You may not have heard of a synthetic short put.

Despite this, you have almost certainly traded one.

This article will break down the synthetic short put trade, which creates a short put without selling a put at all.

We will then touch upon ways to implement synthetic short puts in a portfolio as well as have a discussion around different parallels in the options space.

Contents

- The Basics: Setting up a Synthetic Short Put

- Let’s Fully Understand this…

- When Should I Trade Synthetic Short Puts/Covered Calls?

- When Should I Choose Synthetic Short Puts Over Short Puts?

- Concluding Remarks

The Basics: Setting up a Synthetic Short Put

The synthetic short put consists of the following:

- A position in a stock you like to own

- A call option sold on that stock.

We can see from this structure that we do not even need to trade a put at all to get the exposure of a short put.

Simply buy the shares and sell a call option for the put strike you would like to sell.

If this structure looks remarkably familiar, it is because it is nothing ever than one of the most loved options structures, the covered call.

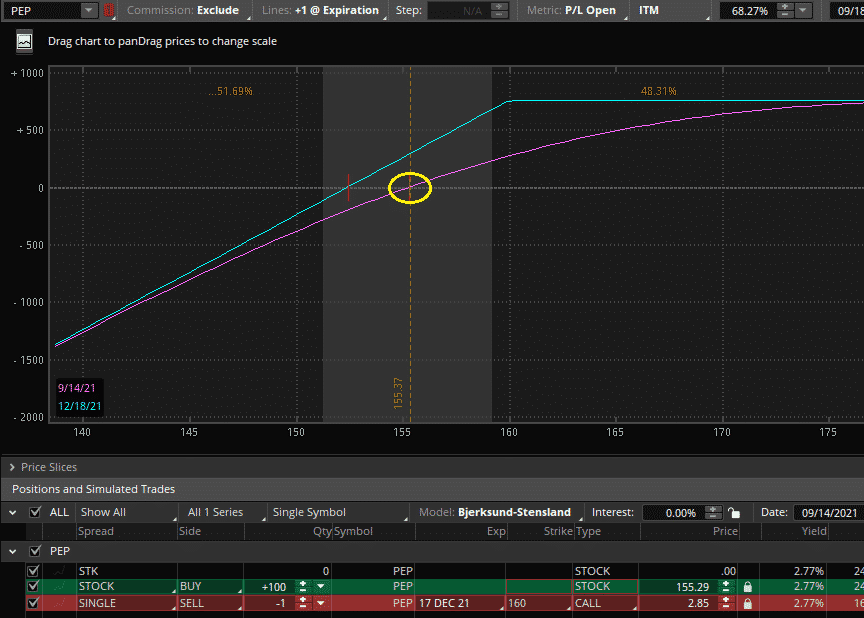

The graph above shows a short synthetic put. It also shows a covered call.

The risk profile is identical to a short 160 put option.

Let’s Fully Understand this…

If you trade covered calls, you are trading a short synthetic put which equates to selling a put.

Potato-Potahto!

Source: Mountain Dental

Some investors will trade covered calls because they believe they are a “conservative” option play, but they will avoid selling puts because they think they are “risky.”

his behavior makes no sense.

Each structure has the same risk exposures.

Try calling out one of these covered call investors as trading synthetic short puts, and you might as well be calling them a fraud!

Next time you can avoid the confrontation and refer them to this article.

Somehow “I love selling synthetic short puts” does not sound as catchy…

When Should I Trade Synthetic Short Puts/Covered Calls?

Short synthetic puts should be traded when an investor is bullish on an underlying but only expects a modest to moderate increase in the share price.

They also can be traded as part of a systematic strategy to generate additional yield in a portfolio.

For more on covered call strategies, click here

When Should I Choose Synthetic Short Puts Over Short Puts?

Since a short and synthetic short put are essentially the same things, how should I know which one to trade?

It is an excellent question.

The answer is that it will not make much of a difference.

Despite this, there are some nuanced tips on choosing one strategy over another.

The most obvious time to choose a synthetic short put in a portfolio is when an investor already has shares of the company in their portfolio.

Instead of selling the shares and subsequently selling a put, the investor can sell a call.

This trade results in fewer transaction costs.

Another time to sell covered calls (or synthetic puts) over the short put has to do with liquidity.

There is a lot more liquidity in out-of-the-money calls than there is in in-the-money puts.

This is simply because the demand for them is higher.

The liquidity effect is usually negligible because a market maker will almost always provide liquidity between the spreads on in-the-money puts.

After all, they can turn around and trade a covered call neutralizing their exposures.

They will do this for almost nothing, so usually, liquidity should not make a difference.

Nevertheless, if you feel the market maker is not giving you a fair mark on an in-the-money put, trading a covered call may be a better option.

Tax and Dividend Implications

A third reason may have to do with tax and dividends.

Depending on your country of residence, tax structure and income bracket, options and dividends can be taxed differently.

This can lead to one structure being advantageous over another.

These differences can be negligible for a smaller investor, but taxes become a more significant factor if you have a large account.

For investors who like to argue for trading covered calls because they get the dividend as oppose to selling puts, remind them that dividends are already factored into the put price; if they are not, the trade is an arbitrage.

So unless there is a tax consideration, there is no reason to favour one structure over another based on dividends or distributions.

These are some small nuances for when it may be better to trade a short synthetic put as opposed to selling a put.

If your trade doesn’t meet any of these criteria, you might sell a put as it requires one transaction instead of two.

Concluding Remarks

The short synthetic put is a way to get exposure to a short put option without trading a put at all.

While few have heard of it, it is also one of the most common option structures traded known as the covered call.

The short synthetic put, covered call and short put all have the exact same exposures, so an investor will benefit equally from one structure or another.

If you are undecided on which structure to pick, consider which one will have the lowest transaction costs, best liquidity and is preferable for your individual tax situation.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gav,

If a long call is equivalent to married put, and a covered call is equivalent to a short put, then a Poor Man Covered Call is equivalent to a collar trade (in other words: married put (long call) + short call 🙂

Sort of, but not really. 🙂 A collar trade uses options with the same expiration date, whereas a PMCC has different expirations. So similar, but not the same.