In entomology, butterflies are transformational creatures in that they were transformed from caterpillars.

In options trading, iron butterflies can transform into asymmetric iron condors.

Here is a classic example of an adjustment where it makes sense to perform this transformation.

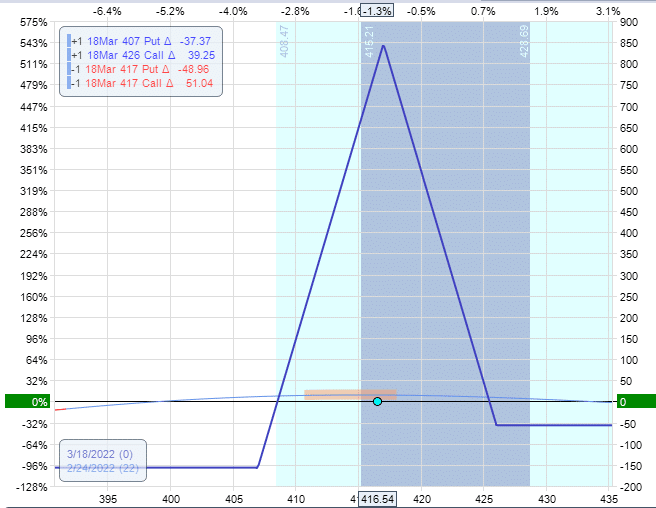

Suppose a trader started with an at-the-money iron butterfly in a non-directional positive-theta income style trade on SPY, which is the ETF matching the S&P 500.

Date: February 24, 2022

Price: SPY @ $416

Buy one March 18 SPY 426 call @ $7.17

Sell one March 18 SPY 417 call @ $11.90

Sell one March 18 SPY 417 put @ $13.17

Buy one March 18 SPY 407 put @ $9.46

Net credit: $843

The goal of this butterfly is to collect income from the passage of time without the price of the underlying moving too far from its current position.

Unfortunately, on the following day, the price made a major move up, resulting in the price being outside the blue lines of the expiration graph as shown:

The current Greeks of the position are:

Delta: -1.9

Theta: 1.4

Vega: -1.5

Theta/Delta: 0.7

The current width and position of the call spread is the 417/426 bear call spread – a nine-point-wide spread in the SPY.

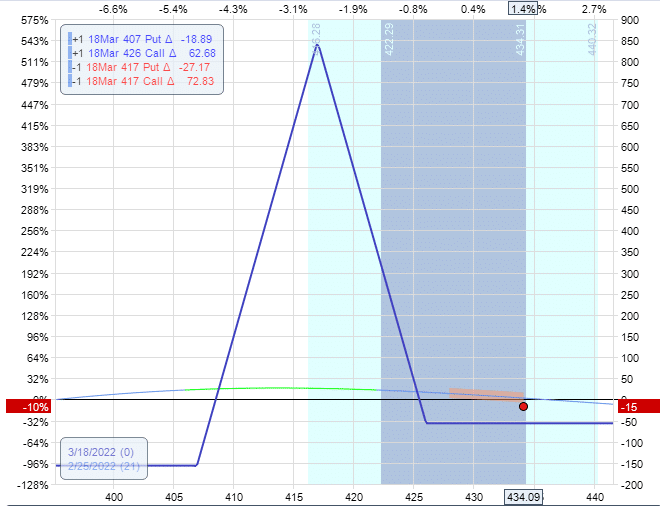

To protect the position, the trader rolls the call spread up to keep the price under the expiration graph.

But they also have to narrow the call spread’s width to keep the position delta close to zero.

The closing and opening of the call spread can be placed as two separate orders into your broker, or it can be placed as a single order like this:

Buy to close one March 18 SPY 417 call @ $21.92

Sell to close one March 18 SPY 426 call @ $15.16

Buy to open one March 18 SPY 440 call @ $6.58

Sell to open one March 18 SPY 434 call @ $9.86

Net Debit: -$348

This adjustment closed the 417/426 call spread and opened the 434/440 call spread.

The new call spread is only 6 points wide instead of the original nine-point-wide spread.

How did the trader know where to place the call spread and how narrow to make it?

They didn’t.

They typically try different strikes, widths, and locations until they find one where the resulting graph and delta “looked” good.

As the trader gains more experience by simply trying them, they will naturally learn where and how narrow to make it.

No specific mathematical rule will tell you because every situation is a little different.

If there was a mathematical rule, computers would do all the trading (which is what is happening, but that’s a different story).

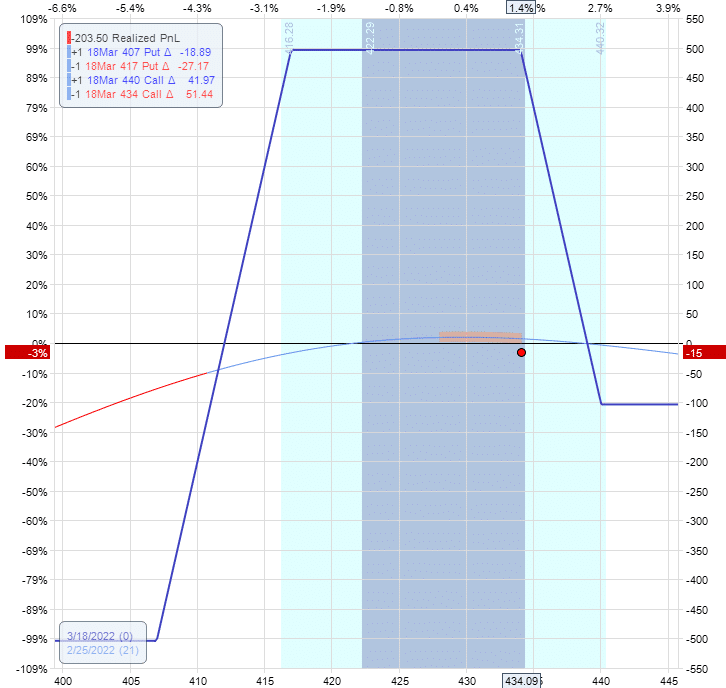

The resulting graph after the adjustment looks good like this:

Why does it “look” good?

Because the price is under the expiration graph, and it has some room before it hits the right edge.

The Greeks look good like this:

Delta: -1.2

Theta: 4.6

Vega: -7.4

Theta/Delta: 3.9

Why do the Greeks look good?

Because it is an improvement on what they were before.

Delta has decreased.

Theta has increased.

As a result, the ratio of Theta to Delta rose from 0.7 to 3.9.

The new expiration graph is no longer a butterfly.

The two short legs are not at the same strike.

So it does not have the pointed peak in the graph as a butterfly would.

Instead, it is an asymmetric iron condor consisting of a put credit spread and a call credit spread.

It is asymmetric because the put credit spread is much wider than the call credit spread.

The put credit spread is 10 points wide, while the call credit spread is 6 points wide.

Conclusion

Apologies to the readers who could not follow the context of this article.

This is not an introductory article because it assumes knowledge of certain vocabulary (such as “at-the-money,” “expiration graph,” “put credit spread,” “bear call spread,” etc.), the option Greeks, and the iron condor strategy.

We have plenty of introductory articles on those concepts.

You will get there.

We hope you enjoyed this article on turning butterflies into asymmetric iron condors.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.