains well-centred, as we can see on Nov 9:

Just like the traditional iron condor, we want the UNH price to stay right in the middle between the put spreads and the call spread.

This unbalanced condor turned out to be very well-behaved and an easy trade that can be closed at +$108 with no adjustments.

To close, you would do the following:

Sell to close two contracts Nov 18 UNH $500 put @ $0.81

Buy to close two contracts Nov 18 UNH $505 put @ $1.04

Buy to close one contract Nov 18 UNH $580 call @ $0.39

Sell to close one contract Nov 18 UNH $585 call @ $0.26

Debit: –$60

Since we got a credit of $168 to initiate the trade and we paid $60 to close the trade, we made a profit of $108 (excluding any commissions and fees).

FAQs

Would a balanced condor result in a delta-neutral trade?

Had we sold a balanced condor with only one put spread and one call spread, we would have ended up with a slightly negative delta at the start of the trade.

This is due to the demand differential between puts and calls.

This put-call skew means that a balanced condor does not necessarily result in a trade that is initially delta-neutral.

Why would one use an unbalanced condor rather than a balanced one?

It is mainly to adjust the delta at the start of the trade.

Perhaps the trader feels slightly bullish on the underlying and hence will sell more put spreads to give the condor a slightly bullish bias.

Perhaps the trader is uncomfortable with the negative delta bias of the traditional balanced condor in this case.

Conclusion

This unbalanced condor example is a variation of the traditional balanced condor.

It is made by having more spreads on one side than the other.

Or it can be made by making the wings wider on one side than the other.

Its main purpose is to adjust the initial delta to give the trade a slight directional bias or to better neutralize trades that have large put-call skews.

We hope you enjoyed this unbalance condor example.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.