Welcome to our in-depth StockTwits review, where we’ll explore the features, benefits, and user experience of this popular social media platform designed for traders and investors.

StockTwits is to the world of trading what Twitter is to the world of politics and news. Members on the StockTwits platform share posts relevant to stocks, ETFs, and cryptocurrency markets.

The platform even has its version of hashtags, which it calls Cashtags when referencing specific stocks.

Twitter has also embraced this with its tagging system, allowing tickers to be denoted and searched for using the “$” before the ticker.

Just how good is StockTwits for traders, though? How does it compare to Twitter? Read on as we break it down.

Contents

What Is StockTwits?

StockTwits is a social media platform designed specifically for traders and investors.

It is meant for sharing general information, news, and “tips” on specific instruments.

While StockTwits is completely free to sign up for, they also have premium content that gives you access to things the free membership does not.

One thing about the free version, it can be a bit cluttered.

You must dig deep to filter out information and find actionable insights for some securities.

Where It All Started?

The social media platform was created in 2008. Howard Lindzon and Soren Macbeth co-founded it.

The two shared a dream of making a forum where traders could interact and share deep discussions on emerging issues and trades on the market.

The idea of a social platform designed for traders resonated within the market because, within a few short years, the company had more than 1 million registered users.

This number may not seem like a lot today, but at the time, social media wasn’t what it is now.

Twitter was just gaining popularity and was just crossing the 50 million mark.

Stocktwits would later cross the 6 Million user mark and garner a 200+ million-dollar valuation.

Rishi Khanna is the current CEO of StockTwits.

Rishi has a computer science background with a passion for the markets.

He was previously head of the Alternative Asset Technology at SS&C Technologies and a founder of RKS Advisors.

Who Uses StockTwits?

Anyone can join StockTwits. As we said above, the service is completely free.

It also has a pretty familiar interface if you have used Twitter before.

The discourse on the platform mainly centers on the stock markets and some crypto as of late.

There is also a focus on all types of trading, so whether you’re a day trader, swing trader, or long-term investor, this platform has all you may need.

Key Features of StockTwits

Some of the key features of Stocktwits include the following:

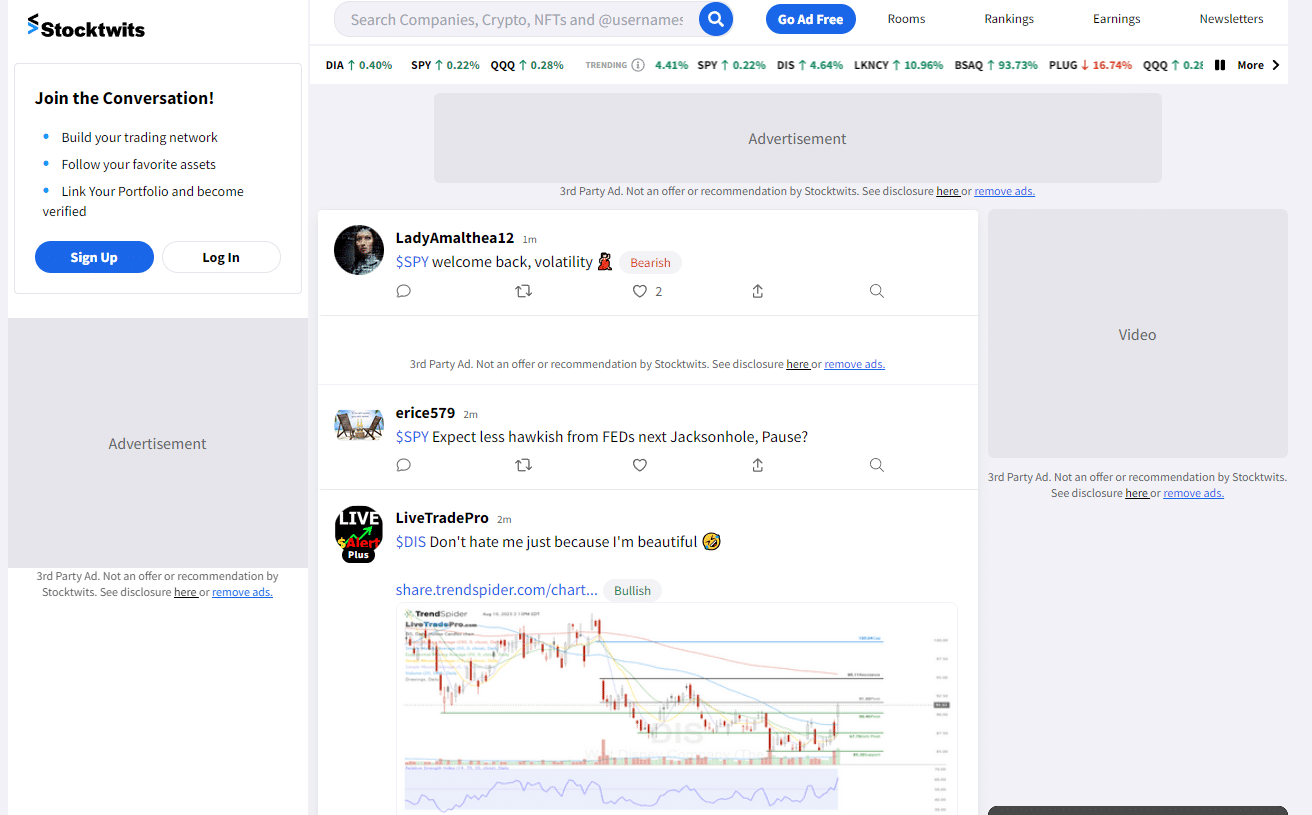

1. Real-Time Discussions

Like Twitter, StockTwits is usually packed with activity.

