Assembling a covered call portfolio is an excellent way for an investor to enhance the yield potential of their portfolio. While it does require additional attention and maintenance compared to a regular stock portfolio, the benefits can be significant.

The best method of creating a covered call portfolio is to take a systematic approach in order to minimize the amount of time need to manage the portfolio.

Investors that decide to set up a covered call portfolio are not looking for home runs. They are not looking for high flying tech stocks or a penny stock that might quadruple in price.

They are looking for slow, steady gains over a long period of time.

Typically they are more conservative investors who want to increase the yield profile of their stock investments. For this reason, covered calls are an attractive proposition for older investors or retirees who still hold stock exposure.

It is realistic to expect a covered call portfolio to return in the vicinity of 6-10% per year even when the stock market is flat.

That can rise to around 15% during bull markets, depending on the types of stocks selected in the portfolio and how far out-of-the-money you sell the calls. The income gained from covered call writing will be higher on riskier stocks, or those with a higher implied volatility. But of course, with a higher return comes higher risk.

When developing a covered call portfolio, it is prudent to stick to safer stocks in well established industries. Dividends play a big part in the total return for the portfolio, so selecting high dividends stocks is attractive.

Typically these stocks have a lower beta and are less risky. The downside is that because these stocks don’t move around as much, the income generated from the covered calls is lower. There is always a trade off when it comes to investing.

Attractive candidates for covered call writing would be stocks like JNJ, KO, KMB, MCD, TGT, PG, WMT and MSFT. You’re generally looking for well established companies that are not as exposed to the wild swings from economic cycles. A good place to find ideas for these types of stocks is in Standard and Poor’s Dividend Aristocrats Portfolio.

Higher risk tolerant investors can sprinkle in some riskier stocks to beef up returns. For this segment, I like to look at stocks such as EEM, AMZN, AAPL, FB, NFLX, PCLN, TSLA and TWTR.

Once you have selected your covered call candidates, the next step would be to examine the option chain for each one. There are a couple of factors that you would need to consider – how far out-of-the-money to sell the calls, and how far out in time you want to go.

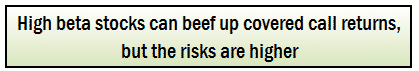

At-the-money calls will provide a much higher yield potential than out-of-the-money calls.

The further out-of-the-money you go, the less likely it is that the stock will reach that level, therefore the option price will be much lower. If you sell at-the-money calls, you receive a higher option premium, but you are forgoing all of the potential capital gains. There’s that trade off again.

This is illustrated in the diagram below:

The next consideration is how far out in time you want to go. Stocks do not have options available for every month over the coming 12 months.

In September 2014, AAPL has options available for the following months: September, October, November, December, January 2015, April 2015, July 2015 and also LEAP’s for January 2016 and 2017.

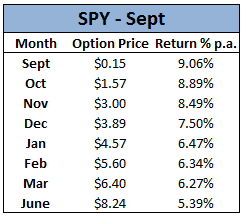

SPY has options available for September, October, November, December, January 2015, February 2015, March 2015, June 2015, September 2015, December 2015, January 2016, June 2016 and December 2016.

The further out in time you go, the higher the option premium, however the option prices increase at a decreasing rate. The return potential in percentage terms, is much higher for shorter-dated options given the higher rate of time decay. You can see this in the table below:

While the return might be highest for selling one month options (or even weekly options), this may not be the best choice for the investor. The reasons for this can include:

- Increased transaction costs from selling options more frequently

- Potential adverse tax consequences from realizing capital gains

- Increased requirement for portfolio monitoring and management

- Low premium received (which gets eaten up by transaction costs)

- Whipsaw action can harm returns in the long run

Each investor will have different opinions on where to sell their covered calls and how far out in time to sell them. A good place to start would be to sell options 6 months out in time, around 2% out of the money.