So, whether you want to engage in active dialogue or just sit back and watch the stream of information to try and mine information, the site can be pretty useful to you.

It provides a fun-filled and easy-to-navigate environment where you can share your thoughts or access insights from other users.

Discussions are organized based on tickers or events, so you can narrow your conversations to what you want to see.

Some of the real-time discussions you can find here include:

- Market news and events

- Sentiment analysis

- Ticker Specific news

In short, StockTwits is designed to cultivate a sense of community around what is normally a pretty lonely profession.

2. Cashtags

This is one of the features that make StockTwits truly unique.

You can think of them as hashtags on Twitter, only that instead of the hash symbol, you get to use the dollar symbol here.

For example, while #BTC would suffice for a topic on Bitcoin on Twitter, $BTC is what you need to represent Bitcoin on StockTwits.

By doing this, you end up tagging discussions and making your posts searchable by ticker or symbol.

Also, much like Hashtags on Twitter, the moment a cashtag is posted, it becomes a clickable link that you can click on and move to a page with recent “Twits” about it.

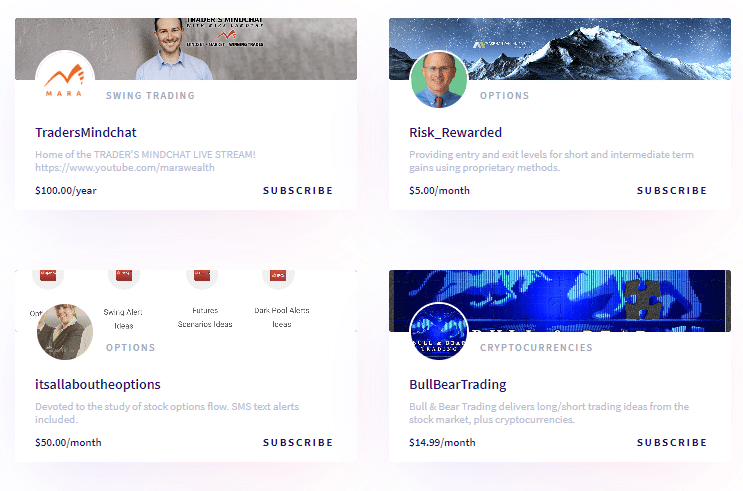

Premium Rooms

There are also Premium rooms available for a yearly or monthly fee.

The rooms are created and moderated by top-notch traders who may not want to freely share their wisdom on the open stream.

This allows you to tap into their trading wisdom.

The rooms have many different themes, so finding one that suits your trading style will not be difficult.

Integrations

You can integrate many different sites and brokerages into StockTwits so that you can act on information as soon as you see it.

It also allows you to track all your investments from a single platform.

This is like a central Dashboard, so you don’t have to move from one app to the next to see how various portfolios perform.

Another bonus of the portfolio integration feature is that it allows you to see what stocks other verified investors hold.

Newsletters

If you are more of a newsletter type, Stocktwits has you covered there as well.

Their three newsletter publications are “The Daily Rip,” “The Litepaper,” and “The Daily Rip India.” “The Daily Rip” provides you with new updates and market insights on a near-daily basis.

Topics include market performance, news releases, Top Earnings due, and Macroeconomic events. “The Daily Rip India” does the same but focuses on the Indian market.

Lastly, “The Litepaper” will bring you up to speed with all things crypto.

The Lists

The final major feature of Stocktwits is its lists section.

Called “Rankings” on their site, this is a list of the top 10 tickers based on different criteria.

The first is “Trending,” the ten tickers with the most streams on Stocktwits. Next is the “Most Active” category, which is the top 10 tickers regarding message volumes for the previous 24 hours.

This category gives some insight into what people are discussing on the site.

Finally, the “Watcher” category shows which tickers have had the most Watch List adds in the last 24 hours.

All of these categories could be useful in their own ways, so there is some value in these lists.

StockTwits vs. Twitter: How They Compare

StockTwits and Twitter share many similarities.

Both are easy to sign up for and are free to use, have extremely active financial (FinTwit) communities, and both have the potential to have a lot of unnecessary chatter.

Ads also support both platforms, but one place that Stocktwits excels is that their paid plan removes these ads from your pages, so you get a completely ad-free experience.

That is something that Twitter Blue is lacking at the same price point.

Regarding value, for an active trader, StockTwits may have a slight edge here.

While Twitter has significantly more users, Stocktwits is solely there for the market and trading.

On Twitter, you can have a nonstop stream of completely unrelated topics.

Pros of StockTwits

- Home to a huge community of traders

- Really easy-to-use interface

- Free to use but with premium features

- Brokerage integration for seamless trading

- Good for socializing about the markets

- Potential for well-organized content

Cons

- The free version is full of ads

- The main timeline is full of chatter

- A lot of the best value is behind a paywall

Conclusion

StockTwits is a great platform for traders and investors.

Anyone looking for a platform where the markets are the main focus will enjoy Stocktwits.

Thanks to its Twitter-like layout, it’s really easy to use the site for experienced Twitter users.

The only challenge with the free version of the site is that it is full of messages and ads.

Luckily, those who prefer a cleaner and more concise user interface can always turn to the premium version of it.

Overall, StockTwits is a fantastic website, home to great information and almost real-time updates.

You can always bank on it to provide a multi-layered environment where you can find valuable information and even meet new trading companions.

We hope you enjoyed our StockTwits Review.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

I find 99% are people trolling that the stock went up or it wend down and they of course knew it

Yep, that doesn’t surprise me.