Let’s take a look at a couple of sample covered call portfolios to compare the structure and return profile:

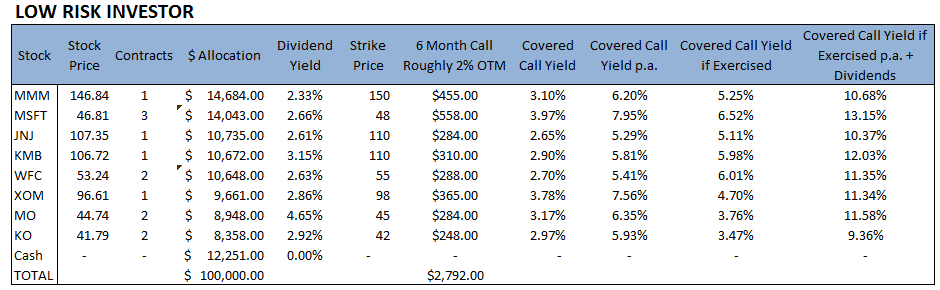

The first portfolio is set up for a low risk investor and contains reasonably low risk stocks that pay a nice dividend. Covered calls are sold 6 months out in duration and roughly 2% out of the money.

You can see that all of the stocks pay a dividend above 2% and the yield on the 6 month call also provides between 2.5% and 4%.

In the table, the covered call yield is then converted to an annualized rate. You can see that if MMM stayed exactly where it is, the total return on the position would be 8.53%, made up of 2.33% in dividends and 6.20% from selling covered calls.

If MMM rises above the option strike price of $150, then the return would also include some capital gains. The last column shows the best possible scenario, the stock rises above the strike price and is called away. The investor also receives the full dividend.

For the stocks in this portfolio, with these covered call parameters, you can expect a return of around 10-12% if the stocks move up by 2% or more.

Notice also that we’ve left $12,251 in cash for potential adjustments, hedging and other opportunities.

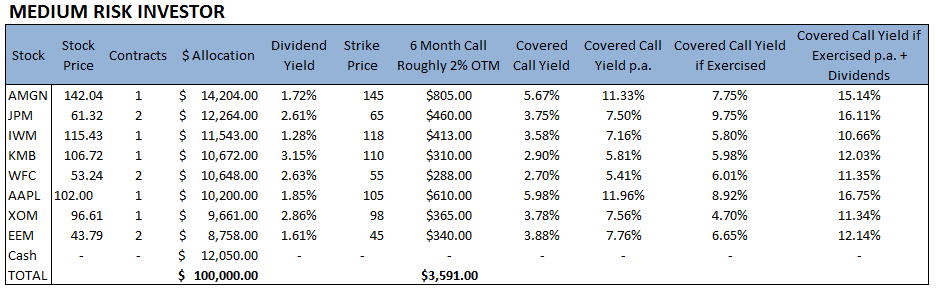

The second covered call portfolio is set up for a medium risk investor. We’ve dropped MMM, MSFT, KO, MO and JNJ and added AMGN, JPM, IWM, AAPL and EEM. This increases the risk profile of the portfolio by replacing some of the low beta stocks with higher beta stocks.

We haven’t given up too much in terms of dividend yield, and we have increased the covered call income to $3,591 from $2,792. The yield percentage on these higher risks stocks is in the 12-16% range. By keeping some lower risk stocks in the portfolio, we keep the overall risk profile under control.

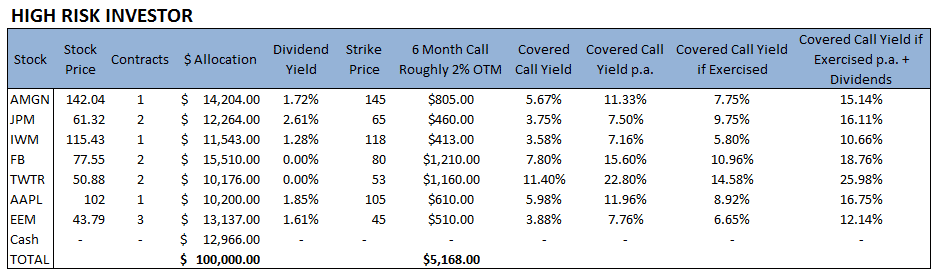

The last covered call portfolio is set up with a higher risk investor in mind. We’ve added in FB and TWTR and ditched WFC, XOM and KMB.

You can see that FB and TWTR have by far the highest return percentage with 18.76% and 25.98%. You would expect this with high flying tech stocks that have recently listed.

We are reducing the dividend yield by adding these stocks, but the income potential from the covered call is excellent. Keep in mind that FB and TWTR are going to be much more volatile than the stocks we removed from the portfolio.

Overall we have increased the option premium received to $5,168.

These examples have shown you three ways you could structure a portfolio of covered calls but there are many more ways you could do this.

An investor could choose to set up an index covered call portfolio comprised solely of SPY stock and options. This would reduce the stock specific risk, but may provide lower returns due to the lower implied volatility on indexes.

They could also sell at-the-money options in order to increase the income profile of the portfolio with the trade off being the lack of capital gain potential.

Another idea is to sell covered calls on only some of the stocks in your portfolio and leave the others with the potential for capital gains. The investor might consider this if some of your stocks have had a nice run up and you would be happy to part with them. Covered calls are a great way to sell a stock for a price you would be happy with.

Investors may also choose to set up their portfolio a little bit at a time. They don’t necessarily need to buy all the stocks on day one. They can be systematic about it and set the portfolio up 25% each month over 4 months. The other thing investors can do is sell cash secured puts, as a way to get into the stocks.

You can buy some long dated out-of-the-money puts to protect some of the downside as discussed here.

Covered calls are a fantastic method for generating extra income from your stock investments. Taking a systematic approach to developing a covered call portfolio is the best approach with the aim of generating out-sized returns in flat, slightly up and slightly down markets.

Investors should consider how much risk to take in their portfolio, how far out in time and how far away from the stock price to sell the calls. This will be dependent on the investors risk tolerance, return objectives and how actively they are able to manage the portfolio.

Nice write up with lots of valuable information. I have had success selling calls to cover my FB shares, but I except lower option premiums to allow more room for price appreciation on my shares. I usually go out a month and look for a strike about 10% above current price. I would rather not lose my shares, thus the higher strike price, but I am ok if it happens.

Wash, rinse and repeat,

David

Great comment David. Makes sense to sell further out of the money calls on higher beta stocks especially if you want to maintain the upside.

Hi Gavin:

If the investor wants to keep the stocks (e.g. is building a dividend-growth portfolio destined for a yield on cost of (say) 10% by retirement time in ten years), he or she wants to keep those stocks, and nt have them called away via selling the call. So setting the call strike at only 2% above current stock price would not be suitable: the risk of having the stock called away would be too great, especially if the expiration date were six months away.

In this situation, I would prefer to look at a 2-3 year price chart of the stock, and set the call strike at resistance. As for duration, a lot can happen in 6 months; I’d calculate the annualized return for expirations of 1,2, and maybe 3 months, and pick the highest annualized return.

If the return is a paltry one (strike too far away from current stock price, or volatility too low to generate a decent premium), then don’t do the call; wait for a better day or month.

The problem I see with a call is that it constrains selling the stock. If something happens to make you want to sell the stock (e.g.a delayed dividend, the death knell for dividend investors), you must first close the call. Most brokerages won’t allow naked calls (i.e. no stock to deliver if the call is exercised). You want to sell the stock quickly, and if the stock has risen toward the strike, it will cost more to close the call than you received when opening it. So this cost reduces any capital gain you might make on selling the stock.

I don’t have (yet) a minimum annualized return I’d want from a covered call to make it worthwhile, but the figure of 30% annualized “strikes” me as a good starting point.

Thoughts?

Hi,

Since a covered call is so akin to a naked put, would it be prudent to have a long put further OTM to limit risk? Also, since one would be limiting upside gains, might as well sell an OTM call as well? Or not?

Now I am wondering what happens is you just cover the whole thing with an Iron Condor….

Thanks,

Jerry

Hi Jerry, yes this is a valid strategy as is known as a collar. It limits the downside risk.

Hi Len,

Yes I can understand that someone wanting to hold on to a stock would be reluctant to sell or have the shares called away.That leaves you holding cash and not generating a yield.

30% is actually very high for a covered call strategy, 10-15% would be a more reasonable expectation over the long term.

In terms of annualized yield, if you keep the strike price the same, the shortest dated option will always have the greatest annualized yield.

If your stock gets called away – then sell some Cash Secured Puts to get back the stock at a lower price.

Yep. Rinse and repeat.